District of Columbia Industrial Contractor Agreement - Self-Employed

Description

How to fill out Industrial Contractor Agreement - Self-Employed?

If you wish to finalize, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Various templates for commercial and personal use are organized by categories and states, or by keywords.

Every legal document template you purchase is your property permanently. You will have access to every form you obtained through your account. Visit the My documents section and choose a form to print or download again.

Stay competitive and download and print the District of Columbia Industrial Contractor Agreement - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal requirements.

- Utilize US Legal Forms to find the District of Columbia Industrial Contractor Agreement - Self-Employed in just a few clicks.

- If you are already a US Legal Forms customer, Log Into your account and press the Download button to obtain the District of Columbia Industrial Contractor Agreement - Self-Employed.

- You can also access forms you previously obtained under the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the relevant city/state.

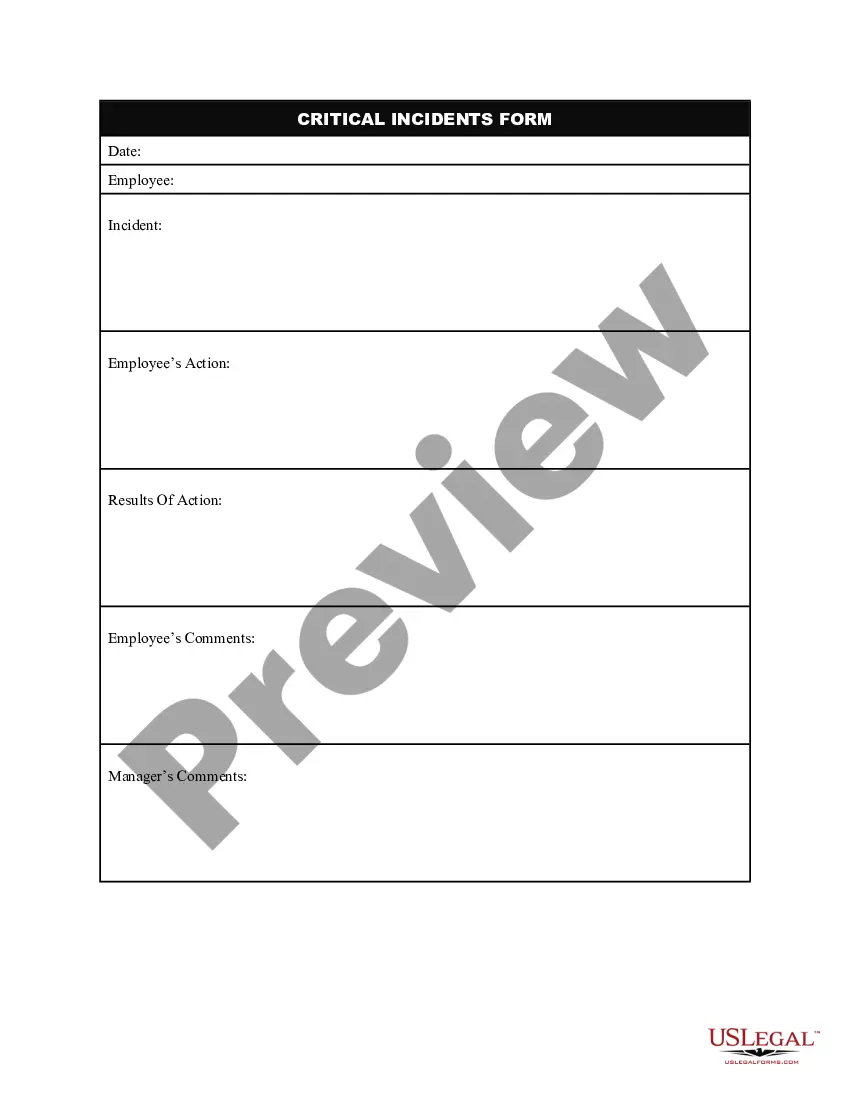

- Step 2. Use the Review feature to check the form’s details. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to locate alternative versions of the legal form template.

- Step 4. After finding the form you need, click the Buy now button. Choose your preferred pricing plan and provide your details to register for an account.

- Step 5. Process the payment. You may use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the District of Columbia Industrial Contractor Agreement - Self-Employed.

Form popularity

FAQ

Yes, independent contractors typically file as self-employed individuals. This means they report their income and expenses on a Schedule C attached to their personal tax return. It’s important to keep accurate financial records to ensure you can take advantage of relevant deductions. For guidance in navigating these tax obligations, consider leveraging tools from US Legal Forms within your District of Columbia Industrial Contractor Agreement - Self-Employed.

The new federal rule on independent contractors focuses on clarifying the classification of workers for wage and hour laws. This ensures that independent contractors, like those defined in the District of Columbia Industrial Contractor Agreement - Self-Employed, are correctly categorized. Misclassification can lead to significant penalties, so understanding this rule is critical for compliance. Keeping informed through resources such as US Legal Forms can help manage your legal obligations effectively.

Yes, in the District of Columbia, many contractors are required to obtain a license to operate legally. Licensing requirements can vary based on the type of work performed, so it's crucial to check the specific regulations that apply to your industry. Ensuring you have the proper licensing protects both you and your clients. For assistance, consider using a service like US Legal Forms to verify your requirements and guidelines.

Creating an independent contractor agreement in the District of Columbia is a straightforward process. Start by defining the scope of work, payment terms, and the duration of the contract. It's essential to include clauses that outline confidentiality, liability, and termination conditions. Utilizing a reliable platform like US Legal Forms can help you draft a comprehensive District of Columbia Industrial Contractor Agreement - Self-Employed that meets your specific needs.

Indeed, an independent contractor falls under the self-employed category. This status allows you to operate independently while fulfilling contracts with various clients. When entering into a District of Columbia Industrial Contractor Agreement - Self-Employed, it’s important to recognize your rights and responsibilities as a self-employed professional.

Receiving a 1099 form is a strong indicator of self-employment status. It means you earned income through independent contracting without taxes withheld by an employer. With a District of Columbia Industrial Contractor Agreement - Self-Employed, you should ensure that your business structure aligns well with tax documentation like the 1099.

Both terms describe similar work arrangements, but they can evoke different perceptions. 'Self-employed' often refers to individuals running a business, while 'independent contractor' specifically denotes someone working under a contract. For your dealings under a District of Columbia Industrial Contractor Agreement - Self-Employed, using the term that aligns with your marketing and client expectations can be beneficial.

As an independent contractor, protecting yourself involves establishing clear contracts, maintaining proper insurance, and keeping detailed records of your work. A well-structured District of Columbia Industrial Contractor Agreement - Self-Employed can serve as your primary protection tool. Additionally, consistently communicating with your clients helps set expectations and reduces disputes.

Self-employment means that you work for yourself rather than for an employer. Generally, if you run your own business or provide services independently, you are considered self-employed. In the context of a District of Columbia Industrial Contractor Agreement - Self-Employed, engaging in contracts and managing your tax responsibilities further solidifies your status.