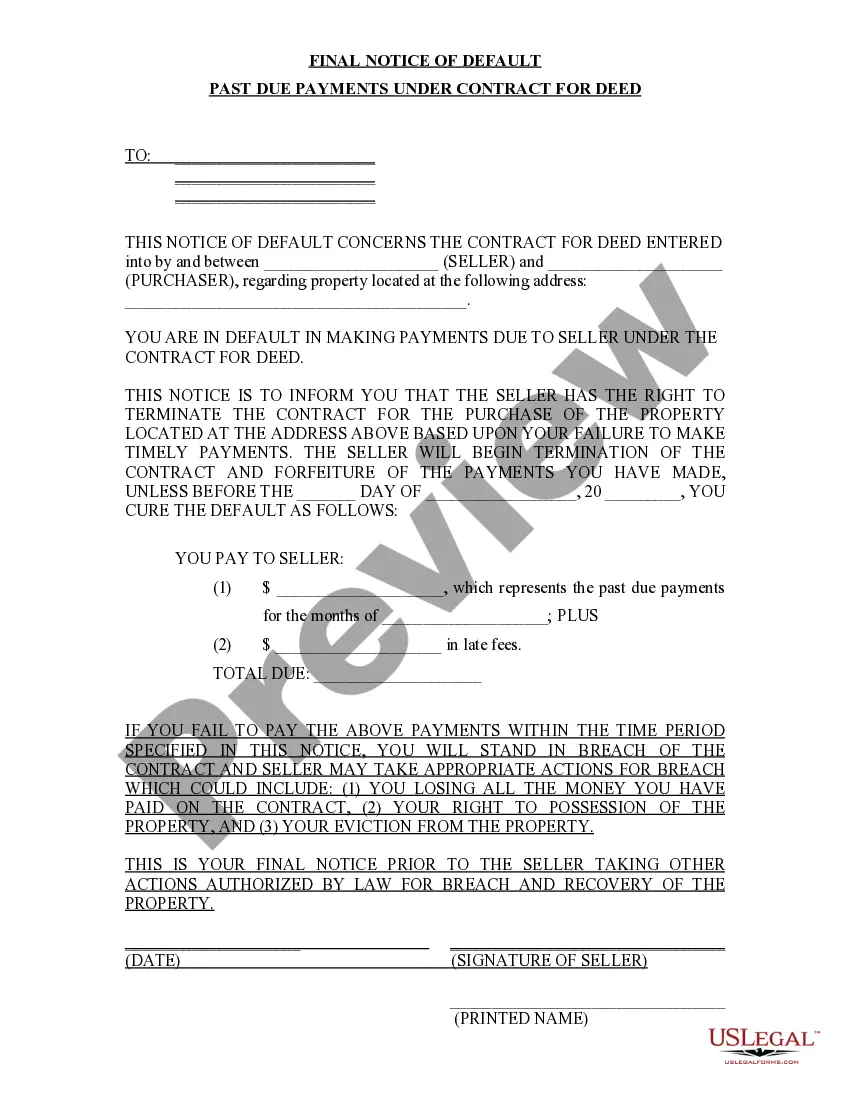

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Delaware Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to obtain a printable Delaware Final Notice of Default for Unpaid Payments related to Contract for Deed.

Our court-acceptable forms are crafted and continually revised by experienced attorneys.

Ours is the most comprehensive Forms collection available online, providing affordable and precise samples for clients, legal practitioners, and small to medium businesses.

Click Buy Now if it’s the document you seek. Create your account and make payment via PayPal or by credit/debit card. Download the form to your device and feel free to reuse it multiple times. Use the Search engine if you need another document template. US Legal Forms presents a wide array of legal and tax samples and packages for both business and personal requirements, including Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed. Over three million users have successfully used our platform. Choose your subscription plan and acquire high-quality documents in just a few clicks.

- The templates are organized into state-specific categories, with many available for preview before download.

- To download samples, users must possess a subscription and must Log In to their account.

- Select Download next to any template you desire and locate it in My documents.

- For those without a subscription, adhere to these guidelines to effortlessly locate and acquire the Delaware Final Notice of Default for Unpaid Payments related to Contract for Deed.

- Ensure you verify that you have the correct form pertaining to the state it’s required in.

- Examine the form by reading its description and utilizing the Preview feature.

Form popularity

FAQ

Several states, including Delaware, New Jersey, and Florida, operate under judicial foreclosure laws. This means that lenders must take legal action through the courts to reclaim properties. Understanding whether you are in a judicial or non-judicial state can help you navigate the process after receiving a Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed.

The number of missed house payments that can trigger foreclosure varies by lender and state guidelines. Generally, missing three to six payments may initiate the foreclosure process, especially after receiving a Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed. It is crucial to communicate with your lender to explore options before reaching this point.

Yes, Delaware is indeed a judicial foreclosure state. This means that lenders typically must go through the court system to foreclose on a property. If you are facing a Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed, you should be prepared for potential legal proceedings.

Delaware is primarily a judicial foreclosure state, meaning most foreclosures are handled through the courts. However, there are scenarios where a non-judicial option could be available, depending on the specifics of the contract. The Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed is usually tied to judicial processes.

The main difference lies in the legal processes involved. In a judicial foreclosure, the lender files a lawsuit against the borrower, often leading to a court decision. In contrast, strict foreclosure allows the lender to take immediate ownership of the property without going through the court, typically after a Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed.

Yes, a non-judicial foreclosure can negatively impact your credit score. When you receive a Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed, it usually leads to a public record that creditors may access. This record can lower your credit score, making it more challenging to secure loans or favorable interest rates in the future.

To repossess land, you need to follow a legal procedure that typically begins with issuing a Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed. This notice must clearly inform the property owner of their overdue payments and the consequences of failing to resolve the issue. After providing this notice, if the payment is not made, you may proceed with a foreclosure process which may include court involvement. Utilizing the resources available through US Legal Forms can help you navigate this process more smoothly, ensuring you follow all necessary legal steps effectively.

The foreclosure process in Louisiana typically involves a public auction after a formal notice of default is issued. As a homeowner, it’s crucial to respond and seek options to prevent this outcome. Learning from the Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed will help you understand your rights and options.

In West Virginia, foreclosure generally involves a judicial process where the lender files a lawsuit to reclaim the property due to unpaid debt. The homeowner is provided with opportunities to reverse the situation through payments or defenses. Recognizing similar processes outlined in the Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed can help you respond appropriately.

Receiving a default notice indicates that you have not met your contractual payment obligations, which may lead to further legal actions, including foreclosure. This is a serious matter that requires immediate attention. Understanding the Delaware Final Notice of Default for Past Due Payments in connection with Contract for Deed can empower you to take necessary steps to address your situation.