Connecticut Clauses Relating to Preferred Returns

Description

How to fill out Clauses Relating To Preferred Returns?

Are you presently in the position where you require papers for possibly company or personal uses almost every time? There are tons of authorized document layouts accessible on the Internet, but getting ones you can rely is not simple. US Legal Forms offers thousands of type layouts, much like the Connecticut Clauses Relating to Preferred Returns, which are composed to satisfy state and federal demands.

Should you be already knowledgeable about US Legal Forms web site and possess a free account, merely log in. Following that, it is possible to obtain the Connecticut Clauses Relating to Preferred Returns template.

Should you not have an bank account and need to begin using US Legal Forms, adopt these measures:

- Obtain the type you want and make sure it is for the proper town/state.

- Make use of the Review option to analyze the form.

- Look at the outline to actually have selected the appropriate type.

- In the event the type is not what you are looking for, take advantage of the Search discipline to obtain the type that suits you and demands.

- Once you find the proper type, simply click Get now.

- Opt for the prices program you need, complete the required information to generate your bank account, and pay money for the transaction utilizing your PayPal or charge card.

- Choose a hassle-free paper structure and obtain your copy.

Get all of the document layouts you possess bought in the My Forms menus. You can obtain a extra copy of Connecticut Clauses Relating to Preferred Returns anytime, if necessary. Just go through the essential type to obtain or print out the document template.

Use US Legal Forms, probably the most considerable variety of authorized varieties, to save some time and stay away from mistakes. The service offers skillfully made authorized document layouts that can be used for a selection of uses. Generate a free account on US Legal Forms and begin generating your daily life easier.

Form popularity

FAQ

Question #1 ? How to Calculate Preferred Return Calculation If the preferred return hurdle is 8% and limited partners invested $1 million, the annual return rate hurdle is $80,000 (0.08 * $1,000,000).

The preferred investors will be the first to receive returns up to a certain percentage, generally 8 to 10 percent. Once you reach this profit percentage, the excess profits are split among the rest of the investors as agreed upon in negotiations. This type of return is most commonly used in real estate investment.

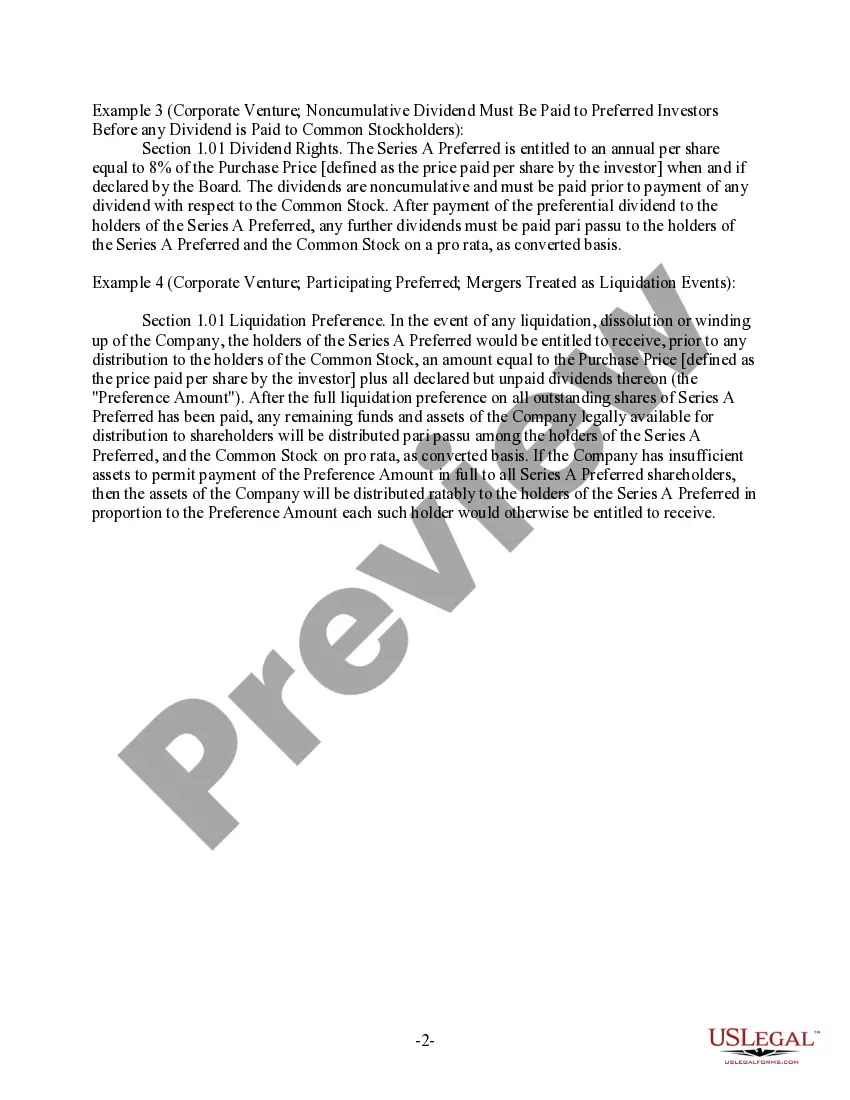

A preferred return is a profit distribution preference whereby profits, either from operations, sale, or refinance, are distributed to one class of equity before another until a certain rate of return on the initial investment is reached.

Economic accruals of preferred return are guaranteed payments as of the time of accrual. treated as distributive share rather than a guaranteed payment with any excess of accrued preferred return over gross income in the year of accrual treated as a guaranteed payment in the year of the accrual.

In a true preferred return (also known as ?hard preferred return?), the operator only receives a portion of the profits from the cash flows or sale proceeds after you (the passive investor) receive your entire preferred return. This would be considered the first hurdle in the waterfall distribution schedule.

An investor invests $100,000 into a deal that pays a 7% preferred return, or $7,000, per year. In Year 1, the operator pays $4,000, rolling over a balance of $3,000 into Year 2. That means the investor needs to receive $10,000 ($7,000 from Year 2 and $3,000 from Year 1) before the preferred return threshold is met.