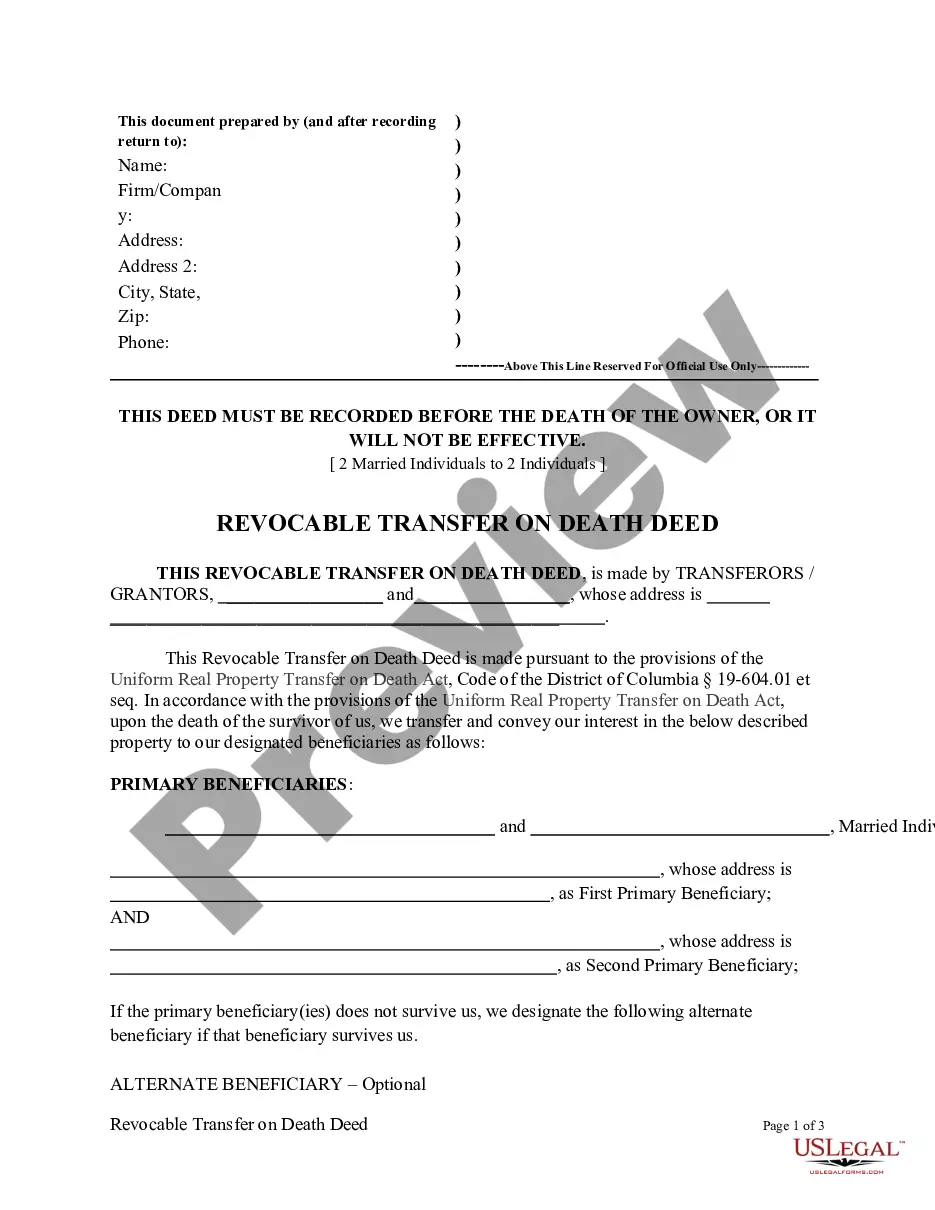

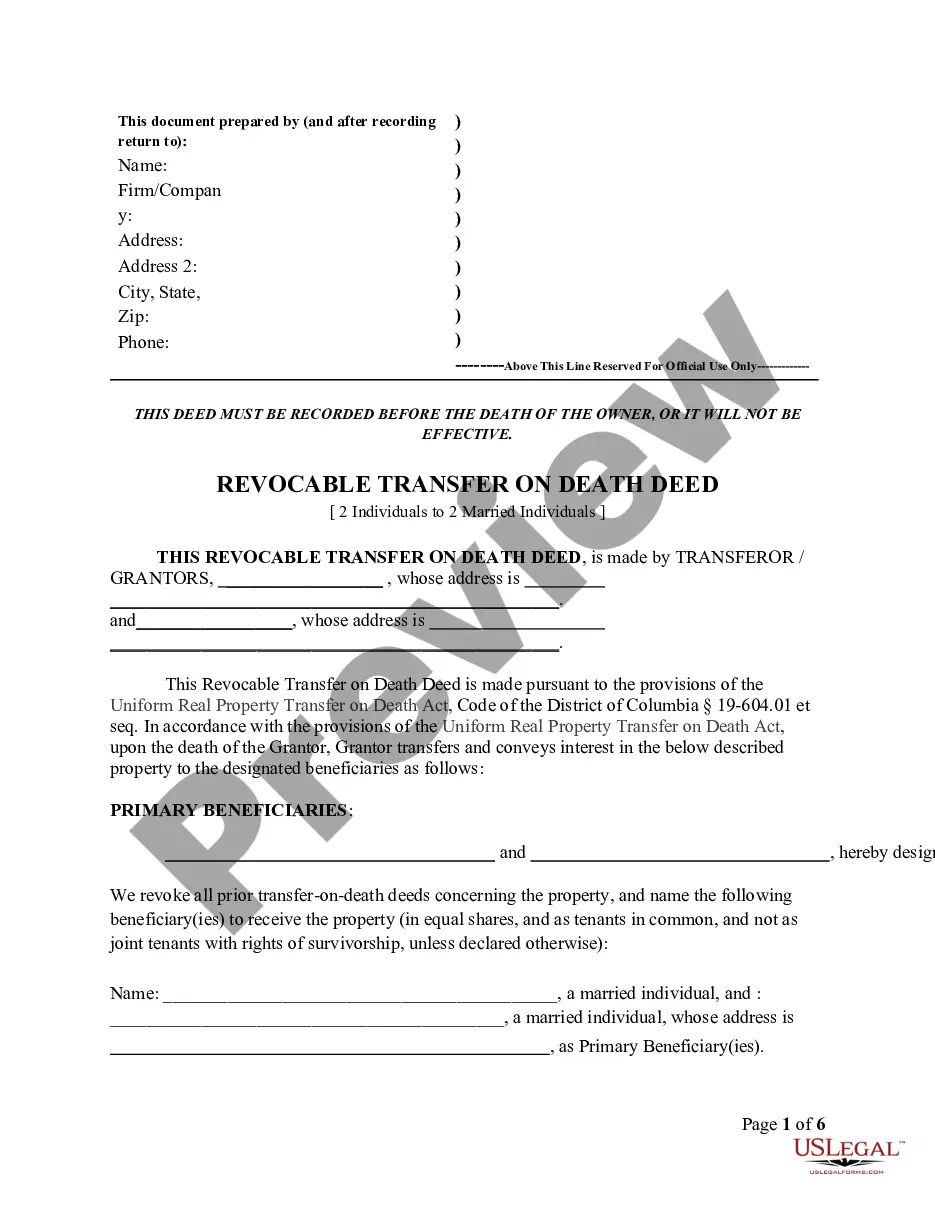

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individuals

Description

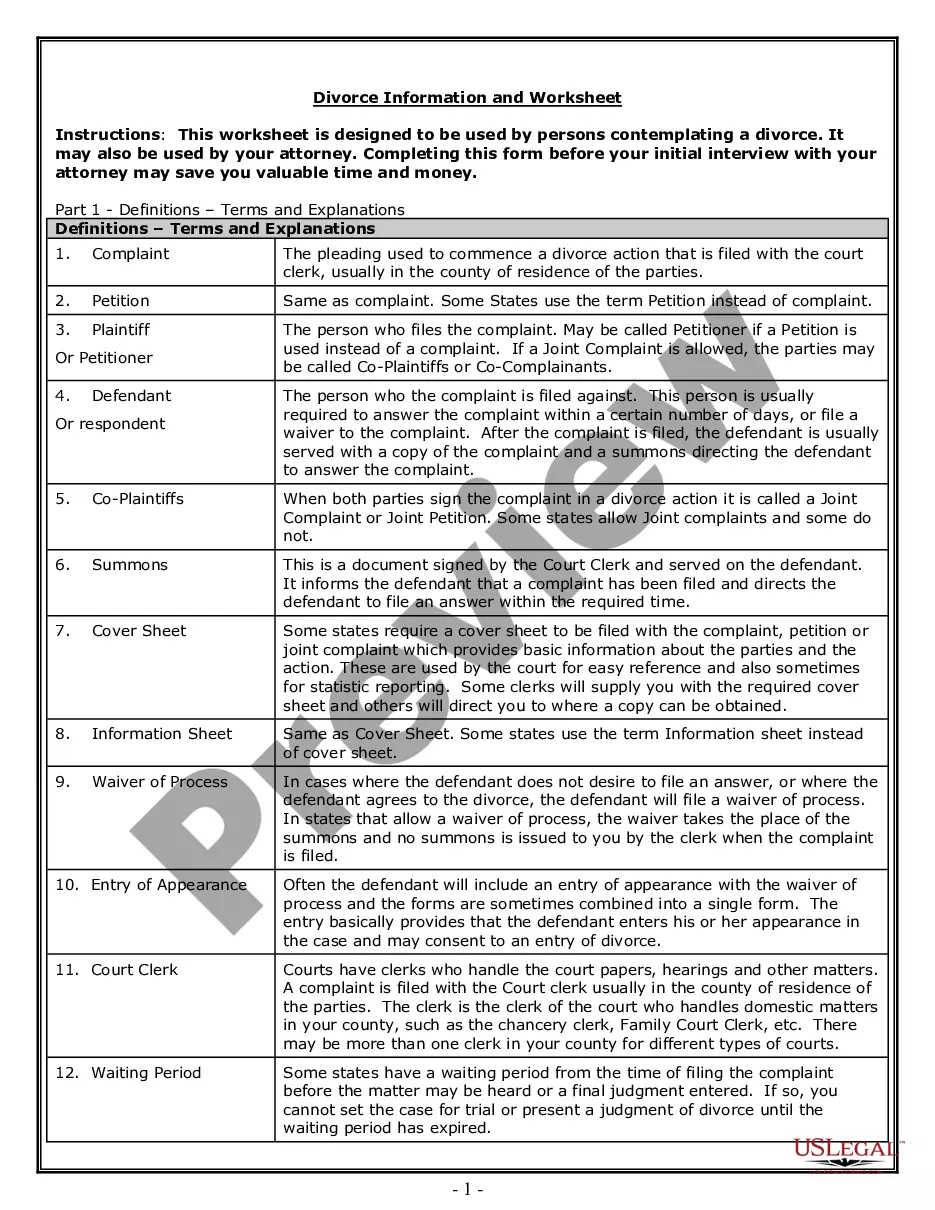

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Two Individuals?

Utilize US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Married Couples to Two Persons.

Our court-accepted forms are crafted and continually revised by experienced attorneys.

We offer the most comprehensive Forms library available online, providing economical and precise samples for individuals, legal professionals, and small to medium-sized businesses.

Press Buy Now if it's the correct template. Create your account and pay using PayPal or a credit card. Download the document to your device and feel free to reuse it multiple times. Utilize the Search field if you need another document template. US Legal Forms offers a vast array of legal and tax templates and packages for both business and personal requirements, including the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Married Couples to Two Persons. Over three million users have successfully utilized our platform. Select your subscription plan and acquire high-quality documents in just a few clicks.

- The templates are categorized by state and many can be previewed before downloading.

- To access templates, users must have a subscription and Log In to their account.

- Click Download next to the desired template and locate it in My documents.

- For those without a subscription, follow these steps to easily find and download the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Married Couples to Two Persons.

- Ensure you select the correct template relevant to the state required.

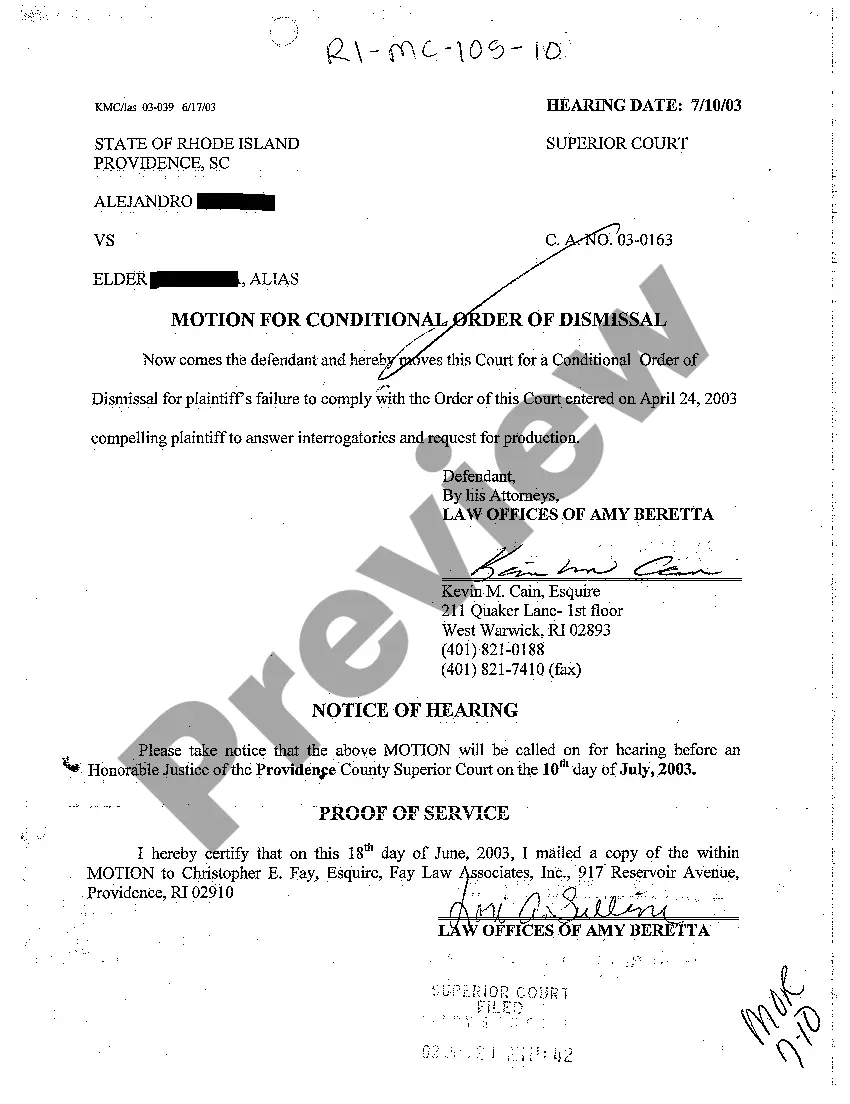

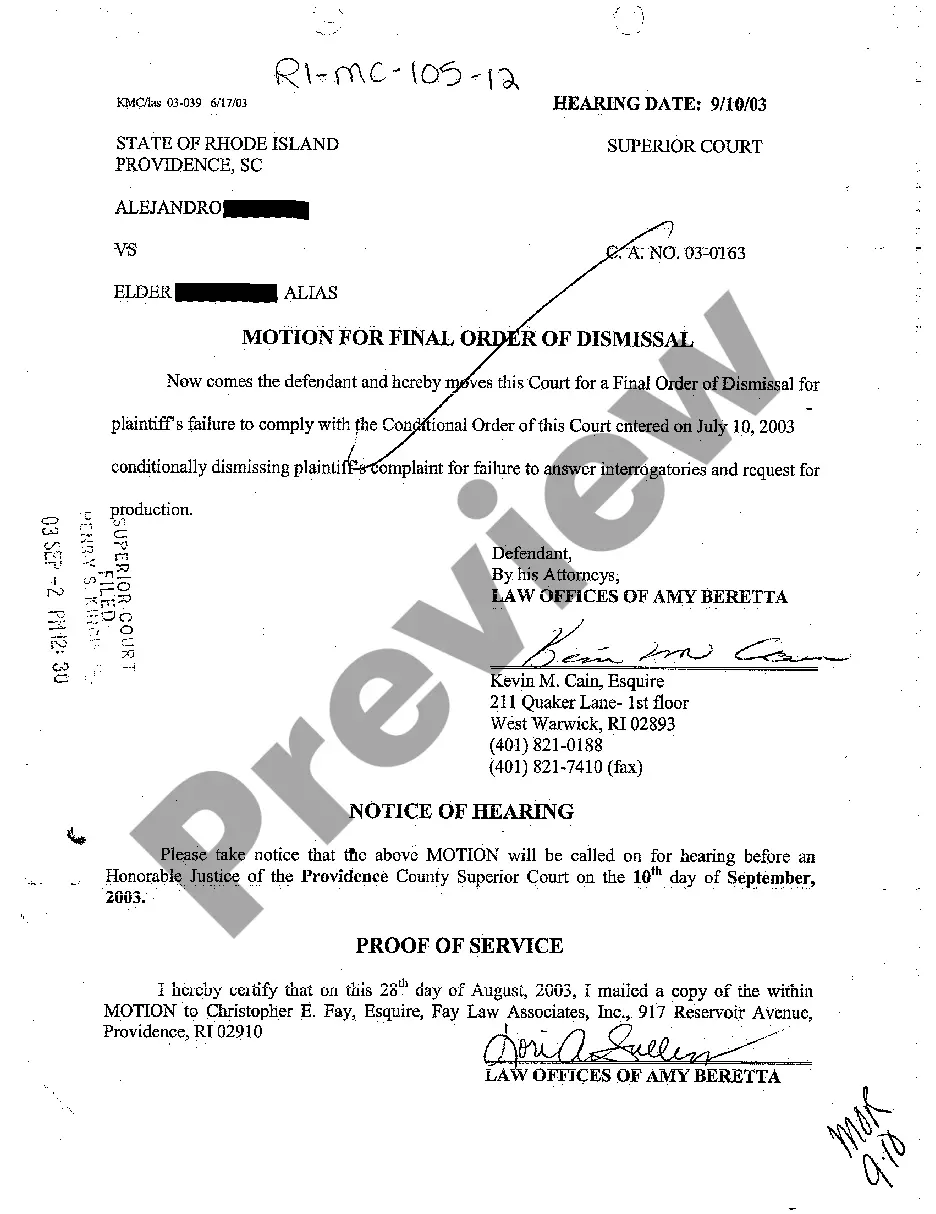

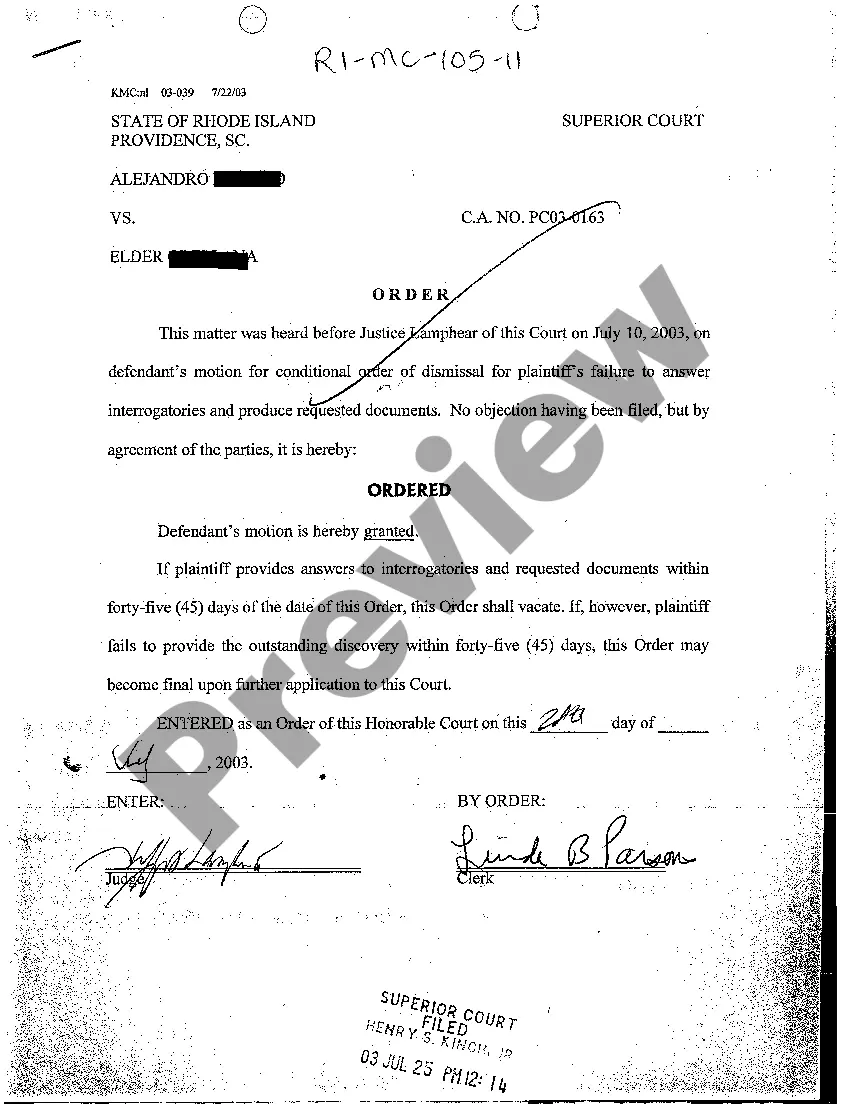

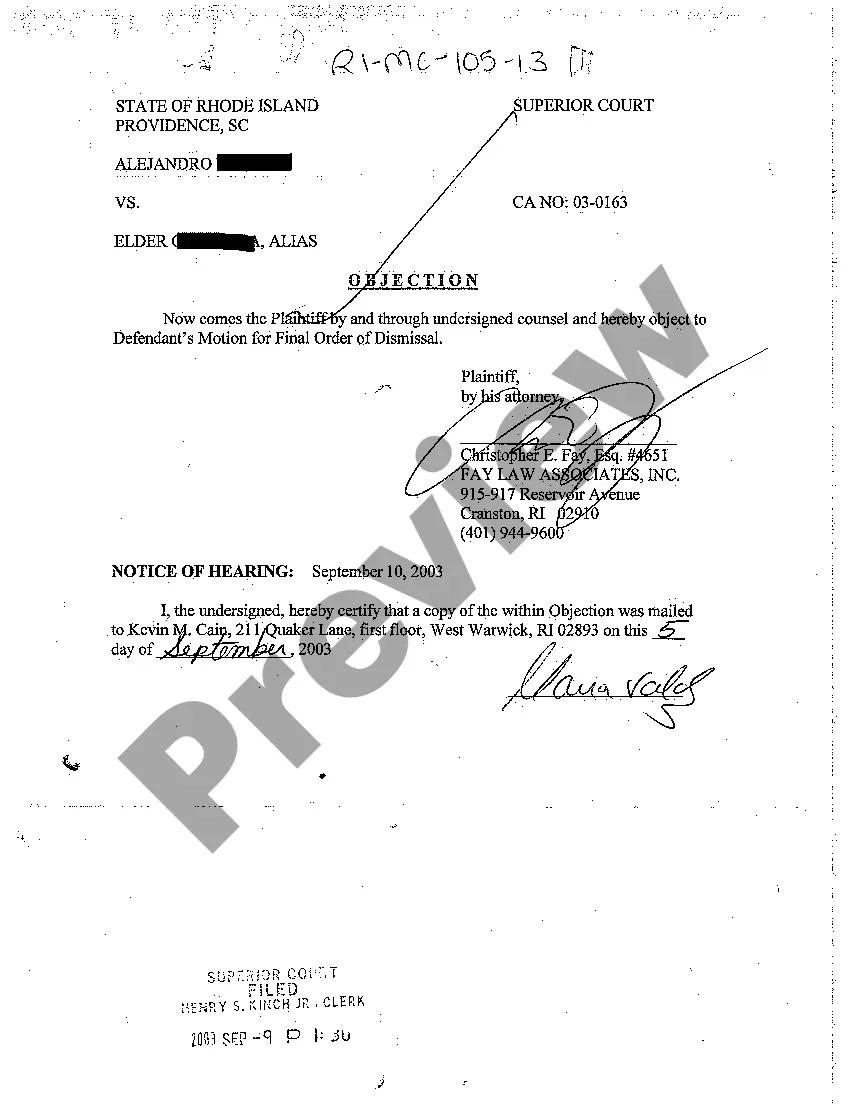

- Examine the form by reviewing the description and using the Preview feature.

Form popularity

FAQ

To transfer a death deed to two beneficiaries using the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individuals, you must first prepare the deed with both beneficiaries' names included. Next, sign the deed in front of a notary public to make it legally binding. Finally, file the deed with the appropriate District of Columbia office to ensure its validity. This simple process helps you effectively pass your property to your chosen beneficiaries without the need for probate.

While Transfer on Death deeds provide a streamlined transfer process, they also have potential downsides. For instance, they do not protect assets from creditors after the property owner's death, which could pose risks to beneficiaries. Furthermore, making changes to the deed can be complex, highlighting the importance of understanding the implications of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individuals before proceeding.

Filling out a Transfer on Death designation affidavit requires specific information, such as the property details and the beneficiaries' names. It's essential to follow your state's guidelines carefully to ensure the affidavit is valid and enforceable. Utilizing platforms like USLegalForms can provide templates and guidance on completing a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individuals correctly.

The primary difference between a Transfer on Death (TOD) deed and a beneficiary deed lies in their usage. A TOD deed allows a property owner to designate beneficiaries who will receive the property upon their death, effectively avoiding probate. In comparison, a beneficiary deed serves a similar purpose but may have certain limitations based on state laws. Understanding the nuances of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individuals can help you make informed decisions regarding property transfer.

Yes, the District of Columbia does permit the use of a Transfer on Death Deed. This legal mechanism allows property owners to designate beneficiaries who will receive the property upon their death without going through probate. If you are considering a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individuals, platforms like USLegalForms can provide the necessary forms and guidance.

Generally, a TOD does not avoid capital gains tax on the appreciation of the property during the owner's lifetime. Upon sale, the beneficiaries of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individuals may still be responsible for capital gains tax if the property has increased in value. Consulting a tax professional can give you additional insights.

Some drawbacks include the potential for disputes among heirs and the lack of control over the property during the owner’s lifetime. Additionally, a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individuals does not address issues like creditors or tax implications on the property post-transfer. Be sure to weigh these considerations carefully.

One disadvantage of a TOD deed is that it does not provide access to the property before the owner's death. Additionally, if you change your mind about the beneficiaries, you will need to update the deed accordingly. It’s important to consider all factors regarding a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individuals before proceeding.

A TOD deed can be a smart choice for transferring property upon death without going through probate. It simplifies the process, allowing your beneficiaries to inherit your property directly. Keep in mind, when considering a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individuals, it's essential to evaluate your family situation and financial goals.

You are not required to hire a lawyer for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Two Individuals. However, consulting a legal professional can provide peace of mind and ensure your documents are completed correctly. Many people choose to use online platforms like USLegalForms for guidance and support in creating these deeds.