Connecticut Memo - Using Self-Employed Independent Contractors

Description

How to fill out Memo - Using Self-Employed Independent Contractors?

Are you in an environment where you require documents for either business or specific purposes nearly every day.

There are numerous legal document templates accessible online, but locating reliable versions can be challenging.

US Legal Forms offers a vast array of form templates, such as the Connecticut Memo - Employing Self-Employed Independent Contractors, designed to comply with federal and state regulations.

Choose the payment plan you want, fill in the necessary information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

Select a convenient document format and download your copy. Access all the document templates you've purchased in the My documents section. You can obtain an extra copy of the Connecticut Memo - Employing Self-Employed Independent Contractors anytime if needed. Just select the desired form to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Connecticut Memo - Employing Self-Employed Independent Contractors template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is intended for the correct city/county.

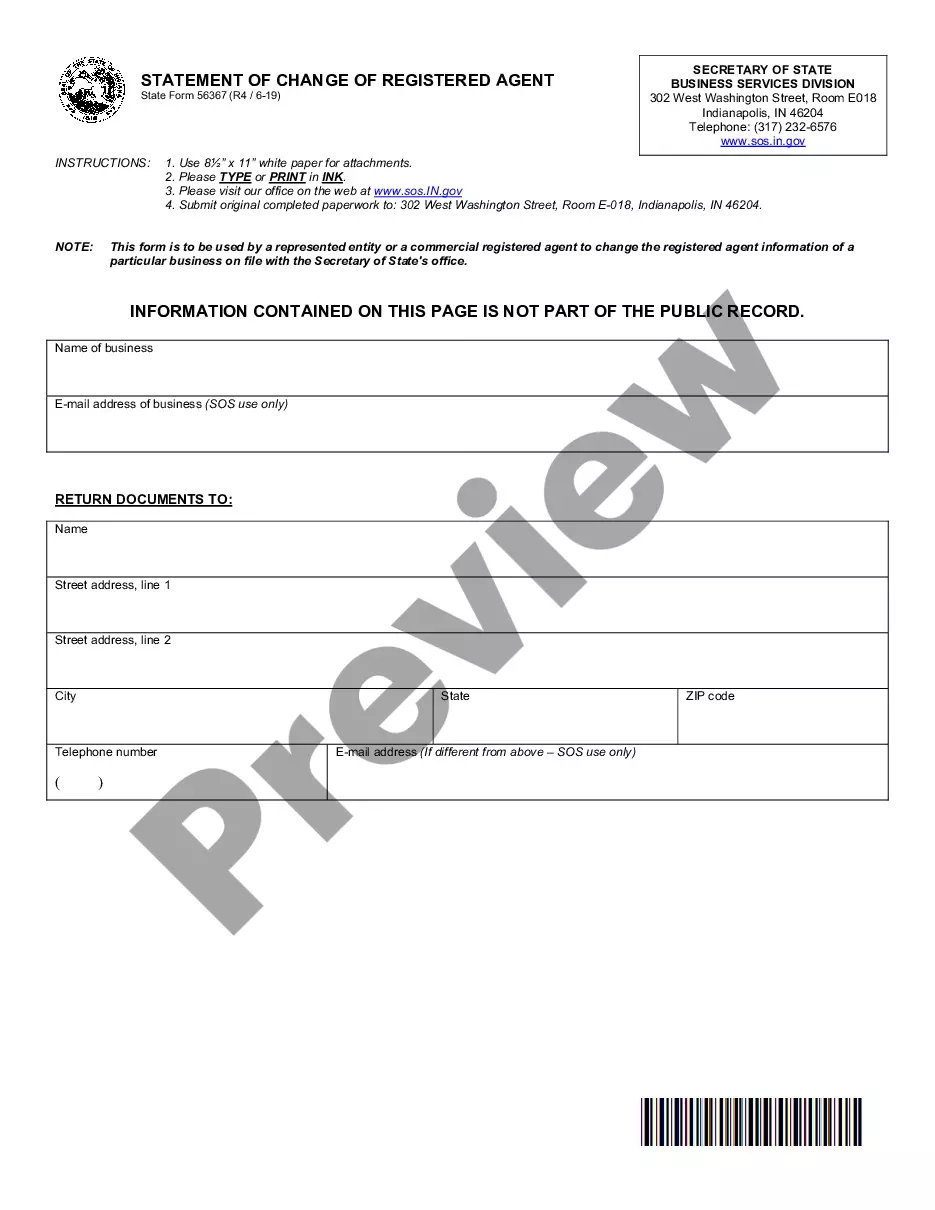

- Utilize the Preview button to review the form.

- Check the description to confirm you have chosen the correct form.

- If the form is not what you are seeking, use the Search field to find a form that fits your needs and requirements.

- Once you find the correct form, click Acquire now.

Form popularity

FAQ

The self-employment assistance program in Connecticut offers support to individuals who want to start or expand their businesses. It provides resources such as training and financial guidance. This program can be incredibly useful for those looking to navigate the complexities outlined in the Connecticut Memo - Using Self-Employed Independent Contractors.

Protect Yourself When Hiring a ContractorGet Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.Consider Hiring Specialized Pros for Additional Guidance.Go With Your Gut.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

Visit us today! The Connecticut Department of Labor today began accepting claim applications for the self-employed, many of whom are eligible to collect unemployment insurance benefits under the federal Pandemic Unemployment Assistance (PUA) Program.

Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.