District of Columbia Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership Between Surviving Partners And Estate Of Deceased Partner?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can find the latest versions of forms such as the District of Columbia Agreement to Dissolve and Wind Up Partnership between Surviving Partners and Estate of Deceased Partner within moments.

If the form does not fulfill your requirements, use the Search field at the top of the screen to find one that fits.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then select your desired pricing plan and provide your details to create an account.

- If you possess a subscription, Log In to download the District of Columbia Agreement to Dissolve and Wind Up Partnership between Surviving Partners and Estate of Deceased Partner from your US Legal Forms library.

- The Download option will appear on each form you view.

- You have access to all previously obtained forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are easy steps to begin.

- Ensure you have selected the correct form for your city/state.

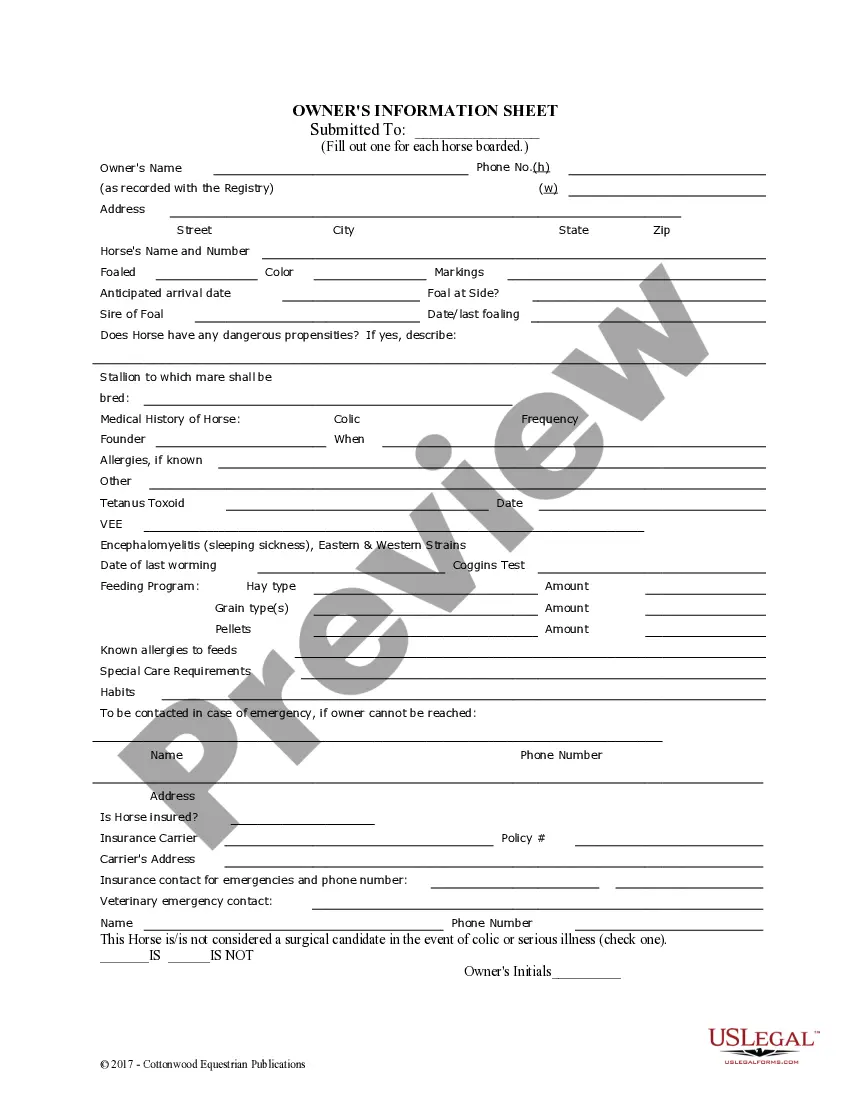

- Click the Review option to examine the form's contents.

Form popularity

FAQ

A partnership may end upon the death of a partner, depending on the agreement in place. If the partnership agreement does not allow for continuation, it automatically dissolves. In contrast, the District of Columbia Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner provides a systematic way to wind up business affairs while addressing the needs of surviving partners.

After the Death of a Business PartnerThe deceased's estate takes over their share of the partnership. A transfer happens of the other partner's share to you on a payment to the estate. You buy the share of the partnership using a financial formula.

The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec. 708(b)(1)(A)). If this occurs, the partnership's tax year closes on the partner's date of death.

The liquidation or dissolution process for partnerships is similar to the liquidation process for corporations. Over a period of time, the partnership's non-cash assets are converted to cash, creditors are paid to the extent possible, and remaining funds, if any, are distributed to the partners.

The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec. 708(b)(1)(A)). If this occurs, the partnership's tax year closes on the partner's date of death.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

Dissolution of a partnership firm on account of death of one of the partners is subject to the contract entered into by the parties. The clause of the partnership deed clearly stated that the death of any partner would not have the effect of dissolving the firm.

On the death of a partner, the partnership ceases to exist. But the firm may not cease to exist as the other remaining partners may decide to continue the business. In case of death of a partner, the treatment of various items is similar to that at the time of retirement of the partner.

The Supreme Court held as under: Section 42(c) of the Partnership Act can appropriately be applied to a' partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.

Section 42(c) of the partnership Act can appropriately be applied to a partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.