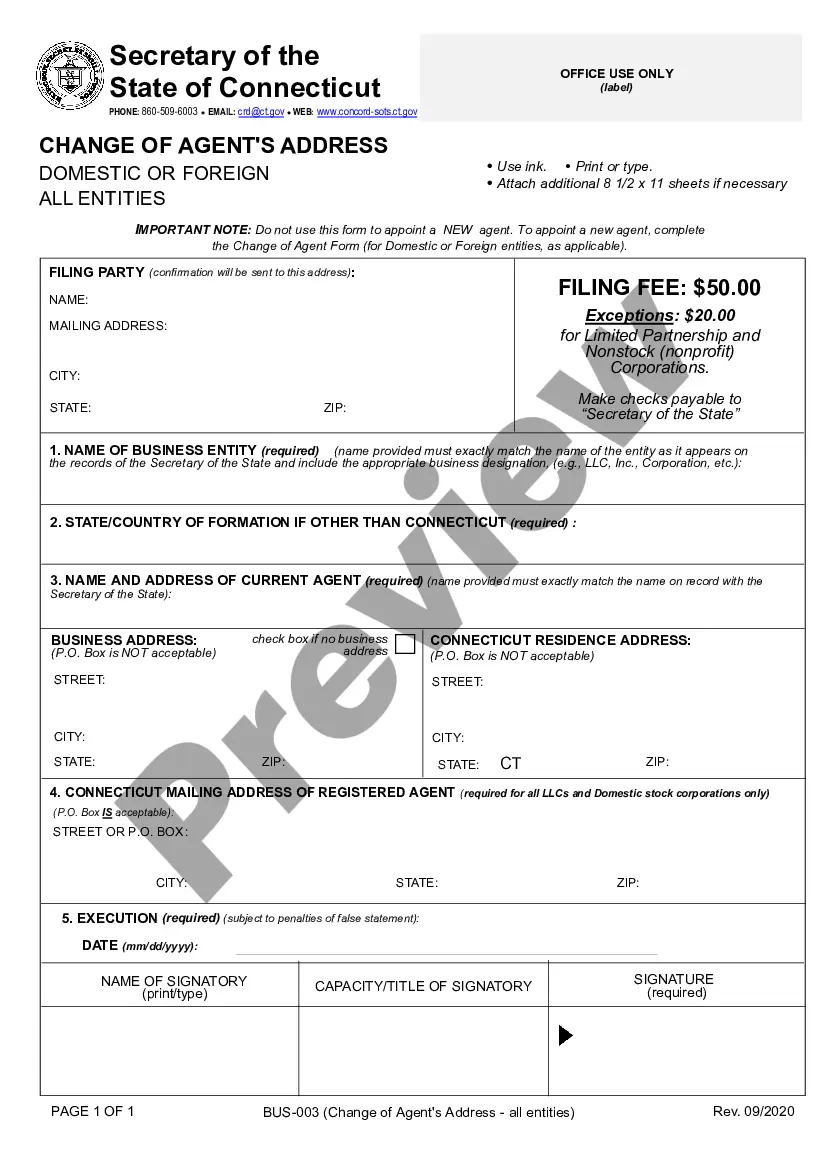

Connecticut Change of Business Address is a process for businesses registered in the state of Connecticut to update their registered business address. This is important for businesses to do in order to ensure that all official correspondence from the state is sent to the correct address. There are three types of Connecticut Change of Business Address: Change of Business Address, Change of Business Name, and Change of Business Address and Name. The Change of Business Address form can be used to update the address on record with the Connecticut Secretary of State. The Change of Business Name form is used to update the name on record with the Connecticut Secretary of State, and the Change of Business Address and Name form is used to update both the address and name on record with the Connecticut Secretary of State.

Connecticut Change of Business Address

Description

How to fill out Connecticut Change Of Business Address?

If you're looking for a method to correctly complete the Connecticut Change of Business Address without enlisting the help of an attorney, then you're in the perfect spot.

US Legal Forms has established itself as the most comprehensive and dependable repository of formal templates for every individual and corporate circumstance.

Another significant benefit of US Legal Forms is that you will never misplace the documents you obtained - you can access any of your downloaded templates in the My documents tab of your profile whenever you need them.

- Ensure the document you view on the page aligns with your legal needs and state regulations by reviewing its description or exploring the Preview mode.

- Enter the document title in the Search tab at the top of the page and select your state from the dropdown to find an alternative template in the event of any discrepancies.

- Repeat the content verification and click Buy now when you are confident the paperwork meets all the requirements.

- Log in to your account and hit Download. Sign up for the service and choose a subscription plan if you do not have one yet.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The document will be ready for download immediately afterwards.

- Decide in which format you wish to save your Connecticut Change of Business Address and download it by clicking the corresponding button.

- Upload your template to an online editor for quick completion and signature or print it to create your physical copy manually.

Form popularity

FAQ

Generally, you do not need a new EIN if you change your business address. The IRS allows you to keep the same EIN; however, you must update your address with them. This update is part of the broader process of a Connecticut Change of Business Address, so make sure all your records reflect your new location. Our platform can help you file the necessary updates easily.

The best address for your LLC should be a location where you can receive essential business documents reliably. This often means using a physical brick-and-mortar office or a registered agent service. Choosing the right address is part of ensuring a successful Connecticut Change of Business Address. Our platform can assist you in selecting an appropriate address that meets legal requirements and fits your operational needs.

Changing your business address is generally not hard but does require attention to detail. You need to ensure that you inform all relevant parties, including state agencies and customers. Understanding the steps involved in a Connecticut Change of Business Address is vital to avoid any complications. Our service provides easy access to the resources you need to make this transition as smooth as possible.

To change your address for Connecticut taxes, you must fill out the appropriate form provided by the Connecticut Department of Revenue Services. Make sure to indicate your current address and the new address clearly. This update is part of the Connecticut Change of Business Address, so keeping your tax information current is crucial. Our platform offers tools to help you navigate this form easily.

Getting a different address for your business involves selecting a new location that fits your needs, whether it be a physical or virtual space. After securing the new address, ensure to inform the Connecticut Secretary of State and update your business registration. This is part of the Connecticut Change of Business Address process, and our service can help streamline this transition effectively.

To get a different address for your business, you can either rent a new office space or use a virtual office service. Once you secure the new address, you’ll need to update your records with the state and local agencies. Keep in mind that a Connecticut Change of Business Address is essential to maintain your business compliance. Using our platform simplifies this process by providing necessary forms and guidance.

Online: Go to . Access your account by entering your User Id and Password. Select Address and General Maintenance under Online Services to submit your address change.

File a Connecticut LLC Certificate of Amendment. When changing the legal name of your Connecticut LLC, you need to file a Certificate of Amendment with the Connecticut Secretary of the State, Commercial Recording Division and pay a $120 filing fee. Learn more about filing a Connecticut Certificate of Amendment.

The CT DMV is open by appointment only. Here are some tips for scheduling your appointment: Check our site often.

Use Form CT-8822 to notify the Connecticut Department of Revenue Services (DRS) that you changed your home or business mailing address, or the physical location of your business.