A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

Connecticut Continuing Guaranty of Business Indebtedness By Corporate Stockholders

Description

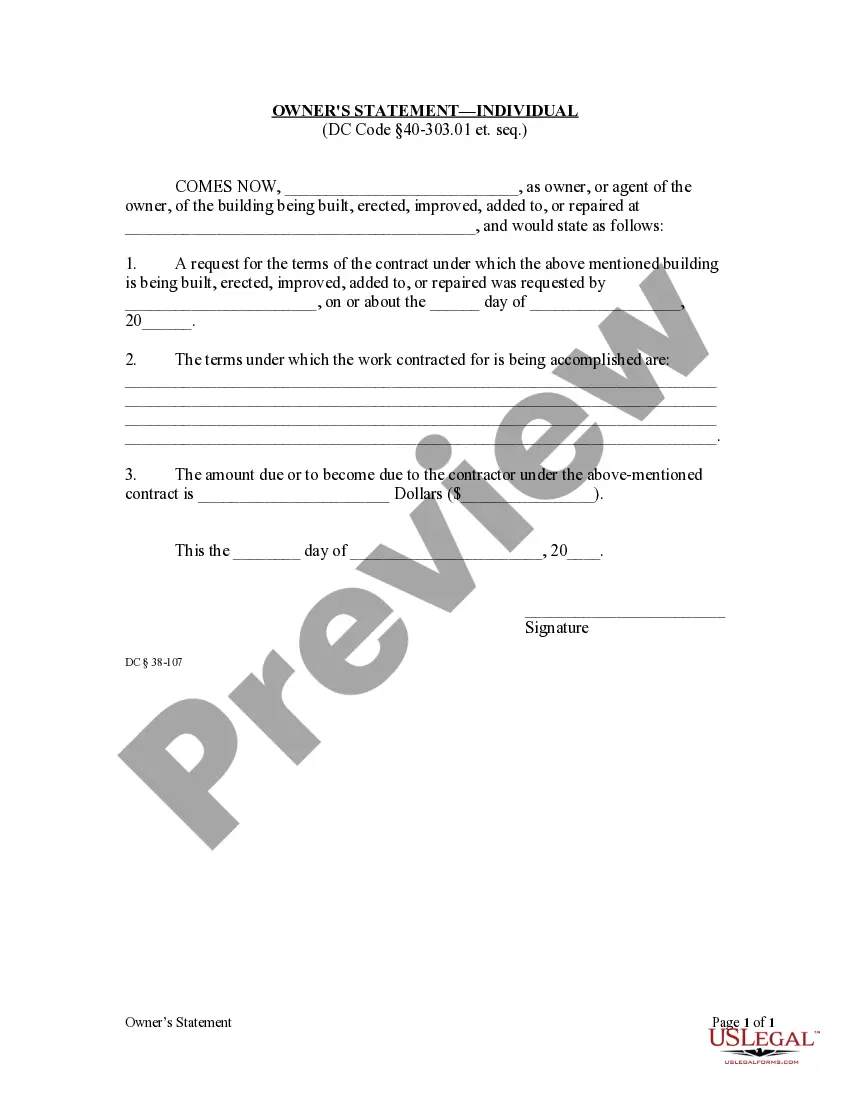

How to fill out Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

If you wish to fulfill, acquire, or print authorized document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Make the most of the site's straightforward and user-friendly search to find the documents you require.

Many templates for business and personal uses are sorted by categories and suggestions, or keywords.

Step 4. After you have found the form you need, click the Purchase now button. Choose the pricing option you prefer and enter your details to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Utilize US Legal Forms to obtain the Connecticut Continuing Guaranty of Business Indebtedness By Corporate Stockholders in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Connecticut Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the content of the form. Don't forget to read the explanation.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative types of the legal form template.

Form popularity

FAQ

Statute 29 33 deals with various regulatory measures affecting business practices and consumer protection in Connecticut. While it may not directly connect with the Connecticut Continuing Guaranty of Business Indebtedness By Corporate Stockholders, it highlights the regulatory environment businesses must navigate. Understanding these interrelations is beneficial for compliance and strategic planning.

Statute 33 929 is another reference to the Connecticut Continuing Guaranty of Business Indebtedness By Corporate Stockholders, emphasizing its relevance in the context of corporate financial security. This statute allows stockholders to provide guarantees, safeguarding their business interests while ensuring creditors are protected. Familiarity with this statute is essential for corporate stockholders in Connecticut.

In Connecticut, statutes of limitations vary based on the nature of the legal claim. Common timeframes include two years for personal injury and contract claims, and six years for written contracts. Being aware of these time limits is crucial for anyone involved in business, particularly those involved with Connecticut Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

Section 33 749 provides information regarding the rights and obligations of directors and officers in corporate governance. This section emphasizes the importance of fiduciary duties, which are essential in managing a company's affairs. Understanding this helps stockholders maintain compliance while engaging in the Connecticut Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

Section 52 575 addresses the statute of limitations for actions related to contracts and torts in Connecticut. It establishes a timeframe within which legal actions must be initiated, ensuring justice is served promptly. Knowing these limitations is important for business owners when considering potential claims, especially related to the Connecticut Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

In Connecticut, the statute of limitations for uninsured motorist claims is generally two years from the date of the accident. This timeframe is critical for individuals seeking compensation for damages incurred due to uninsured motorists. Understanding this limitation helps individuals protect their rights and ensures timely filing of claims.

Connecticut General Statutes 29 292 pertains to regulations concerning business practices and financial responsibilities in the state. While this statute is not directly related to the Connecticut Continuing Guaranty of Business Indebtedness By Corporate Stockholders, it can impact overall compliance for businesses operating in Connecticut. Business owners should be aware of how multiple statutes interact and influence their operations.

Section 33 929 outlines the Connecticut Continuing Guaranty of Business Indebtedness By Corporate Stockholders. This statute provides a framework for corporate stockholders to guarantee the debts of their business, ensuring creditors have recourse if the company cannot meet its financial obligations. Understanding this section is crucial for business owners and stockholders seeking to manage their liabilities effectively.