Connecticut Psychic Services Contract - Self-Employed Independent Contractor

Description

How to fill out Psychic Services Contract - Self-Employed Independent Contractor?

Selecting the appropriate legal document template can be a challenge. Naturally, there are numerous templates available online, but how do you locate the legal form you need? Utilize the US Legal Forms website. The service provides thousands of templates, including the Connecticut Psychic Services Agreement - Self-Employed Independent Contractor, which can be utilized for both business and personal requirements. All forms are reviewed by professionals and comply with state and federal regulations.

If you are currently registered, Log In to your account and click the Download button to retrieve the Connecticut Psychic Services Agreement - Self-Employed Independent Contractor. Use your account to browse through the legal forms you have previously acquired. Navigate to the My documents section of your account to obtain another copy of the document you need.

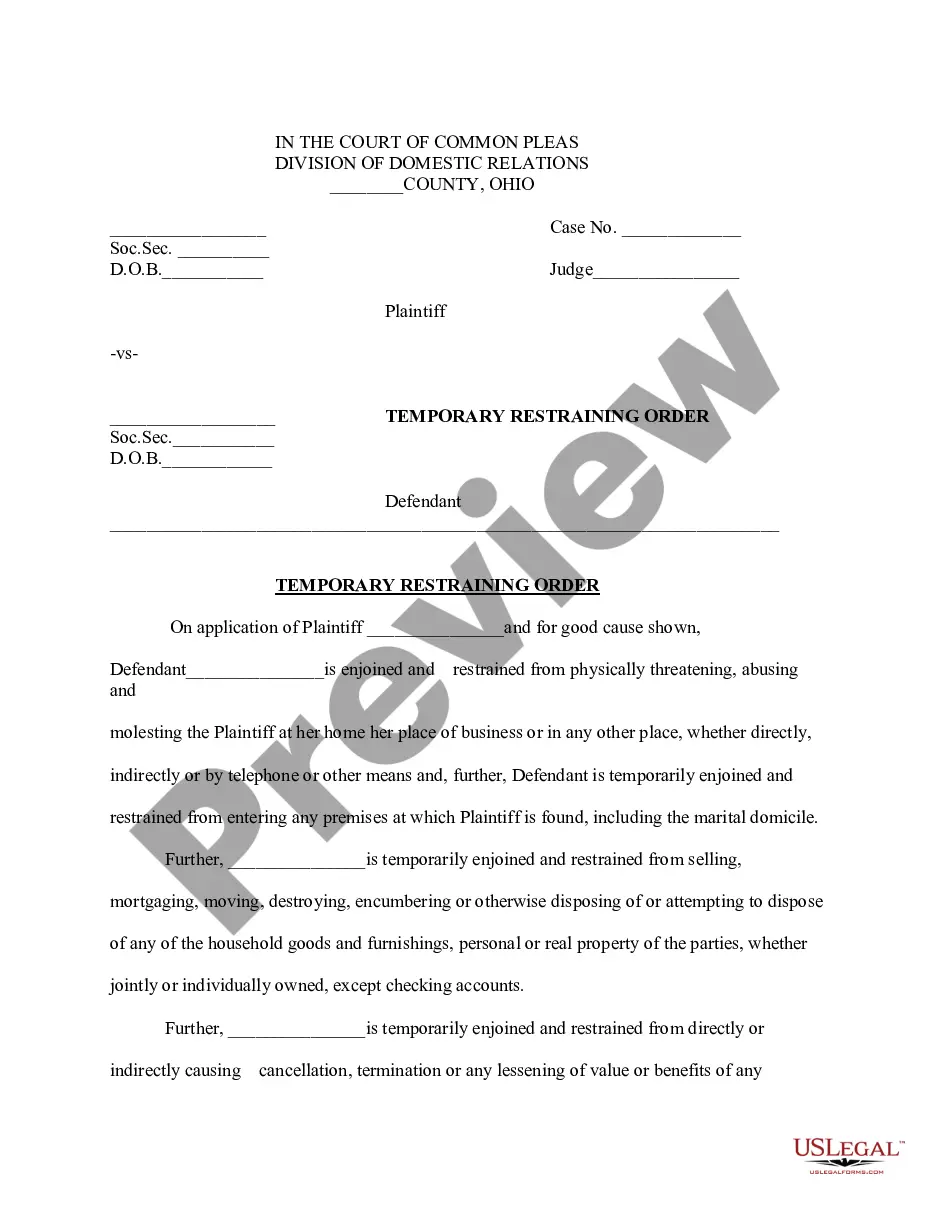

If you are a new user of US Legal Forms, here are simple instructions you should follow: First, ensure you have chosen the correct form for your area/region. You can preview the form using the Preview option and review the form details to confirm it is suitable for you. If the form does not meet your needs, utilize the Search field to find the right form. When you are confident that the form is appropriate, click the Buy Now button to acquire the form. Select the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the legal document template to your device. Finally, complete, edit, print, and sign the acquired Connecticut Psychic Services Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of legal forms where you can access various document templates. Use the service to download properly crafted documents that meet state requirements.

Form popularity

FAQ

Working as an independent contractor in the USA involves defining your services, securing any required licenses, and creating a strong client base. You should also familiarize yourself with the legal aspect of contracting, such as contracts and tax obligations. A Connecticut Psychic Services Contract can provide clarity, helping you navigate your responsibilities while establishing your business successfully.

To be an independent contractor, you must comply with local regulations, have the right licenses, and define your services clearly. You should establish a detailed independent contractor agreement that outlines your responsibilities and rights. Using a Connecticut Psychic Services Contract can simplify this process and ensure that you meet all necessary requirements to operate effectively.

Yes, an independent contractor is indeed considered self-employed. This arrangement allows you more flexibility and independence in your work. As a self-employed individual operating under a Connecticut Psychic Services Contract, you can navigate your business without the constraints of traditional employment.

You gain authorization by researching and following the applicable legal and professional requirements in your state. This includes obtaining necessary licenses and permits specific to your industry, such as psychic services in Connecticut. A comprehensive Connecticut Psychic Services Contract will help guide you through these requirements, facilitating your journey as a self-employed contractor.

Filling out an independent contractor agreement involves specifying the services you will provide, the payment terms, and the duration of the agreement. It is crucial to include any clauses specific to your work, especially if you provide psychic services. Utilizing a Connecticut Psychic Services Contract can streamline this process and ensure all essential details are accurately captured.

Yes, independent contractors usually need work authorization, especially if they are not US citizens. In Connecticut, working without the appropriate permits may lead to legal issues. Using a Connecticut Psychic Services Contract can ensure you meet all local requirements while protecting your rights as a self-employed contractor.

To get authorized as a self-employed independent contractor in the US, you typically need to obtain any necessary state licenses and registrations. For specialized fields like psychic services, you may need to adhere to specific state regulations. A Connecticut Psychic Services Contract can guide you through the requirements related to your field, ensuring compliance and helping you establish your business legally.

Yes, independent contractors are a specific category of self-employed individuals. They work under contracts but do not have the employer-employee relationship typical in traditional jobs. When entering into a Connecticut Psychic Services Contract - Self-Employed Independent Contractor, you affirm your status as self-employed, which has implications for taxes and benefits. This classification allows you to enjoy various freedoms in your work.

Being self-employed means you own and operate your business and report income directly to the IRS. If you receive income without an employer, you are likely self-employed. Under a Connecticut Psychic Services Contract - Self-Employed Independent Contractor, you manage your own taxes and tend to your clients while enjoying the benefits of independence. It's essential to keep detailed financial records to support your self-employment status.

Yes, many therapists operate as independent contractors, allowing them flexibility and autonomy. Entering into a Connecticut Psychic Services Contract - Self-Employed Independent Contractor gives you the freedom to set your rates and choose your clients. However, ensure you comply with state licensing requirements and maintain professional standards. This independence can enhance your practice experience.