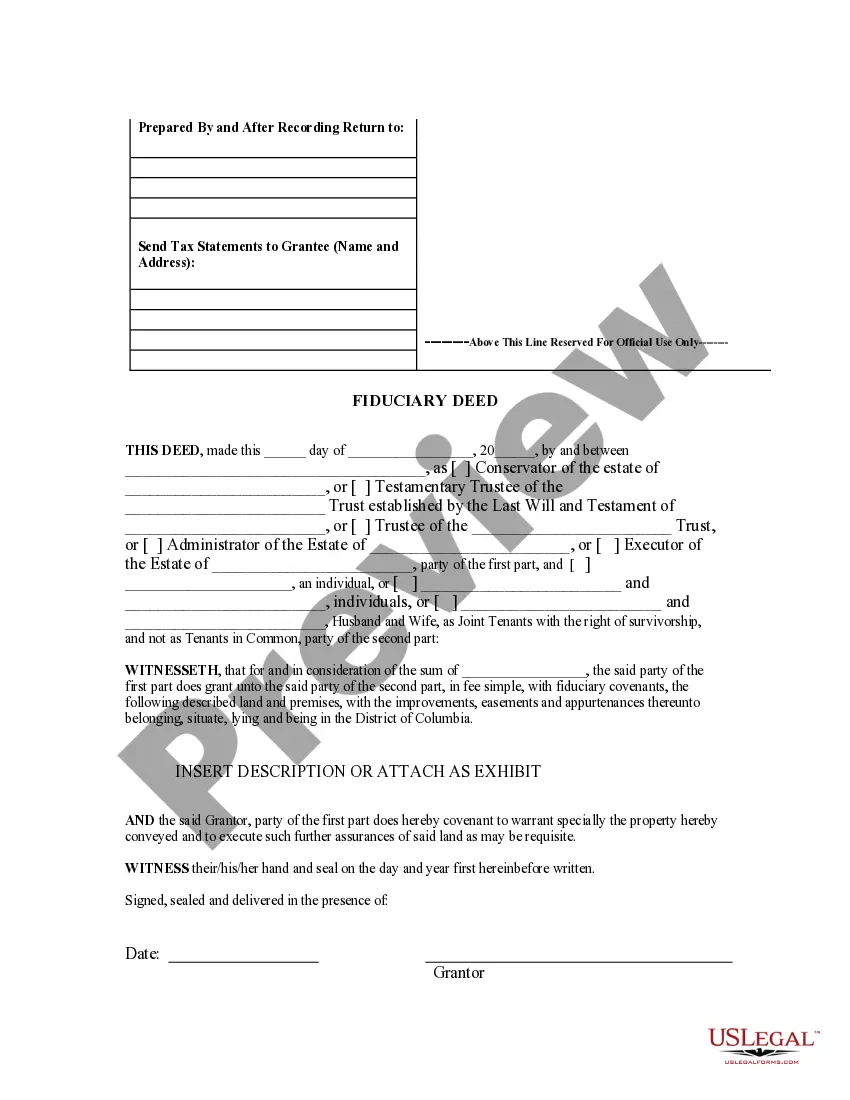

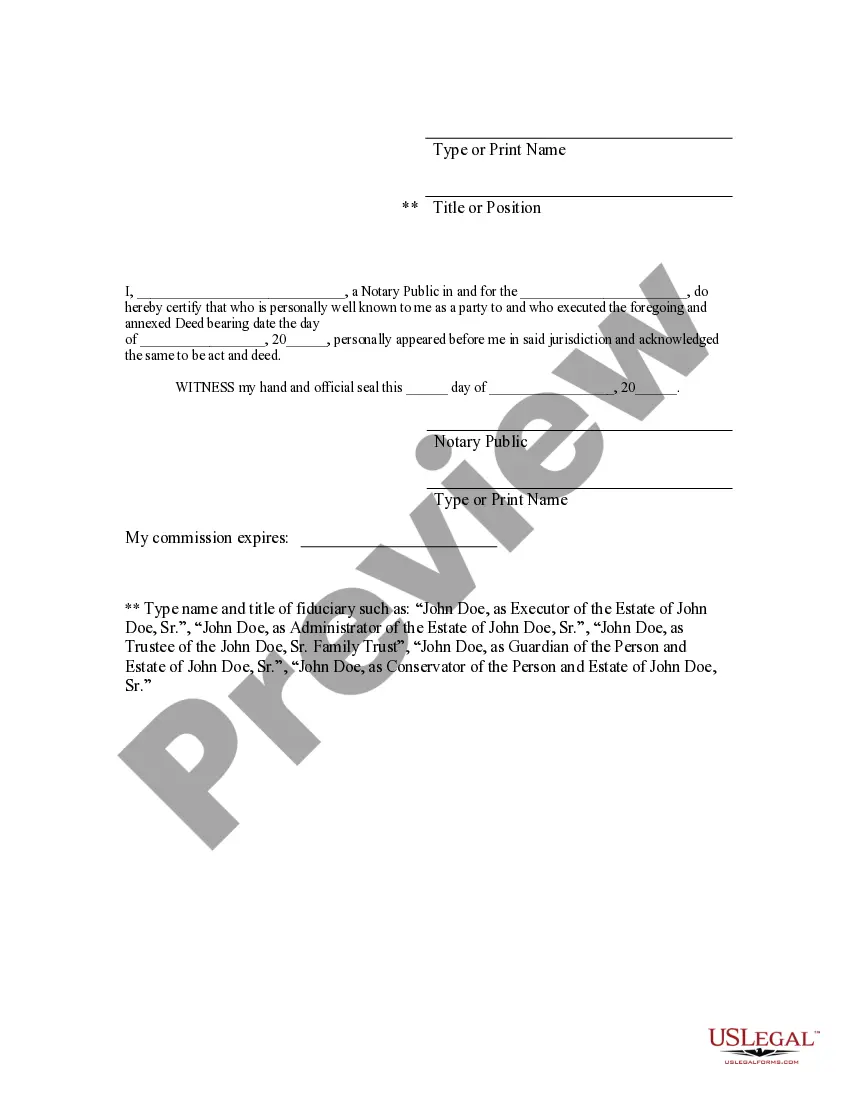

This form is a fiduciary deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Fiduciary Deed For Executors, Trustees, And Other Fiduciaries?

Among numerous paid and complimentary samples available online, you cannot guarantee their dependability.

For instance, who created them or if they’re sufficiently qualified to handle what you require them for.

Remain composed and utilize US Legal Forms!

Review the template by examining the description using the Preview feature. Click Buy Now to initiate the purchase process or discover another sample using the Search bar located in the header. Choose a pricing plan, register for an account, and settle the subscription fee with your credit/debit card or PayPal. Download the form in the required format. Once you have registered and paid for your subscription, you can utilize your District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries as frequently as you need or for as long as it remains valid in your area. Modify it with your preferred offline or online editor, complete it, sign it, and produce a hard copy. Accomplish more for less with US Legal Forms!

- Locate District of Columbia Fiduciary Deed samples for Executors, Trustees, and other Fiduciaries crafted by expert attorneys.

- Avoid the costly and laborious task of searching for a lawyer and then compensating them to draft a document you can easily obtain on your own.

- If you possess a subscription, Log In to your account and locate the Download button adjacent to the form you are searching for.

- You will also have access to your previously obtained samples in the My documents section.

- If you are using our service for the first time, adhere to the instructions provided below to retrieve your District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries swiftly.

- Ensure that the file you observe is valid in the jurisdiction where you reside.

Form popularity

FAQ

An executor's deed allows a personal representative of an estate to transfer property according to the directions in a will, without the warranty typical of a warranty deed. This means that while an executor’s deed may offer less assurance regarding title, it serves a specific purpose in the estate settlement process. Utilizing a District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries is crucial for ensuring compliance with legal requirements while protecting other beneficiaries' interests.

One notable disadvantage of a warranty deed is the seller's obligation to address any title issues that may arise after the sale, potentially leading to legal disputes. This added responsibility can deter some sellers from using this type of deed. For those managing estates, opting for a District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries can offer a safer route, as it limits personal liability.

The strongest form of deed is often considered to be a warranty deed because it provides the highest level of protection to the grantee. It includes explicit guarantees from the seller regarding the title. However, a District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries can also be robust as it legally empowers fiduciaries to act in the best interests of the estate or trust without personal liability.

The key distinction between a warranty deed and a District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries lies in their purpose and use. A warranty deed guarantees the grantor holds clear title to the property and will defend against any claims. In contrast, a fiduciary deed allows executors and trustees to convey property without assuming responsibility for potential title issues, as they are acting on behalf of the estate or trust.

A District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries serves as a legal instrument that allows fiduciaries to transfer property held in trust or for the benefit of another party. This deed ensures that the transfer adheres to the responsibilities of executors and trustees, providing clarity and legality. It primarily protects the interests of other beneficiaries while simplifying the management of inherited or trust property.

Yes, you can write your own will in Washington D.C., provided it adheres to the state's legal requirements. However, having legal expertise can enhance its effectiveness and validity. By consulting with professionals, you can ensure that your will and any related documents, such as a District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries, properly reflect your wishes and comply with the law.

While it is possible to create a deed without a lawyer, consulting with a legal professional is often beneficial. An attorney can help ensure that your District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries meets all legal requirements and addresses your specific needs. This guidance can prevent potential issues or disputes in the future.

To become an executor of an estate in Washington D.C., you must first be appointed by the probate court. This process typically involves submitting the will, providing necessary identification, and completing an application. Once appointed, you will have the authority to create a District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries to manage the estate effectively.

In real estate, the three primary types of deeds include warranty deeds, quitclaim deeds, and special purpose deeds. Each type serves different legal purposes and offers varying levels of protection to the parties involved. When dealing with a District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries, understanding these differences helps ensure you choose the right deed for your situation.

Yes, the personal representative of an estate acts as a fiduciary. This individual is responsible for managing the estate's assets and obligations in accordance with the law. In the context of a District of Columbia Fiduciary Deed for Executors, Trustees, and other Fiduciaries, the personal representative must uphold a duty of care and loyalty when handling estate matters.