This form is a sample of an agreement to extend the time of a loan commitment in order to consummate a purchase of real property which will be security for the loan. In effect the loan applicant is asking for an extension of the date of closing set forth in the loan commitment or application.

District of Columbia Extension of Loan Closing Date

Description

How to fill out Extension Of Loan Closing Date?

Are you currently inside a situation where you will need papers for possibly business or specific purposes virtually every time? There are a lot of lawful record themes available online, but finding kinds you can rely on is not straightforward. US Legal Forms provides a large number of kind themes, like the District of Columbia Extension of Loan Closing Date, that happen to be composed to meet state and federal demands.

Should you be already informed about US Legal Forms site and also have your account, simply log in. After that, you are able to obtain the District of Columbia Extension of Loan Closing Date format.

Unless you come with an account and need to begin using US Legal Forms, follow these steps:

- Discover the kind you will need and make sure it is for that proper town/area.

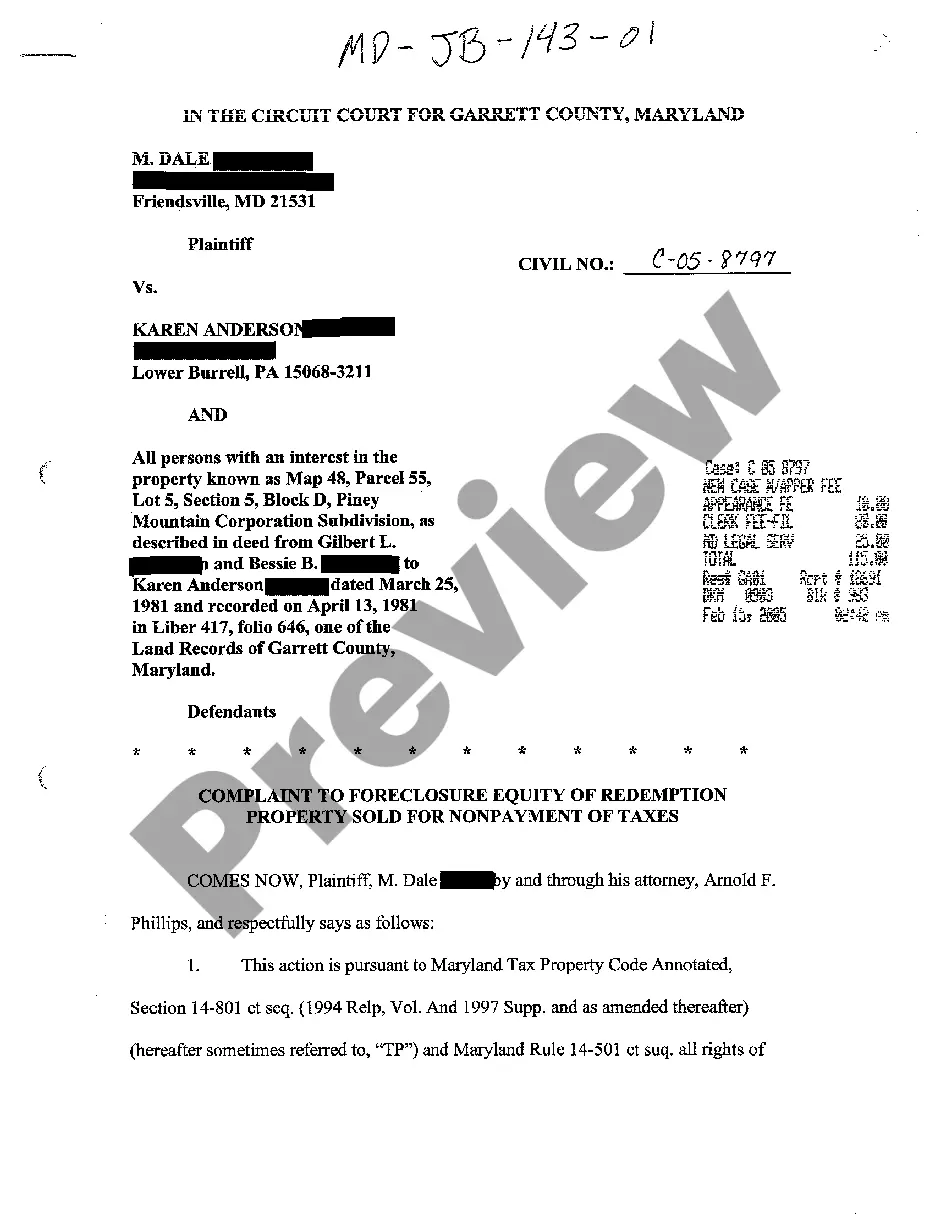

- Use the Preview button to examine the form.

- Browse the outline to ensure that you have selected the appropriate kind.

- When the kind is not what you are trying to find, use the Research area to find the kind that fits your needs and demands.

- When you get the proper kind, just click Acquire now.

- Opt for the rates strategy you want, fill in the specified information to create your money, and pay for your order utilizing your PayPal or Visa or Mastercard.

- Select a handy file formatting and obtain your version.

Locate each of the record themes you have purchased in the My Forms menu. You may get a extra version of District of Columbia Extension of Loan Closing Date at any time, if possible. Just click the needed kind to obtain or printing the record format.

Use US Legal Forms, probably the most extensive selection of lawful forms, to save lots of efforts and prevent faults. The support provides skillfully produced lawful record themes which can be used for an array of purposes. Produce your account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

The U.S. Department of Education's COVID-19 relief for federal student loans is ending. Federal student loan interest resumed on September 1, 2023, and payments restart in October 2023. As federal student loan payments restart, some credit union members may have difficulty meeting their repayment obligations.

Yes. The District of Columbia requires a separate tax extension Form apart from the federal tax extension Form 4868.

In most cases, the borrower no longer had any outstanding student loan reported on their credit record in February 2023, suggesting the loan may have been paid off, discharged, or aged off the borrower's credit record.

There are specific situations when a student loan can be removed from a credit report and nearly all of them are related to inaccuracies. Some examples of inaccurate information include: Missed or late payments (either during regular repayment periods or forbearance and deferment) Student loan default.

If you're notified that you're eligible for forgiveness, loan repayment will be paused until the discharge is processed, the Department of Education says. Your loan servicer should let you know when your student loan debt is discharged.

That the moratorium has ended, foreclosure proceedings will resume unless homeowners are under review for the Homeowner Assistance Fund (HAF) administered by the Department of Housing and Community Development (DHCD). If homeowners are under review for HAF, the moratorium is extended until September 30, 2022.

If your credit report shows that a student loan account was closed due to a transfer, it means that your loan has been sold or transferred to another student loan servicer. This typically happens with federal and private student loans when: A borrower falls behind on monthly payments and defaults.

While negative information about your student loans may disappear from your credit reports after seven years, the student loans will remain on your credit reports ? and in your life ? until you pay them off.