Connecticut Affidavit of Heirship for Mineral Rights

Description

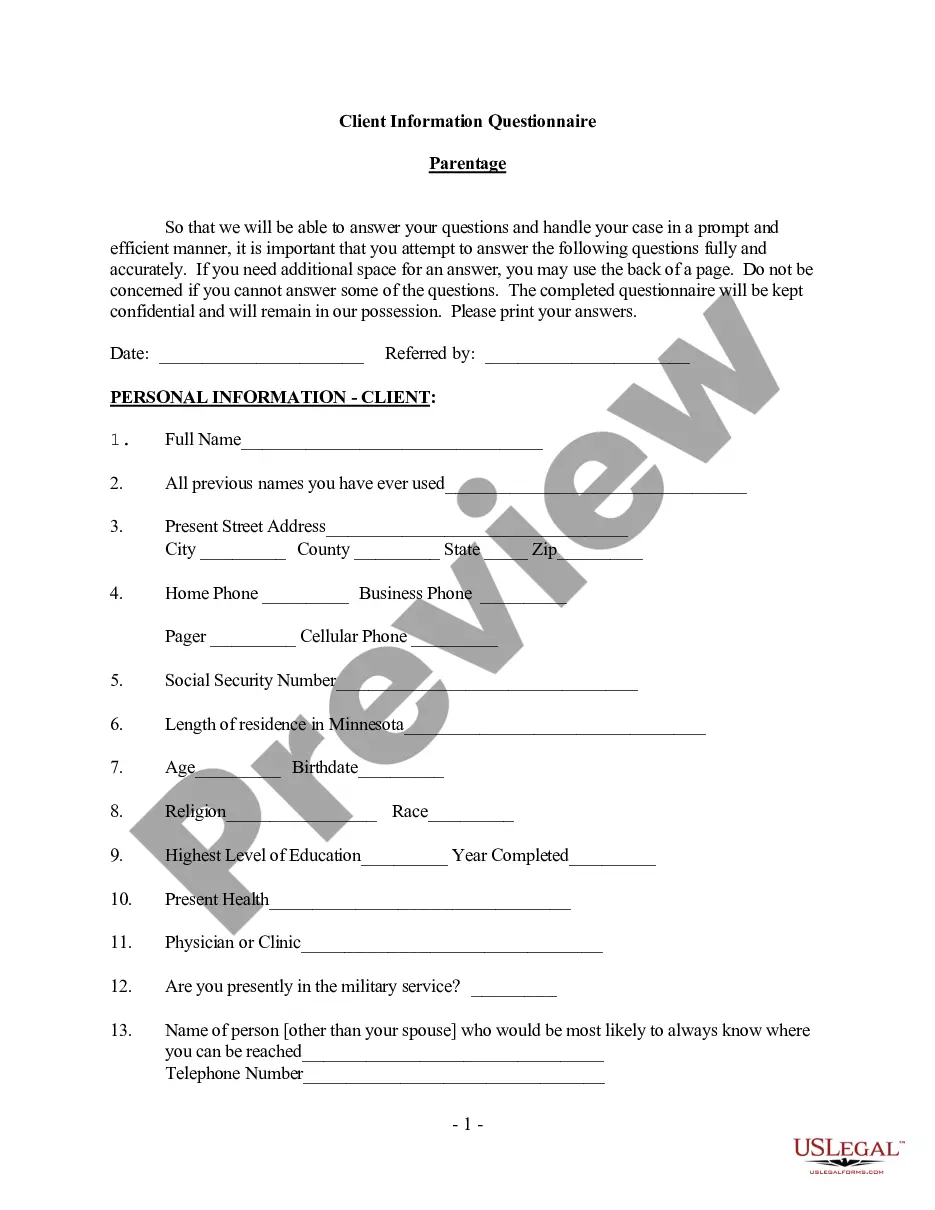

How to fill out Affidavit Of Heirship For Mineral Rights?

US Legal Forms - one of several biggest libraries of authorized types in the States - gives a variety of authorized papers layouts it is possible to download or print out. Using the site, you may get 1000s of types for organization and person functions, sorted by categories, says, or keywords and phrases.You will find the most up-to-date variations of types much like the Connecticut Affidavit of Heirship for Mineral Rights in seconds.

If you already have a membership, log in and download Connecticut Affidavit of Heirship for Mineral Rights in the US Legal Forms library. The Acquire button will appear on every form you look at. You gain access to all formerly downloaded types in the My Forms tab of the accounts.

If you want to use US Legal Forms the first time, listed below are basic instructions to obtain began:

- Ensure you have chosen the right form for your town/region. Click on the Preview button to check the form`s articles. See the form explanation to ensure that you have selected the appropriate form.

- In the event the form does not fit your needs, take advantage of the Lookup industry at the top of the display to discover the one who does.

- When you are satisfied with the form, affirm your choice by clicking on the Acquire now button. Then, choose the pricing program you like and supply your qualifications to sign up to have an accounts.

- Approach the transaction. Utilize your Visa or Mastercard or PayPal accounts to finish the transaction.

- Pick the structure and download the form in your system.

- Make changes. Fill up, edit and print out and indicator the downloaded Connecticut Affidavit of Heirship for Mineral Rights.

Each design you included in your account lacks an expiry date and is also the one you have eternally. So, if you would like download or print out an additional duplicate, just check out the My Forms area and then click on the form you want.

Gain access to the Connecticut Affidavit of Heirship for Mineral Rights with US Legal Forms, probably the most comprehensive library of authorized papers layouts. Use 1000s of professional and state-particular layouts that meet up with your organization or person requires and needs.

Form popularity

FAQ

Unlike the affidavit of heirship, the small estate affidavit only transfers the title of the decedent's homestead. Only a surviving spouse or minor child can inherit property through this affidavit type. The other types of the deceased person's real property cannot be transferred by submitting a small estate affidavit.

All beneficiaries must agree to the terms of the sale, and the purchase must be made at fair market value.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

An affidavit of heirship is a document used to give property to the heirs of a person who has died. It may be needed if the person did not have a will, or if the will was not approved within four years of their death.

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.

Each county in Texas has a different filing fee, but the cost of filing an affidavit of heirship runs from $50 to $75. You will likely also need to pay a notary public to witness the document signing.

The purpose of an Affidavit of Heirship is to put the county records on notice for mineral owners who are deceased that did not have probate proceedings administered to their estate.

What is an heir property owner? You are considered to be an heir property owner if you inherited your primary residence (also called a ?residence homestead?) by (1) will, (2) transfer on death deed, or (3) intestacy ? regardless of whether your ownership interest is recorded in the county's real property records.