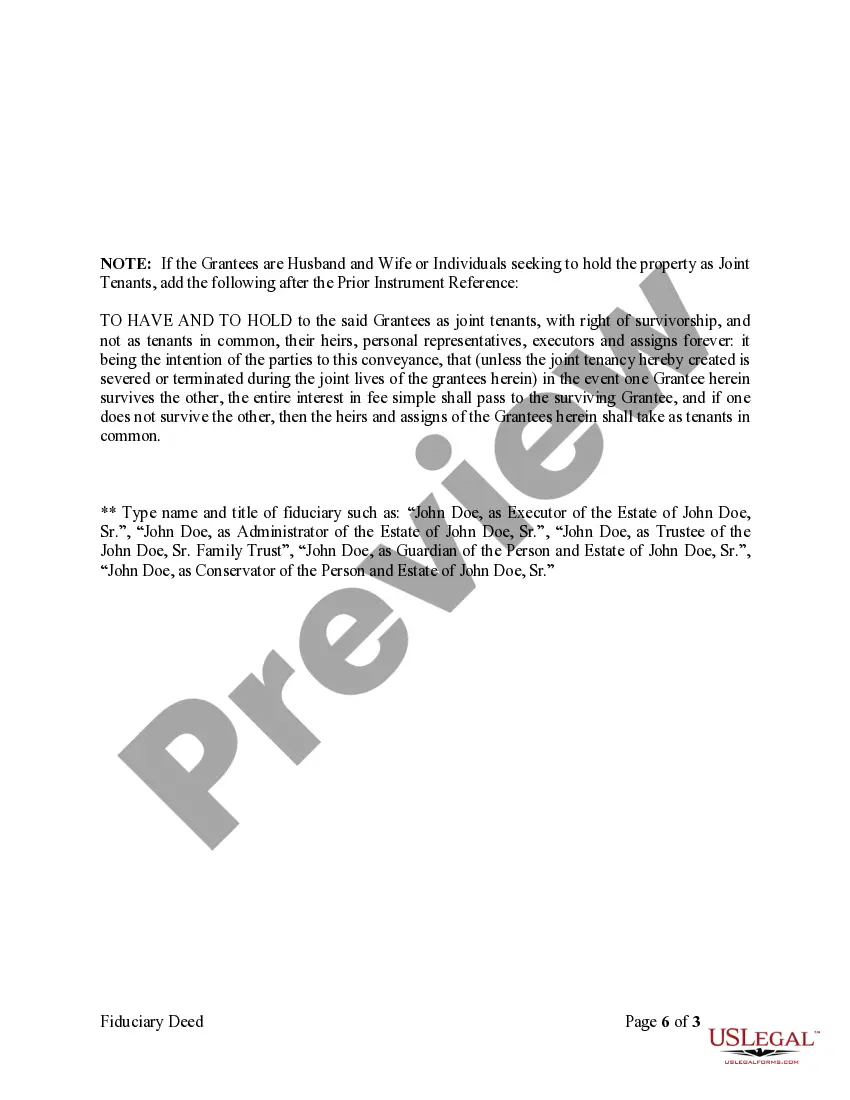

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

South Dakota Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Dakota Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Among countless free and paid templates which you get online, you can't be sure about their accuracy. For example, who made them or if they’re skilled enough to take care of what you need them to. Keep calm and utilize US Legal Forms! Discover South Dakota Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries templates created by professional attorneys and avoid the expensive and time-consuming process of looking for an attorney and then paying them to write a papers for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access your earlier saved files in the My Forms menu.

If you are making use of our platform for the first time, follow the instructions listed below to get your South Dakota Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries with ease:

- Ensure that the document you discover applies in your state.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or look for another template utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you have signed up and paid for your subscription, you can use your South Dakota Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries as many times as you need or for as long as it continues to be active where you live. Revise it in your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

When a property owner dies, the person who is listed as an executor of their estate assumes responsibility for the property. That is, everything the deceased owned. This includes their homes, pensions, bank accounts and other assets.

As an Executor, what you cannot do is go against the terms of the Will, Breach Fiduciary duty, fail to act, self-deal, embezzle, intentionally or unintentionally through neglect harm the estate, and cannot do threats to beneficiaries and heirs.

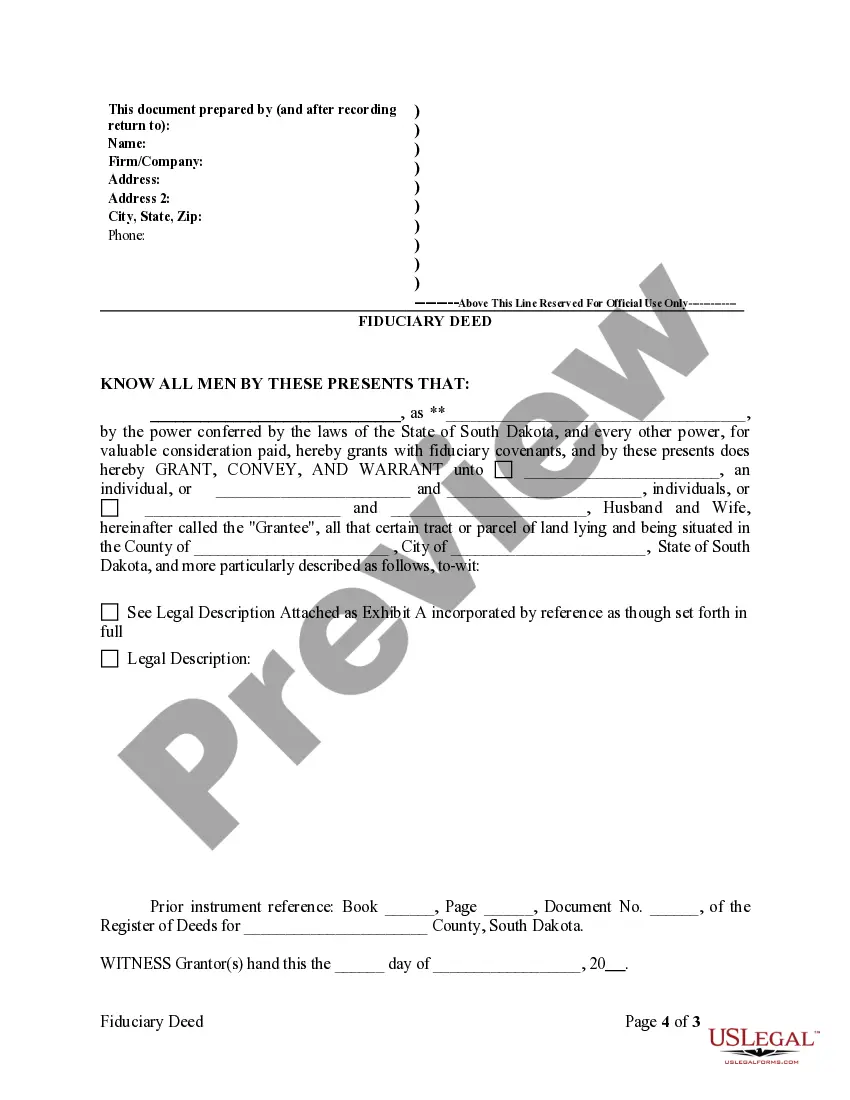

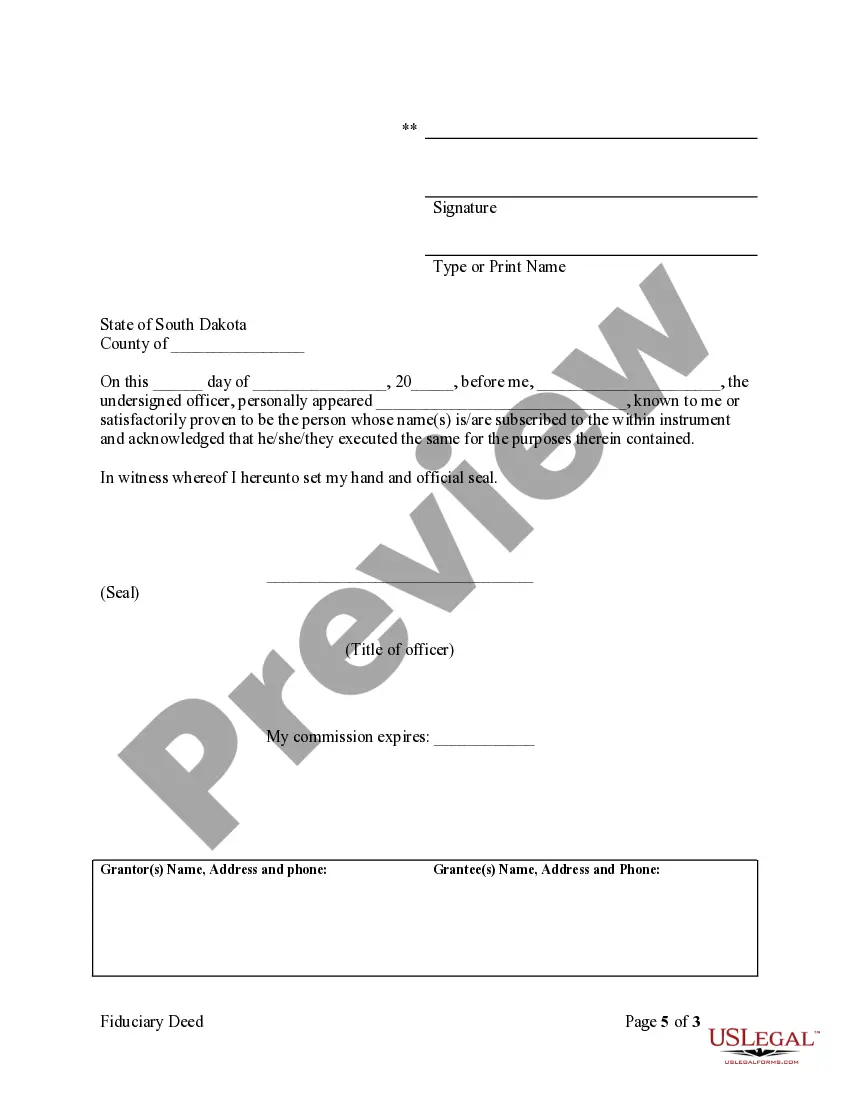

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

Again, the Executors of the Estate have overall authority, so can accept an offer from a potential buyer. But again, the Executors must act in the Beneficiaries' best interests, and so have a duty to sell the property for a reasonable sum.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

Executor's Deed: This may be used when a person dies testate (with a will). The estate's executor will dispose of the decedent's assets and an executor's deed may be used to convey the title or real property to the grantee.

The terms of the Independent Administration of Estates Act do not avoid probate, but they do allow an executor to sell an estate's real estate without probate court approval under some circumstances.