Connecticut Lease of Recreation or Athletic Equipment

Description

Article 2A of the UCC governs any transaction, regardless of its form, that creates a lease of personal property. Article 2A has been adopted, in different forms, by the majority of states, but it does not apply retroactively to transactions that occurred prior to the effective date of its adoption in a particular jurisdiction.

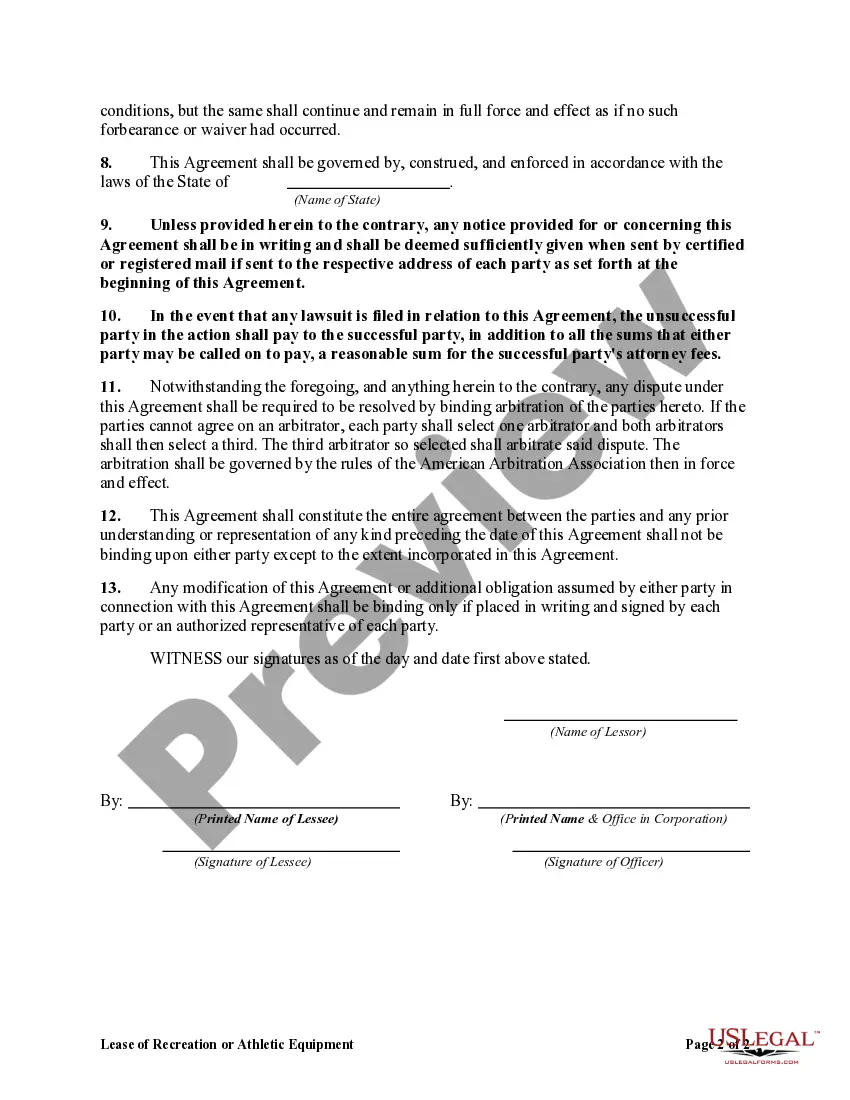

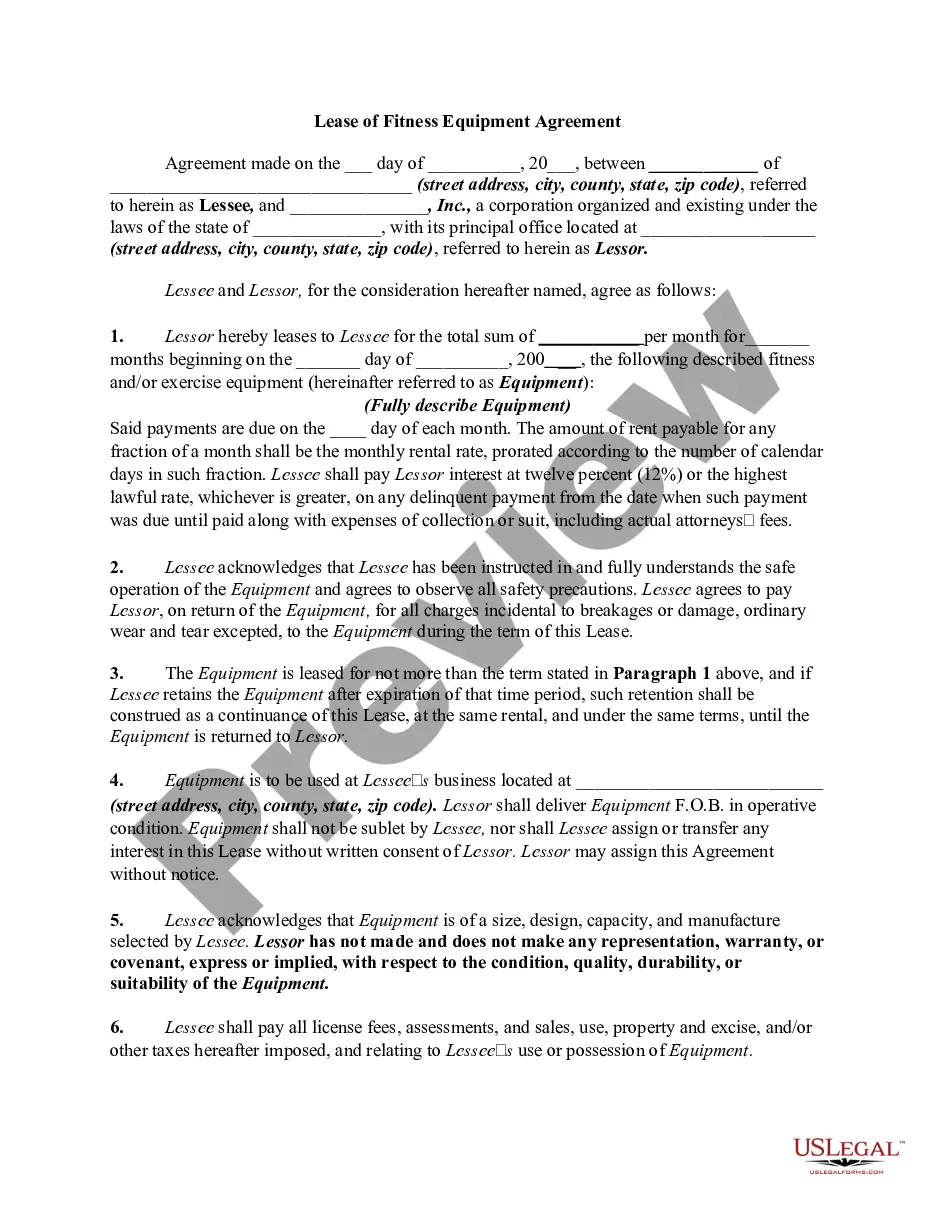

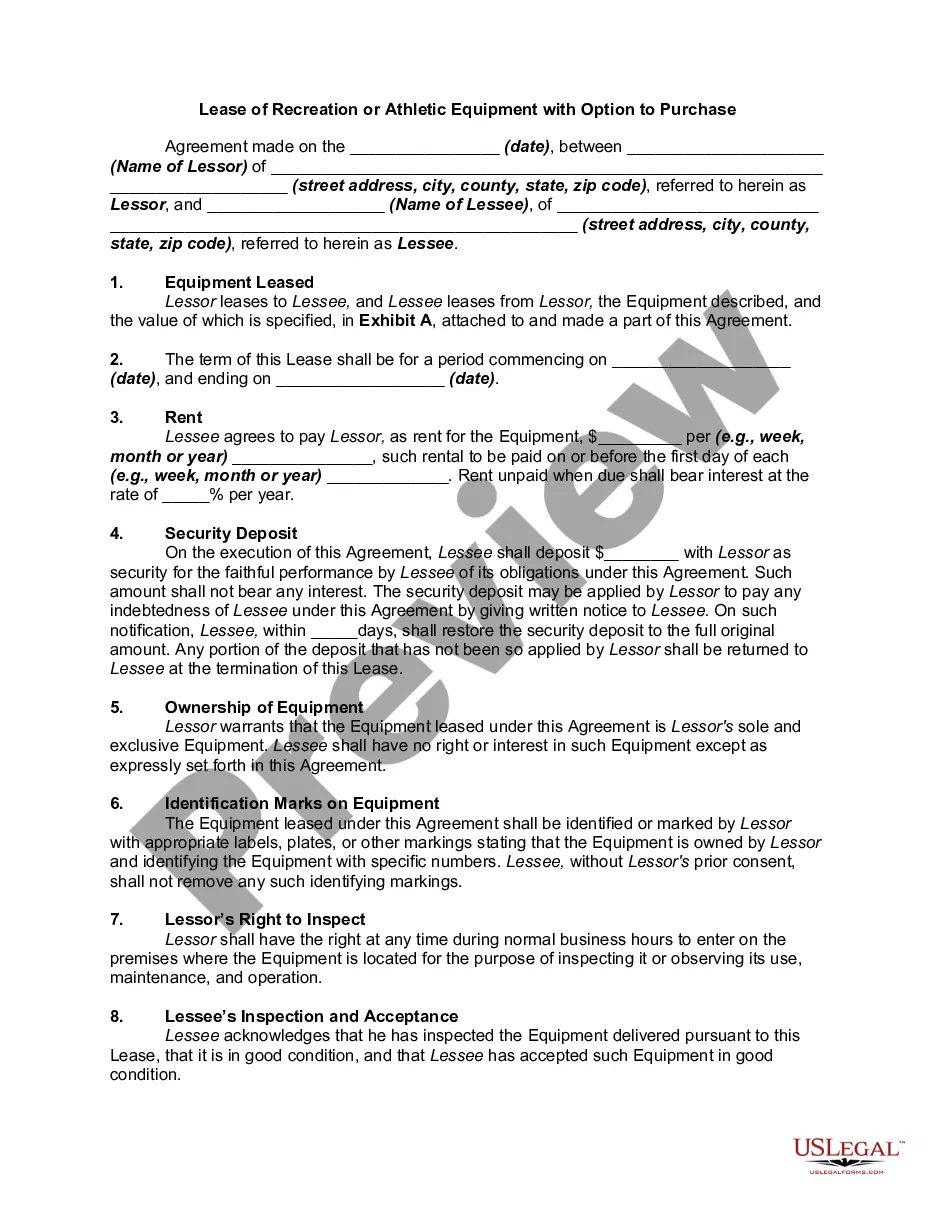

How to fill out Lease Of Recreation Or Athletic Equipment?

US Legal Forms - one of the largest collections of legal documents in the United States - offers an extensive variety of legal form templates that you can download or print.

Through the website, you can access a vast array of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest editions of forms such as the Connecticut Lease of Recreation or Athletic Equipment in a matter of minutes.

If the form does not meet your needs, utilize the Search box at the top of the screen to find a suitable one.

Once you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your information to register for an account.

- If you currently have a monthly subscription, Log In to download the Connecticut Lease of Recreation or Athletic Equipment from your US Legal Forms library.

- The Download option will be visible for every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/county.

- Select the Preview option to review the form’s content. See the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

A Connecticut resale certificate does not have a fixed expiration date; however, it is generally valid as long as your business remains active. It’s wise to periodically review and update the certificate if your purchasing practices change, especially concerning the Connecticut Lease of Recreation or Athletic Equipment. Keep your records organized to ensure compliance.

In Connecticut, certain items are exempt from sales tax. These include food items, prescription drugs, and some services. However, be aware that rentals, specifically those under the Connecticut Lease of Recreation or Athletic Equipment, are generally taxable, so planning accordingly is crucial.

Depending on the circumstances, renting equipment can be taxable in Connecticut. This includes rentals classified under the Connecticut Lease of Recreation or Athletic Equipment. As a rental business, staying informed about tax implications ensures compliance and helps you manage your financial responsibilities effectively.

Yes, rental income is generally subject to taxation in Connecticut. This applies to income derived from leasing athletic or recreation equipment, categorized under the Connecticut Lease of Recreation or Athletic Equipment. It’s essential to report this income accurately when filing your state taxes to avoid penalties.

To obtain a sales tax license in Connecticut, you must register your business with the Connecticut Department of Revenue Services. The process involves filling out a registration form online, providing business details, and specifying the types of goods or services you'll offer, including the rental of recreation or athletic equipment. Once approved, you’ll receive your sales tax permit, allowing you to collect tax from customers.

Yes, equipment rental is generally taxable in Connecticut. This includes the rental of recreation or athletic equipment under the Connecticut Lease of Recreation or Athletic Equipment. As a rental service provider, understanding the tax obligations can help you comply with state laws and ensure smooth operations.

Setting up a Connecticut Lease of Recreation or Athletic Equipment involves several steps. First, you should define the terms clearly, including duration, payment schedules, and liabilities. Then, utilize resources like uslegalforms to guide you in creating a legally sound lease document that protects your interests and ensures a smooth transaction for both parties.

In Connecticut, leases do not typically need to be notarized, including a Connecticut Lease of Recreation or Athletic Equipment. However, it is advisable to ensure that both parties sign the lease to make it enforceable. Remember that certain agreements may benefit from notarization for extra protection.

In Connecticut, gym memberships are generally not subject to sales tax. However, certain fees associated with gym services may fall under taxable categories. When entering into any arrangements, including a Connecticut Lease of Recreation or Athletic Equipment, be aware of all potential costs and whether they are subject to tax.

The 7.35% tax in Connecticut is often referred to as the 'reduced' sales tax rate, which applies to specific services and products. It's essential to identify what falls under this category when planning a budget for recreational needs. As you explore a Connecticut Lease of Recreation or Athletic Equipment, keeping this tax in mind helps in better financial planning.