Connecticut Affidavit of Heirship for Real Property

Description

How to fill out Affidavit Of Heirship For Real Property?

You may commit several hours online searching for the authorized file web template that meets the federal and state specifications you require. US Legal Forms supplies 1000s of authorized varieties that are reviewed by experts. You can easily download or produce the Connecticut Affidavit of Heirship for Real Property from our services.

If you already have a US Legal Forms bank account, it is possible to log in and then click the Down load option. Next, it is possible to complete, modify, produce, or indicator the Connecticut Affidavit of Heirship for Real Property. Every single authorized file web template you buy is the one you have eternally. To have another duplicate of any acquired type, visit the My Forms tab and then click the corresponding option.

If you are using the US Legal Forms website the first time, adhere to the simple instructions under:

- Initial, be sure that you have selected the best file web template for the area/area of your choice. See the type outline to ensure you have picked out the right type. If offered, make use of the Preview option to search with the file web template also.

- In order to discover another variation of your type, make use of the Search industry to find the web template that meets your needs and specifications.

- After you have discovered the web template you would like, click Acquire now to continue.

- Pick the costs prepare you would like, type in your accreditations, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You should use your bank card or PayPal bank account to purchase the authorized type.

- Pick the file format of your file and download it to your gadget.

- Make alterations to your file if required. You may complete, modify and indicator and produce Connecticut Affidavit of Heirship for Real Property.

Down load and produce 1000s of file web templates making use of the US Legal Forms web site, that offers the greatest variety of authorized varieties. Use expert and express-particular web templates to handle your business or individual demands.

Form popularity

FAQ

How to Fill Out Affidavit of Heirship | PDFRUN - YouTube YouTube Start of suggested clip End of suggested clip Read the clause above the signature. Lines. Once you have understood this clause. And have confirmedMoreRead the clause above the signature. Lines. Once you have understood this clause. And have confirmed the information contained in this affidavit. You may sign it a fix your signature.

An affidavit of heir is a written statement that allows an estate to move forward with an uncontested probate. The person who signs the affidavit is agreeing that they are the rightful owner of the assets and that they will transfer them to the appropriate parties as soon as the probate process is complete.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

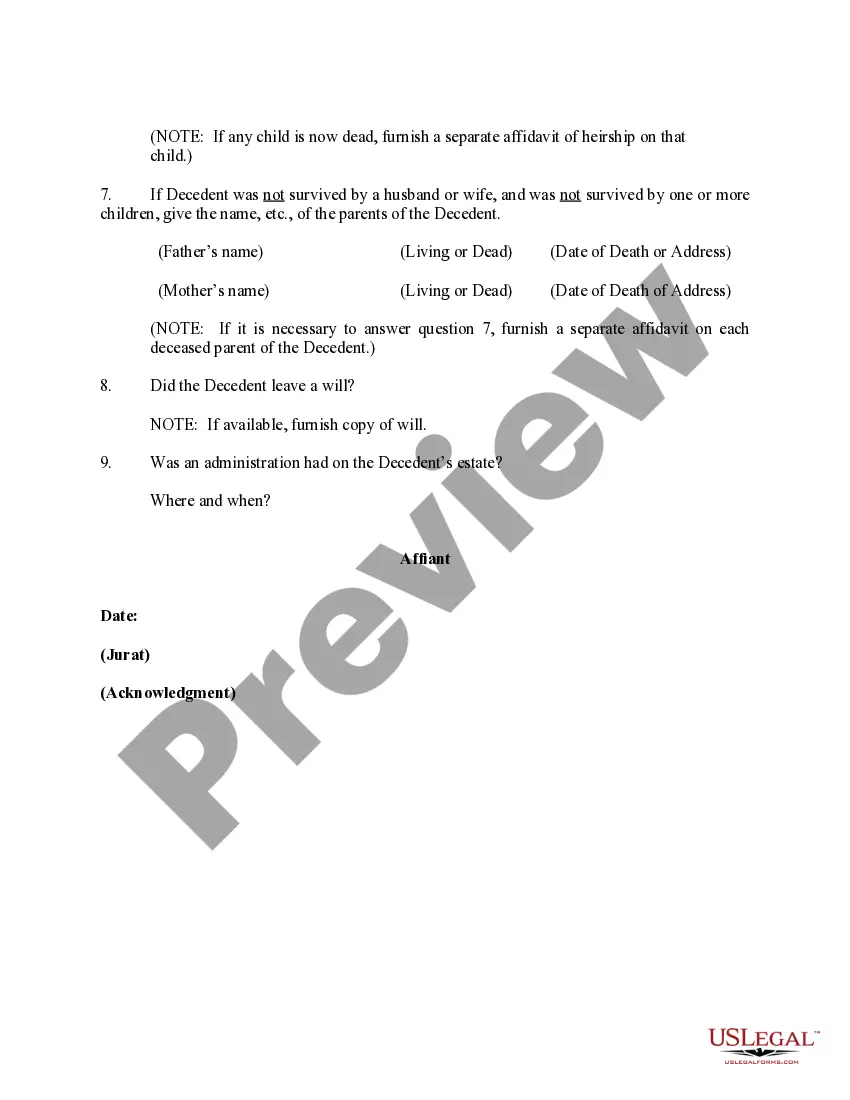

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

In Connecticut, if a decedent had no solely owned real estate and the total value of all of the decedent's personal property does not exceed $40,000, the small estates procedure may be used. The small estates procedure is a simplified method of settling an estate that avoids formal probate proceedings.

An Affidavit of Heirship or Affidavit Concerning Identity of Heirs is authorized by the Texas Estates Code. Essentially, the affidavit is a legal document that must be signed by a person with personal knowledge of the decedent's family and marital history.

Under Oklahoma law, successors (usually children) can file an affidavit of heirship if the deceased individual's estate qualified as a ?small estate.? The affidavit of heirship must contain specific information if its to be used to avoid the probate process.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.