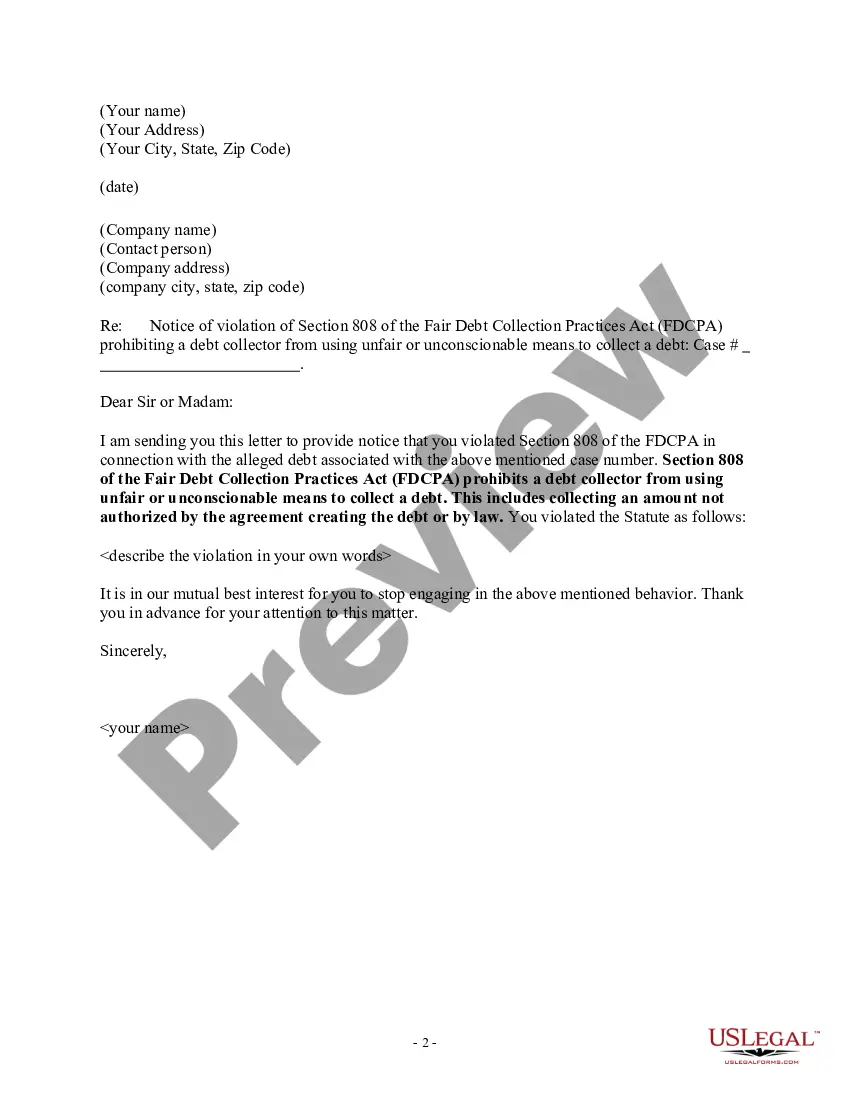

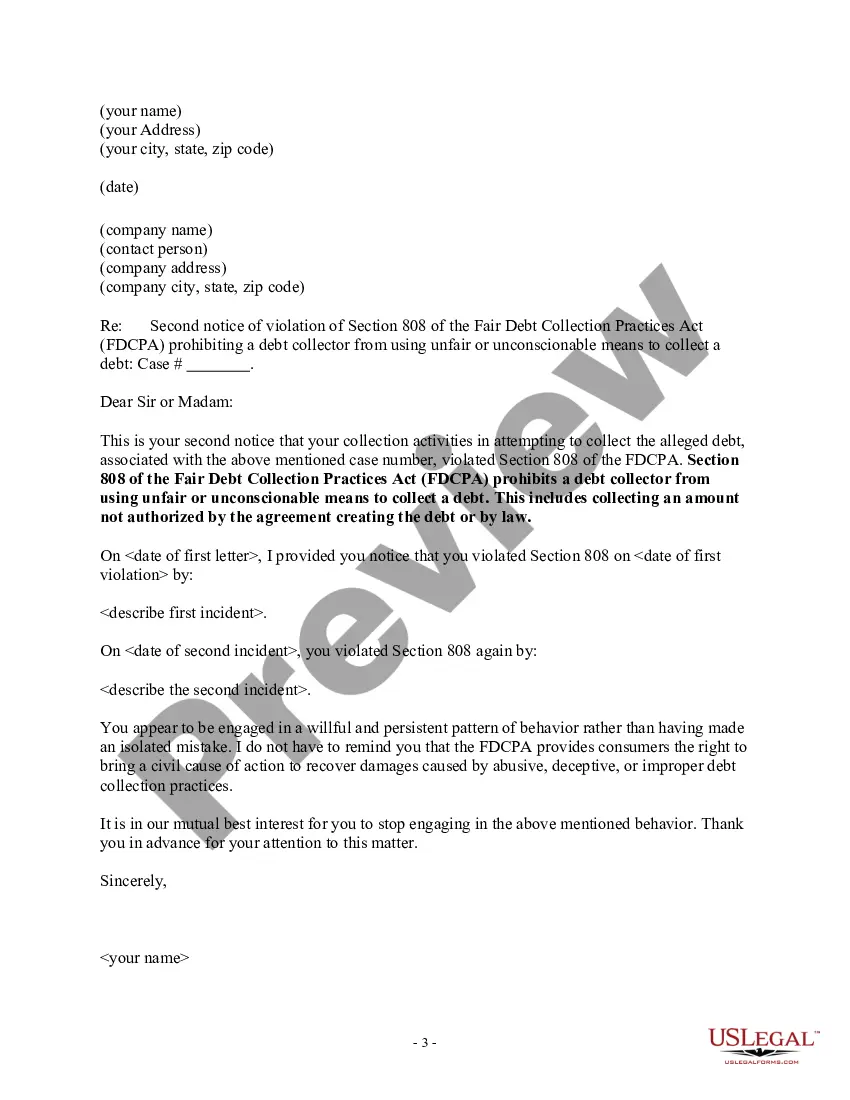

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

District of Columbia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

Selecting the optimal legal document template can be difficult.

Of course, there are numerous designs available online, but how will you locate the legal form you require.

Utilize the US Legal Forms website.

If you are already registered, Log In to your account and click the Acquire button to access the District of Columbia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

If you are a new user of US Legal Forms, here are simple steps you can follow.

Select the file format and download the legal document template to your device.

Complete, modify, and print and sign the acquired District of Columbia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

US Legal Forms is the largest repository of legal forms where you can find various document templates.

Utilize the service to download professionally crafted documents that conform to state requirements.

- The platform offers a wide array of templates, including the District of Columbia Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law, which you can utilize for both business and personal purposes.

- All forms are verified by experts and comply with state and federal regulations.

- Use your account to search for the legal forms you may have purchased previously.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- First, ensure you have selected the correct form for your city/county.

- You can view the form using the Review button and examine the form summary to confirm this is right for you.

- If the form does not fulfill your requirements, utilize the Search field to find the appropriate form.

- Once you are certain that the form works for you, click the Get now button to acquire the form.

- Choose the pricing plan you prefer and input the necessary information.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Even if you do, debt collectors aren't allowed to threaten, harass, or publicly shame you. You can order them to stop contacting you.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Statute of Limitations The Statute of limitations in the District of Columbia for open accounts and writings, such as contracts and promissory notes, is three (3) years from the date of breach. Generally, a renewed promise that can be proved to pay an old debt renews the limitations period.

Under California law, a debt collector can't make any of the following threats. Use or threaten to use physical force or criminal tactics to harm you, your property, or your reputation.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Who does regulation F apply to? Regulation F applies to collection agencies, debt collectors, debt buyers, collection law firms, and loan servicers. Creditors collecting on debts they originally owned do not qualify as debt collectors unless they enlist the aid of a debt collector or use a name other than their own.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.