Connecticut Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

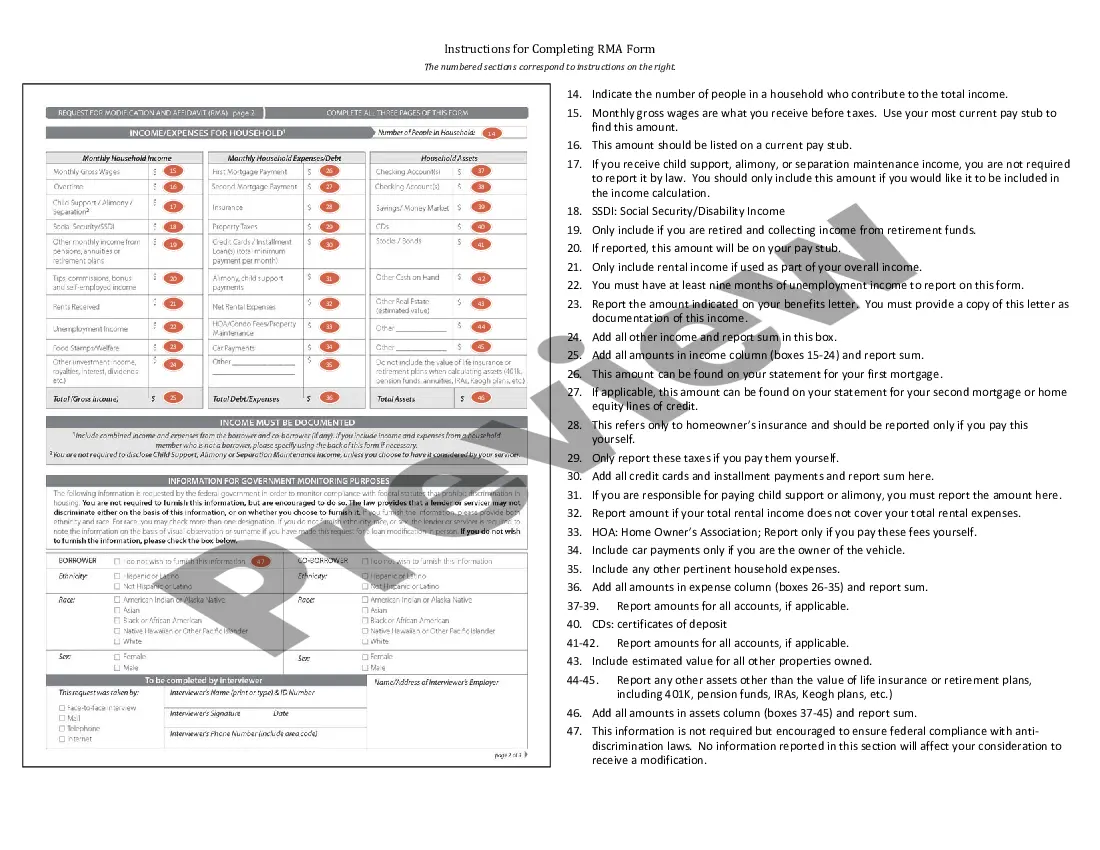

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

You can spend time online looking for the valid document template that meets the federal and state standards you require.

US Legal Forms offers thousands of valid forms that can be reviewed by specialists.

You can download or print the Connecticut Instructions for Completing Request for Loan Modification and Affidavit RMA Form from the services.

If available, make use of the Review option to look through the document template as well.

- If you already have a US Legal Forms account, you may Log In and select the Obtain option.

- Then, you can complete, modify, print, or sign the Connecticut Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

- Every valid document template you purchase is yours permanently.

- To obtain an additional copy of the purchased form, go to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/city of choice.

- Review the form outline to confirm you have picked the right form.

Form popularity

FAQ

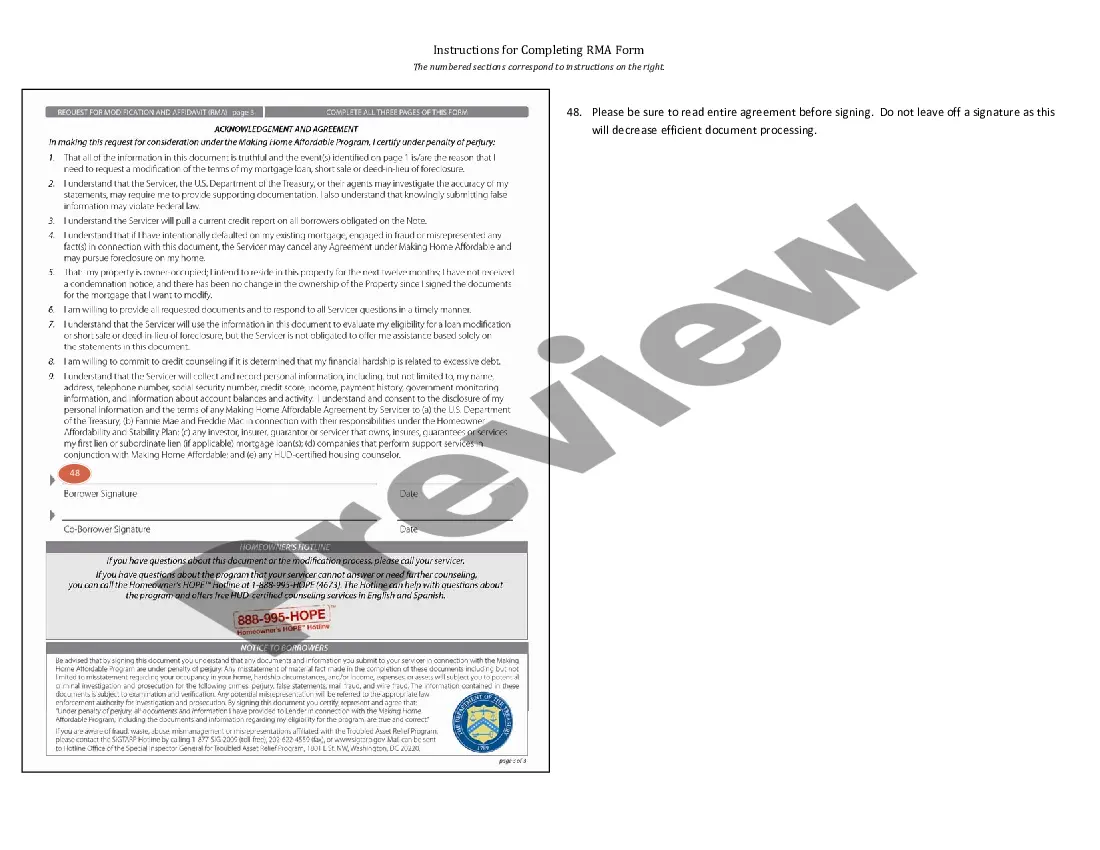

RMA in mortgage refers to the Request for Mortgage Assistance form that borrowers submit to their lenders. This form plays a vital role in securing a loan modification when facing financial hardships. By carefully following the Connecticut Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can ensure that you provide all necessary information to your lender and strengthen your request.

A hardship for a loan modification typically includes significant financial challenges, such as job loss, medical emergencies, or divorce. These events can substantially affect your ability to make mortgage payments. To navigate this process, utilize the Connecticut Instructions for Completing Request for Loan Modification and Affidavit RMA Form effectively, as it provides guidance on how to articulate your specific hardships.

The RMA mortgage form is a document used by borrowers to formally request loan modification. It gathers essential information about your financial situation, including income, expenses, and any hardships you might be facing. By referring to the Connecticut Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can ensure that all required details are correctly submitted, streamlining the modification process.

RMA stands for Request for Mortgage Assistance in the real estate context. This form is essential for borrowers seeking to modify their loans due to unforeseen financial hardships. When following the Connecticut Instructions for Completing Request for Loan Modification and Affidavit RMA Form, it is crucial to complete the RMA accurately, as it helps lenders assess your situation effectively.

The full form of RMA in mortgage stands for Request for Loan Modification and Affidavit. This form is essential for borrowers seeking assistance in modifying their loan terms to make payments more manageable. In the context of the Connecticut Instructions for Completing Request for Loan Modification and Affidavit RMA Form, understanding RMA is crucial as it guides you through the modification process. Utilizing resources like USLegalForms can simplify completing this form and increase your chances of approval.

Filling out an affidavit of financial information requires you to document your current financial status. Start with details regarding your income sources, monthly expenses, and outstanding debts. Follow the Connecticut Instructions for Completing Request for Loan Modification and Affidavit RMA Form carefully to ensure accuracy. If you find this process overwhelming, consider leveraging uLegalForms, which offers user-friendly templates and instructions.

To fill out an affidavit form, begin with your personal information, including your name and address. Clearly state the facts you want to affirm and ensure your language is straightforward. Be sure to follow the Connecticut Instructions for Completing Request for Loan Modification and Affidavit RMA Form to ensure compliance. Using tools from uLegalForms can provide you with examples and guidance tailored to your needs.

To fill out your financial affidavit in Connecticut, start by gathering all your financial information, including income, expenses, and assets. Follow the Connecticut Instructions for Completing Request for Loan Modification and Affidavit RMA Form as a guide. Make sure to provide accurate figures and complete all sections thoroughly. If you need assistance, consider using uLegalForms to access templates and resources that simplify the process.