District of Columbia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

US Legal Forms - one of the most extensive collections of legal documents in the USA - provides a broad selection of legal template documents that you can download or print.

By using the website, you can obtain thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the District of Columbia Agreement to Dissolve and Wind Up Partnership with Sale to Partner by Retiring Partner in moments.

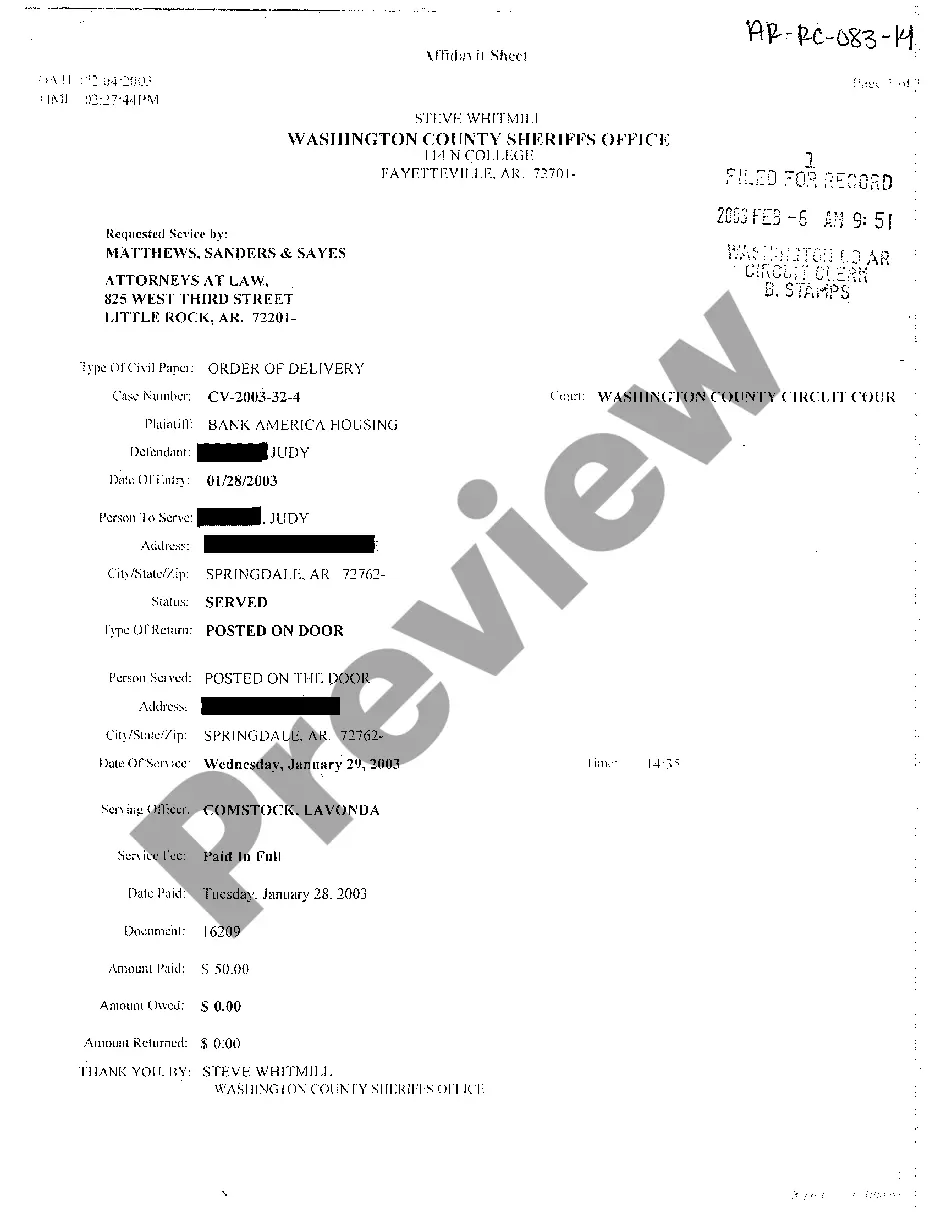

Click the Preview button to review the details of the form. Check the form outline to confirm you have selected the correct one.

If the form does not meet your requirements, utilize the Search field at the top of the page to find an appropriate substitute.

- If you hold a subscription, Log In and acquire the District of Columbia Agreement to Dissolve and Wind Up Partnership with Sale to Partner by Retiring Partner from your US Legal Forms library.

- The Download button will appear on each form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the appropriate form for your city/state.

Form popularity

FAQ

To remove one partner from a partnership firm, you should first review your partnership agreement for specific protocols. If the agreement does not offer a clear solution, using a District of Columbia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner may be beneficial. This document can help navigate the complexities involved and ensure an equitable resolution for all partners.

Removing a person from a partnership involves several steps to ensure legality and fairness. Begin by consulting your partnership agreement to see what provisions exist for removal. If necessary, you can consider drafting a District of Columbia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, which can clearly outline the terms of exit and protect the remaining partners' interests.

Kicking a partner out of a partnership is possible, but it is not a simple or straightforward process. You must follow the terms laid out in your partnership agreement or use a District of Columbia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner if one exists. It's important to identify the circumstances that warrant removal and to act in compliance with legal requirements to avoid potential conflicts.

Yes, you can remove a partner from a partnership firm, but the process requires careful consideration. A District of Columbia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can facilitate this process. It outlines the terms of the partner’s exit and ensures that all parties understand their rights and obligations. Having a formal agreement helps prevent disputes and provides clarity.

When a partner withdraws, the partnership may need to take specific steps to address the withdrawal, which can be outlined in the District of Columbia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. This document can help facilitate a fair evaluation of the departing partner’s share and guide the financial settlement. Ensuring all partners are in agreement on the next steps promotes harmony and financial stability.

Not necessarily. A partnership does not dissolve automatically when one partner leaves; it depends on the terms set in the partnership agreement. The District of Columbia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can provide clarity on whether the remaining partners can continue the business. Reviewing this agreement is essential to understand your options and responsibilities moving forward.

The withdrawal of one partner can lead to the need for a formal dissolution or restructuring of the partnership. The District of Columbia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner guides this process by outlining how assets should be evaluated and how remaining partners can buy out the withdrawing partner's share. Clear communication and adequate documentation are essential for a smooth transition.

If one partner intends to leave the partnership, it's important to review the terms outlined in the District of Columbia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. This document can guide you through the necessary steps to ensure a smooth transition. It typically involves determining the value of the partner's share and addressing financial obligations. Consulting with professionals can help clarify your options.

Responsibility for winding up the partnership usually falls to the partners, often as stipulated in the partnership agreement. In some cases, one partner may be designated to handle the winding up process. Utilizing a District of Columbia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can clarify these responsibilities and streamline the procedures.

In a general partnership, all partners are typically jointly responsible for the partnership's debts and obligations. If the partnership fails, each partner's personal assets may be at risk. Understanding these responsibilities clearly can be aided by using a District of Columbia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner to outline liabilities.