New Mexico Resolution of Meeting of LLC Members to Acquire Assets of a Business

Description

How to fill out Resolution Of Meeting Of LLC Members To Acquire Assets Of A Business?

If you are looking to finalize, acquire, or print authorized document formats, utilize US Legal Forms, the largest collection of legal templates available online.

Utilize the website's straightforward and convenient search feature to locate the documents you require.

An assortment of templates for corporate and individual purposes are organized by categories and jurisdictions, or keywords.

Step 4. After identifying the form you need, click the Get now button. Choose the pricing plan you prefer and provide your information to register for the account.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the New Mexico Resolution of Meeting of LLC Members to Acquire Assets of a Business with just a few clicks.

- If you are already registered with US Legal Forms, Log In to your account and click the Download option to find the New Mexico Resolution of Meeting of LLC Members to Acquire Assets of a Business.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

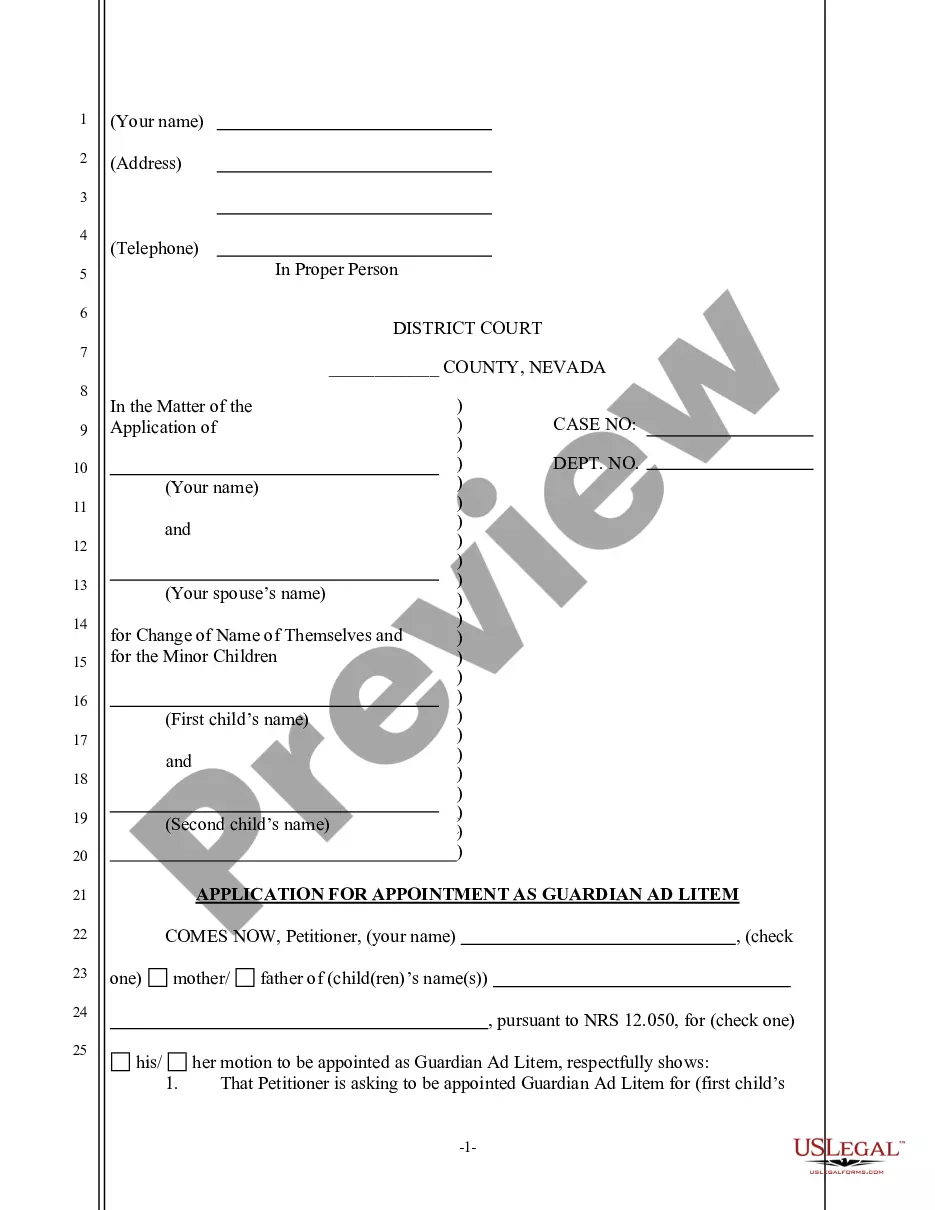

- Step 2. Use the Preview option to review the form’s details. Be sure to read through the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other forms in the legal template database.

Form popularity

FAQ

An operating agreement is a detailed document that outlines the structure and rules governing the LLC’s operations, while a resolution is a specific decision made by the members or managers. The New Mexico Resolution of Meeting of LLC Members to Acquire Assets of a Business acts as a temporary document to capture decisions made during meetings. Both serve distinct purposes, and having both can greatly enhance your LLC's organizational efficiency.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

When you set up an LLC, the LLC is a distinct legal entity. Generally, creditors can go after only the assets of the LLC, not the assets of its individual owners or members. That means that if your LLC fails, you are risking only the money you invested in it, not your home, vehicle, personal accounts, etc.

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

The LLC owns the business and all its assets. The LLC membersthe owners of the LLCrun the LLC. The LLC members ordinarily are not personally liable for LLC debts and lawsuits. For more details, see "Sole Proprietorships vs.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit single-member LLCs, those having only one owner.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

Asset Protection.A single-member LLC may act as a shield to protect your personal assets from the liabilities associated with the business conducted by the LLC.

Law ? 203(d), 202. Since an LLC is a legal person, the property it owns is the property of the LLC, not of the members.