Connecticut Foreclosure Return of Sale — With Proceeds is a document that is part of the foreclosure process in the state of Connecticut. It is used by the foreclosing party, typically the bank or lender, to document how the proceeds from the sale of the foreclosed property were utilized. The document is typically filed with the town clerk's office of the municipality where the property is located. There are two types of Connecticut Foreclosure Return of Sale — With Proceeds: 1) with a deficiency judgment and 2) without a deficiency judgment. In a return of sale with a deficiency judgment, the foreclosing party can obtain a court order for the debtor to pay the difference between the amount of the debt and the proceeds of the sale. In a return of sale without a deficiency judgment, the proceeds of the sale are distributed to the foreclosing party, and no further action is taken.

Connecticut Foreclosure Return of Sale - With Proceeds

Description

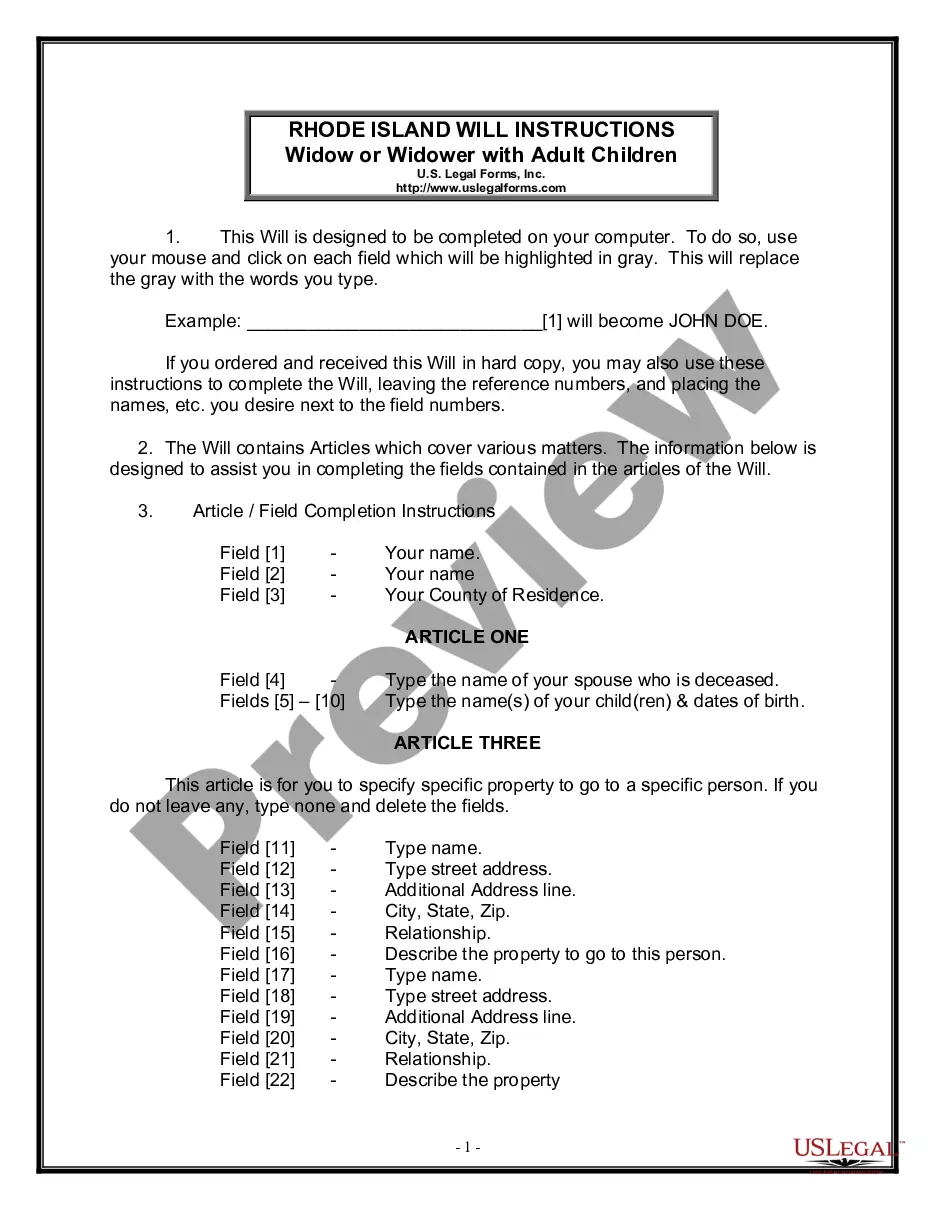

How to fill out Connecticut Foreclosure Return Of Sale - With Proceeds?

If you’re searching for a method to suitably prepare the Connecticut Foreclosure Return of Sale - With Proceeds without enlisting a legal professional, then you’ve arrived at the ideal location.

US Legal Forms has established itself as the most comprehensive and esteemed repository of official templates for every personal and business circumstance. Every document you access on our online service is crafted in alignment with national and state regulations, ensuring that your paperwork is organized.

Another fantastic aspect of US Legal Forms is that you will never misplace the documents you’ve acquired - you can access any of your downloaded forms in the My documents section of your profile whenever you require them.

- Verify that the document displayed on the webpage aligns with your legal circumstances and state regulations by reviewing its textual description or browsing through the Preview mode.

- Input the document title in the Search tab at the top of the page and select your state from the dropdown list to find an alternative template in case of any discrepancies.

- Repeat the content validation process and hit Buy now when you are confident that the paperwork adheres to all requirements.

- Log in to your account and select Download. Create an account with the service and choose a subscription plan if you haven’t done so already.

- Utilize your credit card or the PayPal option to obtain your US Legal Forms subscription. The document will be ready for download immediately after.

- Choose the format you wish to save your Connecticut Foreclosure Return of Sale - With Proceeds and download it by clicking the corresponding button.

- Upload your template to an online editor to complete and sign it swiftly, or print it out to prepare your physical copy manually.

Form popularity

FAQ

Buying a foreclosure can present risks, such as hidden damage or unexpected repairs that may not be immediately visible. Additionally, properties might come without disclosures, leaving you responsible for existing liens or maintenance issues. Being aware of the Connecticut Foreclosure Return of Sale - With Proceeds can help you mitigate potential pitfalls and assist you in claiming any surplus funds if they arise.

The foreclosure process in Connecticut can take several months to over a year, depending on various factors such as court schedules and the borrower's response. After the lender files the foreclosure, the borrower has time to contest it, which can extend the timeline. Also, understanding the Connecticut Foreclosure Return of Sale - With Proceeds can help you navigate potential delays and understand what to expect regarding any funds following a sale.

In a foreclosure sale, the property is typically auctioned to the highest bidder. As a buyer, you need to research the property's condition and understand any liens or claims against it. After winning the bid, you may need to provide immediate payment or secure financing quickly. Knowing about the Connecticut Foreclosure Return of Sale - With Proceeds will also give you insight into how surplus funds may be distributed.

After a foreclosure in Connecticut, the timeline to vacate the property varies. Typically, you have 30 days to move out after the court issues a judgment. However, it's vital to understand any specific directives in your case. The Connecticut Foreclosure Return of Sale - With Proceeds offers insight into what to expect during this process and can assist you in organizing your next steps.

The 120-day rule for foreclosure in Connecticut requires lenders to wait a minimum of 120 days after a payment is missed before initiating the foreclosure process. This rule aims to give borrowers a chance to communicate and possibly rectify their financial issues. If you find yourself in this situation, it’s crucial to act quickly and consider options such as the Connecticut Foreclosure Return of Sale - With Proceeds to mitigate further impacts.

In Connecticut, you can start experiencing serious consequences after only one missed mortgage payment. Most lenders will start contacting you after a single missed payment and may begin the formal foreclosure process once you are three or more months behind. It is essential to remain engaged with your lender and to understand resources like the Connecticut Foreclosure Return of Sale - With Proceeds as a backup plan.

Foreclosure timelines in Connecticut can vary, but generally, it takes about six months to over a year to complete the process. Factors like the court's schedule and whether the case is contested can impact this duration. By understanding this timeline, homeowners can take appropriate steps to address their situation, including looking into the Connecticut Foreclosure Return of Sale - With Proceeds for potential solutions.

Generally, in Connecticut, lenders often initiate the foreclosure process after a homeowner has missed three consecutive mortgage payments. However, keep in mind that each lender may have different policies. The earlier you communicate with your lender, the better chance you have of exploring alternatives before facing foreclosure, such as utilizing the Connecticut Foreclosure Return of Sale - With Proceeds.

In Connecticut, you could face foreclosure after missing just one house payment. It's crucial to understand that lenders often start the foreclosure process when you are significantly behind on payments. Staying informed about your financial obligations can help you avoid falling into this situation. If you find yourself struggling, consider exploring options like the Connecticut Foreclosure Return of Sale - With Proceeds for assistance.

Once a foreclosure sale is finalized in Connecticut, it is generally difficult to back out. However, homeowners may have options during the redemption period to reclaim their property before the transaction is complete. Understanding the intricacies of the Connecticut Foreclosure Return of Sale - With Proceeds will help you be more informed about what financial recourse may be available during this time.