District of Columbia Nursing Agreement - Self-Employed Independent Contractor

Description

How to fill out Nursing Agreement - Self-Employed Independent Contractor?

If you need to compile, obtain, or generate legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Take advantage of the site’s straightforward and convenient search to find the documents you require.

A variety of templates for business and personal purposes are categorized by classes and states, or keywords. Use US Legal Forms to acquire the District of Columbia Nursing Agreement - Self-Employed Independent Contractor with just a few clicks.

If you are already a US Legal Forms member, Log In to your account and click on the Download button to obtain the District of Columbia Nursing Agreement - Self-Employed Independent Contractor. You can also access forms you have previously saved in the My documents tab of your account.

Every legal document template you download is yours to keep indefinitely. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Compete and obtain, and print the District of Columbia Nursing Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

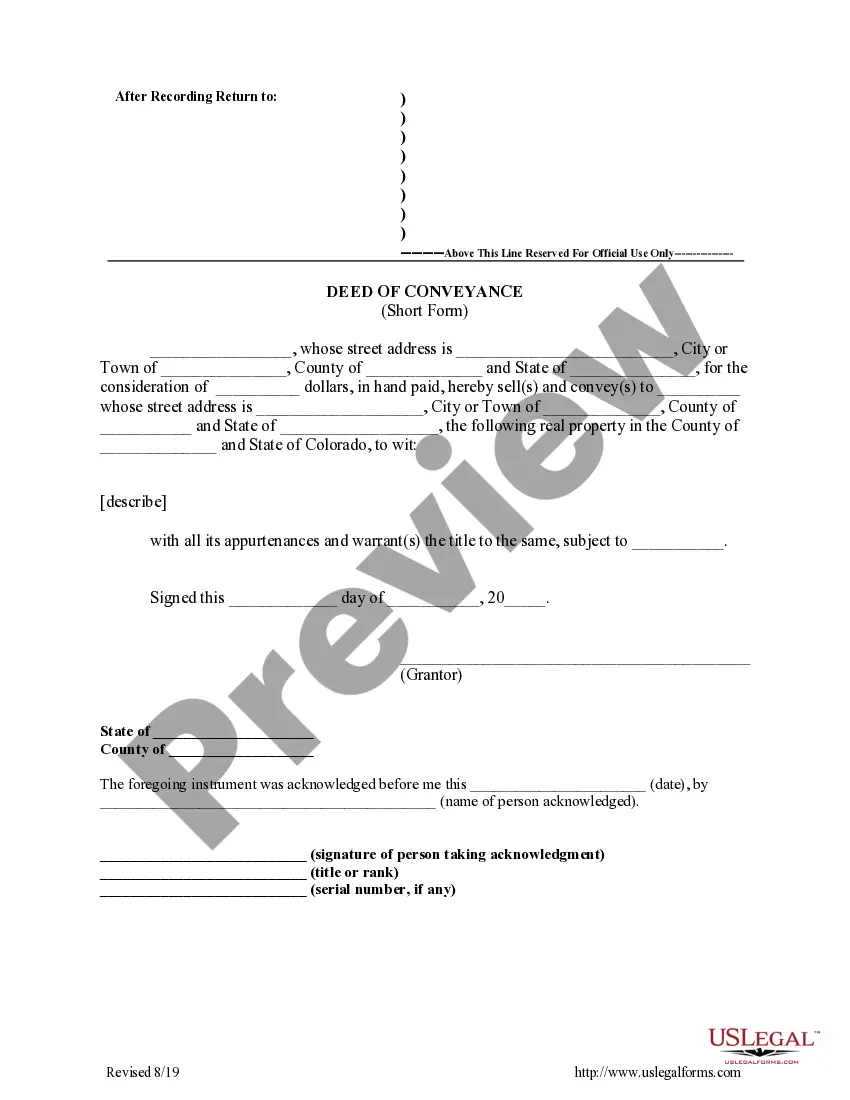

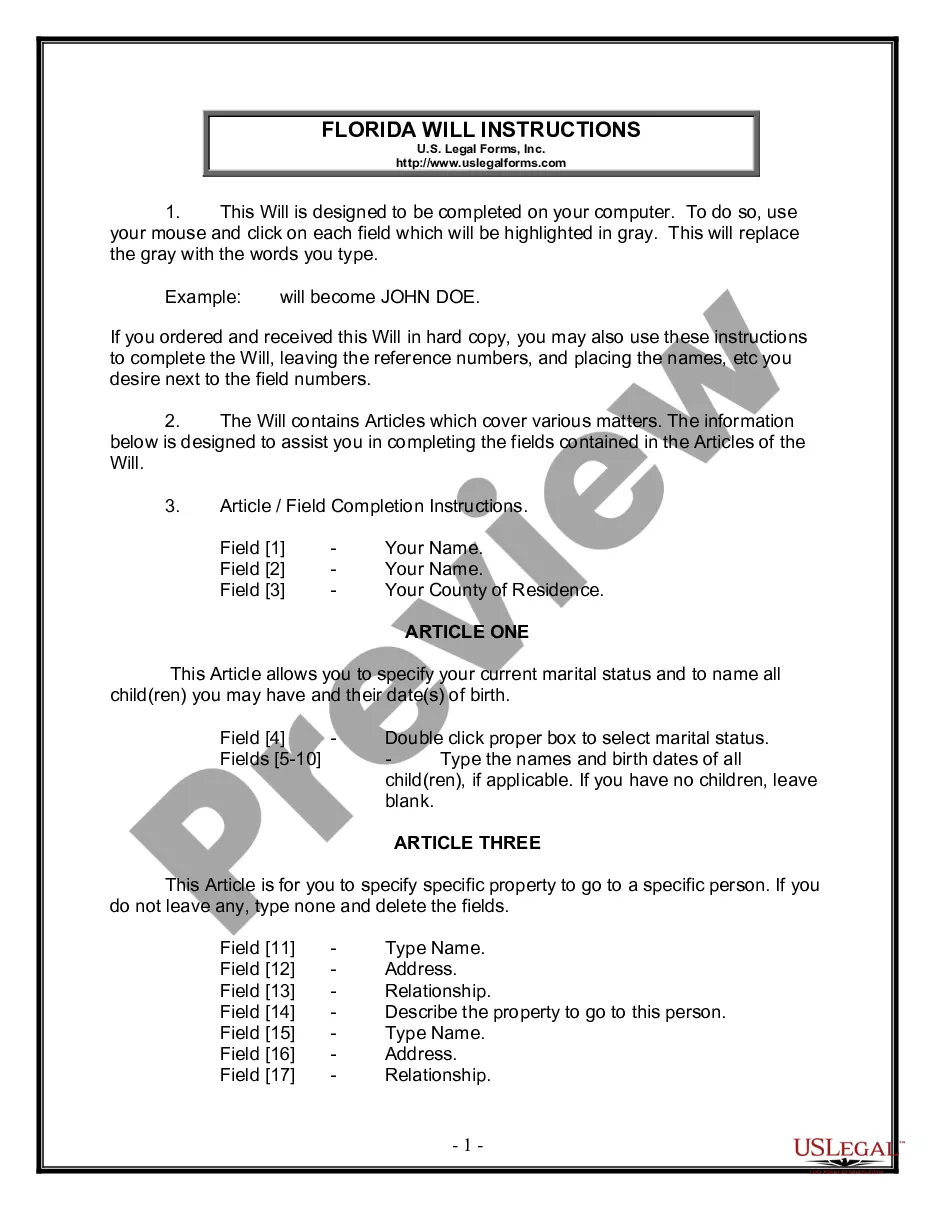

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of your legal document template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your information to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the District of Columbia Nursing Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Yes, an independent contractor is generally considered self-employed. This classification means they operate their own business and are responsible for their own taxes and benefits. When entering a District of Columbia Nursing Agreement - Self-Employed Independent Contractor, nurses can fully embrace the advantages of self-employment, such as flexible work arrangements and the freedom to choose their practice.

Yes, a registered nurse (RN) can be self-employed. By establishing a District of Columbia Nursing Agreement - Self-Employed Independent Contractor, RNs can offer their services independently. This self-employment route allows them to take control of their practice, set their rates, and work with various clients according to their preferences.

While nurses cannot be classified as employees under a 1099 status, they can work as independent contractors. This arrangement is often formalized through a District of Columbia Nursing Agreement - Self-Employed Independent Contractor. This structure provides them with the autonomy to manage their schedules and select their clients, making it an appealing option for many.

Nurses may receive either a W-2 or a 1099 form, depending on their employment status. If they work as employees for a healthcare facility, they typically receive a W-2. However, if they operate under a District of Columbia Nursing Agreement - Self-Employed Independent Contractor, they will receive a 1099, reflecting their independent status and earnings.

Yes, nurses can be classified as 1099 independent contractors. This classification allows them to work on a self-employed basis under a District of Columbia Nursing Agreement - Self-Employed Independent Contractor. Being a 1099 contractor gives nurses more flexibility in their schedules and the ability to choose their clients. However, they must also manage their own taxes and benefits.

Yes, you can work independently as a nurse, but it requires careful planning and adherence to legal requirements. Consider your specialty, market demand, and licensing needs. Working as a self-employed independent contractor offers flexibility and control over your schedule. Drafting a District of Columbia Nursing Agreement - Self-Employed Independent Contractor will ensure you have a solid foundation for your independent practice.

Yes, nurses can work as a 1099, which means they are classified as independent contractors. This arrangement allows for greater flexibility and potential for higher earnings. However, it's important to understand tax implications and the responsibilities that come with this classification. A District of Columbia Nursing Agreement - Self-Employed Independent Contractor can help you navigate these aspects effectively.

To become an independent contractor as a nurse, start by defining your services and target market. Establish your business structure and ensure you have the right licenses. Networking with healthcare facilities and utilizing online platforms can help you find opportunities. Utilize a District of Columbia Nursing Agreement - Self-Employed Independent Contractor to formalize your business relationships and clarify your terms with clients.

The new federal rule on independent contractors focuses on clarifying the criteria used to classify workers. This rule aims to protect workers' rights while ensuring that businesses can operate effectively. For nurses considering self-employment, understanding this rule is crucial, as it may impact your ability to work as a self-employed independent contractor. Consulting a District of Columbia Nursing Agreement - Self-Employed Independent Contractor can provide valuable insights into compliance.

To work as an independent contractor as a nurse, you need to obtain the necessary licenses and certifications. Research the legal requirements in your state, including any specific regulations for the District of Columbia. Once you have your paperwork in order, seek out opportunities that match your skills. Having a District of Columbia Nursing Agreement - Self-Employed Independent Contractor will help protect your interests while you navigate this path.