If an owner of an interest in real property has had a judgment obtained against the owner, this form addresses a release of that judgment lien.

Connecticut Release of Judgment Lien

Description

How to fill out Release Of Judgment Lien?

Are you presently in a situation where you need to have papers for both business or personal purposes nearly every day? There are tons of legitimate document themes available on the net, but finding ones you can rely on is not easy. US Legal Forms provides a large number of kind themes, much like the Connecticut Release of Judgment Lien, which can be created to meet federal and state needs.

When you are currently acquainted with US Legal Forms site and also have a free account, basically log in. Next, you can acquire the Connecticut Release of Judgment Lien web template.

If you do not offer an accounts and wish to begin to use US Legal Forms, follow these steps:

- Discover the kind you want and make sure it is for the appropriate city/state.

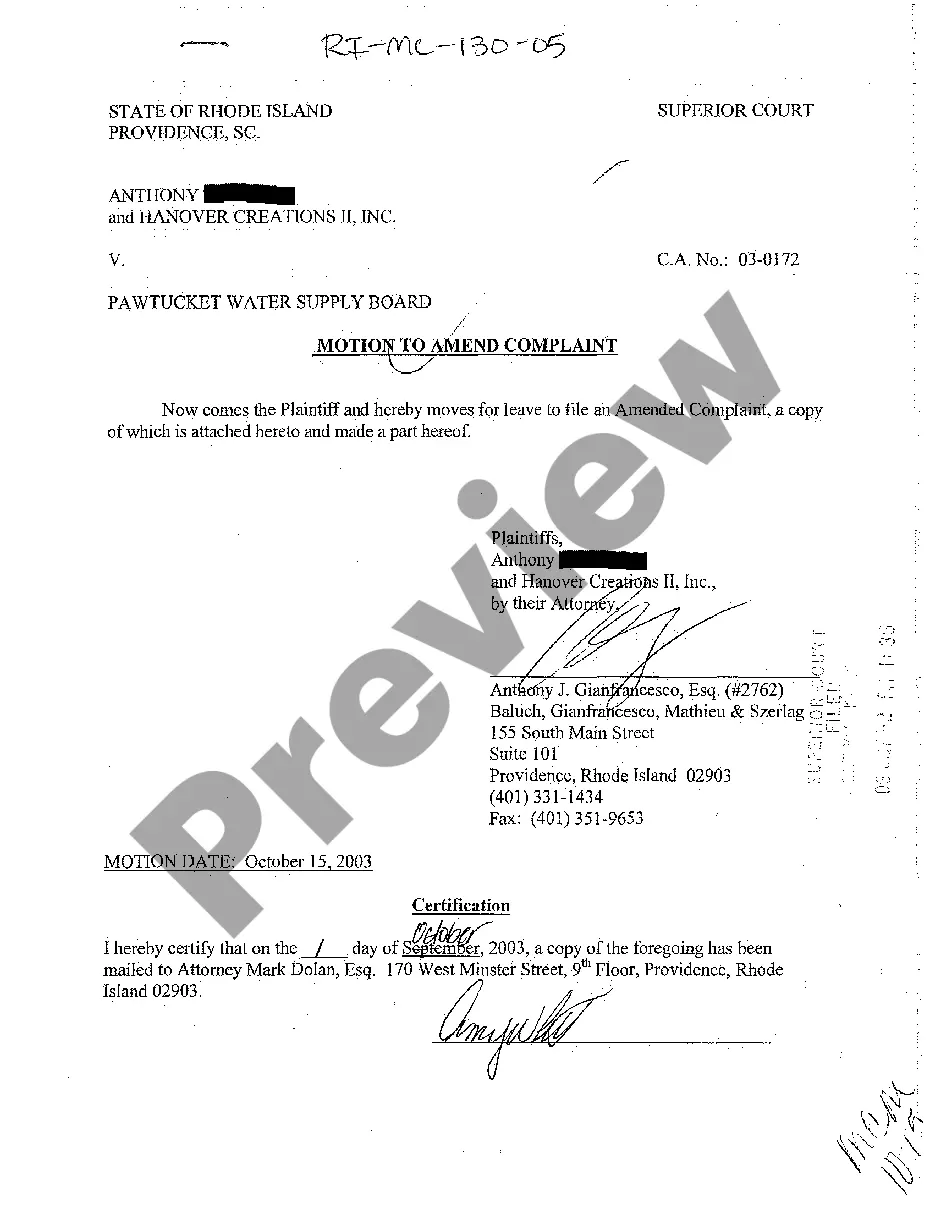

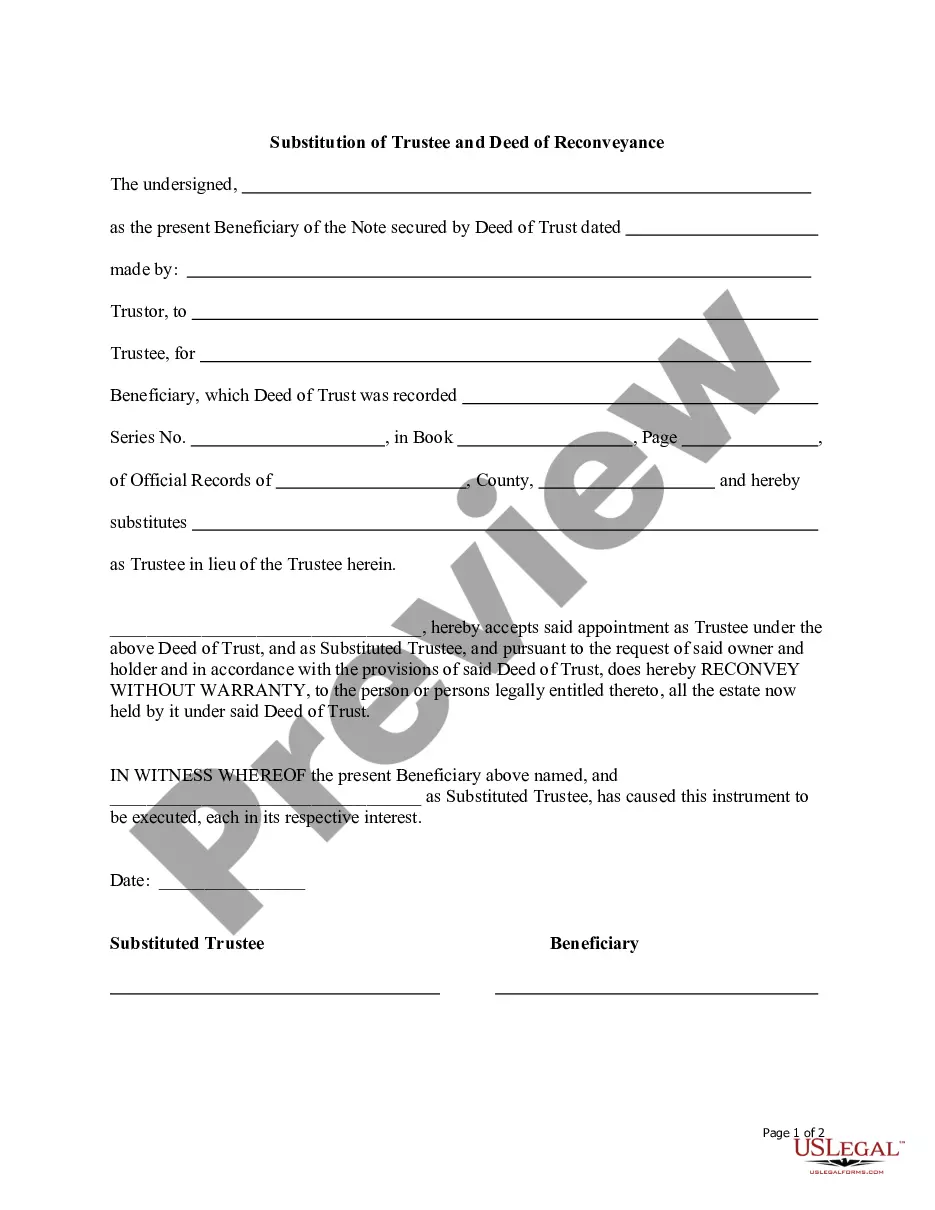

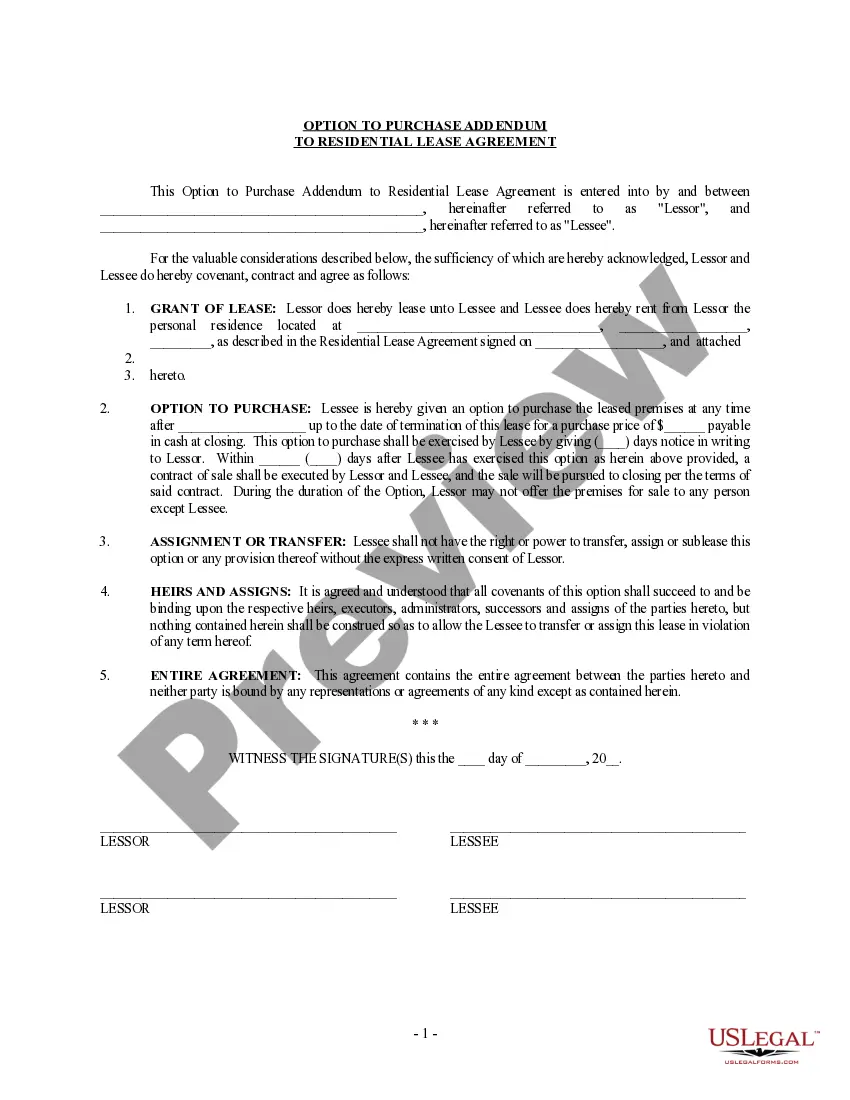

- Use the Review button to review the shape.

- Read the outline to actually have chosen the right kind.

- In the event the kind is not what you are searching for, use the Lookup industry to obtain the kind that meets your requirements and needs.

- When you find the appropriate kind, simply click Purchase now.

- Pick the prices prepare you want, complete the necessary details to produce your account, and buy your order making use of your PayPal or credit card.

- Pick a hassle-free paper file format and acquire your duplicate.

Locate all of the document themes you might have purchased in the My Forms menu. You can get a further duplicate of Connecticut Release of Judgment Lien whenever, if required. Just select the essential kind to acquire or printing the document web template.

Use US Legal Forms, by far the most extensive variety of legitimate forms, to save time as well as avoid mistakes. The support provides appropriately produced legitimate document themes which you can use for an array of purposes. Create a free account on US Legal Forms and commence creating your lifestyle a little easier.

Form popularity

FAQ

A Connecticut taxable estate must file Form CT-4422 UGE with DRS to request the release of a lien. A separate Form CT-4422 UGE must be filed for each property address requiring a release of lien. Form CT-4422 UGE will be considered incomplete if an affirmation box agreeing to payment is not checked.

The renewal of judgment allows the creditor to take legal action to collect the debt, including wage garnishment, bank levy, and even property foreclosure. This can be done by enforcing the judgment through court orders such as garnishment, levying on bank accounts, and foreclosing on property.

If the married couple or joint owners of a property do not have a tenancy by the entireties title, any lien can attach to the person's interest in the property. Whether it's judgment or confessed judgment, the lien will attach to the homeowner's interest, making the lienor a co-owner of the property.

How long does a judgment lien last in Connecticut? A judgment lien in Connecticut will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or five years (liens on personal property).

If you don't pay the judgment, the plaintiff can ask the court for an order called an execution to collect the money from you. Some types of income and assets are protected by law. The plaintiff has 10 years to collect the judgment.

Money judgments entered in Connecticut can be secured by filing a Judgment Lien on Connecticut real estate owned by the judgment debtor. Recording judgment liens on real estate should be among the first steps taken by judgment creditors after obtaining a money judgment.

Money judgments automatically expire (run out) after 10 years. To prevent this from happening, you as the judgment creditor must file a request for renewal of the judgment with the court BEFORE the 10 years run out.