Connecticut Job Expense Record

Description

How to fill out Job Expense Record?

Are you in a scenario where you require documents for both organizational or personal purposes almost daily.

There are numerous legal document templates accessible online, but locating reliable versions can be challenging.

US Legal Forms offers a vast array of form templates, including the Connecticut Job Expense Record, designed to comply with federal and state regulations.

Once you locate the correct form, click on Get now.

Choose a suitable pricing plan, fill out the necessary information to create your account, and complete your purchase using PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Connecticut Job Expense Record template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it corresponds to your correct city/region.

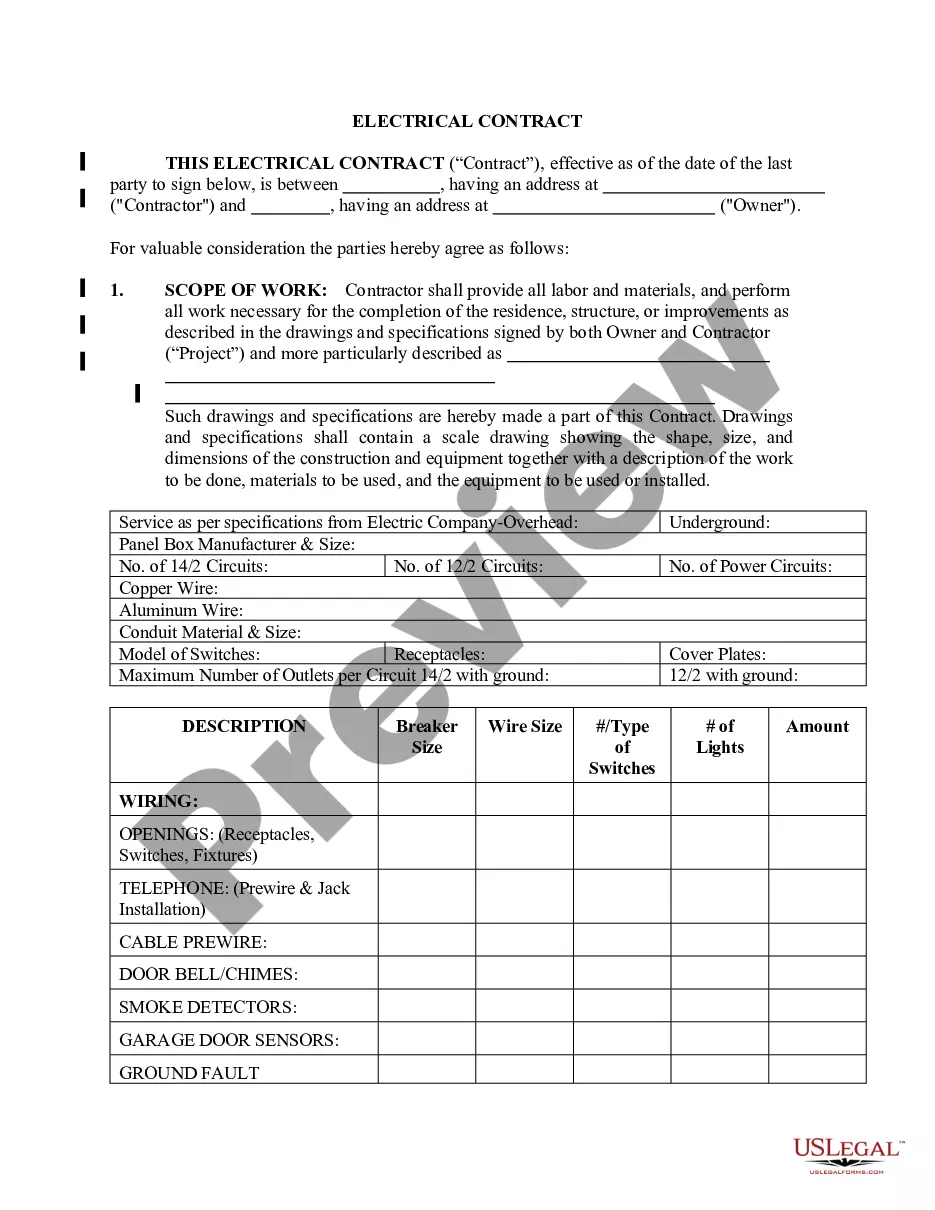

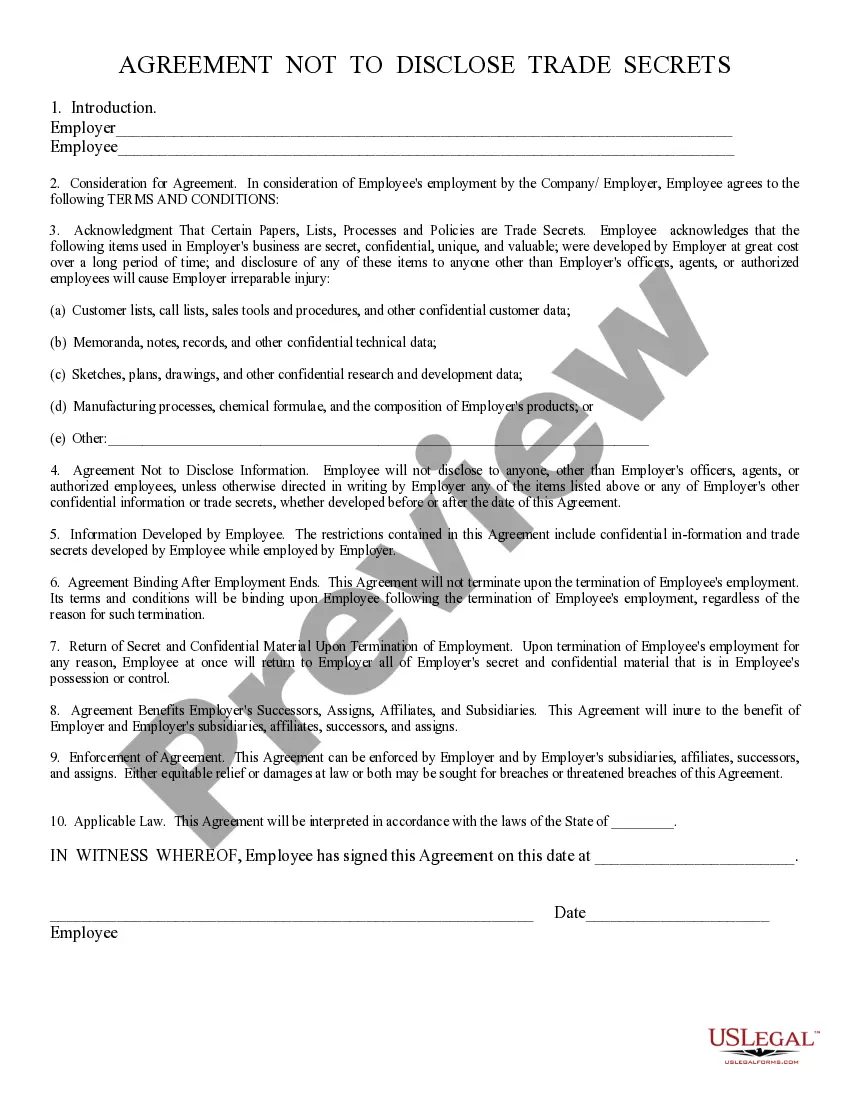

- Utilize the Preview button to view the form.

- Read the description to confirm you have selected the right form.

- If the form does not meet your needs, use the Search field to find a form that suits you and your requirements.

Form popularity

FAQ

The purpose of the Self-employment Worksheet is to provide a method of computing income for individuals whose income is derived from their ownership of a business, but who are not salaried by that business.

For tax year 2020, you may deduct donations worth up to 60% of your income. Make sure that you have written receipts or bank/payroll deductions for any contributions. Any non-cash donations such as clothing have to be deducted at fair market value.

Documents that could be used to prove self-employment include, but are not limited to: business licenses, tax returns, business receipts or invoices, signed affidavits verifying self-employment, contracts or agreements, or bank statements from a business account that show self-employment.

Any accurate, detailed record of your self-employment income and expenses. It can be a spreadsheet, a document from an accounting software program, a handwritten "ledger" book, or anything that records all self-employment income and expenses.

20 popular tax deductions and tax credits for individualsChild tax credit.Child and dependent care tax credit.American opportunity tax credit.Lifetime learning credit.Student loan interest deduction.Adoption credit.Earned income tax credit.Charitable donations deduction.More items...

Here's what you can still deduct:Gambling losses up to your winnings.Interest on the money you borrow to buy an investment.Casualty and theft losses on income-producing property.Federal estate tax on income from certain inherited items, such as IRAs and retirement benefits.More items...

Wage and Tax Statement for Self Employed (1099). These forms prove your wages and taxes as a self employed individual. It's one of the most reliable proofs of income you can produce since it is a legal document. Profit and Loss Statement or Ledger Documentation.

To calculate CT AGI, a taxpayer modifies his or her federal AGI by adding and subtracting specified income and expenses. For some filers, CT AGI is further reduced by a personal exemption to determine Connecticut taxable income. Exemptions and deductions reduce the amount of income subject to tax.

N/A Connecticut does not have a standard or itemized deduction. Instead, it starts with the federal taxable income, since the deductions have already been taken out. No individual income tax. No Deductions must match the federal return.

3 Types of documents that can be used as proof of incomeAnnual tax returns. Your federal tax return is solid proof of what you've made over the course of a year.Bank statements. Your bank statements should show all your incoming payments from clients or sales.Profit and loss statements.