District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor

Description

How to fill out Medical Transcriptionist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print. By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly find the latest forms such as the District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor. If you already have a monthly subscription, Log In and access the District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to get you started: Ensure you have chosen the correct form for the city/county. Click the Preview button to review the form’s content. Check the form summary to confirm that you have selected the right form. If the form does not meet your requirements, use the Search box at the top of the page to find one that does. If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, select your preferred pricing plan and provide your details to register for an account. Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor. Every template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, simply visit the My documents section and click on the form you need.

- Access the District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive library of legal document templates.

- Utilize numerous professional and state-specific templates that meet your business or personal requirements and needs.

Form popularity

FAQ

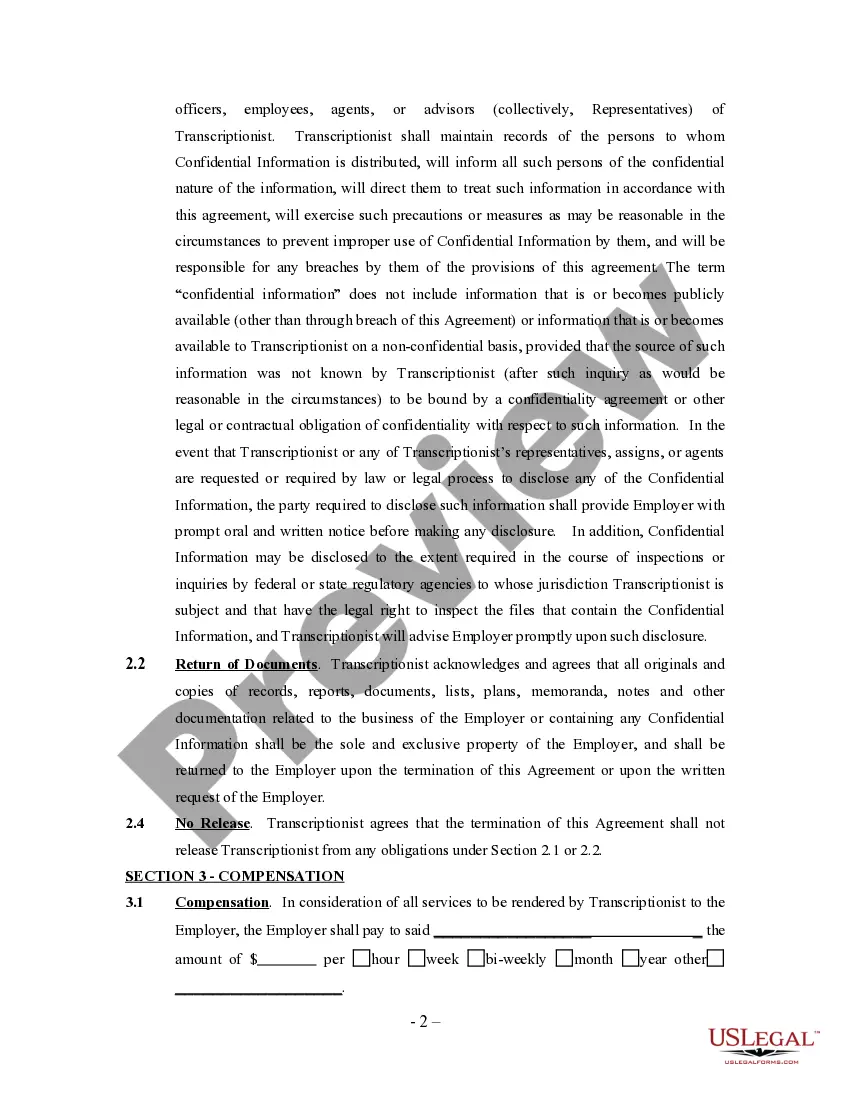

Writing an independent contractor agreement involves outlining key terms clearly and concisely. Begin with your details and those of your client, followed by a description of services, payment structure, and confidentiality clauses, especially under the District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor. Consider using a legal template to ensure you address all necessary legal points, making the process easier and more reliable.

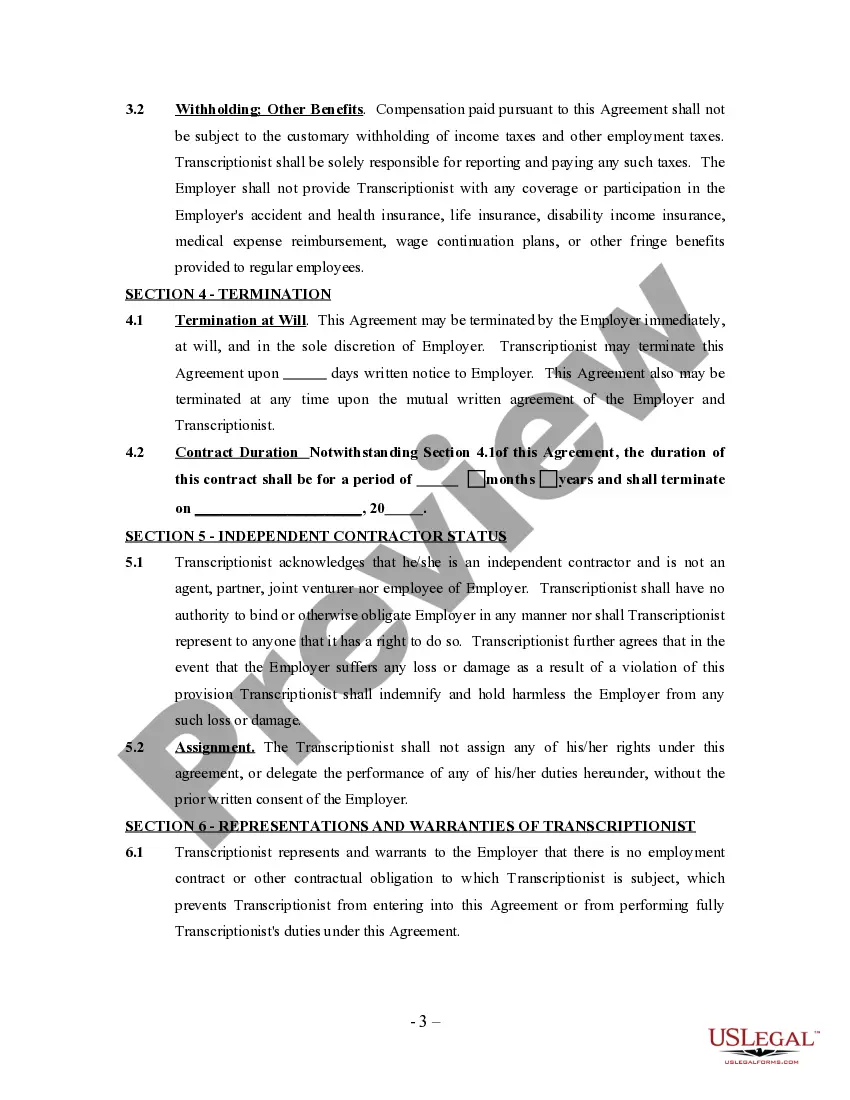

To prove your independent contractor status, gather documents that demonstrate your business relationship with clients. The District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor should detail your work arrangement, payment methods, and how you control your work, showing that you are not an employee. Additionally, invoices, client communication, and records of your business expenses can also support your status.

To fill out an independent contractor agreement, start by clearly stating the scope of work you will perform. Specify the payment terms and any deadlines related to the District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor. Make sure both parties understand their obligations and rights. You may also find it helpful to use a template to ensure you cover all necessary components.

Yes, independent contractors typically file as self-employed individuals. This means that when you enter into a District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor, you are responsible for reporting your income and paying self-employment taxes. It's crucial to keep accurate records of your earnings and expenses to ensure proper filing each tax season.

Reporting independent contractor income requires organization and accuracy. You need to track all earnings and expenses related to your work under the District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor. Utilize IRS forms 1099-NEC to report your income and ensure you keep records of your invoices and receipts. This documentation helps streamline your tax filing process.

Filling out an independent contractor form is straightforward. Start by gathering your personal information, like your name, address, and Social Security number. Then, clearly indicate your services as it applies to the District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor. Ensure you provide your payment preferences and any necessary tax information to avoid issues in the future.

To show proof of income as a 1099 contractor, gather documentation such as your 1099 forms issued by clients and bank statements reflecting deposits. You may also include your District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor to illustrate your earnings structure. Keeping detailed records of invoices and payments will support your claims and provide transparency for any financial inquiries.

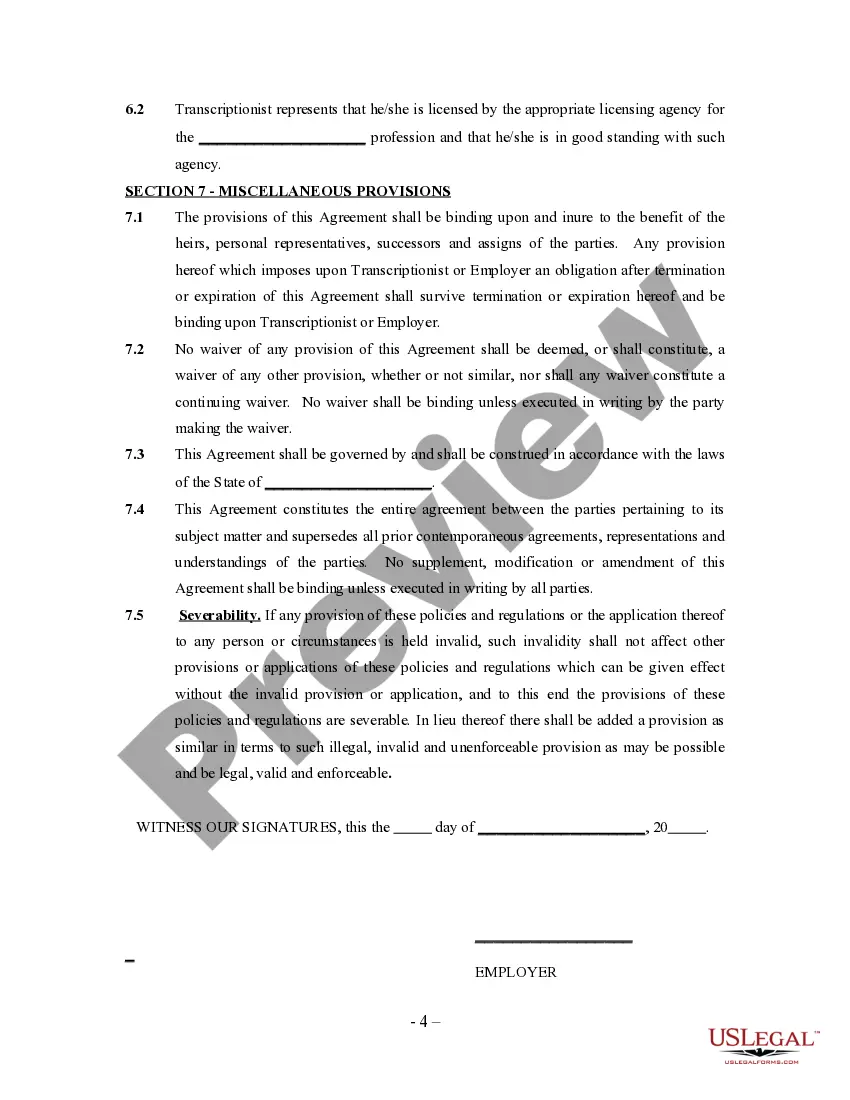

Yes, having a contract is essential for an independent contractor. A District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor clearly lays out the terms of engagement, client expectations, and your obligations. This not only protects your interests but also establishes a professional relationship with your clients, giving you a solid foundation for your work.

An independent contractor can show proof of employment by submitting their District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor. Other valid documentation includes copies of signed contracts, invoices sent to clients, and bank statements reflecting payments received. This comprehensive evidence confirms your role and the nature of your work with various clients.

To demonstrate that you are self-employed, you can showcase your District of Columbia Medical Transcriptionist Agreement - Self-Employed Independent Contractor. Alongside this agreement, tax documents such as a Schedule C form or 1099 forms will reinforce your status. Additionally, maintaining organized records of your work and client communications can further establish your self-employment.