Connecticut Affidavit of Heirship for the Owner of the Property

Description

How to fill out Affidavit Of Heirship For The Owner Of The Property?

You may spend several hours on-line looking for the legal papers format which fits the state and federal specifications you require. US Legal Forms supplies a huge number of legal types which are analyzed by specialists. It is simple to obtain or print out the Connecticut Affidavit of Heirship for the Owner of the Property from your assistance.

If you already have a US Legal Forms accounts, you are able to log in and click the Acquire option. After that, you are able to complete, change, print out, or signal the Connecticut Affidavit of Heirship for the Owner of the Property. Every legal papers format you get is your own property eternally. To get another backup associated with a acquired kind, visit the My Forms tab and click the corresponding option.

If you use the US Legal Forms web site initially, stick to the simple recommendations below:

- Initial, ensure that you have chosen the best papers format for that county/metropolis of your choosing. Read the kind outline to ensure you have picked the proper kind. If available, take advantage of the Preview option to look throughout the papers format too.

- In order to locate another variation of the kind, take advantage of the Search industry to get the format that fits your needs and specifications.

- After you have located the format you desire, click Acquire now to move forward.

- Find the rates strategy you desire, enter your references, and register for a merchant account on US Legal Forms.

- Total the transaction. You can utilize your Visa or Mastercard or PayPal accounts to pay for the legal kind.

- Find the format of the papers and obtain it to your system.

- Make modifications to your papers if required. You may complete, change and signal and print out Connecticut Affidavit of Heirship for the Owner of the Property.

Acquire and print out a huge number of papers web templates making use of the US Legal Forms Internet site, that offers the most important variety of legal types. Use expert and express-particular web templates to handle your organization or person requirements.

Form popularity

FAQ

But if the person (the decedent) left no will, (died intestate) the estate will be divided ing to the laws of ?intestacy.? In addition to overseeing the distribution of the estate, the probate court will ensure that any debts of the decedent, funeral expenses, and taxes are paid prior to distributing the ...

In Connecticut, if a decedent had no solely owned real estate and the total value of all of the decedent's personal property does not exceed $40,000, the small estates procedure may be used. The small estates procedure is a simplified method of settling an estate that avoids formal probate proceedings.

An Affidavit of Heirship or Affidavit Concerning Identity of Heirs is authorized by the Texas Estates Code. Essentially, the affidavit is a legal document that must be signed by a person with personal knowledge of the decedent's family and marital history.

An affidavit of heir is a written statement that allows an estate to move forward with an uncontested probate. The person who signs the affidavit is agreeing that they are the rightful owner of the assets and that they will transfer them to the appropriate parties as soon as the probate process is complete.

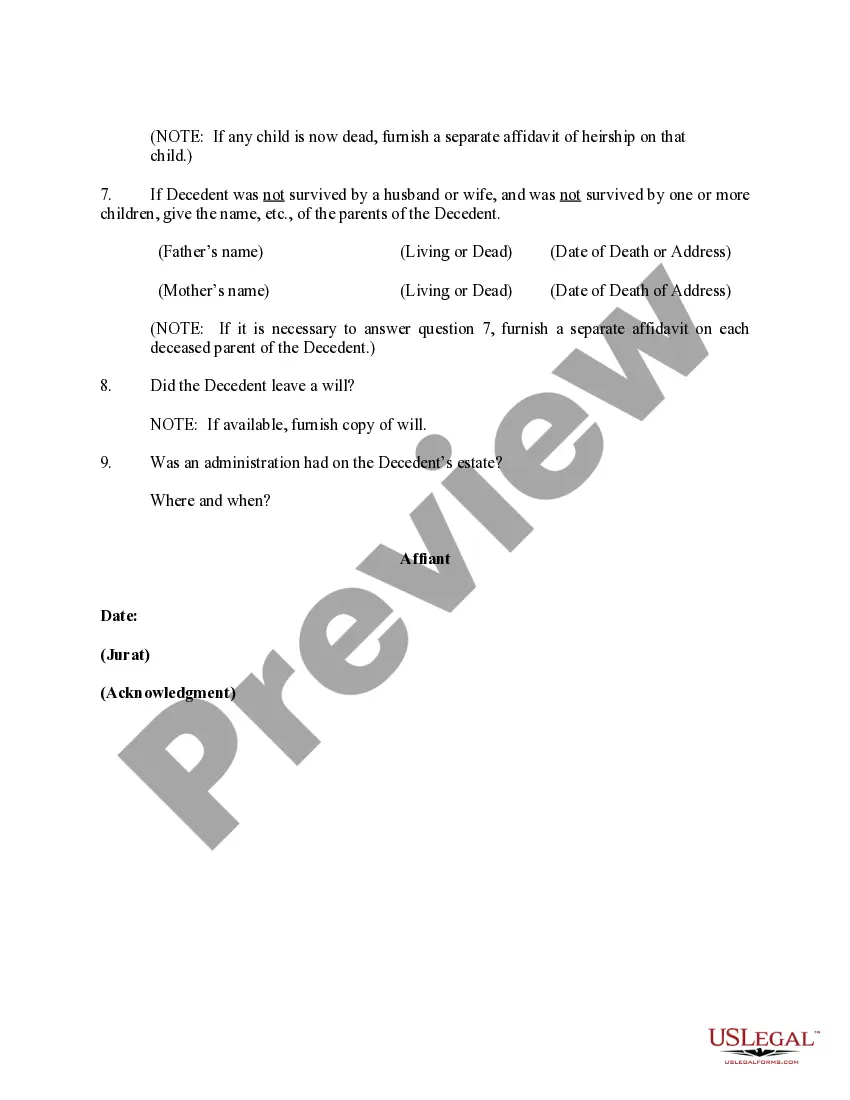

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

How to Fill Out Affidavit of Heirship | PDFRUN - YouTube YouTube Start of suggested clip End of suggested clip Read the clause above the signature. Lines. Once you have understood this clause. And have confirmedMoreRead the clause above the signature. Lines. Once you have understood this clause. And have confirmed the information contained in this affidavit. You may sign it a fix your signature.