Delaware Certificate of Conversion From Limited Partnership To Statutory Trust

Description

How to fill out Delaware Certificate Of Conversion From Limited Partnership To Statutory Trust?

Managing legal documents necessitates focus, accuracy, and utilizing well-prepared templates. US Legal Forms has assisted individuals nationwide in accomplishing just that for 25 years, so when you select your Delaware Certificate of Conversion From Limited Partnership To Statutory Trust template from our collection, you can be confident it adheres to federal and state regulations.

Utilizing our service is straightforward and efficient. To acquire the required documents, all you’ll require is an account with an active subscription. Here’s a brief guide for you to obtain your Delaware Certificate of Conversion From Limited Partnership To Statutory Trust within moments.

All documents are prepared for multiple uses, like the Delaware Certificate of Conversion From Limited Partnership To Statutory Trust displayed on this page. If you require them in the future, you can fill them out without additional payment - simply access the My documents tab in your profile and finalize your document whenever necessary. Explore US Legal Forms and organize your business and personal documentation swiftly and in complete legal adherence!

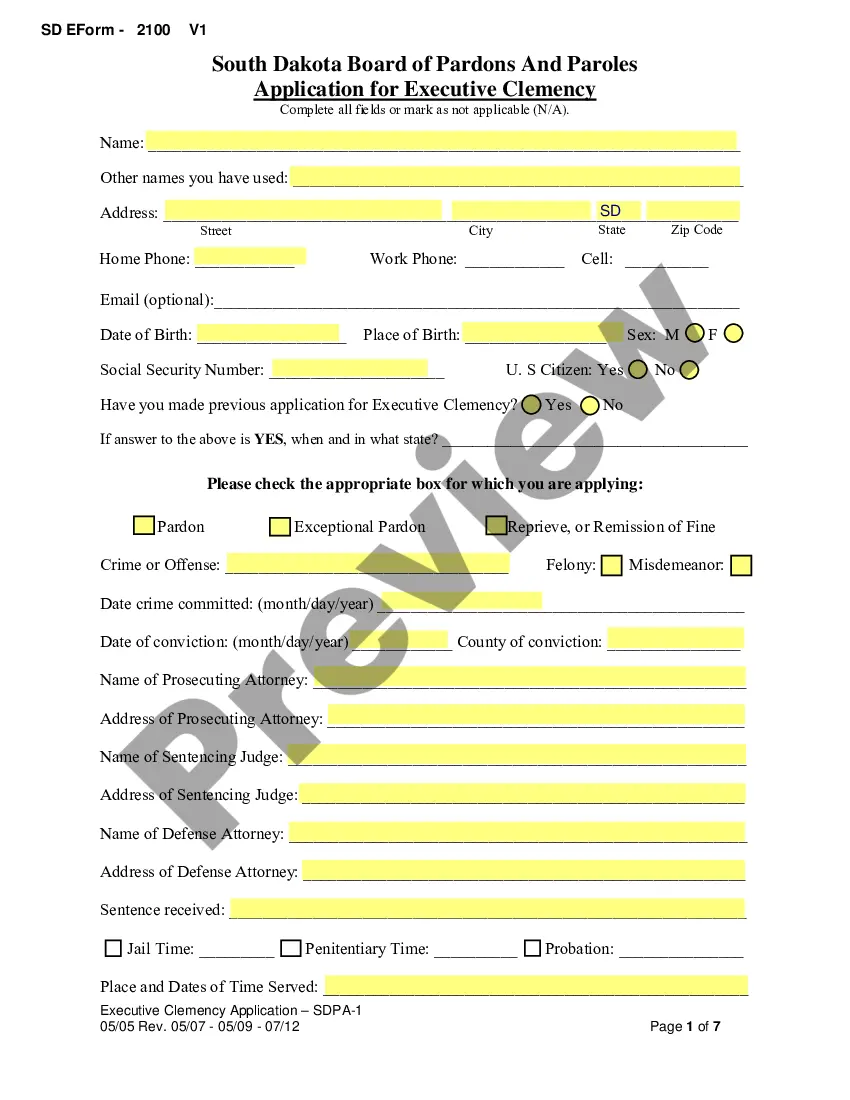

- Ensure to diligently review the form's content and its alignment with general and legal standards by previewing it or reading its synopsis.

- Look for an alternative official template if the one you opened previously doesn’t correspond to your particular situation or state guidelines (the tab for that is located on the upper corner of the page).

- Log in to your account and save the Delaware Certificate of Conversion From Limited Partnership To Statutory Trust in the format you require. If this is your first visit to our site, click Buy now to move forward.

- Sign up for an account, choose your subscription package, and pay using your credit card or PayPal account.

- Select the format in which you wish to receive your form and click Download. Print the template or incorporate it into a professional PDF editor for a paper-free preparation.

Form popularity

FAQ

Yes, a statutory trust operates as a separate legal entity in Delaware. This means it possesses its own rights and responsibilities, distinct from its owners or beneficiaries. When you obtain your Delaware Certificate of Conversion From Limited Partnership To Statutory Trust, you will solidify this separate status, allowing for better management of assets and liabilities.

To set up a statutory trust in Delaware, you must file a Certificate of Trust with the Delaware Division of Corporations. The process involves outlining the terms of the trust, including its purpose and management structure. Using resources like U.S. Legal Forms can simplify this process, guiding you through the necessary steps to ensure your Delaware Certificate of Conversion From Limited Partnership To Statutory Trust is completed accurately.

Yes, a Delaware Statutory Trust is recognized as a legal entity in the state of Delaware. This means it can own property, enter contracts, and engage in business activities independently. By completing the Delaware Certificate of Conversion From Limited Partnership To Statutory Trust, you form this legal entity, gaining the ability to operate with protections and privileges under Delaware law.

The main difference lies in their legal structure and purpose. A basic trust typically manages assets for beneficiaries, while a statutory trust established under Delaware law is a formal business entity. Utilizing a Delaware Certificate of Conversion From Limited Partnership To Statutory Trust clearly defines the roles and responsibilities of the trustee and beneficiaries, promoting clarity and minimizing disputes.

No, a Delaware Statutory Trust is not a disregarded entity. It is treated as a separate entity for tax purposes, unlike a disregarded entity which has no separate taxable status. When you use a Delaware Certificate of Conversion From Limited Partnership To Statutory Trust, you create a distinct legal structure, ensuring you benefit from asset protection and flexible ownership arrangements.

Creating your own Delaware Statutory Trust is a viable process. You must first complete the Delaware Certificate of Conversion From Limited Partnership To Statutory Trust, which allows you to shift your business structure efficiently. This conversion can provide benefits such as asset protection and flexible management options. At US Legal Forms, we offer resources and guidance to help you navigate through this process smoothly.

Yes, a plan of conversion is generally necessary when converting a business entity in Delaware. This plan outlines the specifics of how the conversion will occur, including the terms and conditions. Having a well-defined plan is essential for clarity and compliance during your conversion to a statutory trust.

A certificate of limited partnership in Delaware is a document that establishes a limited partnership as a legal entity. This certificate outlines the rights and responsibilities of the general and limited partners involved in the partnership. It's important to have this certificate in order to solidify your partnership's structure.

A certificate of conversion refers to the legal document that formalizes the change of a business entity's structure. Specifically, in this context, it concerns the transformation from a limited partnership to a statutory trust. This certificate plays a crucial role in clarifying the new entity's formation and operational guidelines.

To establish a statutory trust in Delaware, you must comply with specific regulatory requirements. These may include a filed declaration of trust, naming a registered agent, and fulfilling the conditions outlined in the Delaware Statutes. Knowing these requirements can facilitate a smoother transition during your conversion.