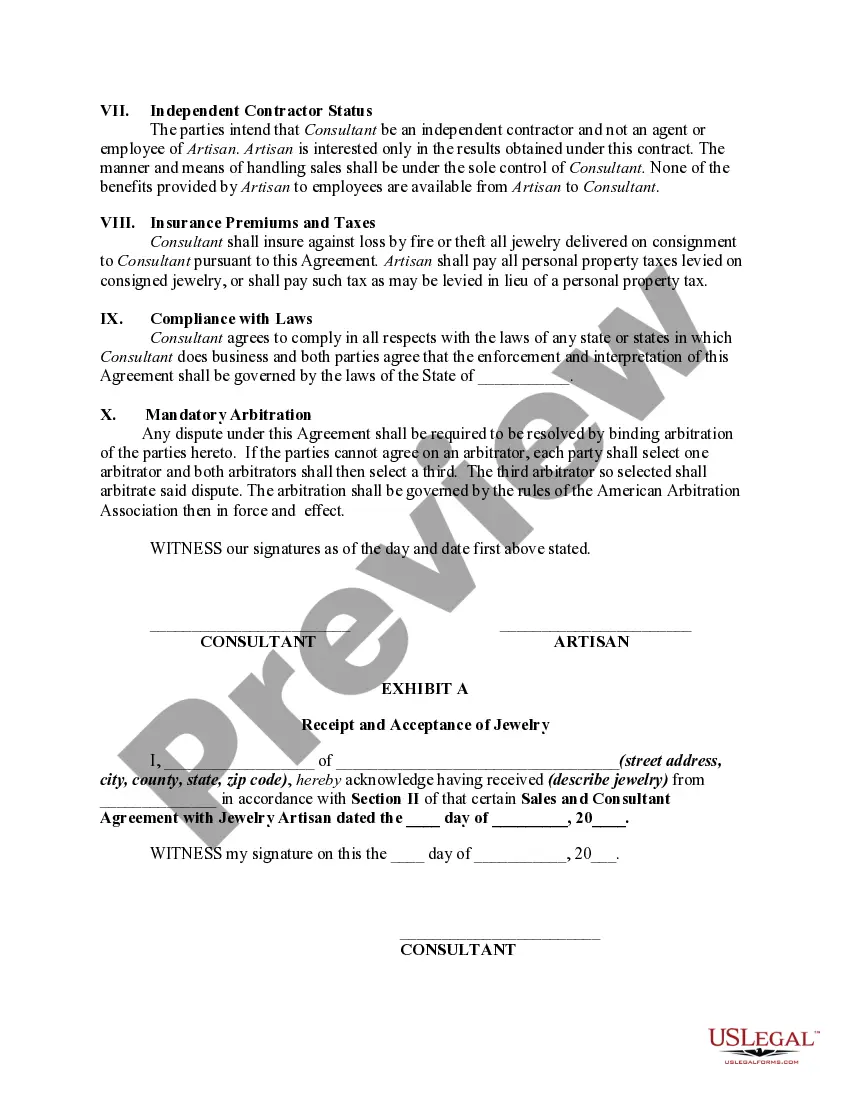

This form is a sample of an agreement to promote and sell jewelry between an artisan, who designs and creates fine jewelry, and an image consultant for various clients who have requested consultant's assessment of their wardrobe with regard to jewelry.

Connecticut Sales and Marketing Consultant Agreement with Jewelry Artisan

Description

How to fill out Sales And Marketing Consultant Agreement With Jewelry Artisan?

Are you currently in a situation where you require documents for either professional or personal purposes almost every day.

There are many legal document templates available online, but finding ones you can trust isn’t easy.

US Legal Forms offers numerous template options, including the Connecticut Sales and Marketing Consultant Agreement with Jewelry Artisan, which are designed to comply with state and federal requirements.

Utilize US Legal Forms, which boasts one of the most extensive collections of legal documents, to save time and avoid mistakes.

The service provides properly formatted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In to your account.

- After that, you can download the Connecticut Sales and Marketing Consultant Agreement with Jewelry Artisan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct state/region.

- Utilize the Review button to inspect the document.

- Examine the summary to make sure you have selected the correct form.

- If the document isn’t what you’re looking for, use the Search field to locate a form that meets your needs and preferences.

- When you find the right form, click Get now.

- Select the pricing option that suits you, provide the necessary details to create your account, and complete your purchase using PayPal or a credit/debit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased under the My documents menu. You can retrieve another copy of the Connecticut Sales and Marketing Consultant Agreement with Jewelry Artisan whenever needed; just click on the required form to download or print the document template.

Form popularity

FAQ

For a consulting contract to be valid, it must include an offer, acceptance, and consideration. Additionally, both parties should have the legal capacity to enter into the agreement. The Connecticut Sales and Marketing Consultant Agreement with Jewelry Artisan ensures these fundamentals are met, promoting a solid foundation for successful consulting relationships.

A consultancy agreement typically features a clear layout, including sections for the parties' information, scope of work, payment terms, and confidentiality. It may also contain signature lines for both parties. The Connecticut Sales and Marketing Consultant Agreement with Jewelry Artisan provides a practical example of how to structure such an agreement effectively.

While both a consulting agreement and a contract serve as legal documents outlining the terms of a relationship, a consulting agreement specifically pertains to consulting services provided. A contract is a broader term that can cover various types of agreements. The Connecticut Sales and Marketing Consultant Agreement with Jewelry Artisan exemplifies a specialized consulting agreement, focusing on collaboration between the consultant and jewelry artisan.

An agreement should include the names of the parties involved, the scope of work, payment terms, and any liabilities or responsibilities. Clear descriptions and expectations help prevent misunderstandings. The Connecticut Sales and Marketing Consultant Agreement with Jewelry Artisan emphasizes the importance of thorough documentation in ensuring both parties are aligned.

A consultancy agreement should contain details like the consultant’s obligations, the payment schedule, duration of the agreement, and termination procedures. Including a confidentiality clause is also important to protect sensitive information. Referencing the Connecticut Sales and Marketing Consultant Agreement with Jewelry Artisan can guide you in crafting a thorough and effective document.

Setting up a consulting agreement involves drafting a document that spells out the terms and conditions of the engagement. You can start by defining the services to be rendered and an appropriate compensation structure. Utilizing resources like the Connecticut Sales and Marketing Consultant Agreement with Jewelry Artisan can streamline the process, ensuring you don’t overlook crucial details.

A consulting agreement should clearly outline the scope of work, payment terms, confidentiality clauses, and termination conditions. When using the Connecticut Sales and Marketing Consultant Agreement with Jewelry Artisan, be sure to specify the services offered and the expected outcomes. This clarity helps both parties maintain a mutual understanding throughout the consulting relationship.

To obtain a seller's permit in Connecticut, you must apply through the Department of Revenue Services. Complete the necessary forms and provide required documentation relevant to your Connecticut Sales and Marketing Consultant Agreement with a Jewelry Artisan. Acquiring a seller's permit allows you to collect sales tax legally and operate your business within state regulations.

Certain services are exempt from sales tax in Connecticut, including personal services, professional services, and consulting services that solely involve advice. When you arrange a Connecticut Sales and Marketing Consultant Agreement with a Jewelry Artisan, ensure you distinguish between taxable and exempt services. Keeping informed helps you manage your finances effectively.

Maintenance services may be taxable in Connecticut, depending on their nature and whether they involve the sale of personal property. If maintenance services are part of a Connecticut Sales and Marketing Consultant Agreement with a Jewelry Artisan that includes materials or tangible goods, tax might apply. Always consider consulting with a tax professional to clarify your specific situation.