District of Columbia Shipping Reimbursement

Description

How to fill out Shipping Reimbursement?

You can spend several hours online looking for the authentic document template that complies with the federal and state requirements you will need.

US Legal Forms offers thousands of valid documents that can be reviewed by experts.

You can acquire or create the District of Columbia Shipping Reimbursement using our services.

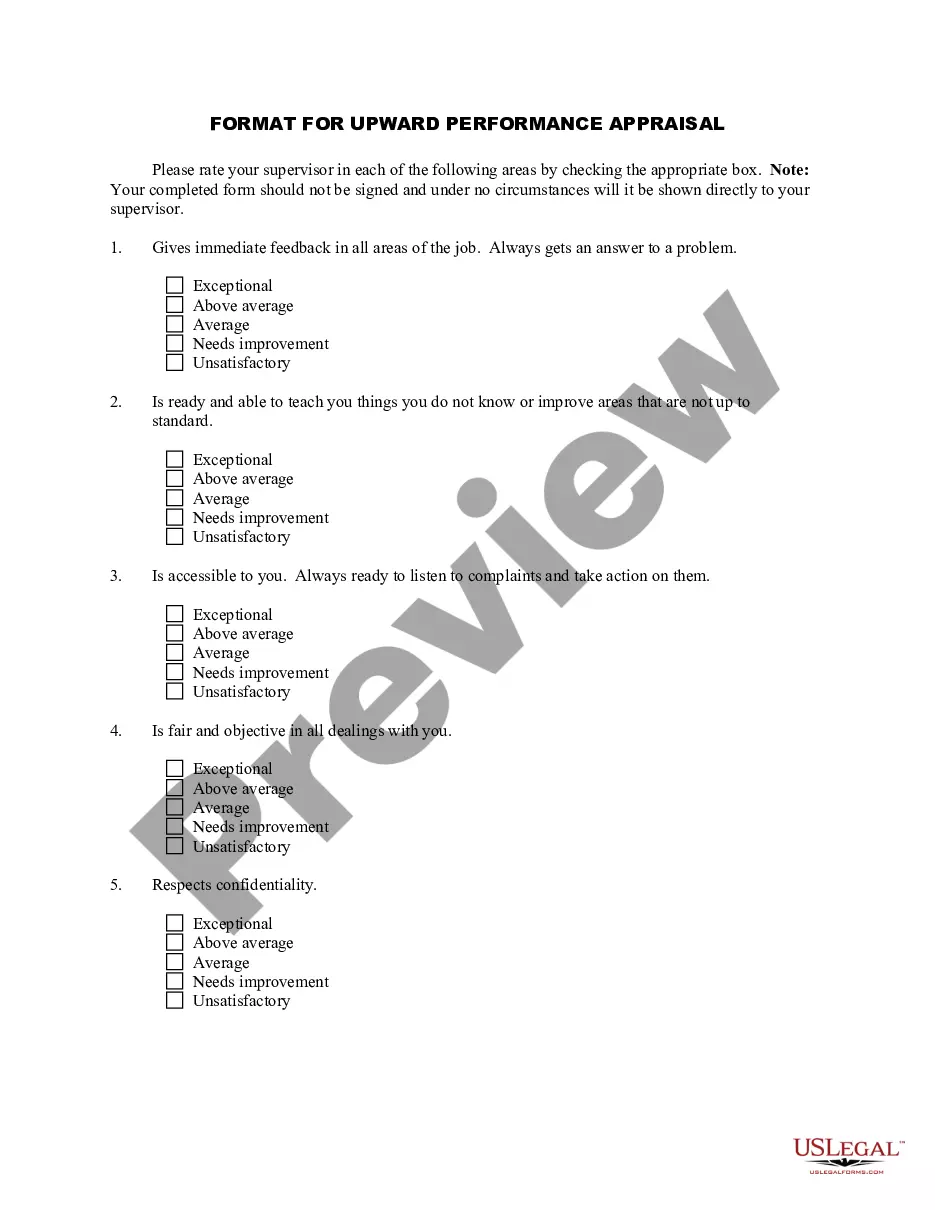

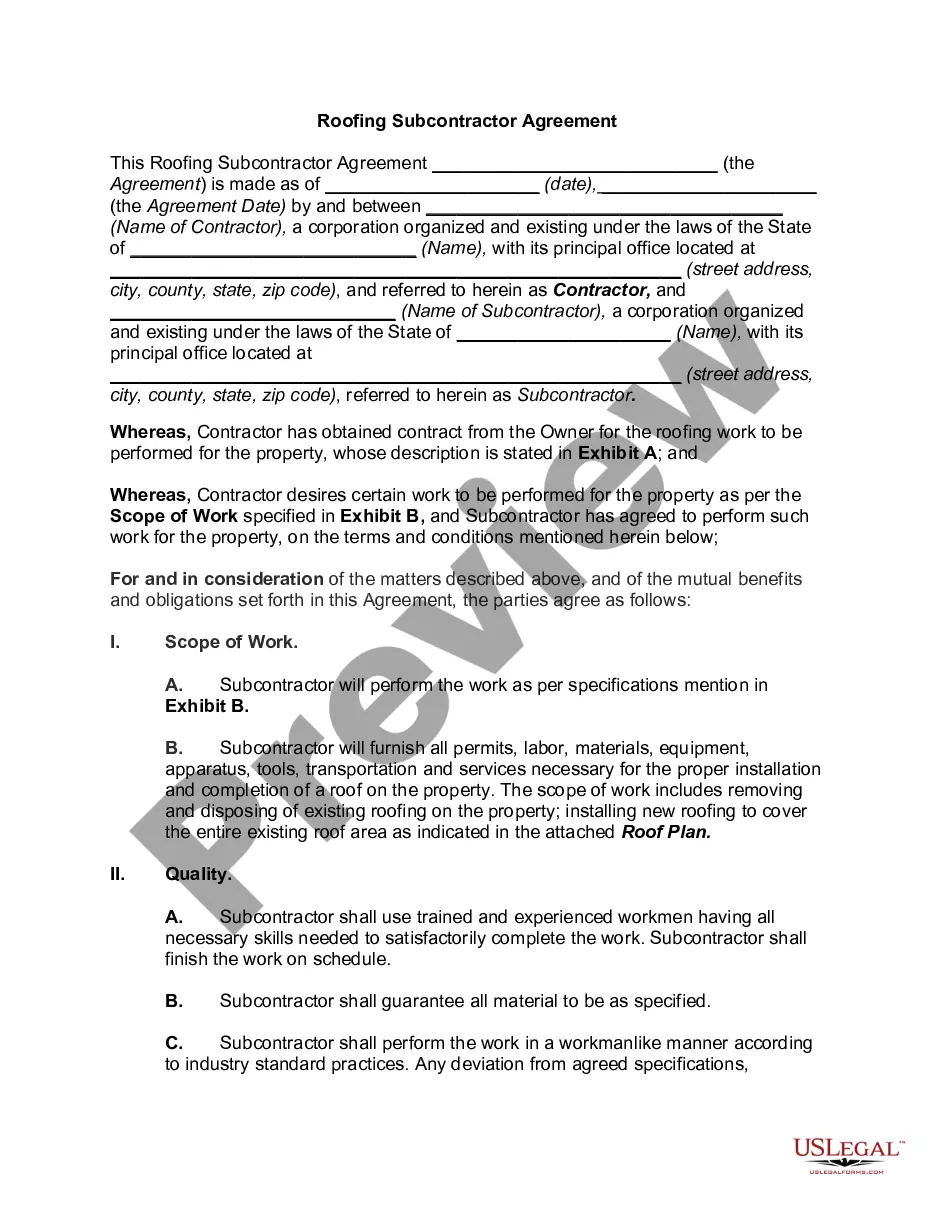

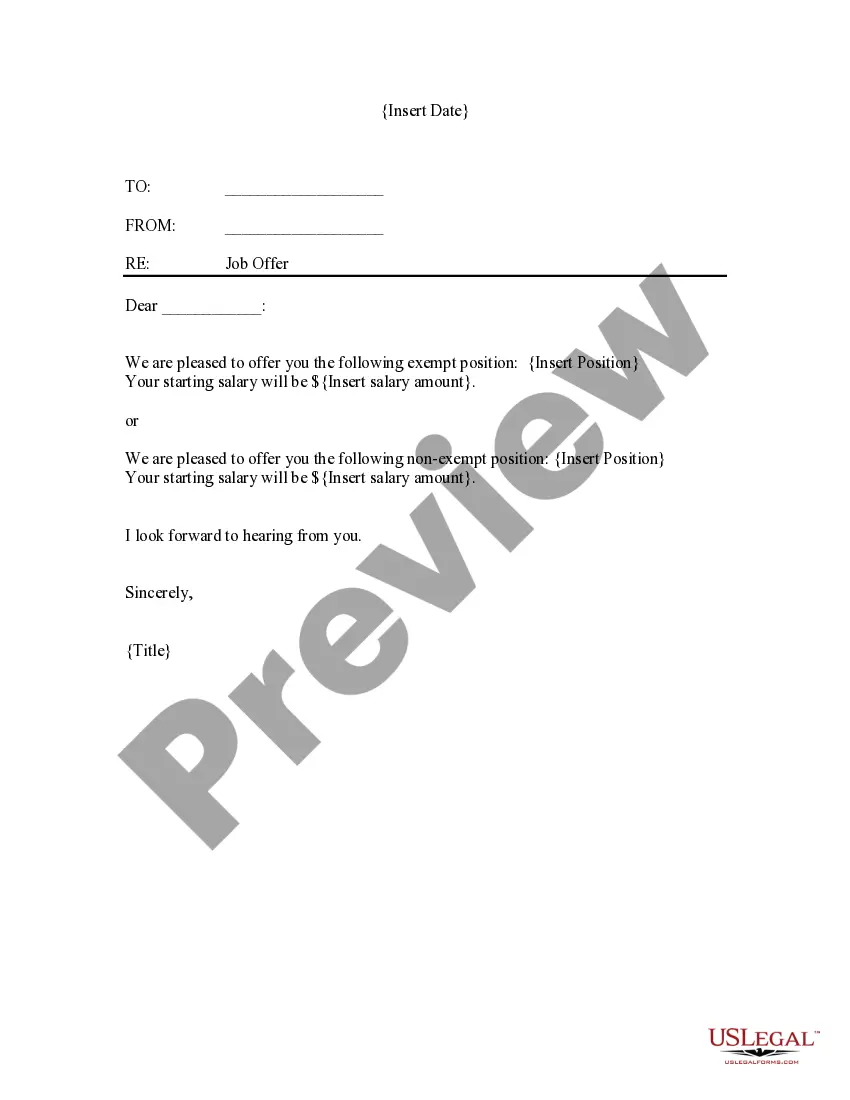

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, create, or sign the District of Columbia Shipping Reimbursement.

- Each valid document template you receive is yours indefinitely.

- To retrieve an additional copy of a downloaded document, go to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Check the document description to verify you have chosen the correct form.

Form popularity

FAQ

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor service and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new personal property.

The Washington, DC sales tax rate is 6%, effective October 1, 2013. This is a single, district-wide general sales tax rate that applies to tangible personal property and selected services.

Services Subject to Sales and Use TaxReal Property Maintenance Services.Landscaping.Data Processing Services.Information Services.Current Tax Rates. Sales and Use Tax.

The minimum combined 2022 sales tax rate for Columbia City, Indiana is 7%. This is the total of state, county and city sales tax rates. The Indiana sales tax rate is currently 7%.

Washington, D.C. : Shipping and handling charges are generally taxable in the District of Columbia if included as a single item on the bill, but separately stated shipping or delivery charges are generally exempt.

In addition to federal income taxes, taxpayers in the nation's capital pay local taxes to the District of Columbia. These include a district income tax, with rates ranging from 4% to 10.75%, a 6% sales tax and property taxes on real estate. The District has an average effective property tax rate of 0.56%.

Goods that are subject to sales tax in Washington D.C. include physical property, like furniture, home appliances, and motor vehicles. Prescription and non-prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Washington D.C. are subject to sales tax.

Goods that are subject to sales tax in Washington include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medicine, groceries and gasoline are tax-exempt. Some services in Washington are subject to sales tax.

Goods that are subject to sales tax in Washington D.C. include physical property, like furniture, home appliances, and motor vehicles. Prescription and non-prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Washington D.C. are subject to sales tax.

Services Subject to Sales and Use TaxReal Property Maintenance Services.Landscaping.Data Processing Services.Information Services.Current Tax Rates. Sales and Use Tax.