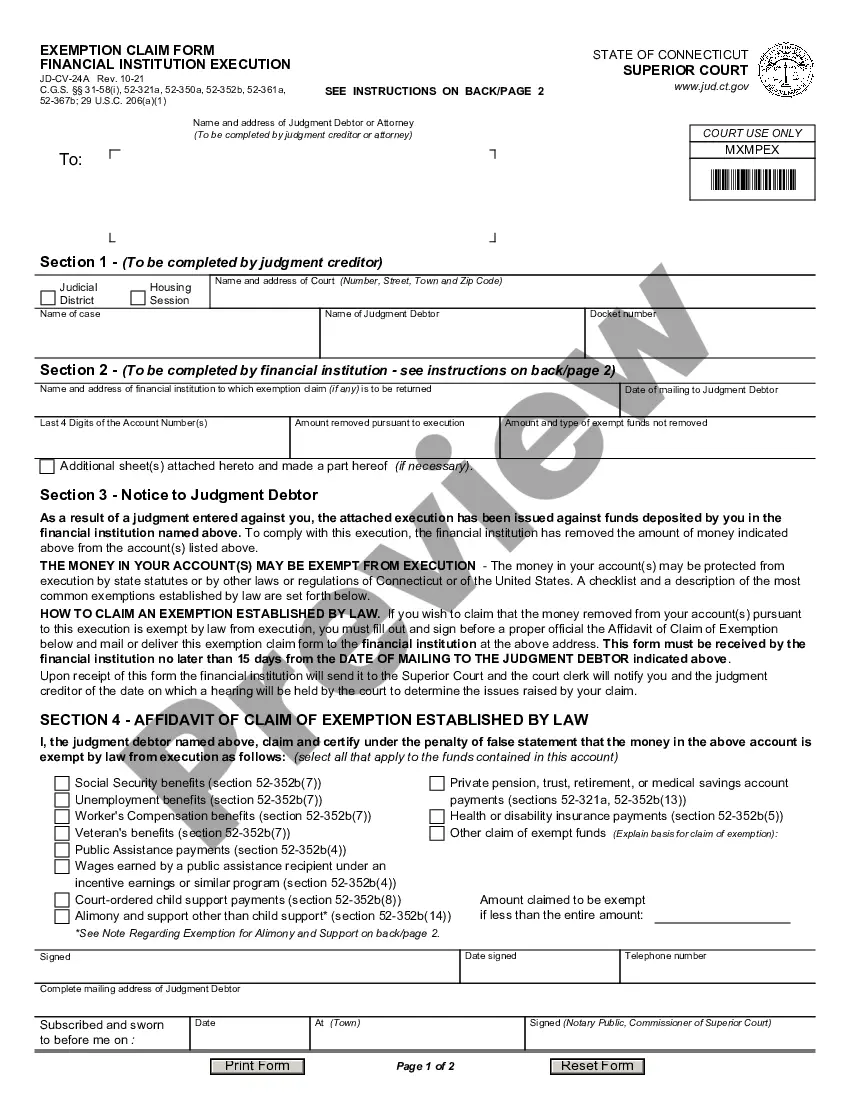

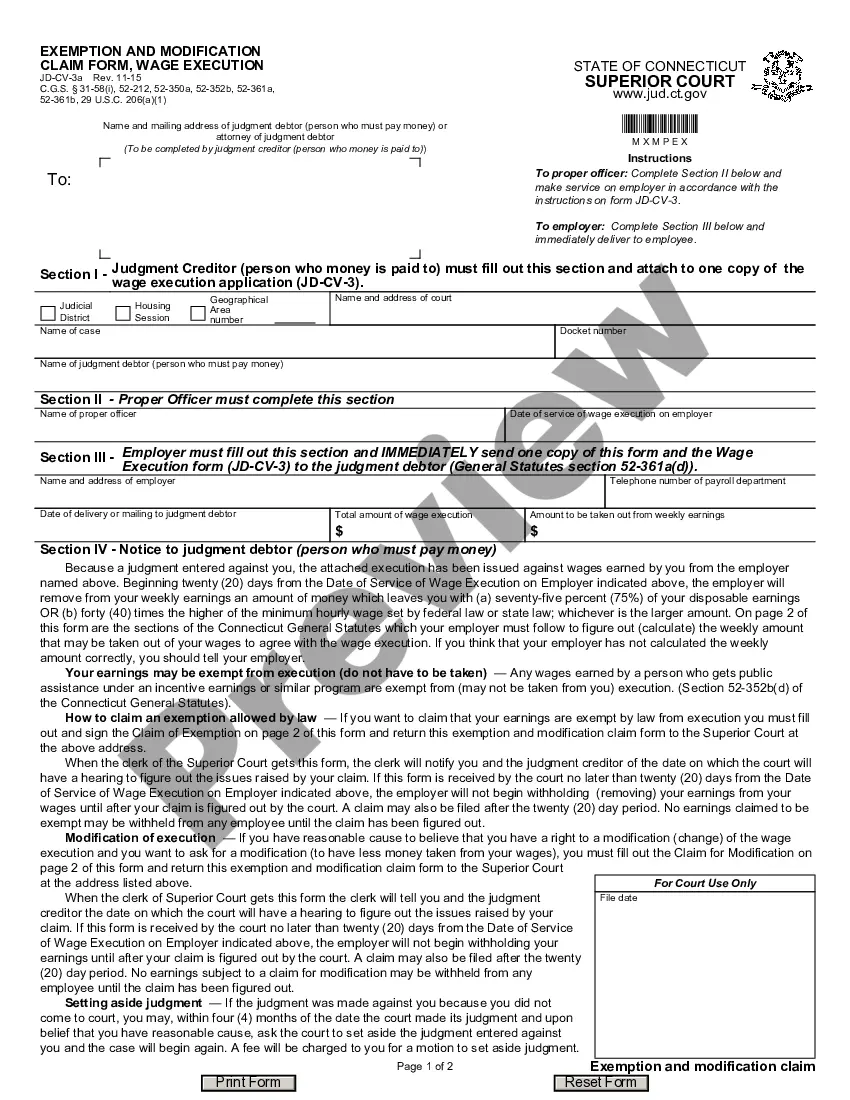

This form is used to request exemption from the order for execution of property of the judgment debtor. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Exemption Claim Form Property Execution

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Exemption Claim Form Property Execution?

The greater the number of documents you need to produce, the more pressure you experience.

You can find a vast array of Connecticut Exemption Claim Form Property Execution templates online, but determining which sources to rely on can be challenging.

Relieve the burden and simplify obtaining samples with US Legal Forms. Access expertly prepared documents designed to comply with state regulations.

Fill in the required information to create your account and complete your order using PayPal or a credit card. Choose a convenient file format and obtain your template. You can locate every document you acquire in the My documents section. Simply navigate there to complete a new version of the Connecticut Exemption Claim Form Property Execution. Even with professionally crafted documents, it’s essential to consider consulting a local attorney to verify that your form is accurately completed. Achieve more for less with US Legal Forms!

- If you are a current US Legal Forms member, Log In to your account, and you’ll discover the Download feature on the page for the Connecticut Exemption Claim Form Property Execution.

- If you haven’t previously utilized our service, follow the steps below to register.

- Ensure the Connecticut Exemption Claim Form Property Execution is applicable in your residing state.

- Confirm your choice by reviewing the description or using the Preview feature, if available for the chosen document.

- Click Buy Now to initiate the registration process and select a pricing option that aligns with your needs.

Form popularity

FAQ

The phrase 'exemption is the exception' signifies that while most assets may be subject to seizure under a judgment, certain items are legally protected. Understanding this distinction is crucial, especially when facing possible execution of your assets. The Connecticut Exemption Claim Form Property Execution offers a structured process to claim these exceptions, allowing you to safeguard essential items from creditors.

A writ of execution typically allows creditors to seize a debtor's assets, but certain items are exempt from being taken. Common exempt items may include a primary residence, essential household goods, and tools for work. By filing the Connecticut Exemption Claim Form Property Execution, you can clearly identify which assets you are claiming as exempt, fostering peace of mind during financial difficulties.

Exemption from execution refers to the legal protection of certain assets from being sold or taken under a judgment. This legal provision is designed to safeguard basic necessities for individuals facing financial challenges. Utilizing the Connecticut Exemption Claim Form Property Execution allows you to formally claim these protections and maintain ownership of your exempt assets.

An execution on a property occurs when a court authorizes the seizure of a property to satisfy a debt or judgment. This legal process can significantly affect your financial situation and ownership of property. The Connecticut Exemption Claim Form Property Execution helps protect some of your assets from being seized during this process, ensuring you retain essential belongings.

To be exempt from execution means that certain assets or properties cannot be taken to satisfy a legal judgment. For individuals facing financial hardship, understanding this exemption can provide relief. The Connecticut Exemption Claim Form Property Execution allows residents to claim these exemptions and protect their necessary personal belongings.

Failing to attend court for a judgment can lead to a default judgment against you, meaning the court may rule in favor of the creditor without hearing your side. This default judgment can result in wage garnishment, bank levies, or property liens. It's crucial to respond appropriately to any legal notices to protect yourself. To address these issues effectively, utilize the Connecticut Exemption Claim Form Property Execution, which can help you understand your rights and options.

In Connecticut, a judgment lien typically lasts for five years from the date it is recorded. However, it can be renewed for another five years if properly filed before the original term expires. This means that creditors can enforce their rights to property execution through this lien for a significant period. To navigate the complexities of this process, consider using the Connecticut Exemption Claim Form Property Execution to ensure you understand your protections and obligations.