Arizona Transfer on Death or TOD - Beneficiary Deed - Individual Grantor to Four Individuals

The Arizona Transfer on Death (TOD) Beneficiary Deed is a legal document that allows an individual grantor to designate beneficiaries who will receive property upon the grantor's death without undergoing probate. This deed can be particularly valuable for individuals wanting to transfer property seamlessly to multiple individuals.

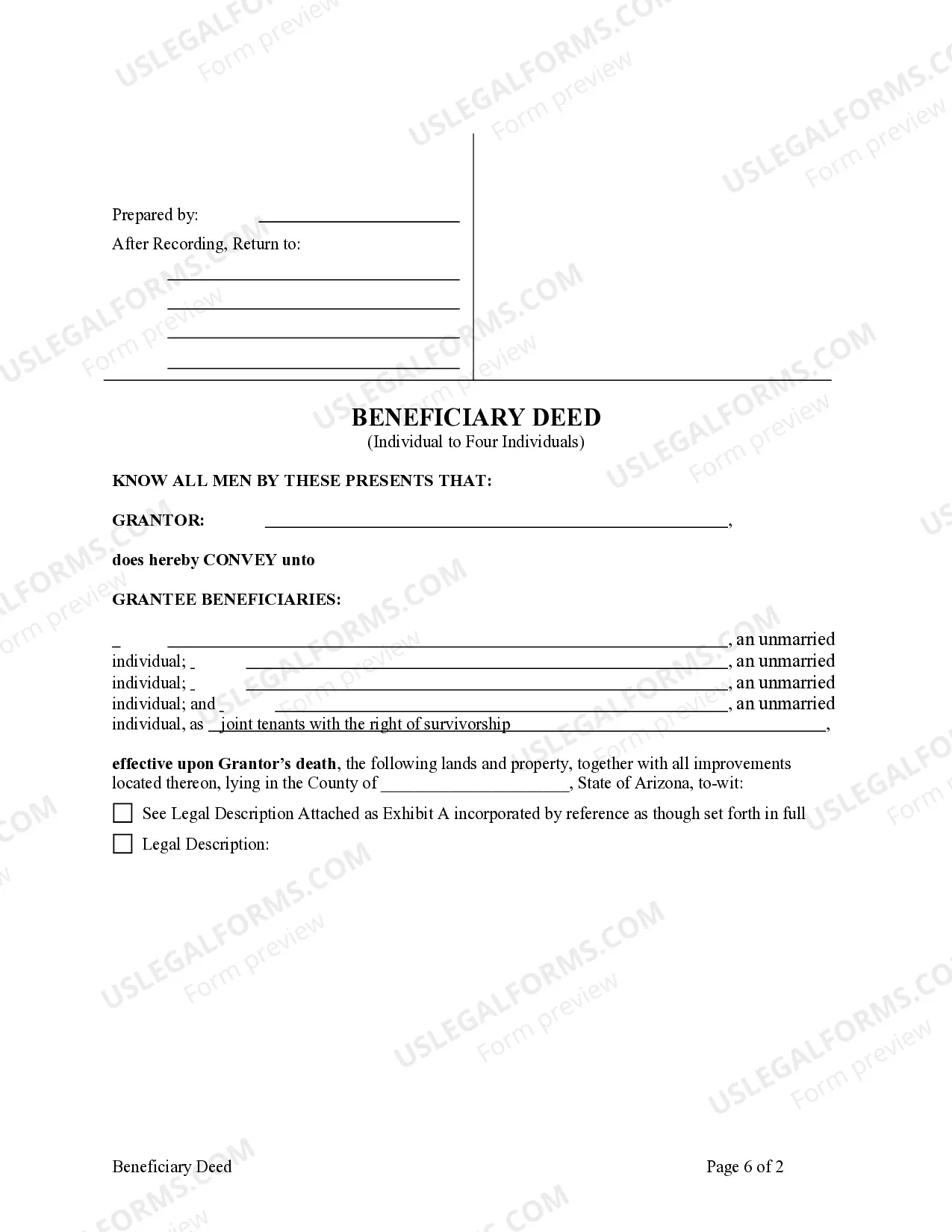

Completing the Arizona TOD Beneficiary Deed requires precise information. The form typically includes sections for the grantor's details, the names of the beneficiaries, and how they will hold the property (e.g., joint tenants with right of survivorship). Users should ensure:

- All parties' full legal names are included.

- The property legal description is accurate and attached as an exhibit.

- Indications of how the grantees will hold the property are clearly marked.

This form is suitable for individuals in Arizona who wish to pass their property directly to beneficiaries upon their death. It is especially beneficial for those who have multiple heirs and want to ensure a smooth transfer of ownership without the need for probate proceedings.

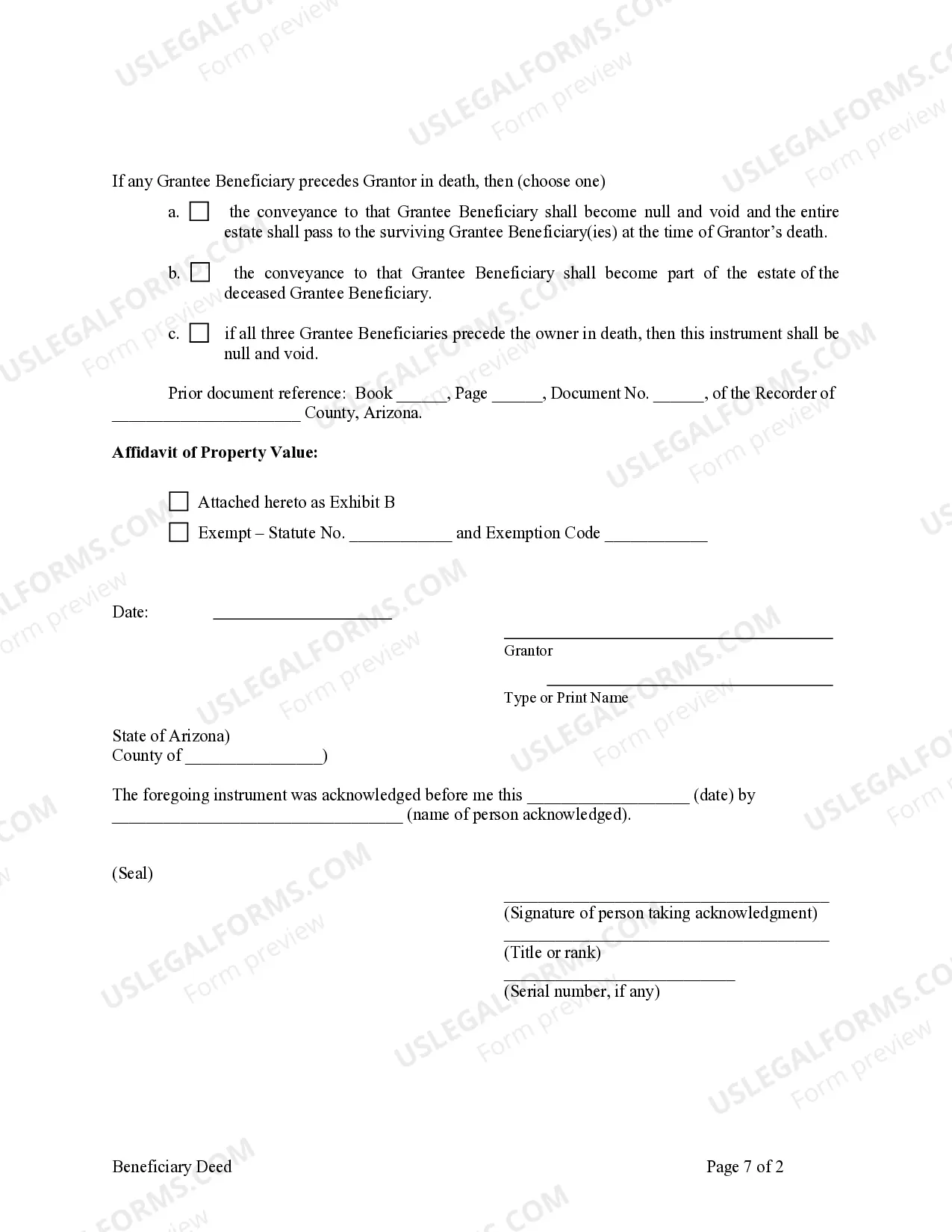

The Arizona Beneficiary Deed is governed by state law, making it crucial for users to understand the legal implications. This document must be recorded with the appropriate county recorder before the grantor's death to be effective. Failure to do so may render the deed null and void.

Several components are essential in the Arizona TOD Beneficiary Deed, including:

- Grantor Information: The full name and details of the individual creating the deed.

- Grantee Beneficiaries: Names of the individuals receiving the property.

- Property Description: A detailed legal description of the real estate involved.

When filling out the Arizona TOD Beneficiary Deed, users should be wary of common pitfalls such as:

- Not recording the deed before the grantor's death.

- Inaccurate property descriptions, which might complicate future transfers.

- Forgetting to specify how the grantees will hold the property.

The signing of the Arizona Beneficiary Deed typically requires notarization. It ensures that the grantor's identity is verified, and the signing is witnessed according to legal standards. Expect:

- A notary public will witness the signature.

- A signature of the notary, including their seal, is necessary for the document to be valid.

Form popularity

FAQ

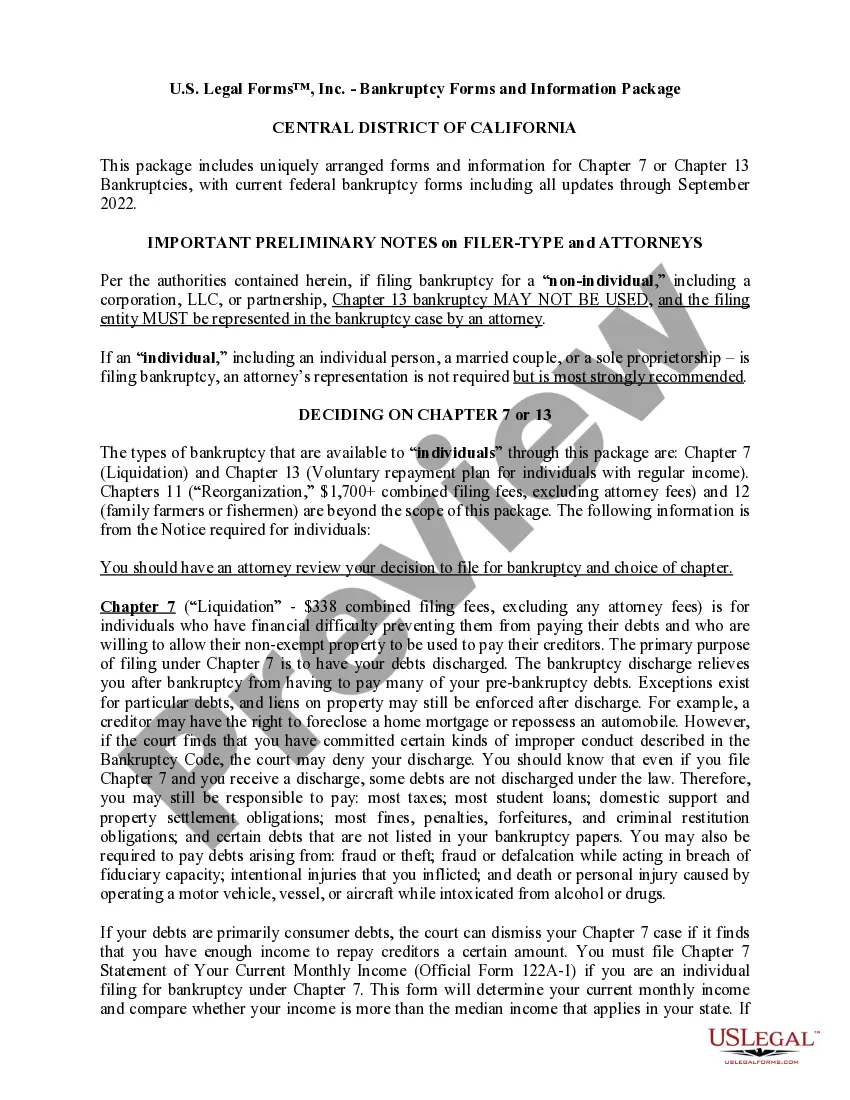

The choice between a Transfer on Death (TOD) and a beneficiary deed often depends on your specific needs. An Arizona Transfer on Death or TOD - Beneficiary Deed - Individual Grantor to Four Individuals allows for a seamless transfer of property without going through probate. This process can simplify inheritance for your loved ones. Ultimately, assess your situation to decide which option serves you and your beneficiaries best.

Yes, accounts associated with the Transfer on Death or TOD - Beneficiary Deed - Individual Grantor may be subject to creditors' claims. In Arizona, outstanding debts of the grantor can affect the transfer of assets intended for beneficiaries, making it essential to consider the financial situation before establishing a TOD deed. It's advisable to consult with legal professionals or services like uslegalforms to navigate these complexities effectively.

The Transfer on Death or TOD - Beneficiary Deed - Individual Grantor to Four Individuals does have some negatives. One significant concern is that if a beneficiary dies before the grantor, the property may unintentionally revert to the grantor's estate, which could complicate matters. Moreover, potential disputes among beneficiaries can arise if expectations are not clearly communicated.

In Arizona, the law allows for the Transfer on Death or TOD - Beneficiary Deed - Individual Grantor to include up to four individuals as beneficiaries. This means you can designate multiple heirs to inherit the property, providing flexibility in estate planning. It's essential to clearly specify each beneficiary to ensure the property transfers as intended.

While the Transfer on Death or TOD - Beneficiary Deed - Individual Grantor to Four Individuals has many benefits, there are some drawbacks. For instance, if the grantor incurs significant debts, the property may still be subject to those claims even after the grantor's death. Additionally, any changes in marital status or beneficiary designations must be updated through new deeds to reflect the most current wishes.

An alternative to the Transfer on Death or TOD - Beneficiary Deed - Individual Grantor to Four Individuals is creating a living trust. A living trust allows individuals to place their assets into the trust, which can be managed during their lifetime and distributed after death. However, unlike a TOD deed, a living trust often requires more complex paperwork and formalities at the time of creation.

Yes, Arizona permits the use of Transfer on Death or TOD - Beneficiary Deeds. These deeds provide a straightforward method for individuals to designate beneficiaries who will inherit their property after they pass away. By utilizing a TOD deed, property owners can retain full control over their asset during their lifetime, while ensuring a seamless transfer upon their death.

The best option to avoid probate in Arizona is often the Transfer on Death or TOD - Beneficiary Deed - Individual Grantor to Four Individuals. This specific arrangement allows property ownership to transfer directly to beneficiaries upon the grantor's death, bypassing the lengthy probate process. Using a TOD deed simplifies estate planning and ensures a smoother transition of property to intended heirs.

Yes, recording a beneficiary deed is necessary in Arizona for it to be legally recognized. After notarization, you must submit the deed to the county recorder to make it effective. This step helps ensure that your wishes regarding property transfer are honored and publicly documented.

Creating a beneficiary deed in Arizona involves drafting the deed with specific details about the property and the intended beneficiaries. You will need to include the legal description of the property and sign it in front of a notary. This Arizona Transfer on Death or TOD - Beneficiary Deed - Individual Grantor to Four Individuals effectively allows you to designate up to four individuals to receive the property upon your passing.