Wisconsin Headhunter Agreement - Self-Employed Independent Contractor

Description

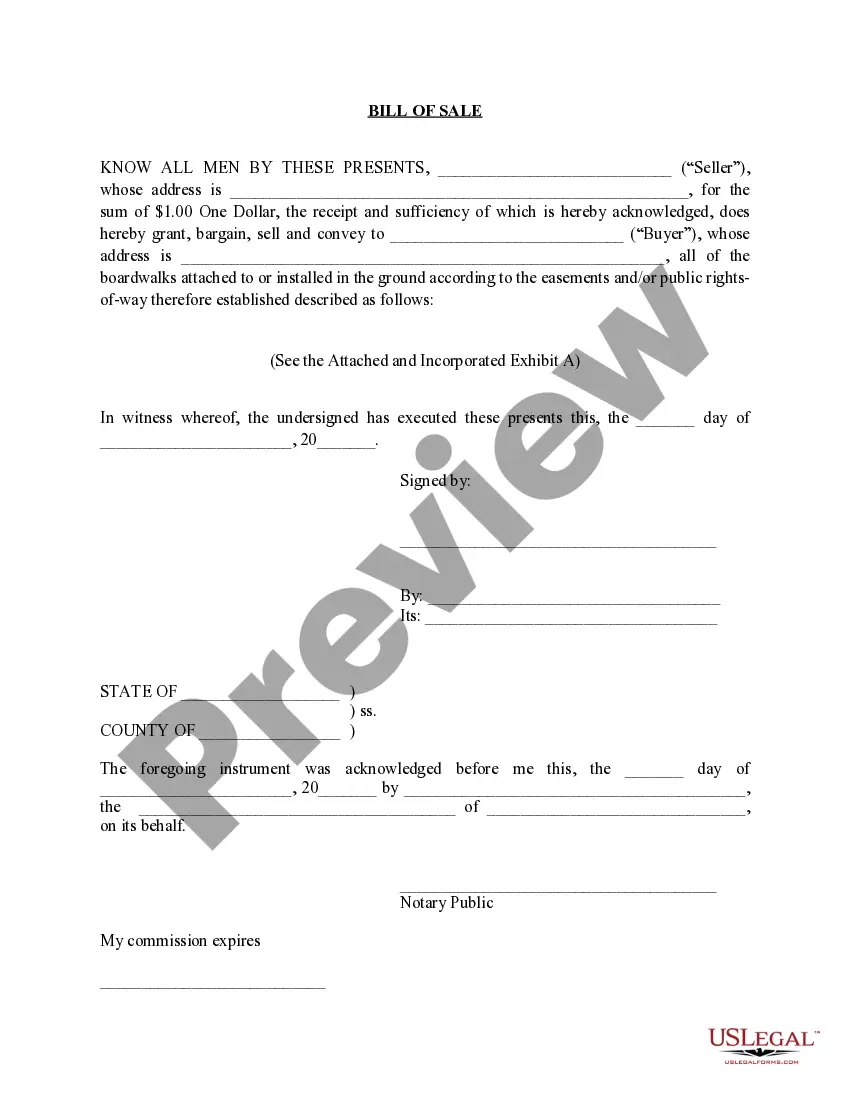

How to fill out Headhunter Agreement - Self-Employed Independent Contractor?

If you desire to total, obtain, or print authentic documents templates, utilize US Legal Forms, the primary selection of valid forms, available online.

Benefit from the site’s simple and user-friendly search to find the documents you require. Numerous templates for business and personal purposes are categorized by classes and regions, or keywords.

Employ US Legal Forms to acquire the Wisconsin Headhunter Agreement - Self-Employed Independent Contractor in just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

Step 6. Download the format of the legal form and obtain it on your device. Step 7. Complete, modify, and print or sign the Wisconsin Headhunter Agreement - Self-Employed Independent Contractor. Each legal document template you buy is yours forever. You will have access to every form you acquired within your account. Click on the My documents section and select a form to print or download again. Finalize and obtain, and print the Wisconsin Headhunter Agreement - Self-Employed Independent Contractor with US Legal Forms. There are various professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Wisconsin Headhunter Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously purchased from the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to examine the form’s content. Don’t forget to read through the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form template.

- Step 4. Once you have located the form you need, choose the Purchase now option. Select the payment method you prefer and enter your details to register for an account.

Form popularity

FAQ

Creating an independent contractor agreement involves several key steps. Start by clearly defining the scope of work, payment terms, and duration of the contract. You can use the Wisconsin Headhunter Agreement - Self-Employed Independent Contractor template available on the US Legal Forms platform to simplify this process. This resource provides a reliable foundation and ensures you include all necessary legal elements.

The new federal rule on independent contractors clarifies the criteria used to determine a worker's status. It emphasizes the importance of the relationship between the worker and the business. Under this rule, it is essential to understand how the Wisconsin Headhunter Agreement - Self-Employed Independent Contractor fits into these criteria. Adapting to these changes can help you maintain compliance and protect your business.

Legal requirements for independent contractors can include proper classification to avoid mislabeling them as employees. Contractors must typically manage their own taxes and benefits, which differs from employees who receive these from their employer. It is crucial to draft a Wisconsin Headhunter Agreement - Self-Employed Independent Contractor that complies with state laws to ensure your agreement is valid and enforceable.

When employing an independent contractor, you typically need to prepare a written agreement that covers the terms of the engagement. Additionally, you may require tax forms like the W-9 to collect the contractor's tax identification information. Utilizing resources from US Legal Forms can help you create a comprehensive Wisconsin Headhunter Agreement - Self-Employed Independent Contractor that meets your needs.

The purpose of an independent contractor agreement is to clearly define the expectations and responsibilities of both parties involved. This agreement establishes the scope of work, payment terms, and deadlines, ensuring that both the contractor and the hiring party are on the same page. A well-drafted Wisconsin Headhunter Agreement - Self-Employed Independent Contractor can prevent misunderstandings and protect both parties legally.

Exiting an independent contractor agreement can vary based on the terms outlined in the contract. Generally, you should review the agreement for any termination clauses that specify how either party can end the relationship. For a smoother process, consider discussing your situation with the contractor and reaching a mutual agreement, possibly utilizing tools from US Legal Forms to ensure compliance with the Wisconsin Headhunter Agreement - Self-Employed Independent Contractor.

The main difference lies in the nature of the relationship. An employment contract typically establishes an ongoing relationship between an employer and employee, with specific obligations and benefits. In contrast, a Wisconsin Headhunter Agreement - Self-Employed Independent Contractor outlines the terms of a project-based relationship, where the contractor operates independently and retains control over how they complete their work.

Writing an independent contractor agreement starts with defining the scope of work and the relationship between the contractor and the business. Include sections on payment, deadlines, and termination clauses to protect both parties. Be clear and specific to avoid any misunderstandings. For a reliable framework, you can use a Wisconsin Headhunter Agreement - Self-Employed Independent Contractor sample from uslegalforms, which provides all necessary components.

Filling out an independent contractor form requires you to provide essential details about the work and the parties involved. Begin by entering your name and address, followed by the business information. Clearly specify the services you will provide, along with the payment terms. If you want to ensure clarity and compliance, consider using the Wisconsin Headhunter Agreement - Self-Employed Independent Contractor template available at uslegalforms.

To fill out a declaration of independent contractor status form, start by providing your personal information, including your name and contact details. Then, describe the nature of your work and the relationship between you and the business. Always ensure that your answers align with the criteria set forth in the Wisconsin Headhunter Agreement - Self-Employed Independent Contractor guidelines. Using a template from uslegalforms can help you navigate this form accurately.