District of Columbia Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Drafting Agreement - Self-Employed Independent Contractor?

Are you presently in a scenario where you require documents for either business or personal purposes frequently.

There are numerous authentic document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms provides a vast array of form templates, including the District of Columbia Drafting Agreement - Self-Employed Independent Contractor, designed to fulfill federal and state regulations.

If you find the appropriate form, click on Acquire now.

Select a suitable document format and download your version. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the District of Columbia Drafting Agreement - Self-Employed Independent Contractor anytime, if needed. Just select the necessary form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service offers properly crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the District of Columbia Drafting Agreement - Self-Employed Independent Contractor template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

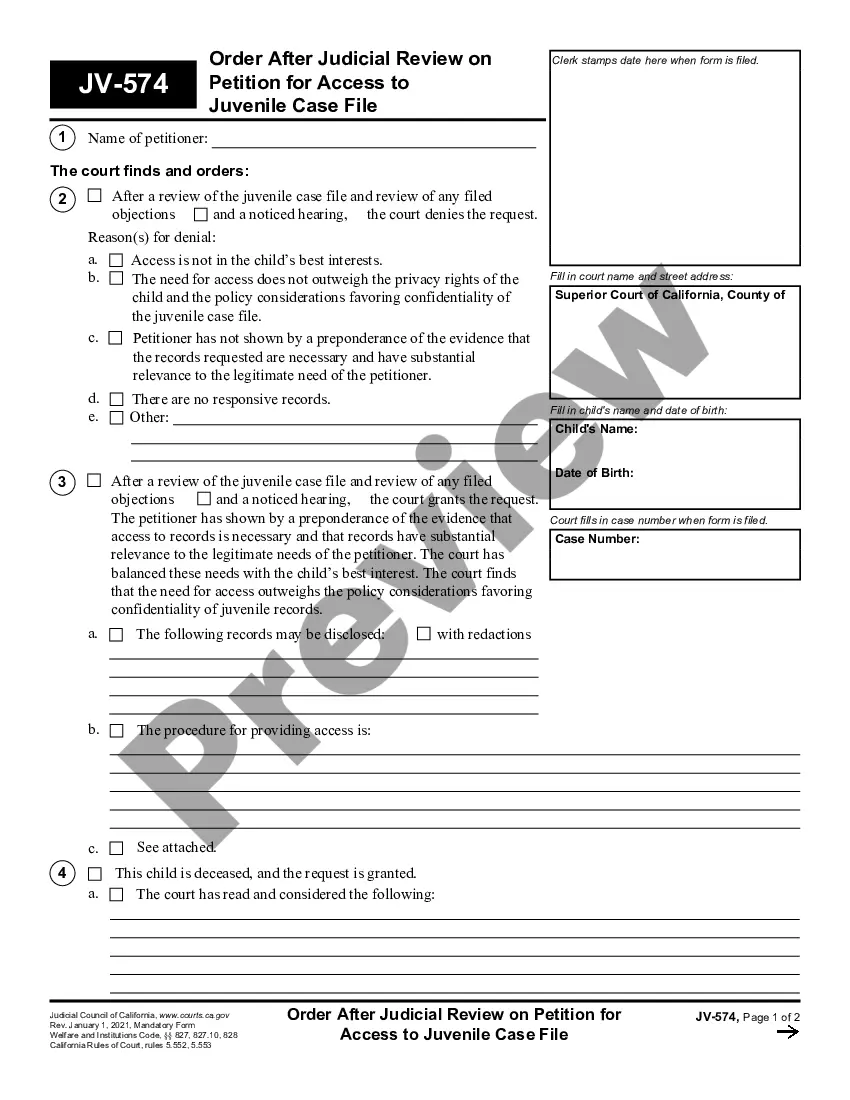

- Utilize the Preview button to review the form.

- Examine the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your needs and specifications.

Form popularity

FAQ

To fill out an independent contractor form, begin by entering the basic information such as the contractor's name and address. Next, specify the type of services being provided and the payment details. Utilizing a template from USLegalForms can enhance accuracy and efficiency. These templates are designed for the District of Columbia Drafting Agreement - Self-Employed Independent Contractor, ensuring that you meet local requirements.

Yes, an independent contractor is considered self-employed. They operate their own business and provide services to clients, rather than being an employee of a single company. This status often offers flexibility and control over work schedules. For detailed guidance specific to the District of Columbia Drafting Agreement - Self-Employed Independent Contractor, consider the resources available through USLegalForms.

To write an independent contractor agreement, start with a clear title that specifies the nature of the agreement. Next, include essential components such as the working relationship, payment structure, and confidentiality terms. Using a template from USLegalForms can streamline this process, particularly for the District of Columbia Drafting Agreement - Self-Employed Independent Contractor. This way, you ensure that the agreement covers all necessary legal bases.

Filling out an independent contractor agreement involves several key steps. First, agree on the scope of work, payment details, and deadlines. Then, enter this information into a structured template, like those provided by USLegalForms. These templates are tailored for the District of Columbia Drafting Agreement - Self-Employed Independent Contractor, making it straightforward to complete the form.

Typically, the business hiring the independent contractor drafts the agreement. However, both parties should review and agree on the terms. To ensure clarity and legality, many choose to utilize resources like USLegalForms. This platform offers templates specifically for the District of Columbia Drafting Agreement - Self-Employed Independent Contractor to make the process easier.

Yes, an independent contractor is generally considered self-employed. This status allows you to work for multiple clients without being tied to a single employer. Being self-employed also means you are responsible for your taxes and business expenses. If you're in the District of Columbia, creating a District of Columbia Drafting Agreement - Self-Employed Independent Contractor can provide clarity and protect your rights as a self-employed individual.

The new federal rule focuses on the classification of workers as independent contractors versus employees. This rule aims to simplify the process for determining who qualifies as an independent contractor. Understanding these changes is essential for self-employed individuals in the District of Columbia. A comprehensive District of Columbia Drafting Agreement - Self-Employed Independent Contractor can help navigate such regulations and protect your interests.

In the District of Columbia, licensing requirements depend on the type of work an independent contractor will perform. Certain trades, like construction or plumbing, typically require a license, while others do not. It is crucial for any independent contractor to check local regulations to ensure compliance. For those drafting agreements, using a District of Columbia Drafting Agreement - Self-Employed Independent Contractor can help clarify responsibilities.