Connecticut Affidavit of Heirship for Small Estates

Description

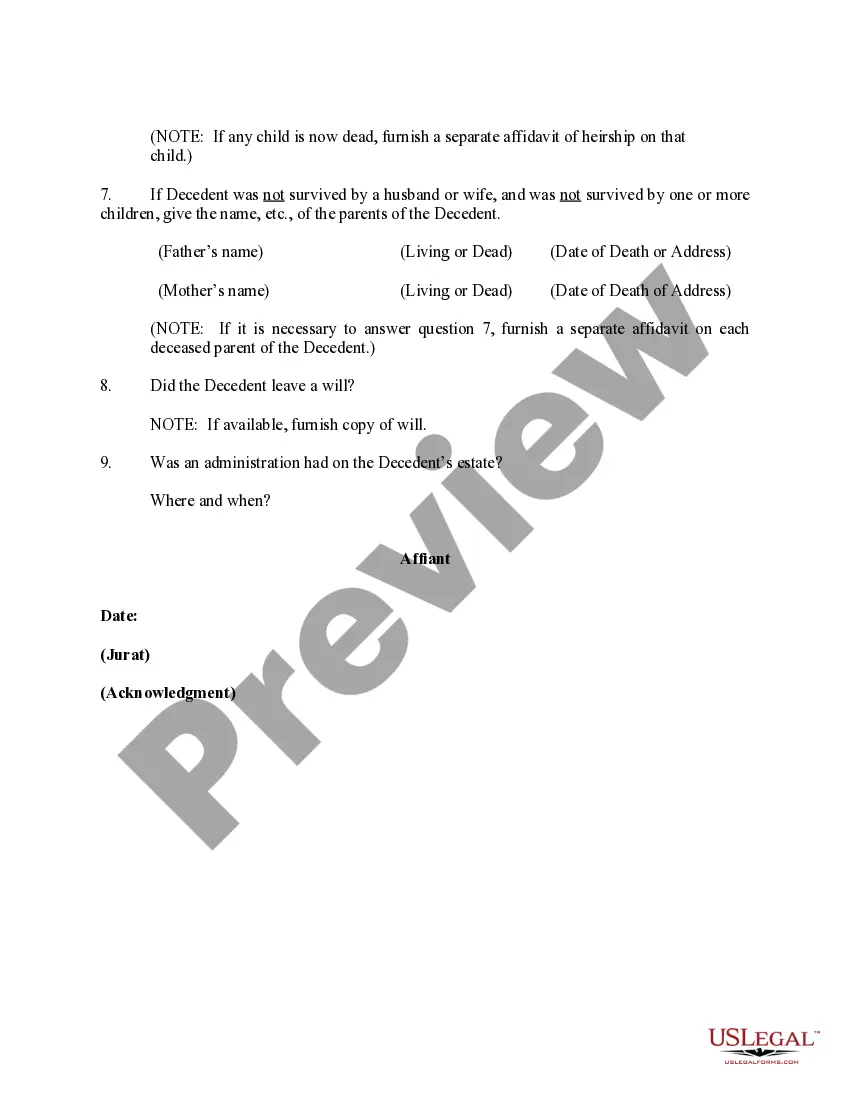

How to fill out Affidavit Of Heirship For Small Estates?

Finding the right legal record format can be a battle. Needless to say, there are plenty of web templates available on the Internet, but how can you get the legal kind you need? Take advantage of the US Legal Forms site. The service delivers a large number of web templates, like the Connecticut Affidavit of Heirship for Small Estates, that you can use for business and personal requires. Every one of the kinds are examined by professionals and meet state and federal specifications.

When you are previously registered, log in to your profile and then click the Download option to get the Connecticut Affidavit of Heirship for Small Estates. Utilize your profile to check through the legal kinds you possess ordered earlier. Visit the My Forms tab of your respective profile and acquire yet another backup from the record you need.

When you are a new customer of US Legal Forms, here are simple recommendations for you to comply with:

- First, make certain you have chosen the proper kind to your city/region. You can check out the shape while using Review option and read the shape description to guarantee it will be the right one for you.

- In the event the kind will not meet your preferences, utilize the Seach area to get the proper kind.

- Once you are certain the shape is acceptable, click the Buy now option to get the kind.

- Choose the rates prepare you want and enter in the needed details. Create your profile and purchase an order using your PayPal profile or credit card.

- Choose the document formatting and down load the legal record format to your device.

- Full, edit and produce and indication the attained Connecticut Affidavit of Heirship for Small Estates.

US Legal Forms is the largest collection of legal kinds where you will find different record web templates. Take advantage of the company to down load skillfully-created files that comply with status specifications.

Form popularity

FAQ

In Connecticut, if a decedent had no solely owned real estate and the total value of all of the decedent's personal property does not exceed $40,000, the small estates procedure may be used.

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

To use the small estate procedure, the surviving spouse, next of kin or other person files what is called an ?Affidavit in Lieu of Probate of Will/Administration,? form PC-212, listing the decedent's solely owned assets, funeral expenses, expenses associated with settling the estate, taxes and the decedent's debts. Small Estates in Connecticut- Affidavit in lieu of administration baschelaw.com ? small-estates baschelaw.com ? small-estates

For instance, in Connecticut, if the decedent's solely-owned assets include no real property and are valued at less than $40,000 ? which is the state's ?small estates limit? ? then the estate can be settled without full probate, under a much shorter and more simplified process.

How to fill out a small estate affidavit in Illinois Fill in your name and information in #1. Complete the information about the decedent in #2-4. Mark either #7a or #7b depending on what is true. ... Complete #9a to indicate the names of the spouse and children if any. How to file a small estate affidavit in Illinois | .com ? articles ? how-to-file-a-sm... .com ? articles ? how-to-file-a-sm...

Avoiding Probate In Connecticut If assets are jointly owned, they are not subject to probate. If assets pass by beneficiary designation, they are not subject to probate. Finally, if assets are in a Revocable Trust, they are not subject to probate.

List of Probate Assets Real property which is titled only in the name of the person who passed away (the person who passed away is called the decedent). Personal property owned by the decedent. ... Bank accounts if those accounts are solely in the name of the decedent. ... Interests in certain types of businesses.

$40,000 Full "probate" is ONLY required by law if the person who dies, with or without a will, (1) owned real estate (not just a life use) that does not pass by the deed to the "surviving" joint owner, OR (2) owned $40,000 or more of other assets that also don't pass by beneficiary or joint ownership to another person. When Somebody Dies in Connecticut: PAPERWORK - sharinglaw.net sharinglaw.net ? estateplan sharinglaw.net ? estateplan