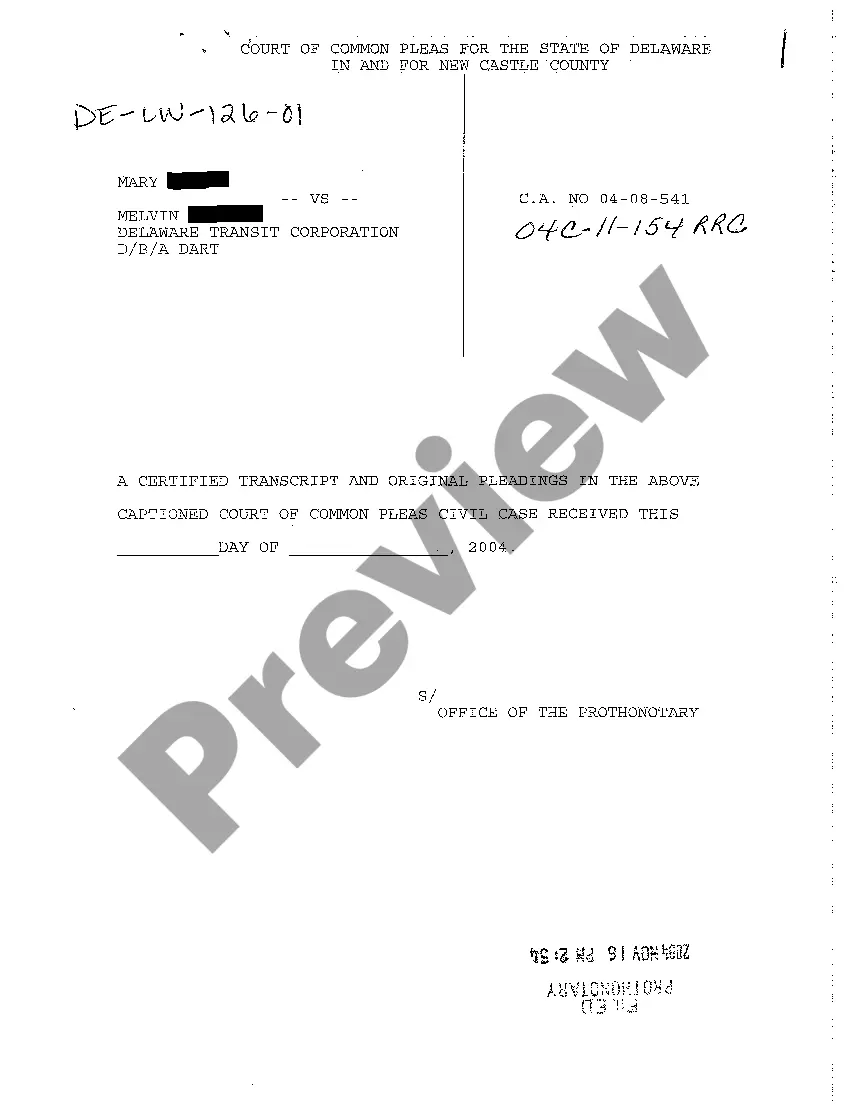

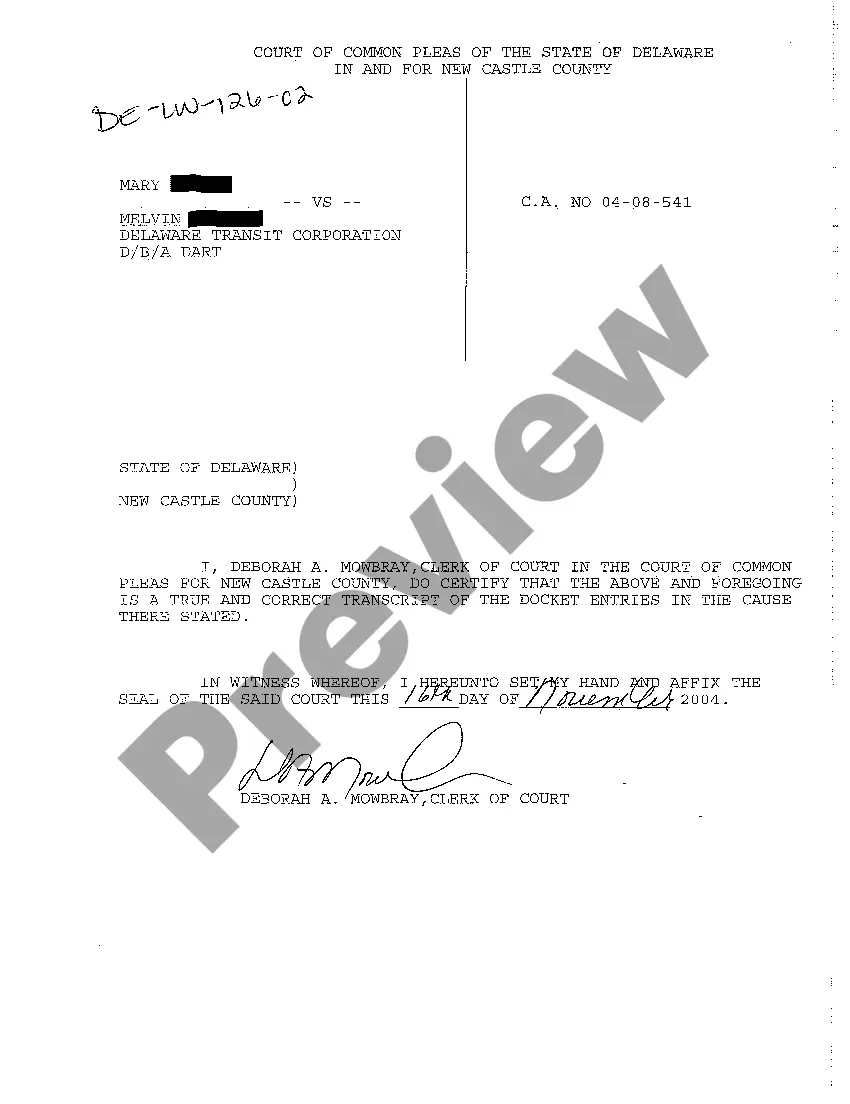

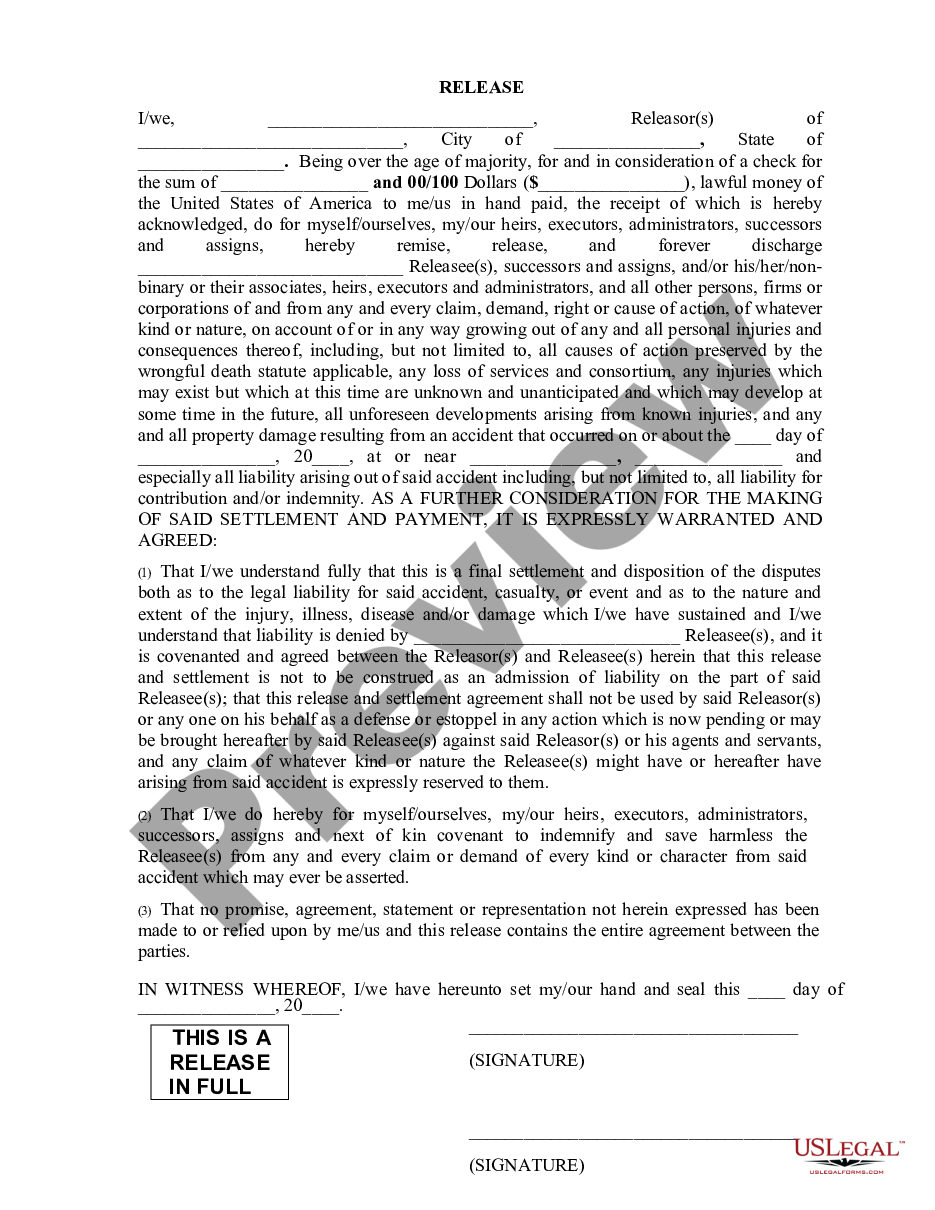

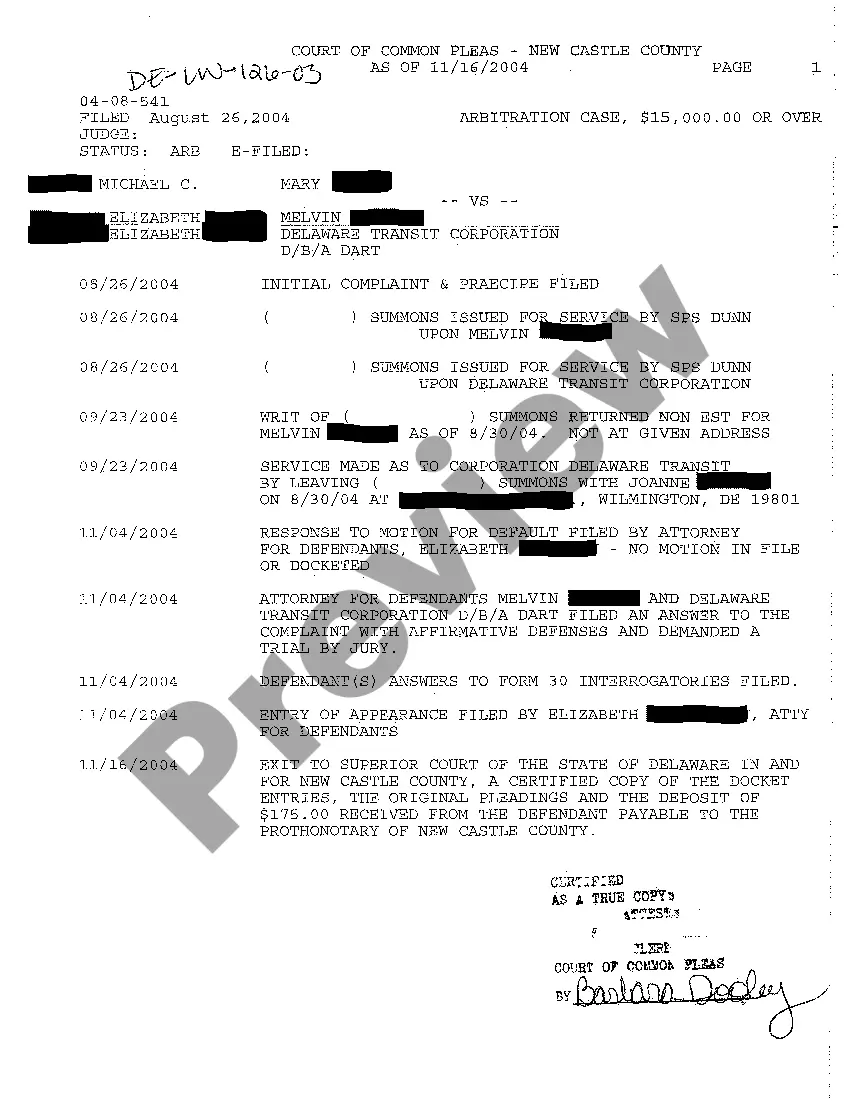

Delaware File Listing

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware File Listing?

Amid countless complimentary and paid examples that you can discover online, you cannot guarantee their precision and trustworthiness.

For instance, who produced them or if they possess the proficiency to handle what you require of them.

Stay calm and utilize US Legal Forms!

Press Buy Now to commence the purchasing procedure or search for another template using the Search function located in the header. Select a pricing plan, register for an account. Complete the payment for the subscription using your credit/debit card or Paypal. Download the form in your chosen file format. Once you’ve registered and purchased your subscription, you can use your Delaware File Listing as frequently as required or as long as it remains valid in your state. Modify it in your preferred editor, fill it out, sign it, and print a hard copy. Achieve more for less with US Legal Forms!

- Locate Delaware File Listing samples crafted by experienced legal professionals and avoid the expensive and time-intensive process of searching for an attorney and subsequently paying them to draft a document that you can procure yourself.

- If you already hold a membership, Log In to your account and locate the Download button adjacent to the document you’re in search of.

- You will also have access to all of your previously acquired templates in the My documents section.

- If you are using our service for the first time, adhere to the instructions below to acquire your Delaware File Listing effortlessly.

- Ensure that the template you view is applicable in your residing state.

- Examine the document by reviewing the description through the Preview option.

Form popularity

FAQ

The minimum income required to file taxes varies based on your filing status and age. In Delaware, if your income exceeds a certain limit, you must file a tax return. The Delaware File Listing can provide insights into these income thresholds and help you determine your obligations. To ensure you meet the requirements without hassle, consider integrating trusted resources or seeking professional advice.

Minimum wage itself does not directly influence your requirement to file taxes; however, any income above the exemption amount typically requires you to file. In Delaware, if you earn minimum wage and your total income surpasses the state's required threshold, you must file a return. The Delaware File Listing serves as an essential resource for understanding your filing responsibilities. Always consult the latest income thresholds for accurate compliance.

The requirement to file taxes in Delaware is based on your income as well as your filing status. If your income exceeds Delaware's set limits, you must file a tax return. Using the Delaware File Listing helps clarify the thresholds specific to your situation, making the filing process simpler. Staying informed about these guidelines helps avoid penalties and ensures accurate tax reporting.

To determine if you need to file a tax return in Delaware, review your total annual income and compare it to the state's thresholds. Generally, if you earn above a specific limit, you must file. The Delaware File Listing can assist you in checking your income levels and understanding the factors affecting your tax return status. Consulting a tax advisor can provide personalized insights.

To file taxes in Delaware, there is no specific minimum income requirement, as all residents must file a tax return if they earn income. However, if you earn over a certain threshold, which can change yearly, you will need to file. The Delaware File Listing enables you to understand your filing obligations better. Hence, it's advantageous to consult the latest guidelines or a tax professional.

The popularity of Delaware LLCs stems from their asset protection and privacy features. Owners benefit from limited liability, safeguarding personal assets in legal matters. Furthermore, the state allows LLCs to maintain member anonymity, boosting security and peace of mind for business owners. All these factors combined make a Delaware File Listing an attractive option for many entrepreneurs.

Delaware LLCs enjoy popularity due to their simplicity and tax benefits. The state does not impose income taxes on LLCs that operate outside of Delaware, making it financially appealing. Additionally, the formation process is straightforward, allowing entities to register quickly. For those seeking an efficient solution, a Delaware File Listing can be invaluable.

Delaware is home to a vast array of companies, from startups to Fortune 500 firms. Notable companies, including Google and Amazon, have chosen to establish their legal presence in Delaware. This trend underscores the state's reputation for providing a strong legal foundation. By filing in Delaware, companies can benefit from the advantages associated with Delaware File Listing.

Most companies choose to file in Delaware due to its business-friendly laws and efficient legal system. Delaware provides a specialized court system, the Court of Chancery, which handles business disputes quickly. Additionally, the flexibility in corporate structure allows companies to tailor their needs effectively. This makes Delaware File Listing a smart choice for many businesses.

You do need a registered agent with a physical address in Delaware to open an LLC. This address can be that of the registered agent, not necessarily yours. The Delaware File Listing provides essential information to help you comply with this requirement, ensuring your LLC is established correctly.