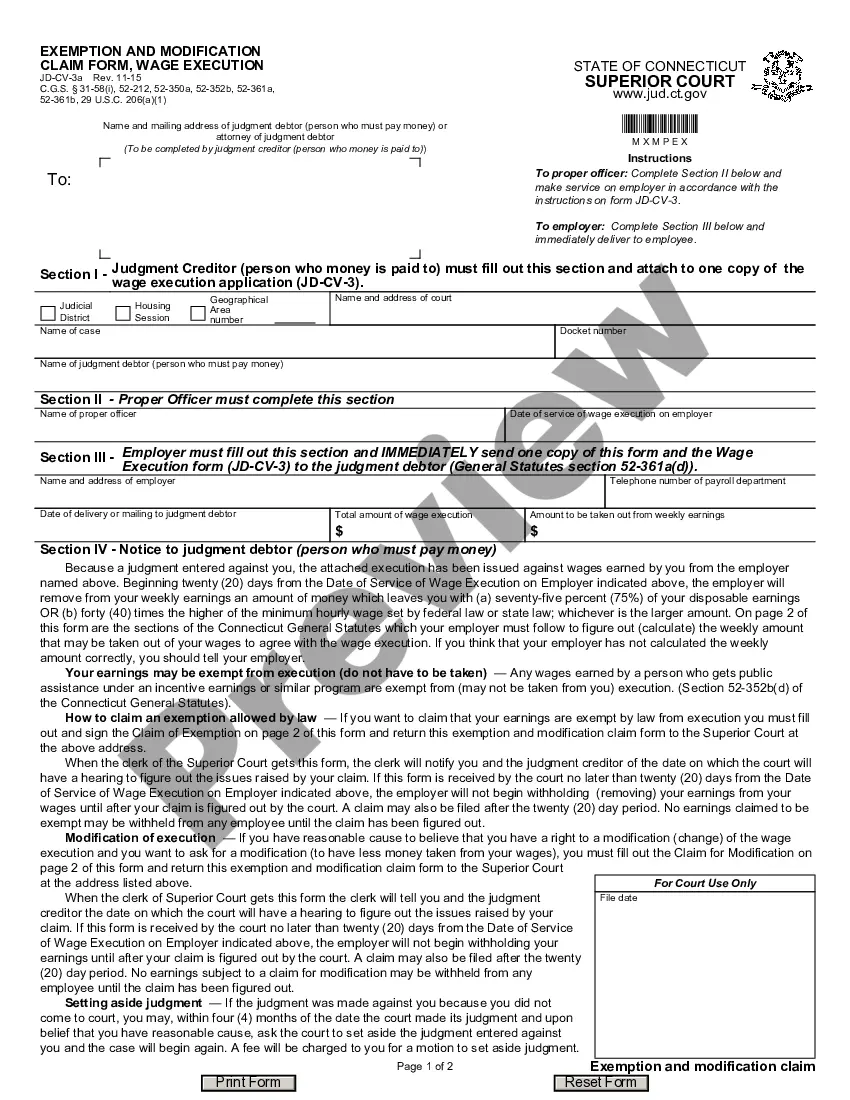

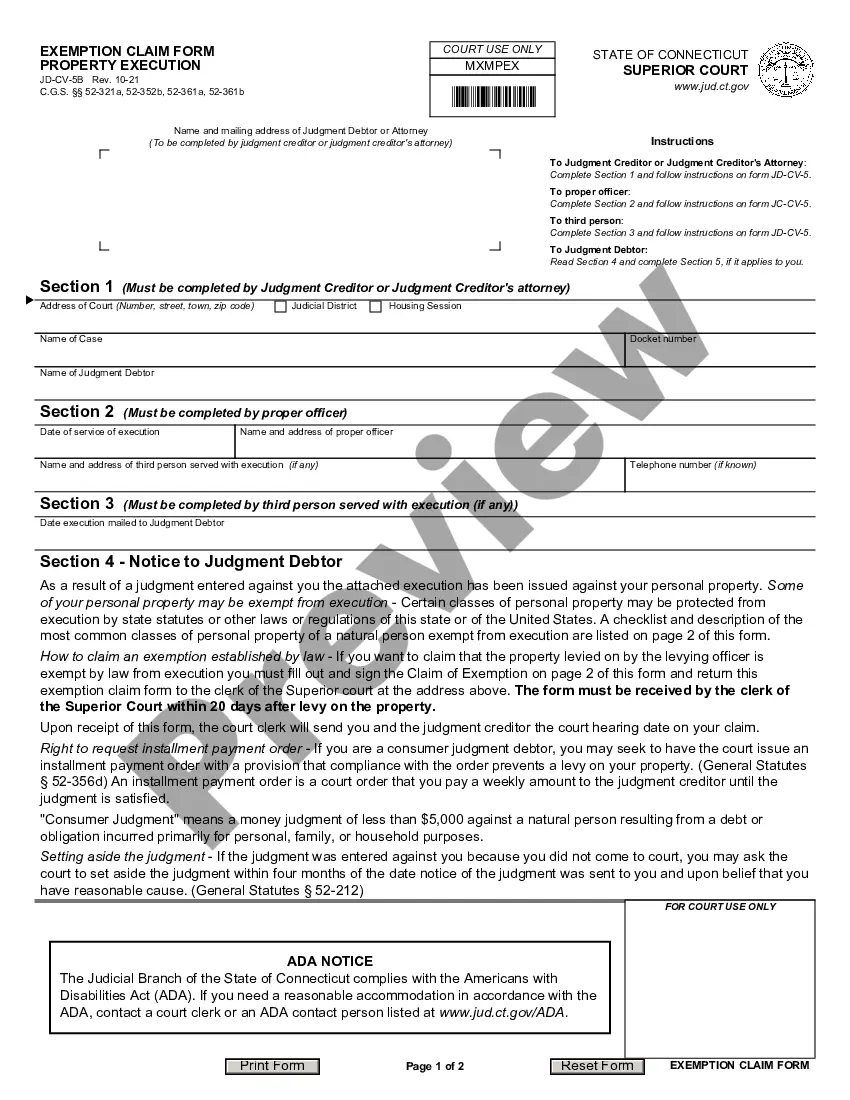

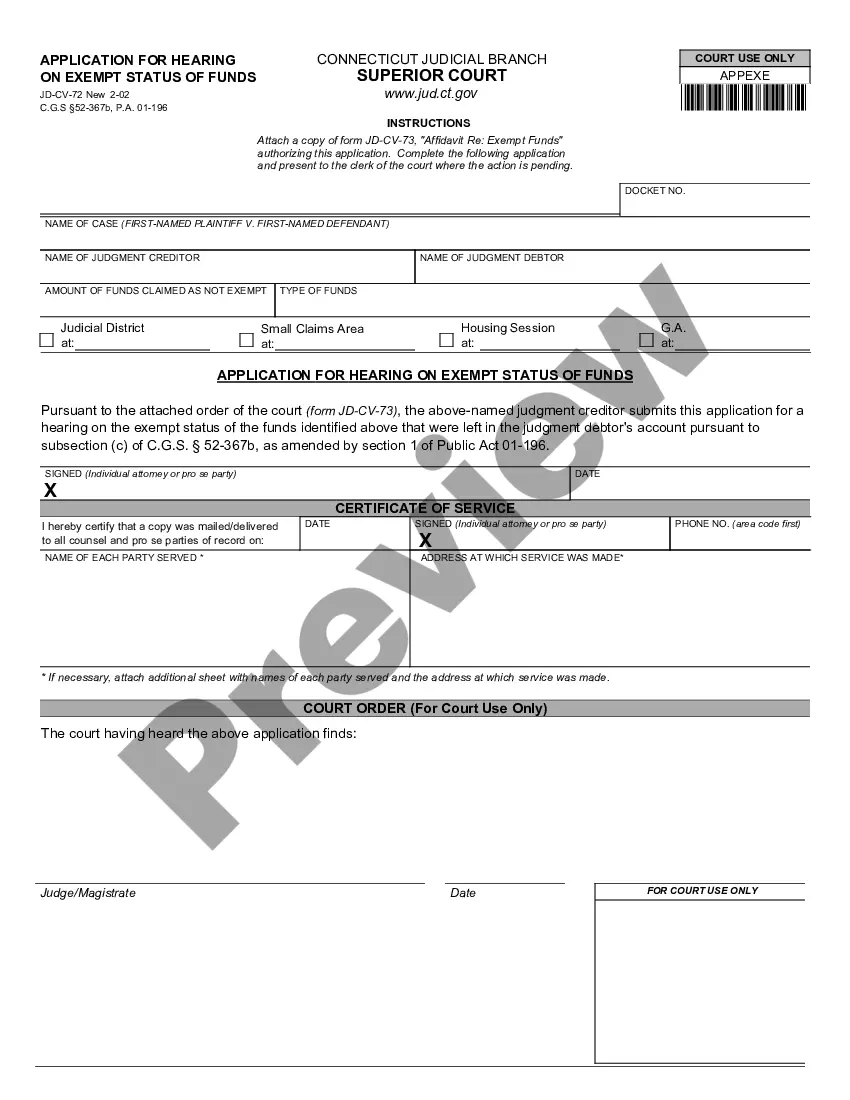

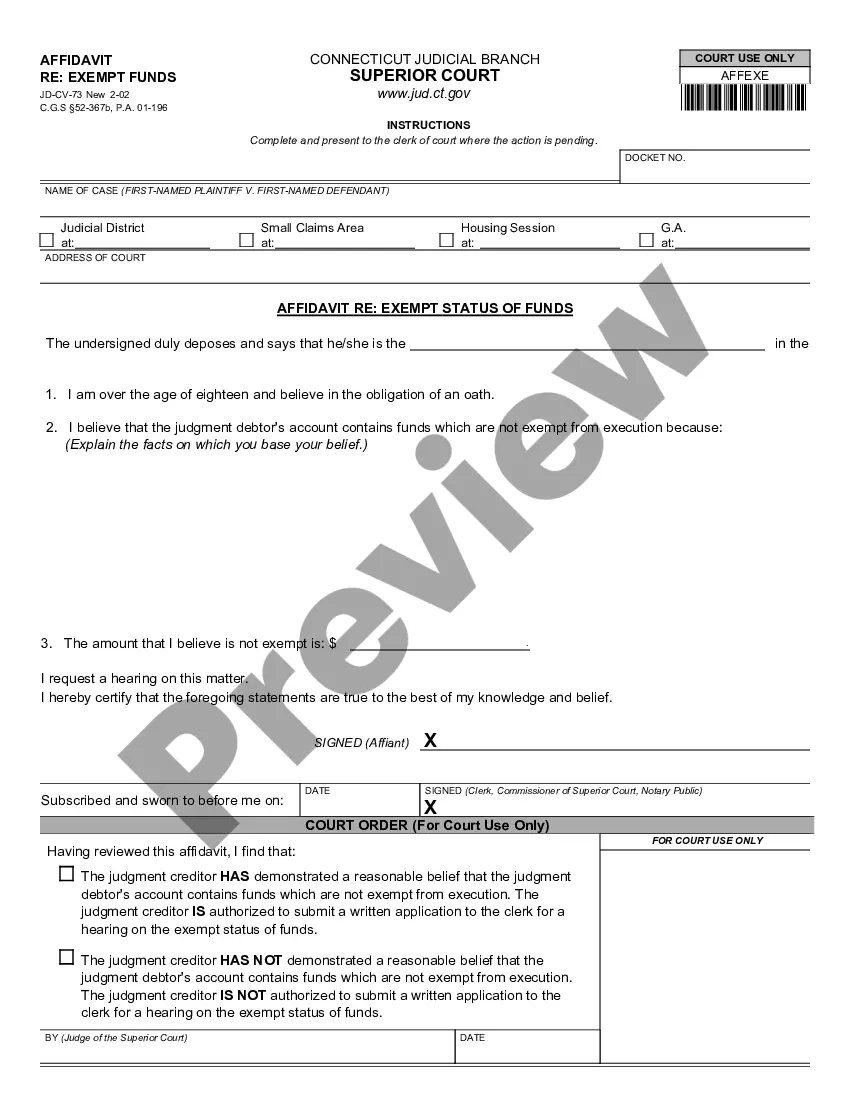

This form is used to request an exemption from financial institution execution. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Exemption Claim Form Financial Institution Execution

Description

How to fill out Connecticut Exemption Claim Form Financial Institution Execution?

The larger quantity of documents you need to prepare - the more anxious you become.

You can find thousands of Connecticut Exemption Claim Form Bank Execution templates online; however, you can't be sure which ones to trust.

Eliminate the inconvenience and simplify finding samples with US Legal Forms.

Click Buy Now to initiate the registration process and select a pricing plan that suits your needs. Fill in the required information to create your account and pay for the order using your PayPal or credit card. Choose a convenient document format and obtain your sample. Access all templates you download in the My documents section. Simply navigate there to produce a new copy of your Connecticut Exemption Claim Form Bank Execution. Even with professionally drafted documents, it remains important to consider consulting a local attorney to review the completed sample to ensure your paperwork is accurately filled out. Achieve more for less with US Legal Forms!

- Obtain expertly crafted forms that comply with state regulations.

- If you already possess a US Legal Forms subscription, Log In to your account, and you will find the Download option on the Connecticut Exemption Claim Form Bank Execution’s page.

- If you are a new user, complete the registration process by following these instructions.

- Verify that the Connecticut Exemption Claim Form Bank Execution is applicable in your state.

- Reconfirm your selection by reviewing the description or utilizing the Preview feature if available for the chosen document.

Form popularity

FAQ

When the phrase 'your financial institution' is used, it refers to the bank or other financial entities where you hold an account. For the Connecticut Exemption Claim Form Financial Institution Execution, understanding your financial institution's policies and processes is vital. These entities play a crucial role in facilitating transactions, managing claims, and supporting your financial needs.

Yes, an FFI, or Foreign Financial Institution, is indeed a type of financial institution that operates outside of the United States. It can provide various financial services, similar to domestic banks. In relation to the Connecticut Exemption Claim Form Financial Institution Execution, recognizing the difference between domestic and foreign institutions can be crucial for handling international financial matters.

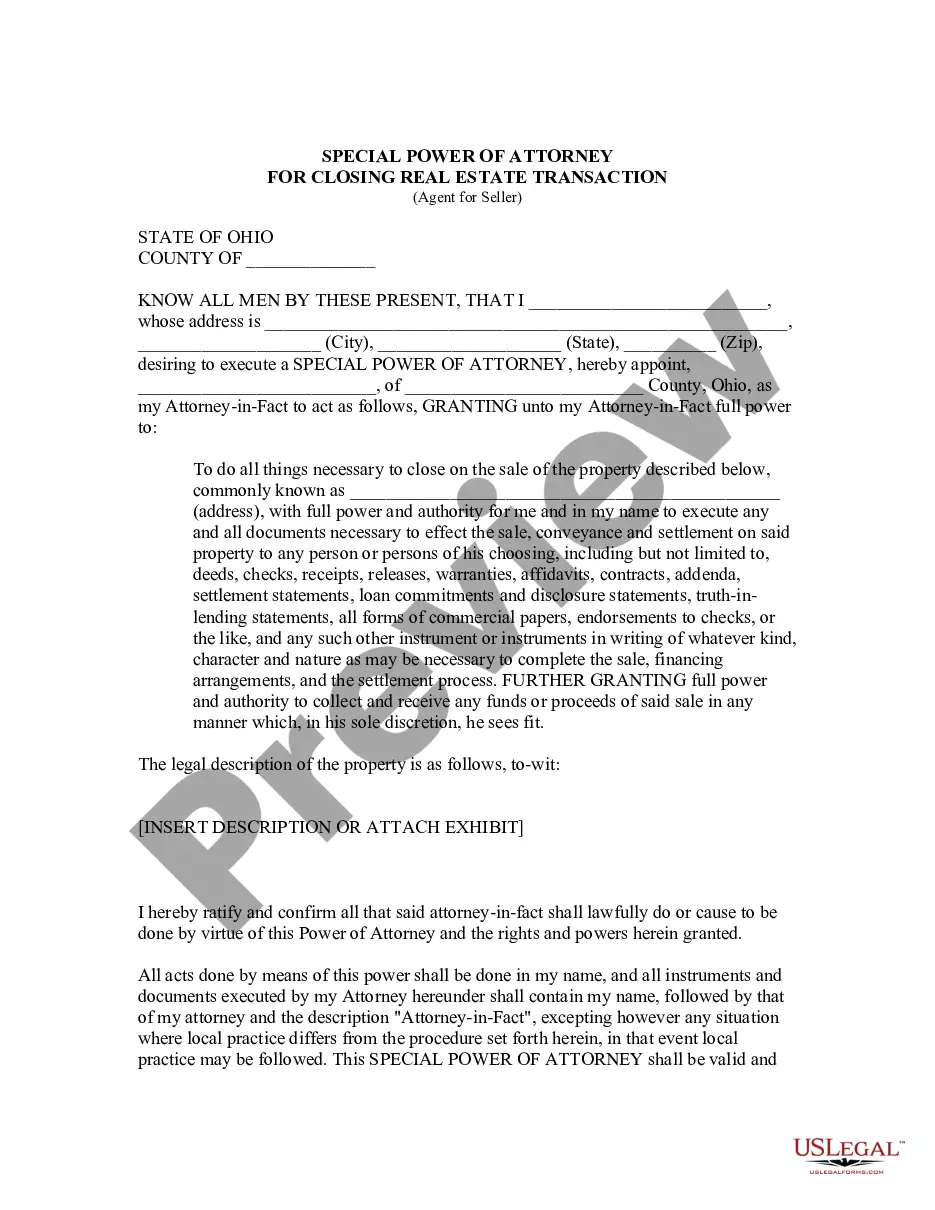

Bank execution refers to the legal process in which a financial institution carries out a court order or judgment against a debtor's assets. In the context of the Connecticut Exemption Claim Form Financial Institution Execution, it may involve the bank assessing the debtor's accounts to fulfill claims. Understanding this process can help you navigate financial obligations and ensure you take appropriate steps in managing your finances.

When a document is executed by a bank, it indicates that the bank has officially processed and approved the associated transaction or claim. In the case of the Connecticut Exemption Claim Form Financial Institution Execution, this means the form has been completed and acknowledged by the financial institution. It serves as confirmation that the bank has reviewed the claim and its details, which can help expedite any necessary further actions.

Form Cert 119 is the official exemption certificate used in Connecticut to designate items that are exempt from sales tax. This form is crucial for entities making tax-exempt purchases in the state, as it ensures compliance and protects financial interests. When dealing with the Connecticut Exemption Claim Form Financial Institution Execution, utilizing Form Cert 119 can aid in clarifying your tax exemptions and protecting your assets from legal claims.

Exemption from execution means certain assets or income are protected from being seized by creditors to satisfy debts. This is important because it ensures individuals maintain access to essential resources. Understanding this protection is crucial when completing the Connecticut Exemption Claim Form Financial Institution Execution, as it allows you to safeguard your vital financial lifelines.

An execution on a property refers to the legal process where a court authorizes the seizure and sale of a property to satisfy a judgement. This occurs after a creditor has obtained a court ruling in their favor. Protecting your assets is vital when navigating financial disputes, and using the Connecticut Exemption Claim Form Financial Institution Execution can help you identify what assets remain secure against such actions.

An exemption certificate is a legal document that specifies what items or transactions are exempt from certain taxes or legal claims. These certificates play a critical role in various financial contexts, including executions and sales tax. When addressing the Connecticut Exemption Claim Form Financial Institution Execution, understanding your exemption certificate can help you uphold your rights and protect your financial assets.

Being exempt from execution means certain assets, funds, or properties cannot be seized to satisfy a debt. This exemption provides significant legal protection during financial hardship or debt recovery. Familiarizing yourself with this concept is essential when completing the Connecticut Exemption Claim Form Financial Institution Execution to ensure you can claim the exemptions that apply to your situation.

A tax exemption certificate serves to legally verify that a buyer is exempt from sales tax for specific purchases. This is especially important for businesses that want to avoid paying tax on items they intend to resell. When dealing with financial institutions and the Connecticut Exemption Claim Form Financial Institution Execution, having this certificate can simplify transactions and ensure compliance with state laws.