Connecticut Consulting and Marketing Agreement - Wireless Communications

Description

How to fill out Consulting And Marketing Agreement - Wireless Communications?

You might spend time online attempting to locate the legal document template that meets the federal and state criteria you require.

US Legal Forms offers a vast array of legal forms that are vetted by professionals.

You can conveniently download or print the Connecticut Consulting and Marketing Agreement - Wireless Communications from the service.

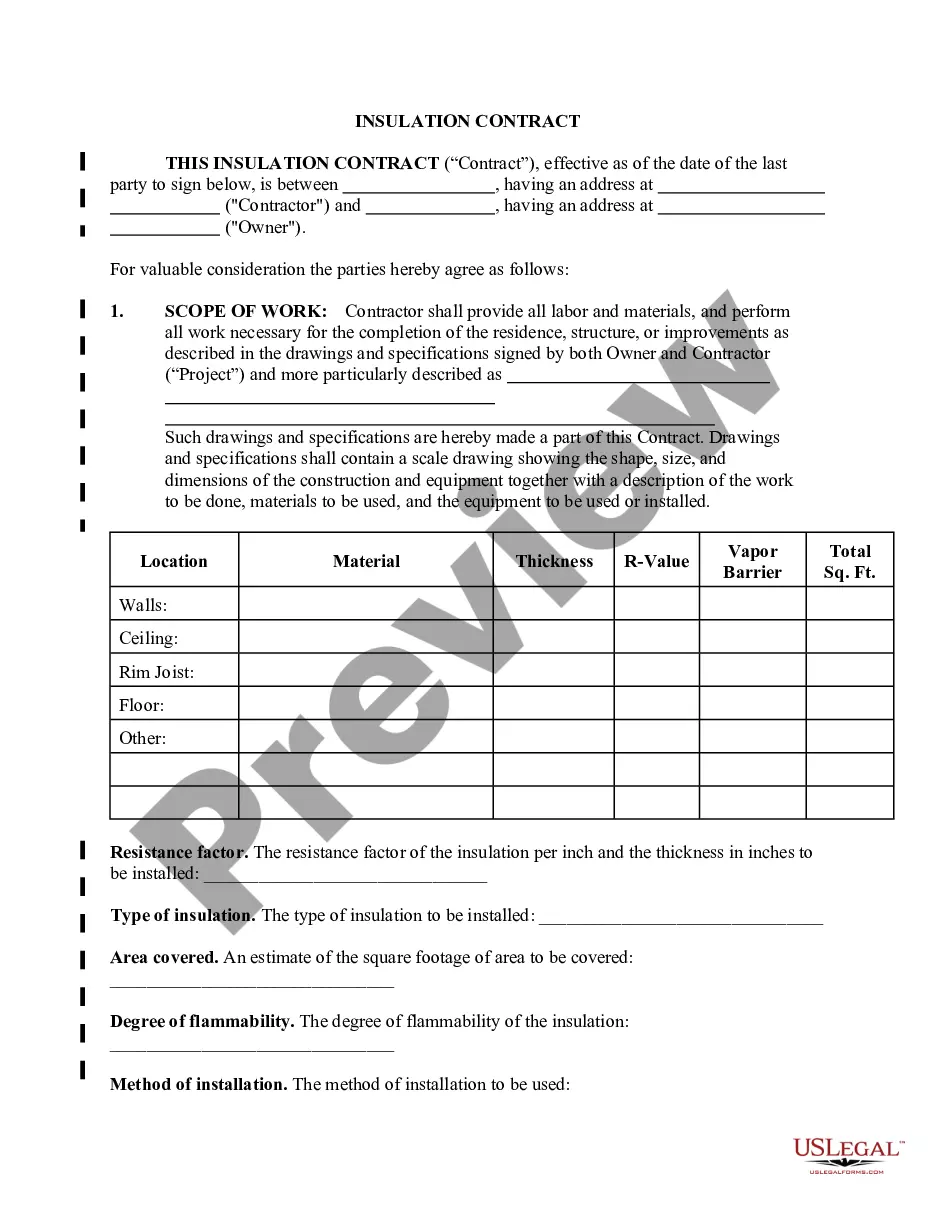

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Connecticut Consulting and Marketing Agreement - Wireless Communications.

- Every legal document template you acquire is yours indefinitely.

- To obtain a different version of the purchased form, navigate to the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, adhere to the basic instructions below.

- First, make sure you have selected the correct document template for the area/city of your choice.

- Examine the form details to confirm that you have picked the appropriate form.

Form popularity

FAQ

Sales Tax RatesThe statewide rate of 6.35% applies to the retail sale, lease, or rental of most goods and taxable services.

One of the main tax benefits of electing a pass-through business structure is avoiding double taxation. Business earnings are only taxed once, on the owner or shareholder's personal tax return. One of the first decisions every business owner makes is how to structure their business.

Tax Structure Business management and consulting services are subject to Connecticut sales and use taxes if the services apply to core business activities or human resource management activities (CGS § 12-407 (a) (37) (J)) and Conn. Agencies Regs.

For now, digital advertising services are still tax exempt. However, tangible property like printed materials related to the campaign may be considered taxable.

Pass-through taxation refers to the fact that a pass-through business pays no taxes. Instead, some control person pays the business's taxes through that person's own personal tax return.

Pass-through income is only subject to a single layer of income tax and is generally taxed as ordinary income up to the maximum 37 percent rate. However, certain pass-through income is eligible for a 20 percent deduction, which reduces the top tax rate to a maximum of 29.6 percent.

Several exemptions are certain types of safety gear, some types of groceries, certain types of clothing, children's car seats, children's bicycle helmets, college textbooks, compact fluorescent light bulbs, most types of medical equipment, and certain motor vehicles.

What Is Pass Through Income? Pass through income is sent from a pass-through entity to its owners. These special business structures help to reduce the effects of double taxation. Because income isn't taxed at the corporate level, tax liability is passed on to the owners.

Pass-through means that any profits or losses from operating the business are passed to the individual owners, who pay taxes on their returns. Most small businesses are operated in this way. A business owner must have positive taxable income to qualify for a pass-through deduction.

Advertising and public relations services are subject to Connecticut Sales and Use Tax when the benefit and use of the service occurs in this state regardless of the place of business of the service provider or the place of business of the client.