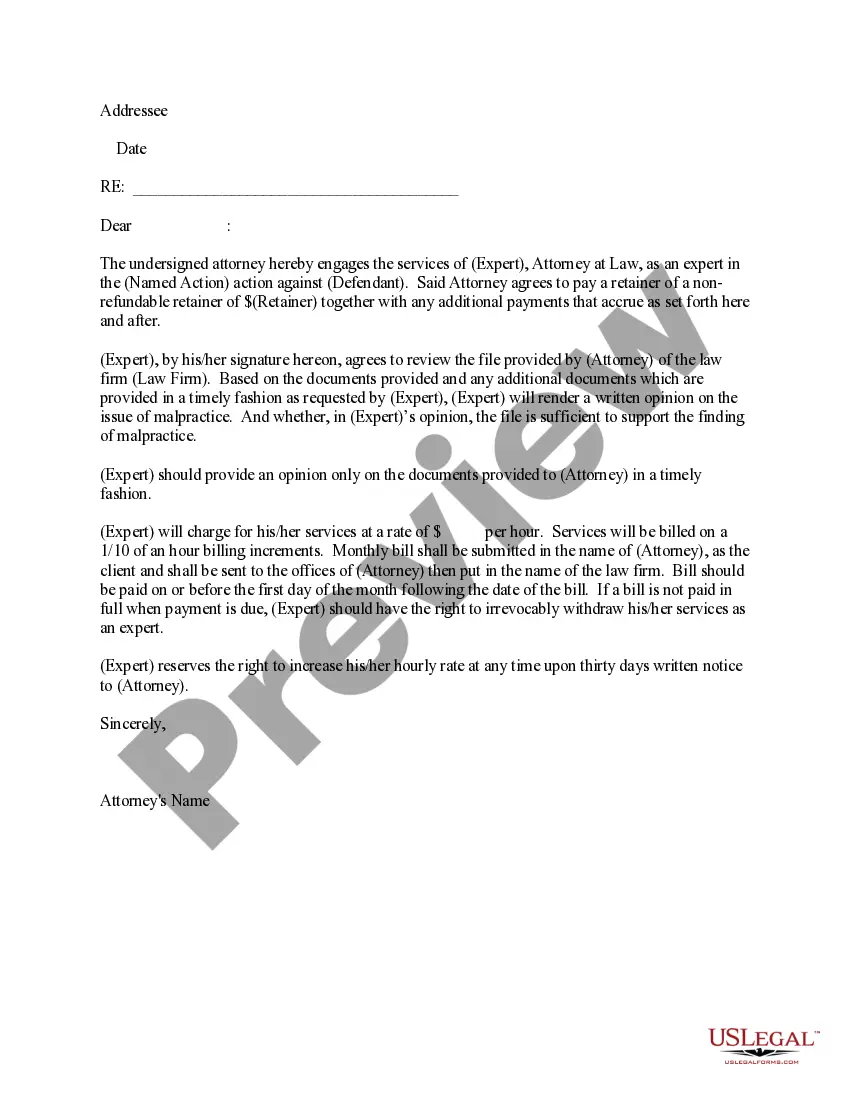

Connecticut Debt Agreement

Description

How to fill out Debt Agreement?

If you need to finish, retrieve, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Make use of the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After you’ve located the form you need, click the Get now button. Choose the payment plan you prefer and provide your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, modify, print, or sign the Connecticut Debt Agreement.

- Utilize US Legal Forms to acquire the Connecticut Debt Agreement in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Connecticut Debt Agreement.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's content. Don't forget to read the description.

- Step 3. If you aren't satisfied with the document, use the Search area at the top of the page to find other versions of the legal form template.

Form popularity

FAQ

To obtain a Connecticut debt agreement, begin by determining how much you owe and who your creditors are. Next, contact your creditors to negotiate the terms of the agreement. If you prefer a structured approach, platforms like US Legal Forms can assist you in drafting a professional and legally sound debt agreement.

A Connecticut debt agreement can be worth your while if it alleviates financial pressure and helps you organize repayments. Such agreements can also provide a clear path to restoring your credit. If you are uncertain about proceeding alone, consider using resources like US Legal Forms for guidance and templates.

In Connecticut, a debt usually becomes uncollectible after seven years if there has been no activity on the account. This timeline can significantly impact your financial strategy, so it's important to stay informed. If you are struggling with collections, drafting a Connecticut debt agreement may help you negotiate more favorable terms before the debt becomes stale.

Yes, you can perform debt settlement on your own, particularly if you have a good understanding of your financial situation. However, negotiating directly with creditors can be challenging. Consider using resources like US Legal Forms to guide you through creating a solid Connecticut debt agreement that can facilitate your discussions with creditors.

Writing a Connecticut debt agreement involves clearly outlining the debt amount, repayment terms, and any interest rates. Be sure to include the payment schedule and any conditions that apply if payments are missed. Utilizing services like US Legal Forms can simplify this process by providing templates that ensure you include all necessary elements.

The 7 7 rule for collections in Connecticut suggests that a debt becomes uncollectible typically after seven years of inactivity. This means if you do not make any payments or acknowledge the debt during this period, creditors may lose their right to collect. Understanding this rule can help you strategize your debt repayment plan effectively.

To get a Connecticut debt agreement, start by assessing your financial situation and gathering all relevant debt information. Next, reach out to your creditors to propose a debt agreement, which outlines the terms of repayment. Alternatively, you can use platforms like US Legal Forms to create a customized debt agreement that meets your needs.

The 777 rule refers to a common guideline concerning debt collection practices, indicating that a creditor should not contact a debtor more than seven times within seven days. This rule aims to prevent harassment and establish fair collection processes. Understanding this, along with recognizing your rights under a Connecticut Debt Agreement, can empower you in negotiating with collectors.

To write an effective debt settlement letter, begin with your account details and clearly state your intention to settle the debt. Offer a specific payment amount and terms, and request a written confirmation of the settlement. A well-structured letter can lay the groundwork for a solid Connecticut Debt Agreement that satisfies both your needs and those of the creditor.

In Connecticut, most debts become uncollectible after six years, depending on the type of debt. This is due to the statute of limitations that applies to collections. However, debts like mortgages and judgments may follow different timelines, so it's vital to understand these terms when dealing with a Connecticut Debt Agreement.