District of Columbia Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

How to fill out Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

If you have to full, download, or printing lawful file layouts, use US Legal Forms, the largest collection of lawful varieties, that can be found online. Take advantage of the site`s simple and easy handy search to discover the documents you want. A variety of layouts for enterprise and person reasons are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to discover the District of Columbia Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death in just a handful of mouse clicks.

When you are already a US Legal Forms client, log in in your accounts and click the Download option to obtain the District of Columbia Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death. You can also gain access to varieties you previously downloaded within the My Forms tab of your own accounts.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape for that appropriate metropolis/region.

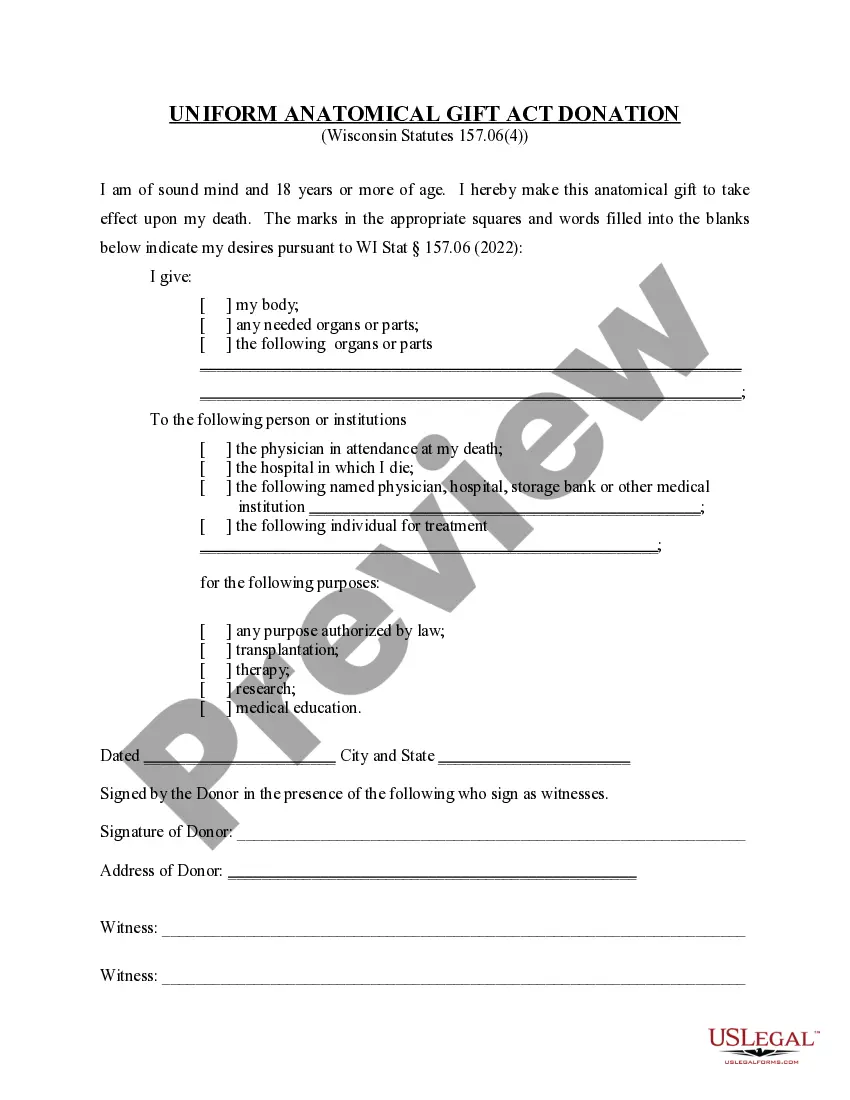

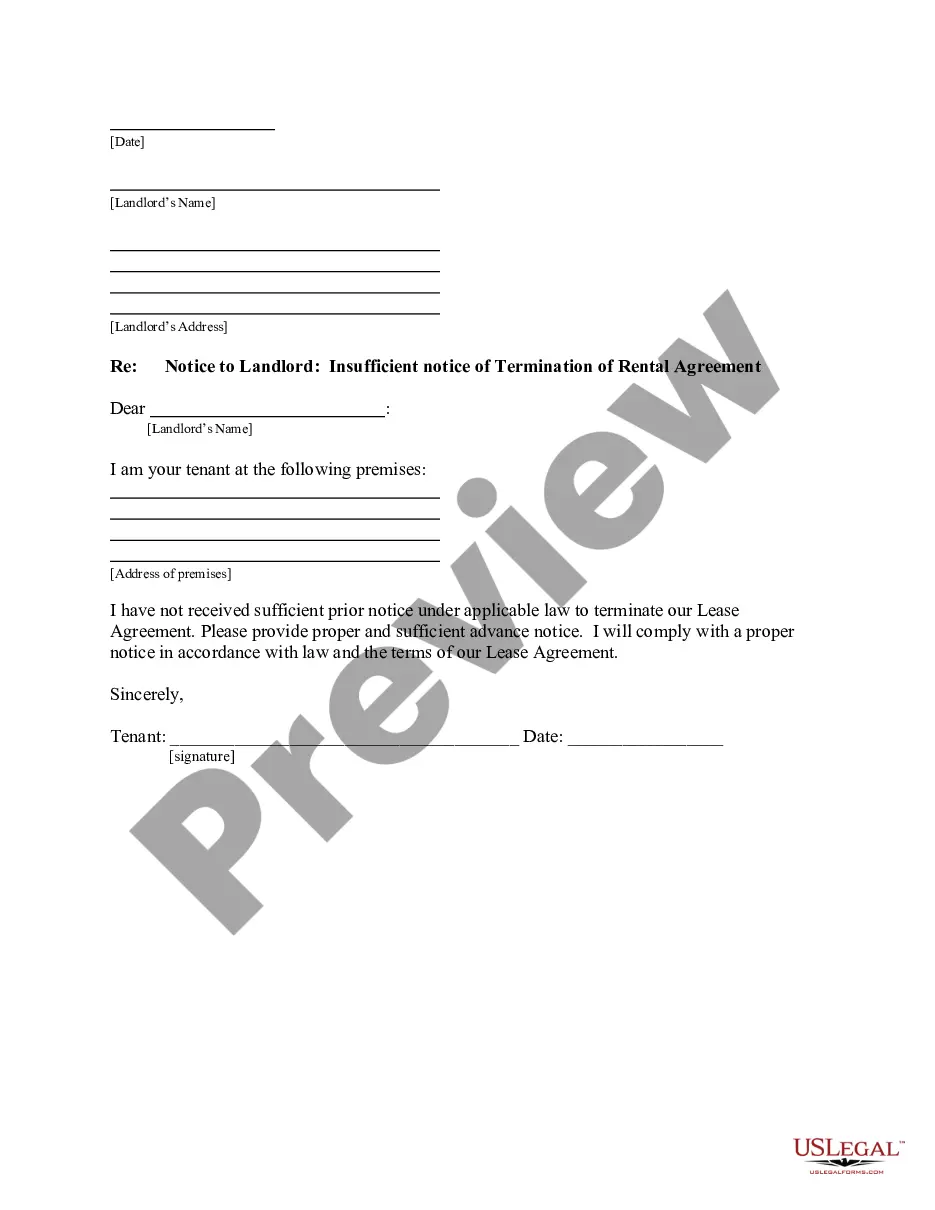

- Step 2. Make use of the Preview choice to check out the form`s information. Do not forget to see the information.

- Step 3. When you are unsatisfied with the form, make use of the Look for area at the top of the display to discover other versions from the lawful form design.

- Step 4. After you have located the shape you want, go through the Purchase now option. Choose the costs prepare you choose and add your references to register to have an accounts.

- Step 5. Method the purchase. You can use your credit card or PayPal accounts to complete the purchase.

- Step 6. Pick the format from the lawful form and download it in your product.

- Step 7. Full, change and printing or indication the District of Columbia Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death.

Each and every lawful file design you get is the one you have for a long time. You may have acces to each and every form you downloaded inside your acccount. Select the My Forms area and select a form to printing or download again.

Remain competitive and download, and printing the District of Columbia Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death with US Legal Forms. There are thousands of specialist and status-distinct varieties you can utilize for your personal enterprise or person needs.

Form popularity

FAQ

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

Each owner would pay the premiums and be the beneficiary of the policy. The face amount of the insurance would be calculated based on the other's ownership interest. Upon the death of one owner, the insurance proceeds would be used to purchase the ownership interests from the deceased owner's estate or family.

Under a key person life insurance policy, the business owns the policy, pays the premiums and is the beneficiary. If a key person dies, the business then collects a death benefit. That money can be used to help a business replace lost revenue as they search for a replacement.

How a buy-sell funded with life insurance works. In a cross-purchase plan, each business owner purchases a life insurance policy on each of the other owners. Each business owner will pay the premium and will be the owner and beneficiary of the policy written on the partner's life.

The purpose of a buy-and-sell agreement is to provide the surviving co-owners with cash to purchase the interest of a deceased co-owner. According to the agreement, each co-owner takes out life cover on the other co-owners' lives.

As part of the agreement, the business buys life insurance policies on the lives of each owner. The business pays the premiums and therefore exists as the owner and beneficiary of the policy. When an employee-owner dies, that share of the company passes to the heirs of his or her estate.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

Here is how buy-sell agreements work:Determine which events invoke a triggered buyout.Establish who has rights and purchase obligations.Identify the names and address of the purchasers.Set a purchase price or valuation with applicable discounts.Establish payment terms as well as their intervals.More items...

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.