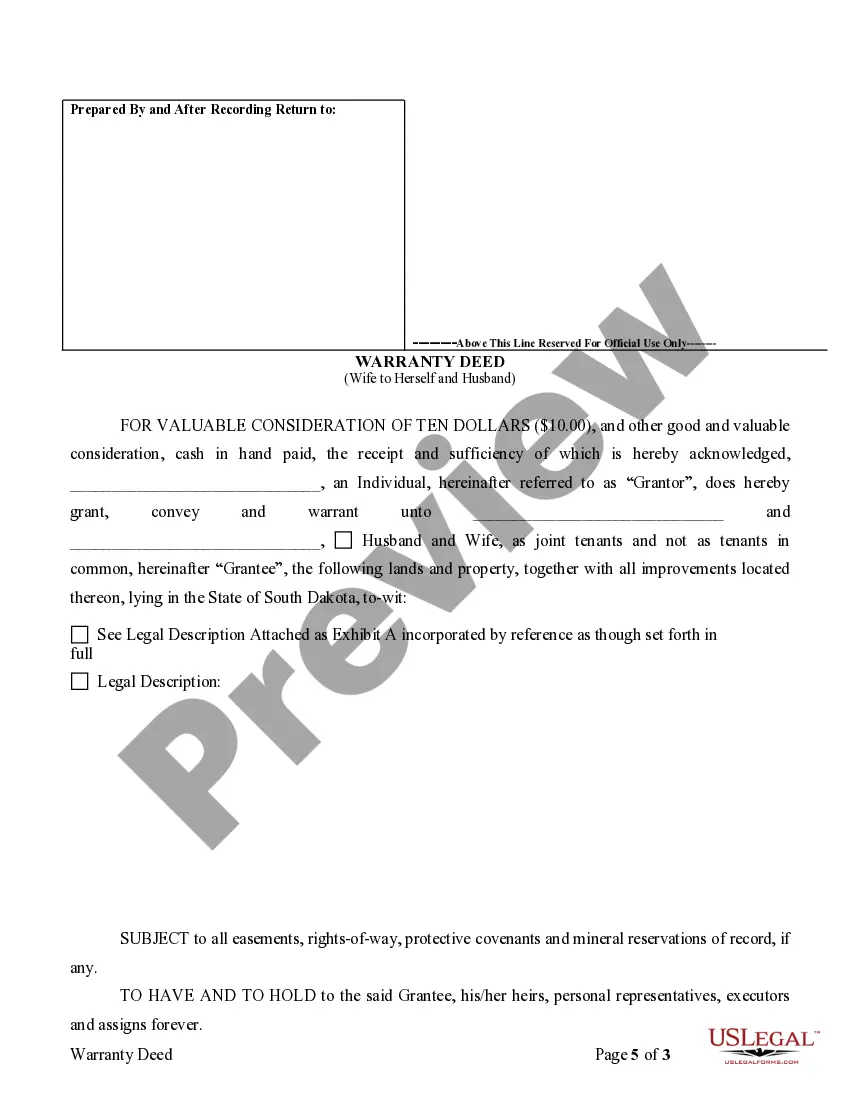

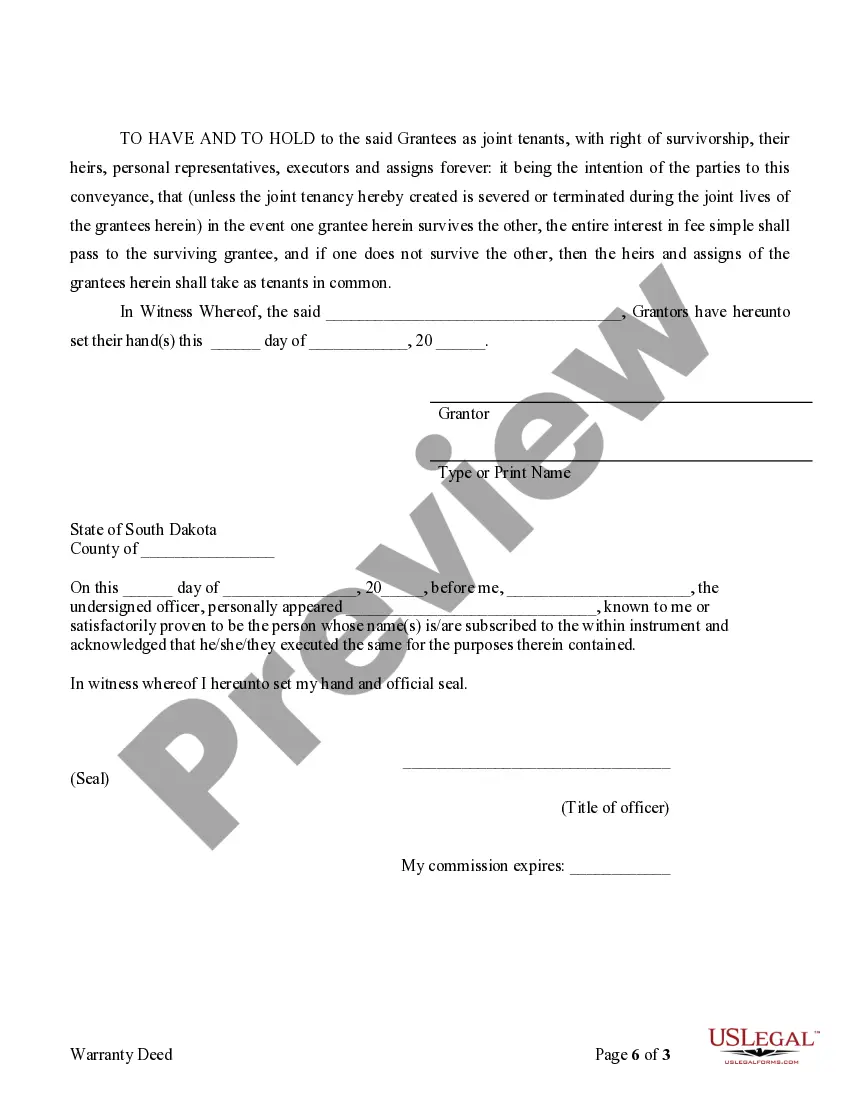

This form is a Warranty Deed where a wife transfers property to herself and her husband.

South Dakota Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants

Description

How to fill out South Dakota Warranty Deed To Separate Property Of One Spouse To Both Spouses As Joint Tenants?

Among countless free and paid templates which you get online, you can't be sure about their accuracy. For example, who made them or if they’re skilled enough to take care of what you need them to. Keep calm and utilize US Legal Forms! Discover South Dakota Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants templates created by professional attorneys and avoid the expensive and time-consuming process of looking for an attorney and then paying them to write a papers for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access your earlier saved files in the My Forms menu.

If you are making use of our platform for the first time, follow the instructions listed below to get your South Dakota Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants with ease:

- Ensure that the document you discover applies in your state.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or look for another template utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you have signed up and paid for your subscription, you can use your South Dakota Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants as many times as you need or for as long as it continues to be active where you live. Revise it in your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

The names on the mortgage show who's responsible for paying back the loan, while the title shows who owns the property. You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

In estate law, joint tenancy is a special form of ownership by two or more persons of the same property. The individuals, who are called joint tenants, share equal ownership of the property and have the equal, undivided right to keep or dispose of the property. Joint tenancy creates a Right of Survivorship.

In cases where a couple shares a home but only one spouse's name is on it, the home will not automatically pass to the surviving pass, if his or her name is not on the title.

California married couples generally have three options to take title to their community (vs separate) property real estate: community property, joint tenancy or Community Property with Right of Survivorship. The latter coming into play in California July of 2001.

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.

Separate property can become marital property if it is mixed with marital property. For example, if one of the spouses uses money they had before the marriage to buy a house for the couple, that money might become marital property.

In California, most married couples hold real property (such as land and buildings) as joint tenants with right of survivorship.For instance, many married couples share real property as joint tenants. This way, upon the death of a spouse, the surviving spouse will own 100% share of the property.

An unmarried couple may each own a home that qualifies as their principal residence but a married couple may only nominate one property and must elect jointly. It is possible to cut capital gains bills by living in the second property for a period of time.