District of Columbia Documentation Required to Confirm Accredited Investor Status

Description

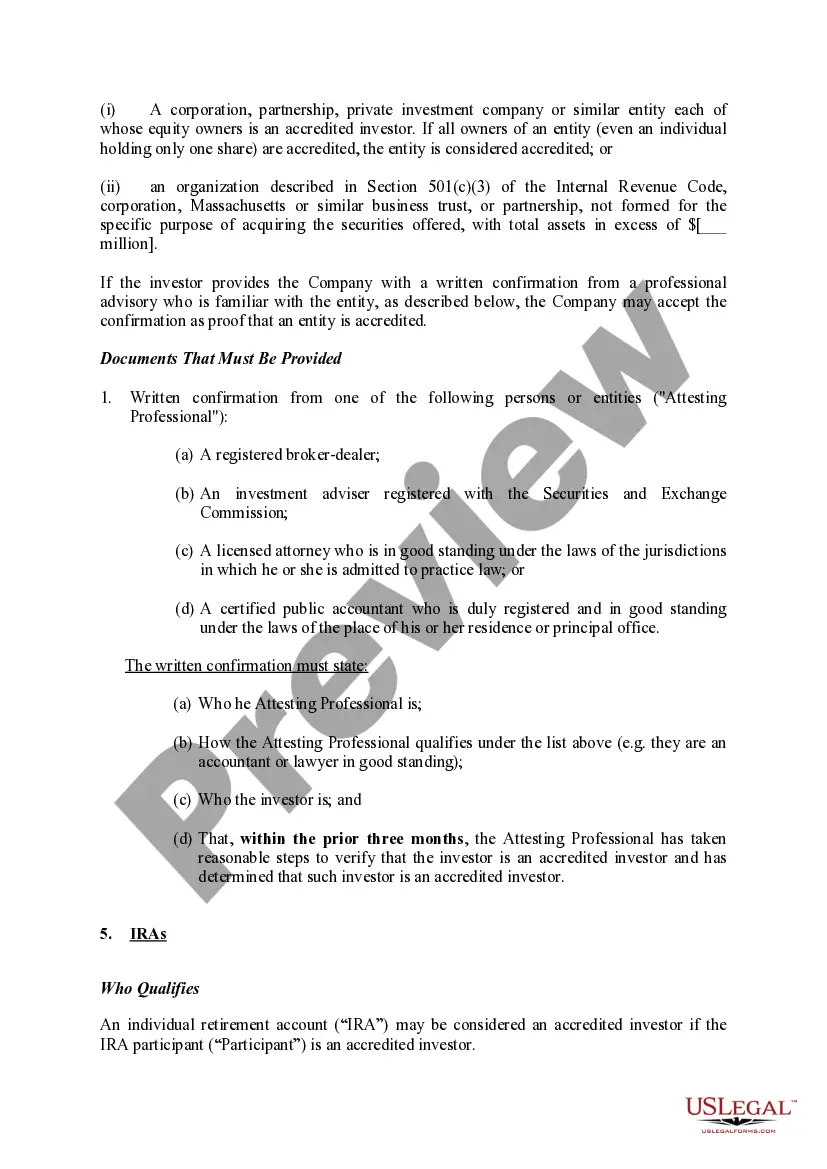

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

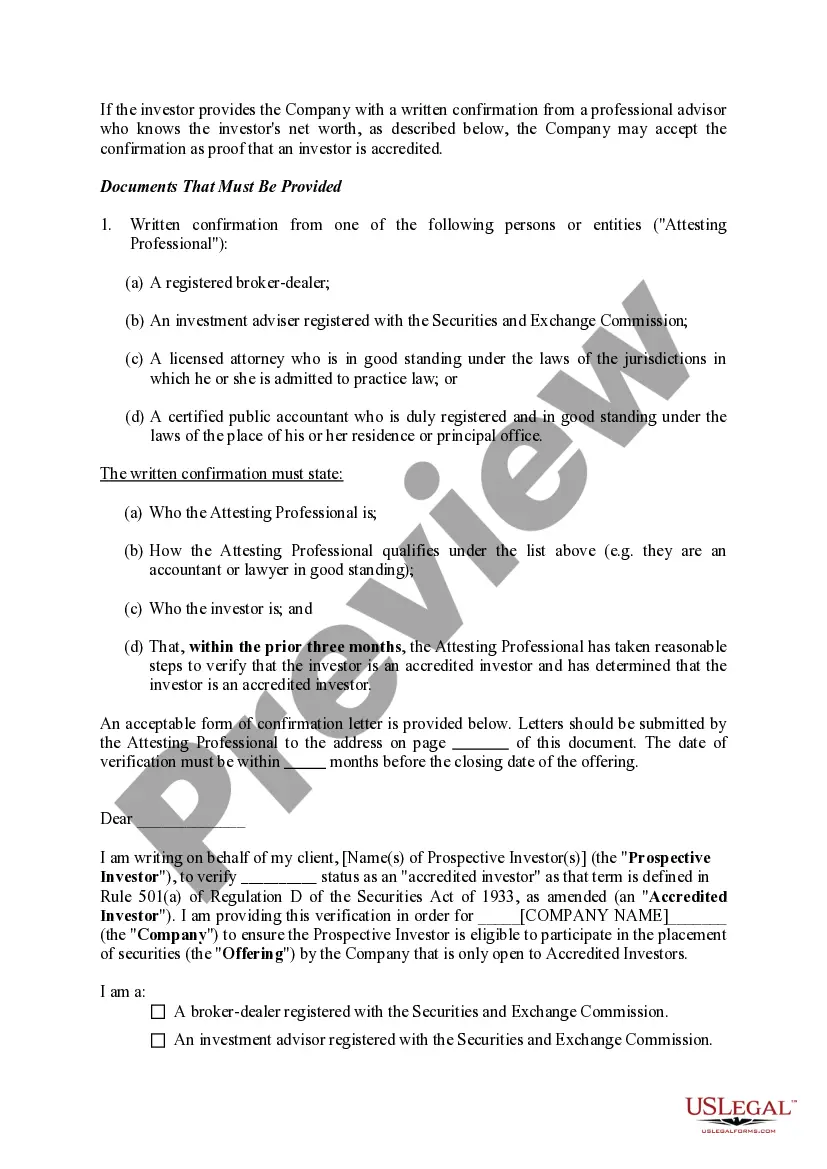

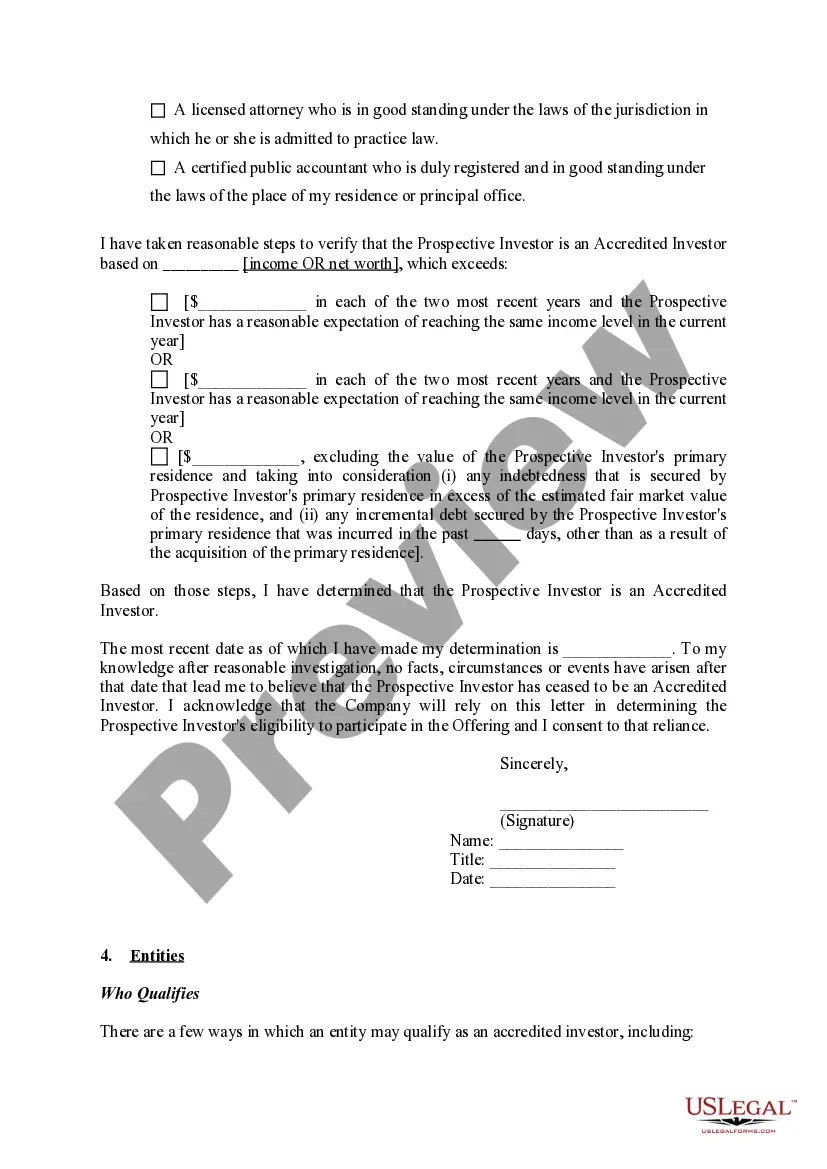

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Documentation Required To Confirm Accredited Investor Status?

If you have to complete, download, or print lawful record templates, use US Legal Forms, the most important collection of lawful forms, which can be found on-line. Use the site`s simple and handy lookup to get the documents you want. A variety of templates for organization and person functions are categorized by types and suggests, or key phrases. Use US Legal Forms to get the District of Columbia Documentation Required to Confirm Accredited Investor Status in a few clicks.

If you are previously a US Legal Forms customer, log in in your account and click on the Download switch to find the District of Columbia Documentation Required to Confirm Accredited Investor Status. You can also access forms you previously saved within the My Forms tab of your account.

If you work with US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for your appropriate town/nation.

- Step 2. Utilize the Review option to look through the form`s articles. Don`t forget about to read through the information.

- Step 3. If you are not satisfied with all the form, take advantage of the Research discipline near the top of the monitor to discover other versions of the lawful form template.

- Step 4. When you have discovered the form you want, click the Get now switch. Select the prices program you prefer and add your accreditations to sign up for an account.

- Step 5. Approach the financial transaction. You can use your credit card or PayPal account to perform the financial transaction.

- Step 6. Find the file format of the lawful form and download it on the system.

- Step 7. Full, edit and print or indication the District of Columbia Documentation Required to Confirm Accredited Investor Status.

Every single lawful record template you purchase is your own eternally. You possess acces to every form you saved inside your acccount. Click on the My Forms area and decide on a form to print or download again.

Compete and download, and print the District of Columbia Documentation Required to Confirm Accredited Investor Status with US Legal Forms. There are many professional and state-particular forms you can use for your personal organization or person requires.

Form popularity

FAQ

This criteria requires that an individual have net assets that count for at least $5 million, with liabilities subtracted. This means that an investor with $4.5 million in real estate and $500,000 in cash may be considered an accredited investor.

Anyone can buy securities under this exemption, but there are limits depending on whether they are an eligible or non-eligible investor. To qualify as an eligible investor, you must have: Net assets, alone or with a spouse, exceeding $400,000. Net income before tax.

Examples of supporting documents Latest statement from brokerage houses showing net personal assets For net equity of property: Title deeds free of encumbrances. Latest housing loan statement For income: Salary Slip.

This criteria requires that an individual have net assets that count for at least $5 million, with liabilities subtracted. This means that an investor with $4.5 million in real estate and $500,000 in cash may be considered an accredited investor.

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.

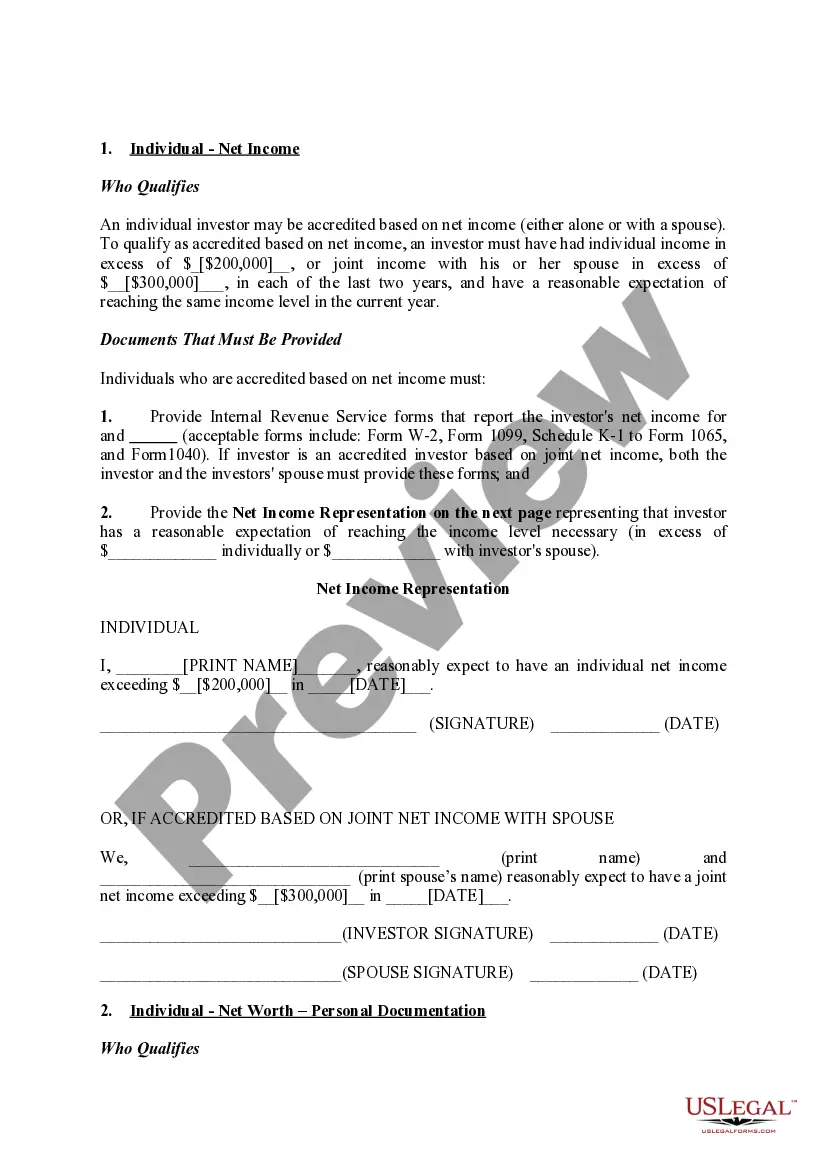

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

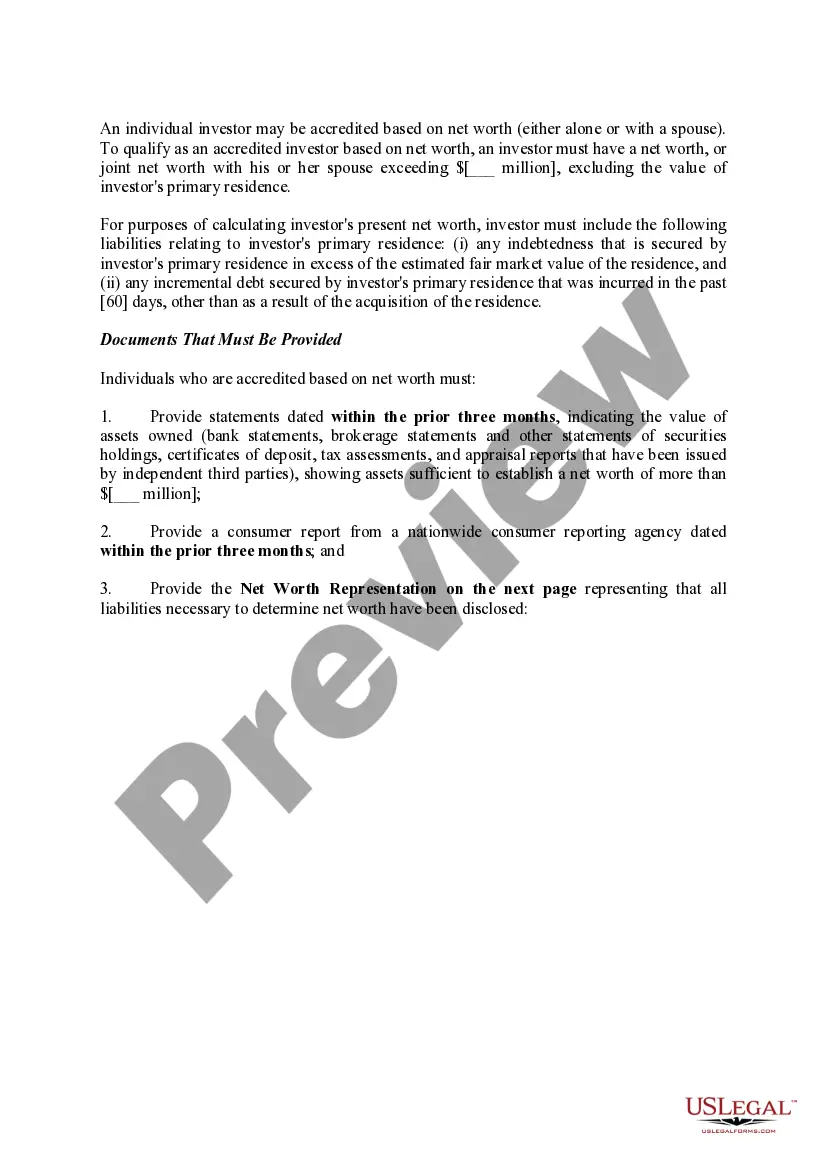

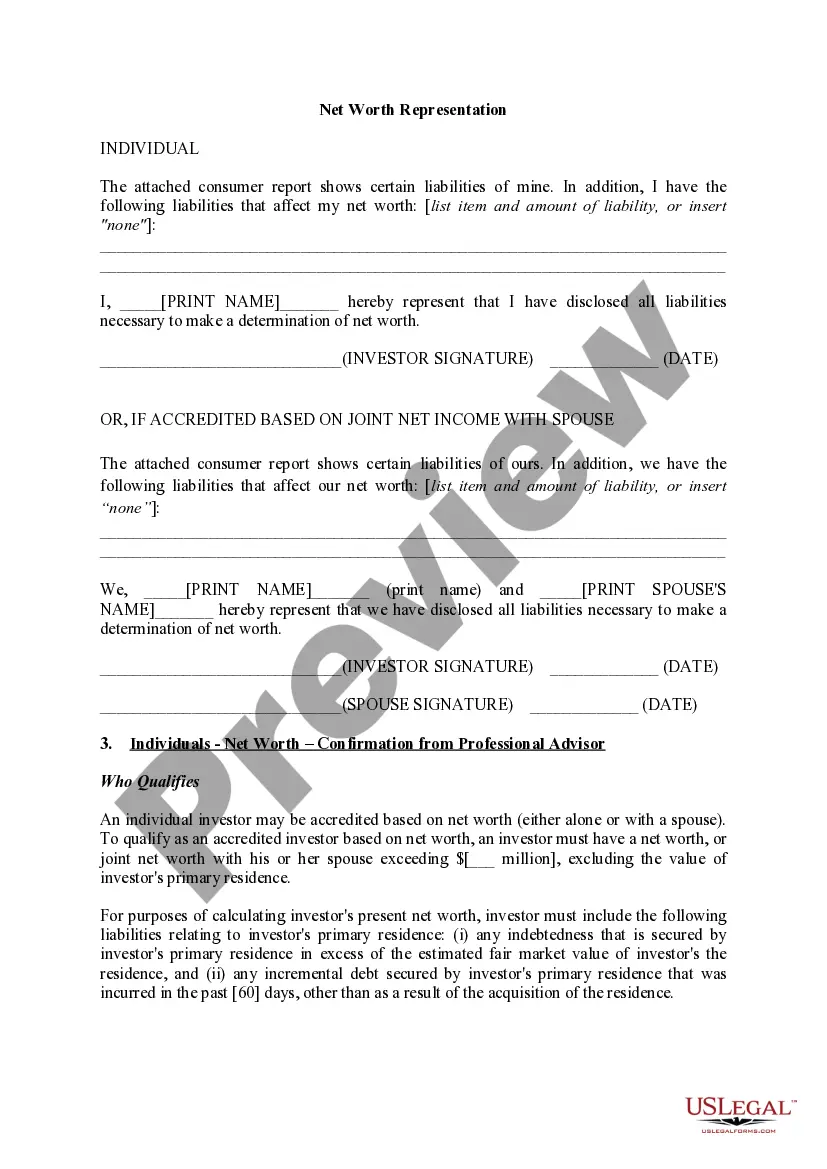

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.