Connecticut How to Request a Home Affordable Modification Guide

Description

How to fill out How To Request A Home Affordable Modification Guide?

You can commit time online searching for the valid document format that adheres to the state and federal requirements you require.

US Legal Forms offers numerous valid templates that have been reviewed by experts.

You can download or print the Connecticut How to Request a Home Affordable Modification Guide from our service.

First, make sure you have selected the correct document format for your state/city of preference. Review the form description to confirm you have chosen the right form. If available, utilize the Review feature to browse through the document format as well.

- If you already have a US Legal Forms account, you can Log In and select the Download button.

- After that, you can fill out, modify, print, or sign the Connecticut How to Request a Home Affordable Modification Guide.

- Every valid document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple steps outlined below.

Form popularity

FAQ

Securing a mortgage modification can vary in difficulty based on your financial situation and lender requirements. While some homeowners successfully modify their loans, others may face challenges if they lack proper documentation. However, following the Connecticut How to Request a Home Affordable Modification Guide can simplify the process. Utilizing resources from platforms like uslegalforms can offer valuable support and guide you through the necessary steps.

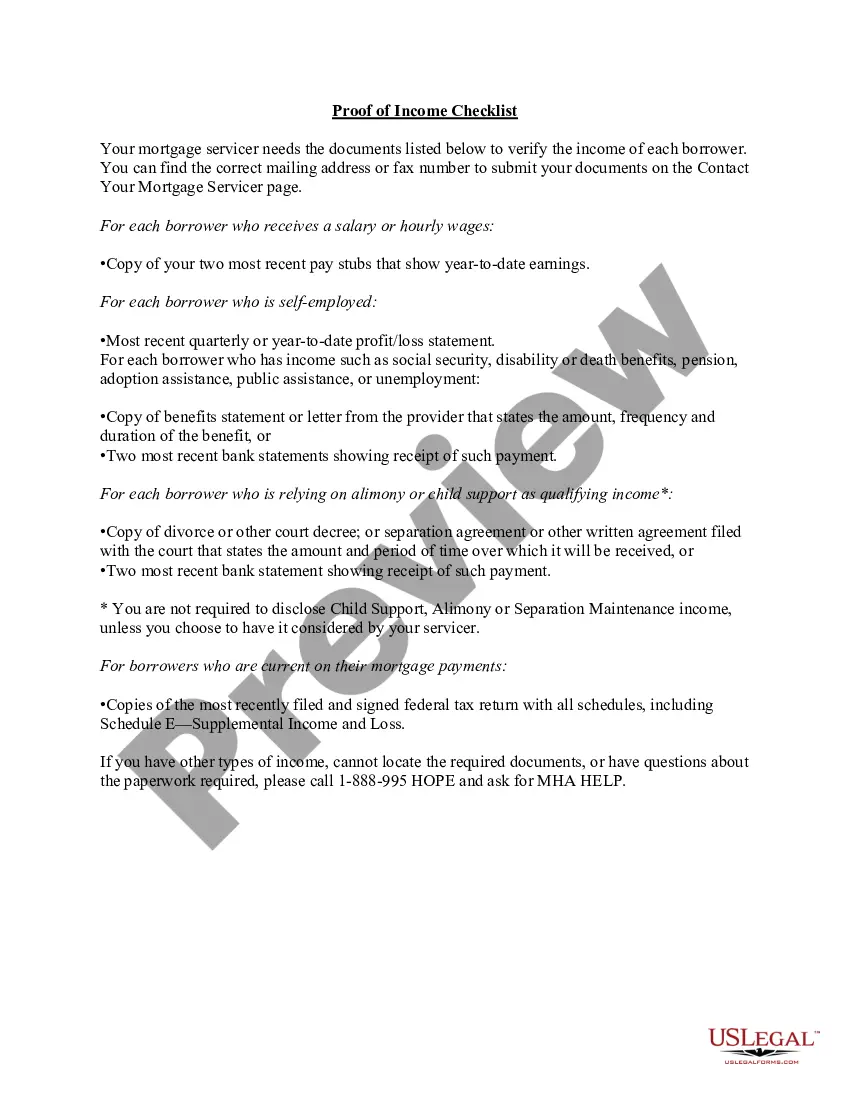

The Home Affordable Modification Program aims to reduce monthly mortgage payments for homeowners facing financial difficulty. By restructuring the terms of the mortgage, the program makes it easier for families to keep their homes. This initiative is particularly valuable during challenging economic times. To navigate this program effectively, refer to the Connecticut How to Request a Home Affordable Modification Guide.

The Virginia Mortgage Relief Program assists homeowners who are struggling to make their mortgage payments due to financial hardships. Eligibility typically requires documentation showing loss of income or increased expenses. It is important to review the specific qualifications outlined by the program for a full understanding. If you want assistance similar to this program in Connecticut, check the Connecticut How to Request a Home Affordable Modification Guide.

Affordable housing in Connecticut is governed by specific regulations that aim to provide equitable opportunities for all residents. Generally, units must be affordable to those earning a certain percentage of the area median income. Moreover, these units often come with guidelines to maintain their affordability over time. To learn more, you can refer to the Connecticut How to Request a Home Affordable Modification Guide for additional insights.

HAMP stands for Home Affordable Modification Program. It is a government initiative designed to assist homeowners who have fallen behind on their mortgage payments. By providing resources and guidance, HAMP helps borrowers modify their loans to make payments more affordable. For those seeking assistance, the Connecticut How to Request a Home Affordable Modification Guide can streamline the process.

To qualify for affordable housing in Connecticut, individuals and families must meet certain income limits and other criteria set by housing authorities. Generally, those earning below a specific percentage of the area median income may be eligible. For more details on how to apply for affordable housing opportunities, the Connecticut How to Request a Home Affordable Modification Guide is a valuable resource. It not only outlines qualification requirements but also provides actionable steps to enhance your chances of securing housing.

The CT home grant program helps residents of Connecticut secure financial support for housing. It aims to make homeownership more accessible by providing assistance that can lower mortgage costs. If you are looking to understand how to navigate this program effectively, refer to the Connecticut How to Request a Home Affordable Modification Guide for detailed steps. This guide can provide clarity on eligibility and application processes.