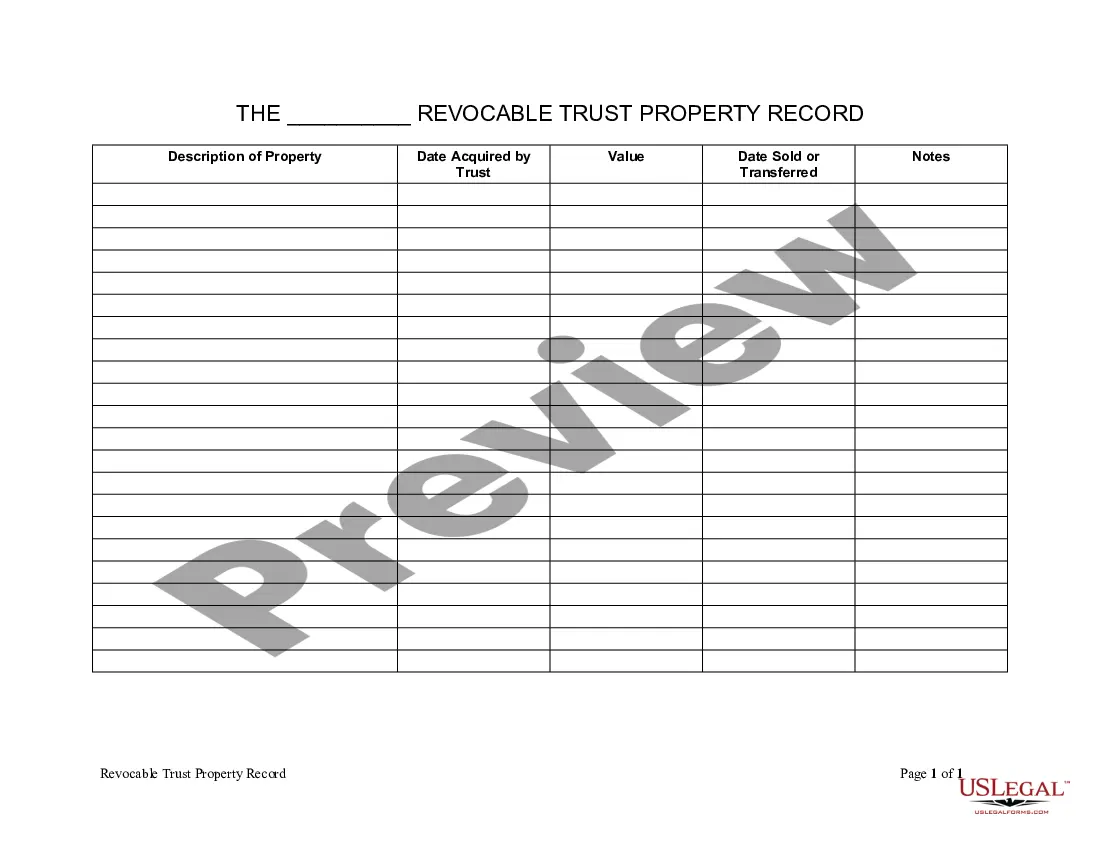

South Carolina Living Trust Property Record

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Carolina Living Trust Property Record?

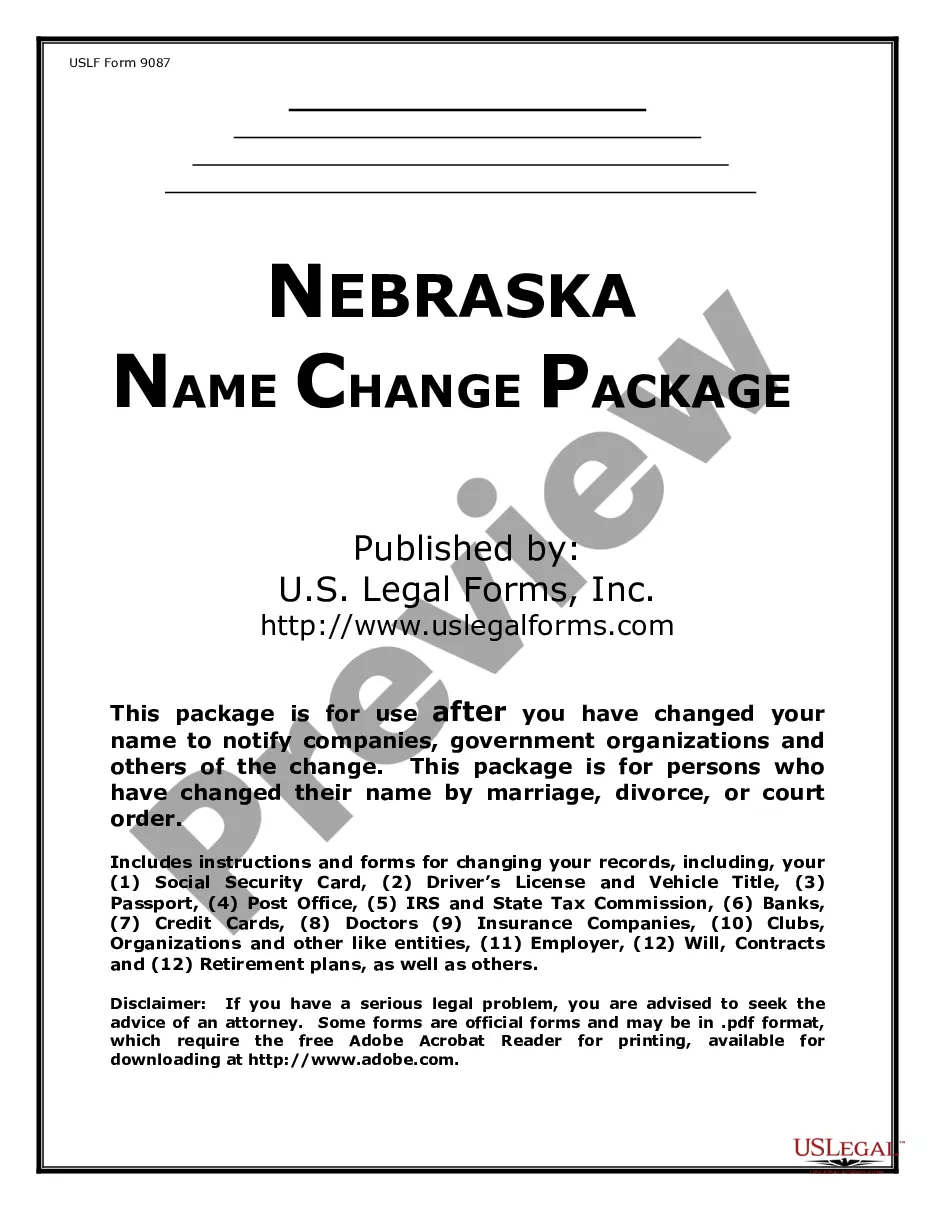

Creating documents isn't the most straightforward task, especially for those who rarely deal with legal papers. That's why we advise utilizing correct South Carolina Living Trust Property Record templates created by skilled lawyers. It allows you to prevent problems when in court or handling formal organizations. Find the files you require on our site for top-quality forms and correct information.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the file web page. Right after downloading the sample, it’ll be stored in the My Forms menu.

Customers without a subscription can easily get an account. Utilize this simple step-by-step guide to get your South Carolina Living Trust Property Record:

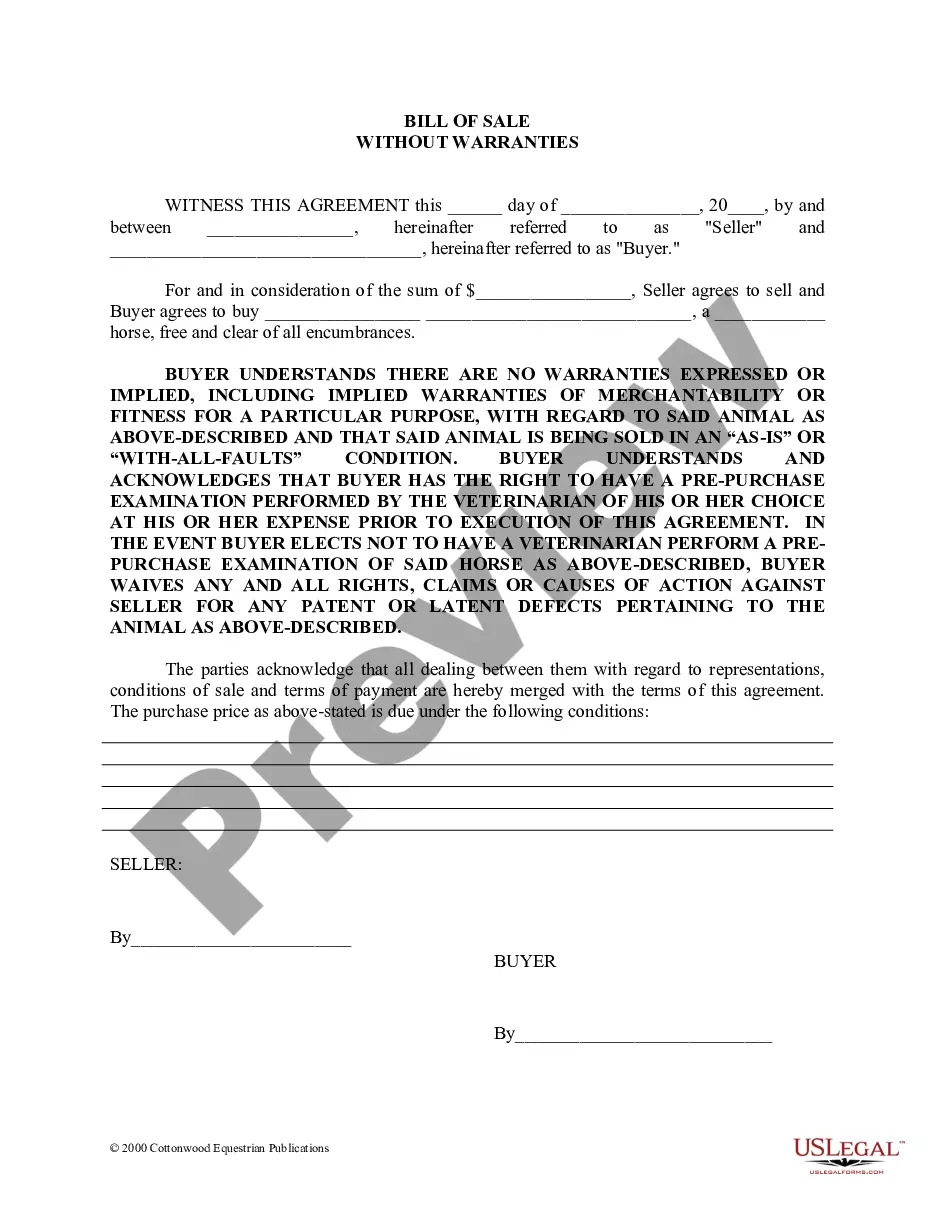

- Make certain that the form you found is eligible for use in the state it’s needed in.

- Confirm the document. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this template is what you need or use the Search field to find another one.

- Choose a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after doing these simple actions, you are able to fill out the sample in a preferred editor. Recheck filled in information and consider requesting an attorney to review your South Carolina Living Trust Property Record for correctness. With US Legal Forms, everything becomes much simpler. Try it now!

Form popularity

FAQ

With an irrevocable trust, the assets that fund the trust become the property of the trust, and the terms of the trust direct that the trustor no longer controls the assets.Because the assets within the trust are no longer the property of the trustor, a creditor cannot come after them to satisfy debts of the trustor.

Trusts may be revocable or irrevocable. Each trust is different, and the creator of each trust generally determines whether the trust is revocable.Therefore, if a judgment debtor is also the creator of a revocable trust, the judgment creditor can generally garnish the money or property held by that trust.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

Trusts aren't public record, so they're not usually recorded anywhere. Instead, the trust attorney determines who is entitled to receive a copy of the document, even if state law doesn't require it.

With a revocable trust, your assets will not be protected from creditors looking to sue. That's because you maintain ownership of the trust while you're alive. Therefore if you lose a lawsuit and a judgment is awarded to the creditor, the trust may have to be closed and the money handed over.

A living trust does not protect your assets from a lawsuit. Living trusts are revocable, meaning you remain in control of the assets and you are the legal owner until your death.

Its primary purpose is to avoid probate court, since revocable living trusts do not reduce estate taxes. With a revocable trust, your assets will not be protected from creditors looking to sue.With this kind of trust, assets are more protected from creditors.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.