This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Connecticut Application for Certificate of Discharge of IRS Lien

Description

How to fill out Application For Certificate Of Discharge Of IRS Lien?

Have you found yourself in a situation where you require documents for various business or personal purposes almost daily? There are countless legal document templates accessible online, yet locating reliable versions is challenging. US Legal Forms offers thousands of form templates, including the Connecticut Application for Certificate of Discharge of IRS Lien, which can be tailored to meet state and federal criteria.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Connecticut Application for Certificate of Discharge of IRS Lien template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Discover the form you need and ensure it is for the correct city/region. Utilize the Preview option to review the form. Check the description to confirm you have selected the right form. If the form isn’t what you are looking for, use the Search feature to find the form that suits your needs and requirements. Once you find the correct form, click on Buy now. Select the payment plan you want, complete the required information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard. Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Connecticut Application for Certificate of Discharge of IRS Lien at any time if needed. Just select the desired form to download or print the document template.

- Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides well-crafted legal document templates that can be used for a variety of purposes.

- Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

To obtain a lien release from the IRS, you need to file the Connecticut Application for Certificate of Discharge of IRS Lien, along with supporting documents that demonstrate your eligibility. Once the IRS processes your application, they will issue a discharge if everything checks out. It's crucial to follow the guidelines precisely to ensure a timely release. US Legal Forms can guide you through this process, making it easier to navigate the necessary steps.

You should send Form 14135, the Connecticut Application for Certificate of Discharge of IRS Lien, to the appropriate IRS address specified in the form instructions. Typically, this is the address for the IRS office that handles lien discharges in your state. Make sure to include all required documents and information to avoid delays. For a smooth process, consider using the US Legal Forms platform, where you can find additional resources and support for your application.

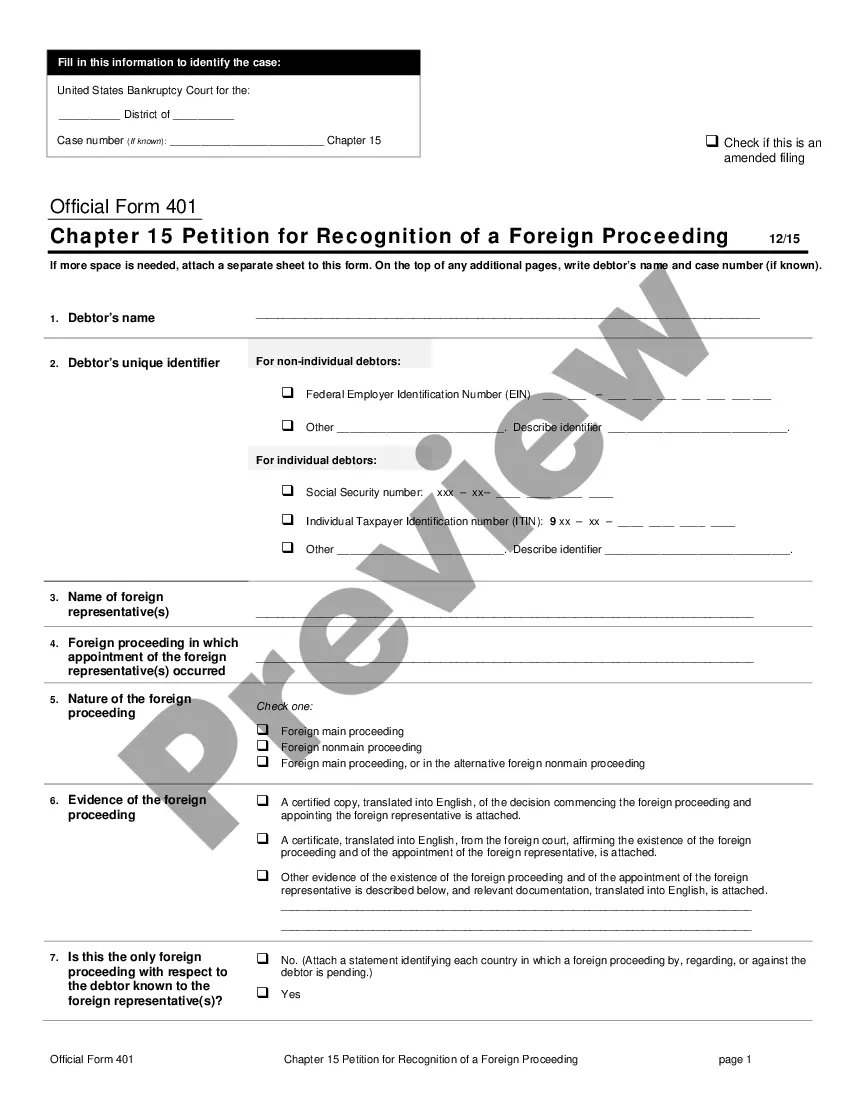

To apply for a certificate of discharge from a federal tax lien, you should complete Form 14135, which is the Application for Certificate of Discharge of Property From Federal Tax Lien. This form allows you to request a discharge of the lien on specific property. After submitting the application, the IRS will assess your request and inform you about the outcome. Utilizing the US Legal platform can simplify your Connecticut Application for Certificate of Discharge of IRS Lien and guide you through the necessary steps.

To request a lien release from the IRS, you need to complete the appropriate forms and submit them to the IRS. You can start this process by filling out Form 12277, which is the Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien. Once you submit your request, the IRS will review your application and notify you of their decision. For a more streamlined experience, consider using the US Legal platform to assist with your Connecticut Application for Certificate of Discharge of IRS Lien.

Yes, Connecticut is a tax lien state, meaning that if property taxes remain unpaid, the state can place a lien against the property. This lien secures the tax debt and can affect property ownership. Understanding the implications of tax liens in Connecticut is important for property owners. The Connecticut Application for Certificate of Discharge of IRS Lien can help you address any liens against your property.

To apply for a federal tax lien discharge, you must complete IRS Form 14135 and submit it to the IRS. This process requires you to provide information about your tax situation and the property involved. Once the IRS reviews your application, they will notify you of their decision. The Connecticut Application for Certificate of Discharge of IRS Lien can help you navigate this procedure smoothly.

Form 4422 is the IRS form used to request the discharge of a federal tax lien when you are selling property. This form helps facilitate the sale by allowing the IRS to release the lien on the property. If you’re considering selling property encumbered by a lien, understanding this form is crucial. The Connecticut Application for Certificate of Discharge of IRS Lien can guide you through the necessary steps.

Yes, you can remove a federal tax lien by either paying the tax debt in full or applying for a certificate of discharge. If you meet certain criteria, the IRS may grant you a discharge, allowing you to clear the lien from your property. Leveraging the Connecticut Application for Certificate of Discharge of IRS Lien can assist you in this process, ensuring you follow the correct steps.

To obtain a federal tax lien payoff, you must request a payoff amount from the IRS. This can be done by calling their customer service or sending a written request. The IRS will provide you with the total amount needed to satisfy the lien. Utilizing the Connecticut Application for Certificate of Discharge of IRS Lien can also help clarify the steps you need to take to resolve your tax issues.

Form 14135 should be filed with the IRS at the address specified in the instructions of the form. Generally, it is sent to the Centralized Lien Unit. Make sure to keep a copy of the completed form for your records. The Connecticut Application for Certificate of Discharge of IRS Lien guides you on where and how to submit the form effectively.