Delaware Payment of Wages

Description

How to fill out Delaware Payment Of Wages?

The larger the volume of documents you need to prepare - the more anxious you become.

You can find a vast array of Delaware Payment of Wages forms online, but you might be uncertain about which ones to trust.

Eliminate the stress and simplify the process of finding samples using US Legal Forms. Obtain precisely formulated documents that are designed to meet state requirements.

Enter the requested details to set up your account and pay for your order using either PayPal or a credit card. Choose a convenient document type and access your template. Locate each document you acquire in the My documents section. Visit there to complete a new copy of your Delaware Payment of Wages. Even with expertly prepared templates, it is still crucial to consider consulting a local attorney to verify that your document is filled out correctly. Achieve more for less with US Legal Forms!

- If you currently maintain a US Legal Forms subscription, Log In to your account, and you'll come across the Download feature on the Delaware Payment of Wages’s page.

- If you have not utilized our service previously, follow these steps to complete the registration process.

- Verify that the Delaware Payment of Wages is suitable for your state.

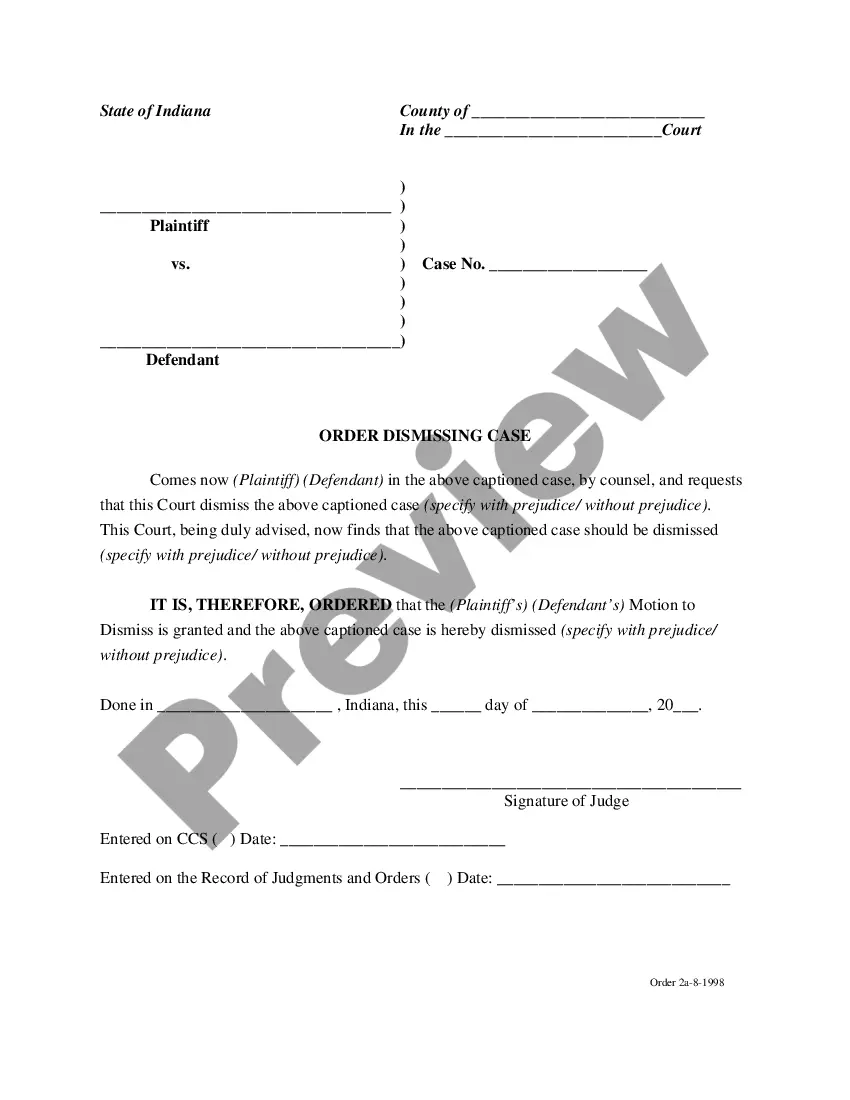

- Reconfirm your choice by reviewing the description or utilizing the Preview function if available for the chosen document.

- Click Buy Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

Yes, Delaware does withhold state taxes from employee paychecks. This withholding is part of the state's effort to ensure that residents contribute to public services. For anyone navigating Delaware Payment of Wages, it’s essential to understand how these deductions affect your net income. If you require detailed information on tax calculations, USLegalForms offers tools to simplify this process.

Section 1151 of Title 30 of the Delaware Code outlines the rules regarding the payment of wages in Delaware. This section mandates that employees should receive their wages on time and specifies how frequently payments should occur. Understanding this law is crucial for both employers and employees to ensure compliance with Delaware Payment of Wages regulations. If you need further assistance with payroll practices, consider resources like USLegalForms to clarify your responsibilities.

The Wage Payment and Collection Law in Delaware regulates how employers handle wage payment practices and outlines the procedures for employees to claim unpaid wages. This law promotes fairness and protects workers from potential exploitation by establishing clear standards for wage payments. Understanding these laws is vital for ensuring you receive your rightful earnings. For comprehensive assistance, Uslegalforms can supply the necessary forms and guidance to help you with your wage collection concerns.

Wage garnishment law in Delaware allows creditors to collect debts directly from an employee's paycheck after a court judgment. This process is governed by specific regulations to protect employees from excessive deductions. Being informed about these laws helps you understand your rights and options. If you encounter wage garnishment issues, Uslegalforms provides essential tools and legal documents to assist you in addressing these situations.

The Workers Compensation Act in Delaware provides benefits to employees who suffer work-related injuries or illnesses. This legislation guarantees that injured workers receive medical treatment and wage replacement during their recovery. Knowing your rights under this act can empower you to seek the assistance you deserve when you face workplace injuries. Uslegalforms can guide you through the necessary forms and claims process.

If you give your employer at least 72 hours' notice, you must be paid immediately on your last day of work. Like employees who are fired or laid off, your final paycheck must include all of your accrued, unused vacation time or PTO.

Under California employment law, all employers have a legal obligation to pay employees the wages they have earned and to pay these wages on time.For example, as to regular pay, employees are charged with a $100 penalty if they fail to pay an employee on his/her regular payday.

From 1 April 2021 thousands of low paid workers will receive a pay rise of almost 9%, as the eligibility for the national living wage is widened to include 23 and 24-year-olds.

In California, wages, with some exceptions, must be paid at least twice during each calendar month on the days designated in advance as regular paydays. 11 Minnesota.

Delaware is one of 30 states that sets its own minimum wage above the federal standard. The wage increased from $8.25 in 2015 to $9.25 in 2020.