Connecticut Job Sharing Policy

Description

How to fill out Job Sharing Policy?

Have you been in a situation where you need documents for both professional or personal use almost every day.

There are numerous legitimate document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the Connecticut Job Sharing Policy, that are designed to comply with state and federal regulations.

If you have located the correct form, click Buy now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- You can then download the Connecticut Job Sharing Policy template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/state.

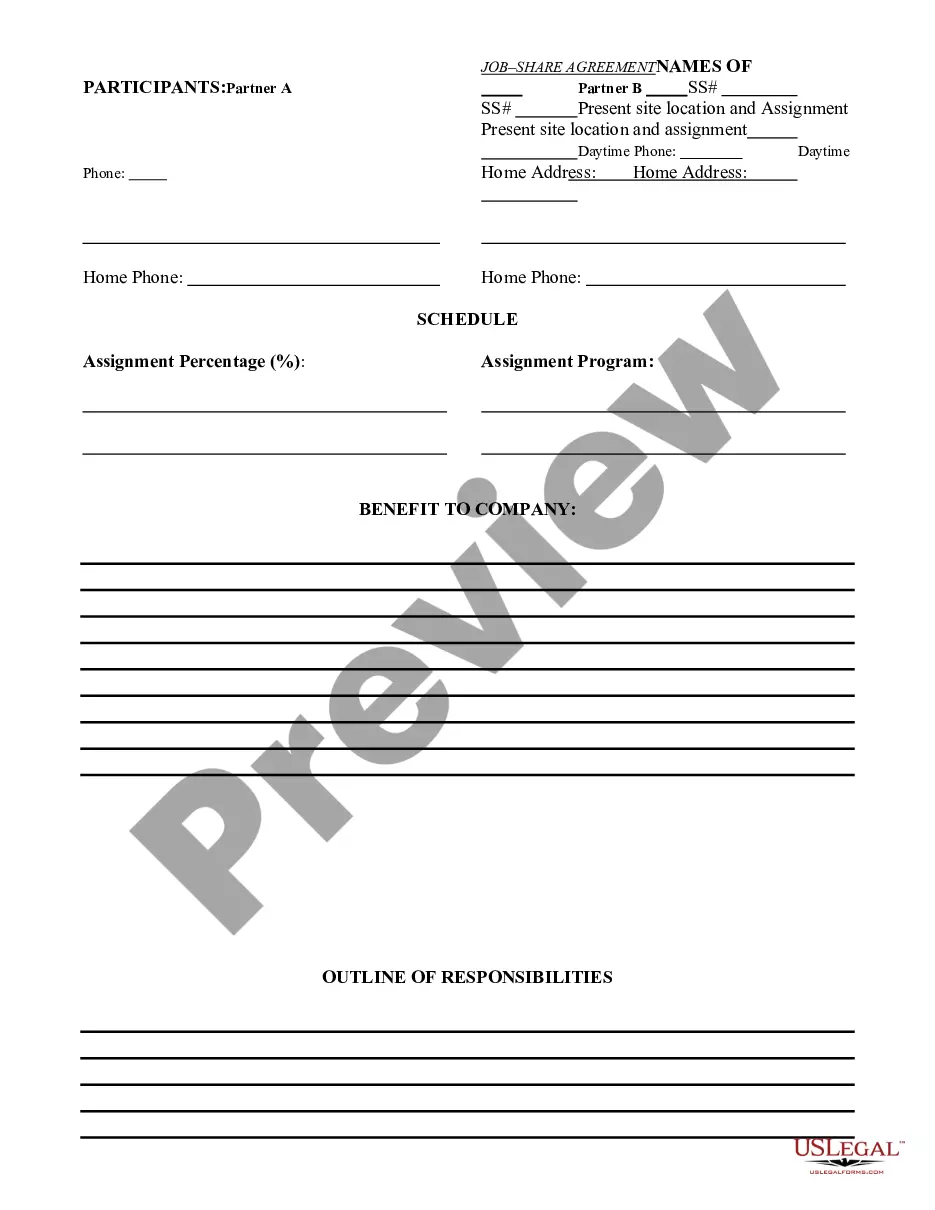

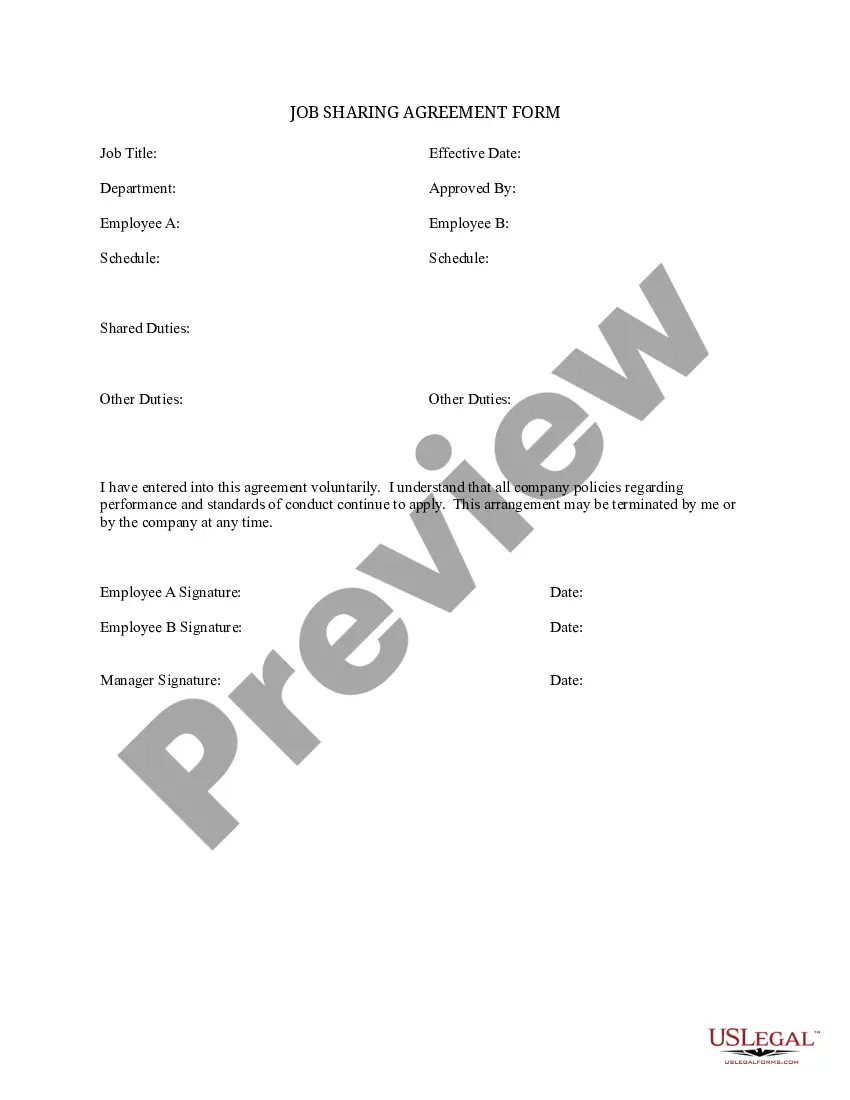

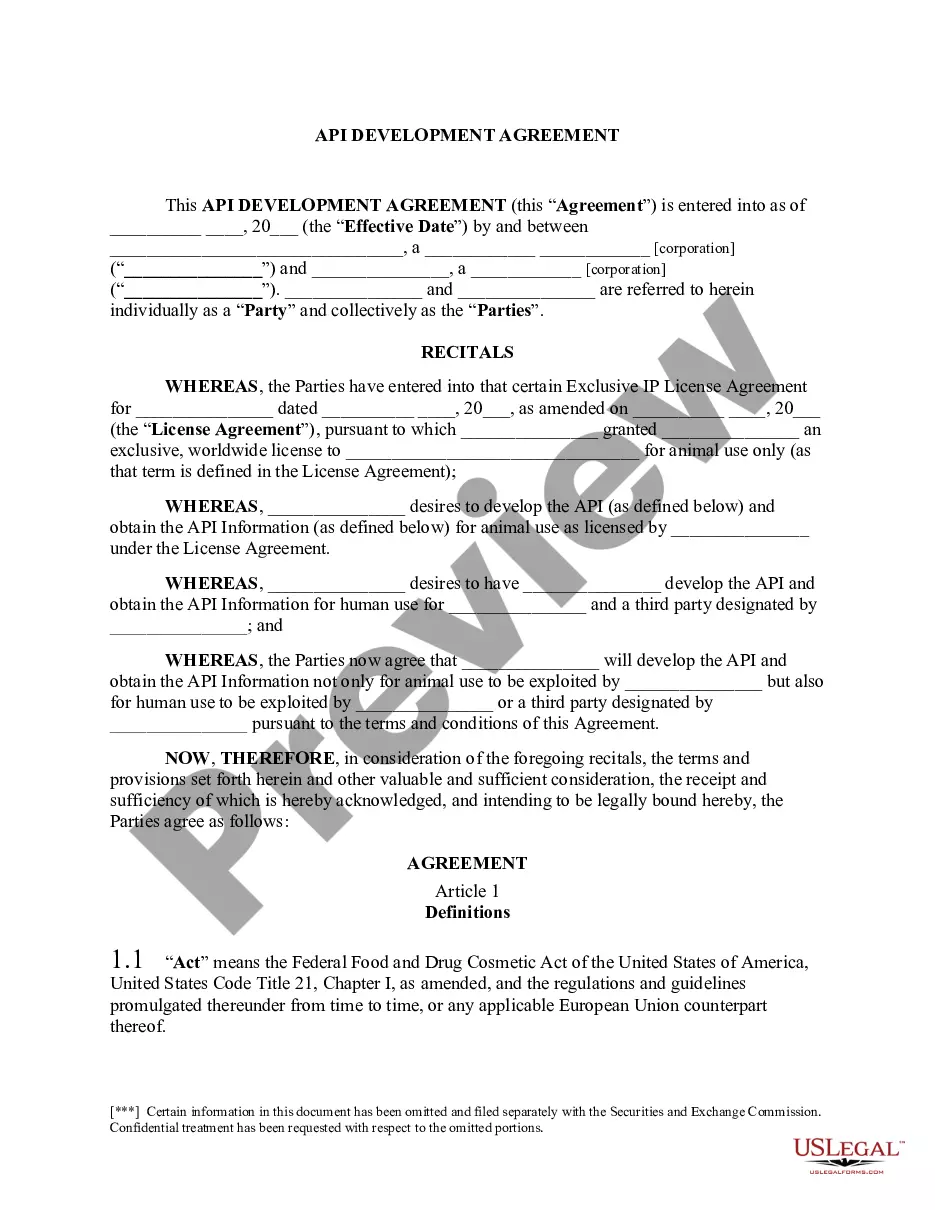

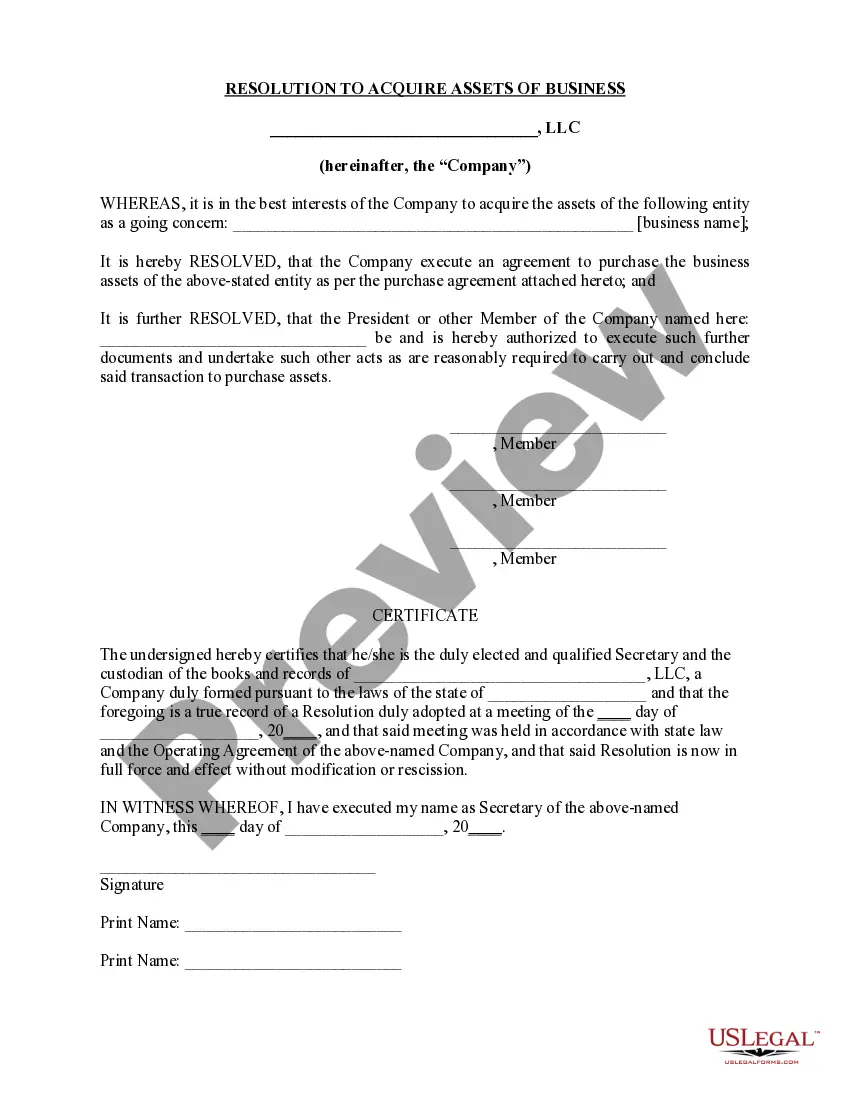

- Utilize the Preview button to examine the document.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

States with workshare programs include Arizona, Arkansas, California, Colorado, Connecticut, Florida, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nebraska, New Hampshire, New Jersey, New York, Ohio, Oregon, Pennsylvania, Rhode Island, Texas, Vermont, Washington, and Wisconsin.

A program called work sharing, or short-time compensation, encourages employers to temporarily reduce the hours of their employees rather than lay them off during an economic downturn. Work sharing allows employers to keep their skilled workforce and reestablish a full-time schedule when economic conditions improve.

To download our Shared Work Application Document. submit it to CTDOL Shared Work (Questions and Participants List). are to email the application to DOL.sharedwork@ct.gov or fax it to (860) 263-6681. notified within 30 days of the status of their application via mail or email.

Work sharing (also referred to as shared work or short-time compensation) is a type of unemployment benefit. Work sharing provides employers with an alternative to layoffs when they are faced with a temporary decline in business.

You are allowed to work part-time and collect partial unemployment benefits as long as you are still looking for full-time work. Your weekly benefit check is reduced by two-thirds (2/3) of your gross part-time wages.

Work Sharing is an Unemployment Insurance program paid for by your employer, at no cost to you.

The Connecticut Department of Labor's Shared Work Program helps businesses prevent layoffs by allowing them to temporarily reduce employee hours and use partial unemployment benefits to supplement lost wages.

Under California's Work Sharing program, an employer facing the same situation could file a Work Sharing plan with EDD reducing the work week of all employees from five days to four days (a 20 percent reduction). The employees would be eligible to receive 20 percent of their weekly Unemployment Insurance benefits.

Connecticut allows you to work part-time while collecting unemployment; however, that will affect how much money you collect. If you work, the state will deduct an amount equal to 2/3 of your pay for that part-time job before taxes (gross income) rounded to the nearest dollar.