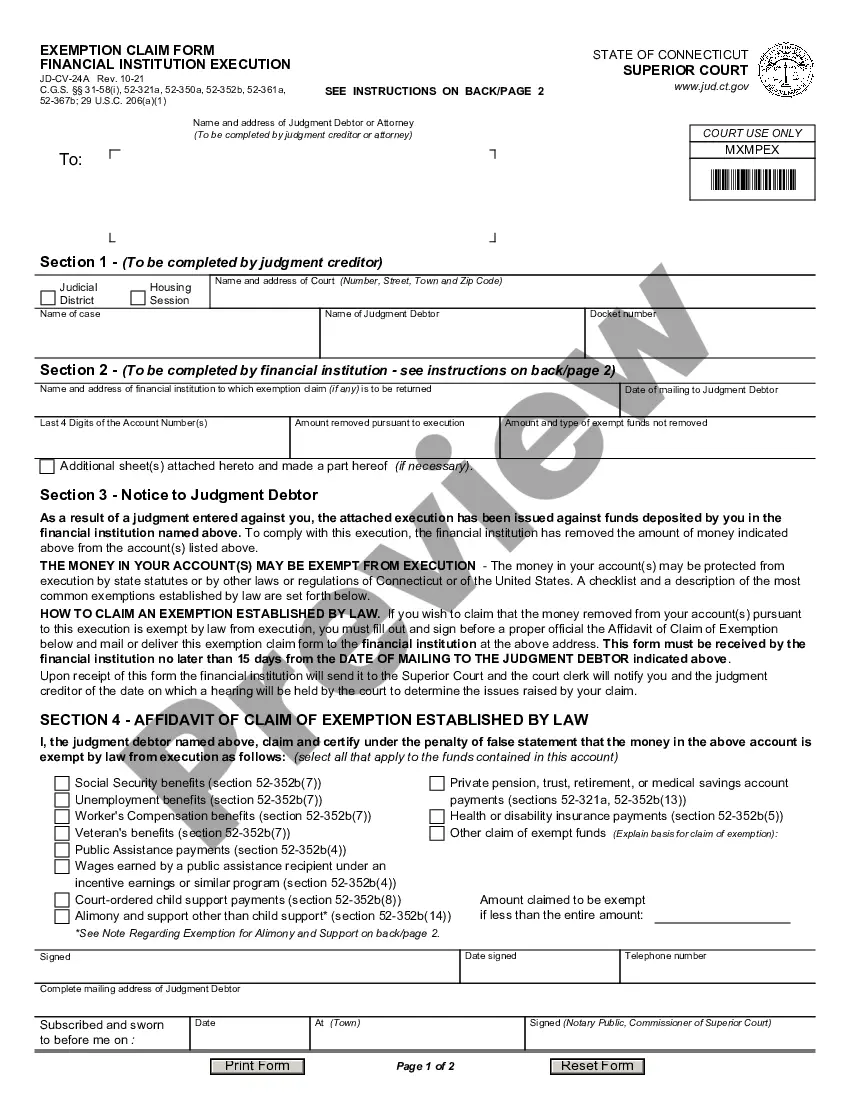

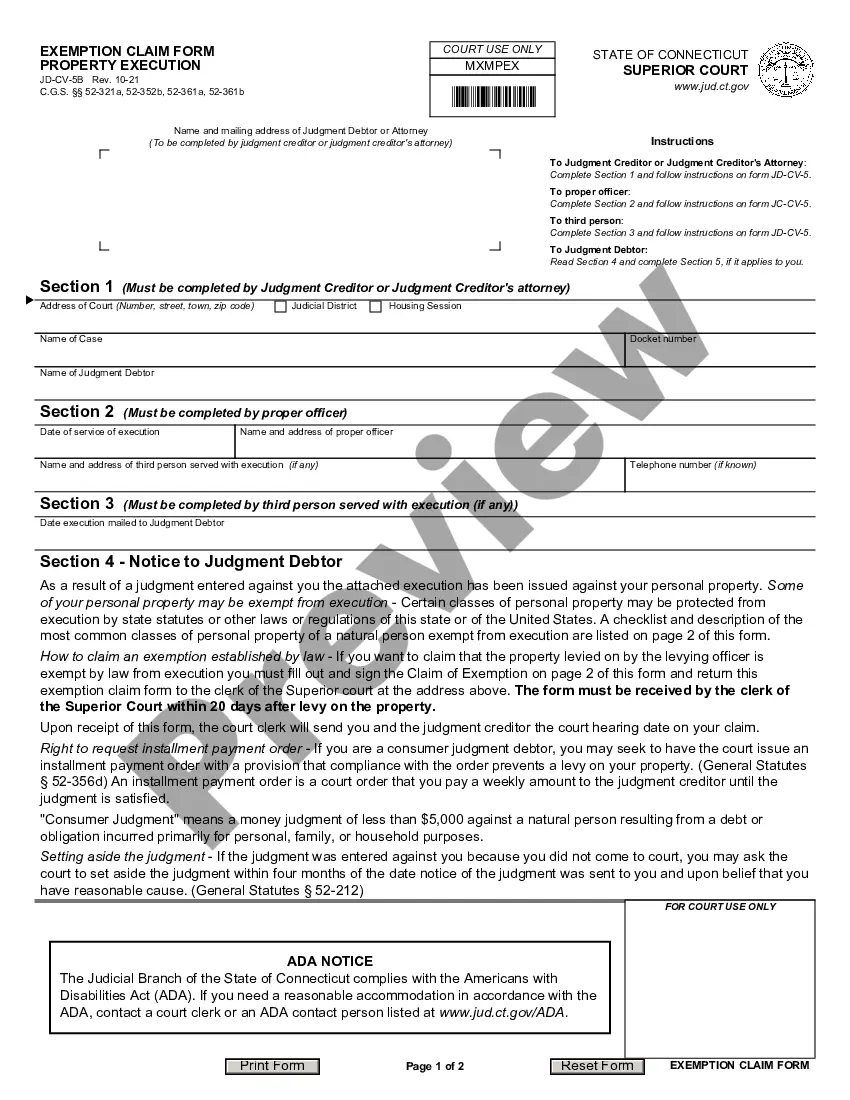

This form is used for modification or exemption from the order for execution of wages provided to the employer of the judgment debtor. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Exemption and Modification Claim Form, Wage Execution

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Exemption And Modification Claim Form, Wage Execution?

The greater the documentation you need to complete - the more stressful it becomes for you.

You can discover thousands of Connecticut Exemption and Modification Claim Form Wage Execution samples online, yet, you are unsure which ones to trust.

Eliminate the inconvenience and simplify the process of obtaining samples with US Legal Forms. Acquire professionally crafted forms that are designed to comply with state regulations.

Access each sample you acquire in the My documents menu. Simply navigate there to produce a new copy of your Connecticut Exemption and Modification Claim Form Wage Execution. Even when using carefully crafted templates, it remains prudent to consider consulting a local attorney to review the completed form to ensure that your documentation is filled out correctly. Achieve more while spending less with US Legal Forms!

- Ensure that the Connecticut Exemption and Modification Claim Form Wage Execution is recognized in your residing state.

- Verify your selection by reviewing the description or utilizing the Preview feature if available for the chosen document.

- Press Buy Now to initiate the registration process and choose a rates plan that suits your requirements.

- Input the necessary information to establish your profile and process your payment using PayPal or a credit card.

- Choose a suitable document format and download your sample.

Form popularity

FAQ

Garnishment laws in Connecticut dictate how creditors can collect debts through wage execution. In this process, creditors may take a portion of your wages directly from your employer after obtaining a judgment. However, you can protect your income by filing the Connecticut Exemption and Modification Claim Form, which helps you assert your rights and claim necessary exemptions. It's important to be informed about these laws, as they help maintain your financial stability while addressing any outstanding debts.

Exemption from execution refers to specific protections that safeguard certain assets from being seized to satisfy a debt. In Connecticut, if a creditor obtains a wage execution against you, completing the Connecticut Exemption and Modification Claim Form is essential. This form allows you to claim exemptions for income and property, ensuring that you retain essential resources for living. Understanding this process can provide you with significant relief during financial challenges.

Writing a letter to stop wage garnishment requires clear and concise communication. Start by addressing the creditor and include your account information for easy identification. In the letter, invoke the Connecticut Exemption and Modification Claim Form, Wage Execution, detailing how it applies to your situation. Clarity is key, so describe your circumstances effectively, and consider using uslegalforms for templates that can assist in crafting a professional and effective letter.

Filling out a challenge to a garnishment form involves several steps. First, clearly state your reasons for disputing the garnishment, such as incorrect creditor claims or improper notice. Ensure you include relevant details about your financial situation and reference the Connecticut Exemption and Modification Claim Form, Wage Execution for possible exemptions. For accurate guidance, consulting templates available on uslegalforms can simplify the process and enhance your chances of success.

Garnishment amount is determined based on several factors, including the nature of the debt and your disposable income. In Connecticut, creditors must adhere to legal limits when calculating how much they can garnish from your wages. Typically, the calculation considers standard exemptions under the Connecticut Exemption and Modification Claim Form, Wage Execution. Knowing how garnishment is determined can help you take informed steps to protect your income.

In Connecticut, wage garnishment laws stipulate how much of your paycheck can be withheld to repay debts. Generally, your creditor must obtain a court judgment before garnishment can occur. After a judgment, they can file a wage execution order, which allows for specific deductions. Understanding these laws is crucial, as they determine your rights and the procedures involved.

To stop wage garnishment in Connecticut, you first need to understand your options. One effective way is to file a Connecticut Exemption and Modification Claim Form, Wage Execution, which allows you to claim certain exemptions that may protect your income. Additionally, you can negotiate with your creditor or seek legal advice to explore other potential solutions. Proactively addressing the garnishment will enable you to regain financial control.

Rights of exemption typically include the ability to protect a portion of your income, specific assets, and certain benefits from being seized for debt repayment. In Connecticut, these rights are governed by both state and federal laws, providing various protections depending on individual circumstances. Utilizing the Connecticut Exemption and Modification Claim Form can help individuals better understand and assert their rights regarding exemption from wage execution.

The right to claim exemptions allows individuals to assert their financial protections against creditors, ensuring that basic needs are met. This legal right helps prevent overwhelming financial burden by allowing exemption of certain income or assets from wage execution. Completing the Connecticut Exemption and Modification Claim Form is a vital step in exercising this right and securing financial relief.

Someone might want to claim exempt status to protect vital income from being garnished, enabling them to cover essential living expenses like housing and food. By claiming exemptions, individuals can maintain financial stability despite debts. The Connecticut Exemption and Modification Claim Form provides a clear pathway for individuals seeking to secure their rights and manage their financial obligations more effectively.