District of Columbia Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor

Description

How to fill out Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor?

Are you currently in a situation that requires documentation for both business or personal purposes every day.

There are numerous legitimate document templates available online, but locating ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the District of Columbia Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor, which can be tailored to meet federal and state regulations.

Choose a convenient file format and download your copy.

Access all of the document templates you have purchased in the My documents menu. You can retrieve an additional copy of the District of Columbia Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor at any time if needed. Just click on the relevant form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the District of Columbia Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to your specific region/state.

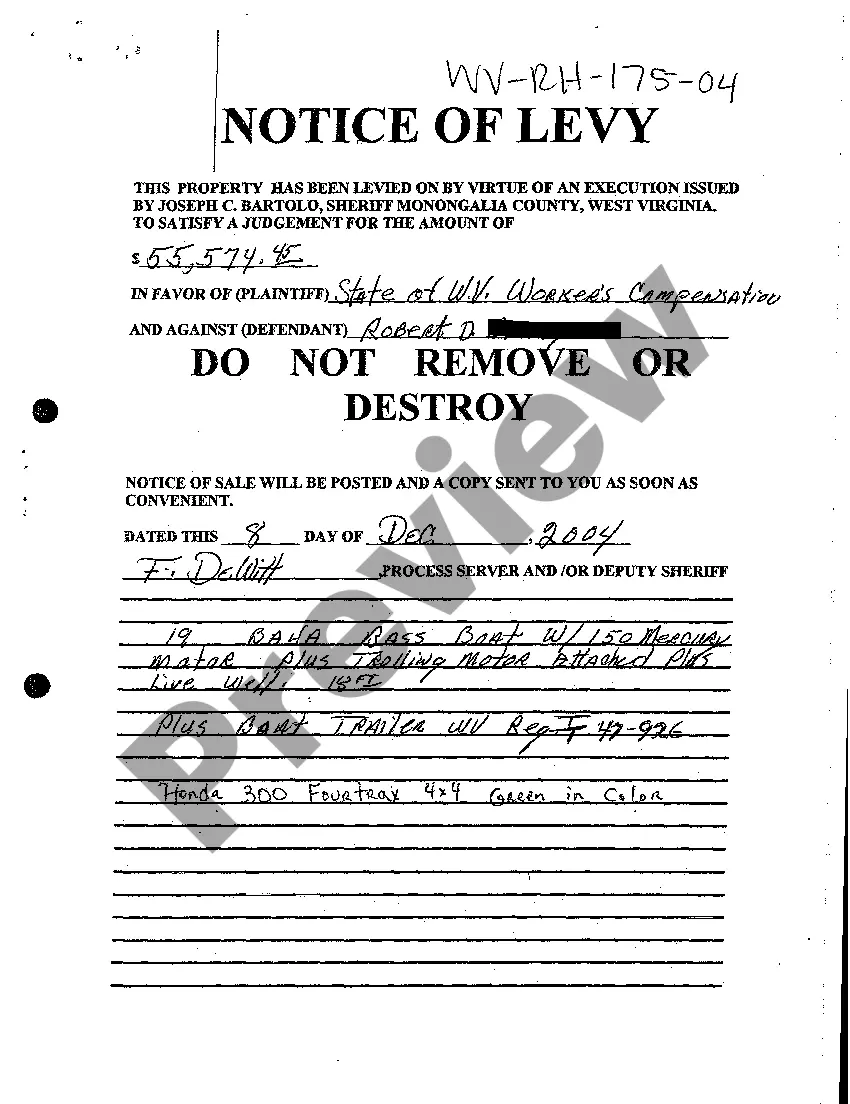

- Use the Review button to examine the form.

- Read the summary to confirm you have selected the correct form.

- If the form does not match what you are searching for, use the Look for field to find the form that meets your needs and requirements.

- When you find the right form, click on Get now.

- Select the pricing plan you prefer, complete the required information to create your account, and pay for your order using PayPal or a credit card.

Form popularity

FAQ

The buy and sell agreement requires that the business share be sold to the company or the remaining members of the business according to a predetermined formula. In the case of the death of a partner, the estate must agree to sell.

The circumstances under which the business entity can be dissolved, the process of dissolution, and how distributions of the company's assets are to be made among the owners are critical terms to be reviewed in a Buy-Sell Agreement.

How a buy-sell funded with life insurance works. In a cross-purchase plan, each business owner purchases a life insurance policy on each of the other owners. Each business owner will pay the premium and will be the owner and beneficiary of the policy written on the partner's life.

Under a key person life insurance policy, the business owns the policy, pays the premiums and is the beneficiary. If a key person dies, the business then collects a death benefit. That money can be used to help a business replace lost revenue as they search for a replacement.

Why do you need a buy-sell agreement?You'll establish a fair value price for shares.You'll develop an exit plan for business partners.You'll keep business interests with the surviving owners.You'll create a business continuity plan.

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

Each owner would pay the premiums and be the beneficiary of the policy. The face amount of the insurance would be calculated based on the other's ownership interest. Upon the death of one owner, the insurance proceeds would be used to purchase the ownership interests from the deceased owner's estate or family.

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

As part of the agreement, the business buys life insurance policies on the lives of each owner. The business pays the premiums and therefore exists as the owner and beneficiary of the policy. When an employee-owner dies, that share of the company passes to the heirs of his or her estate.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.