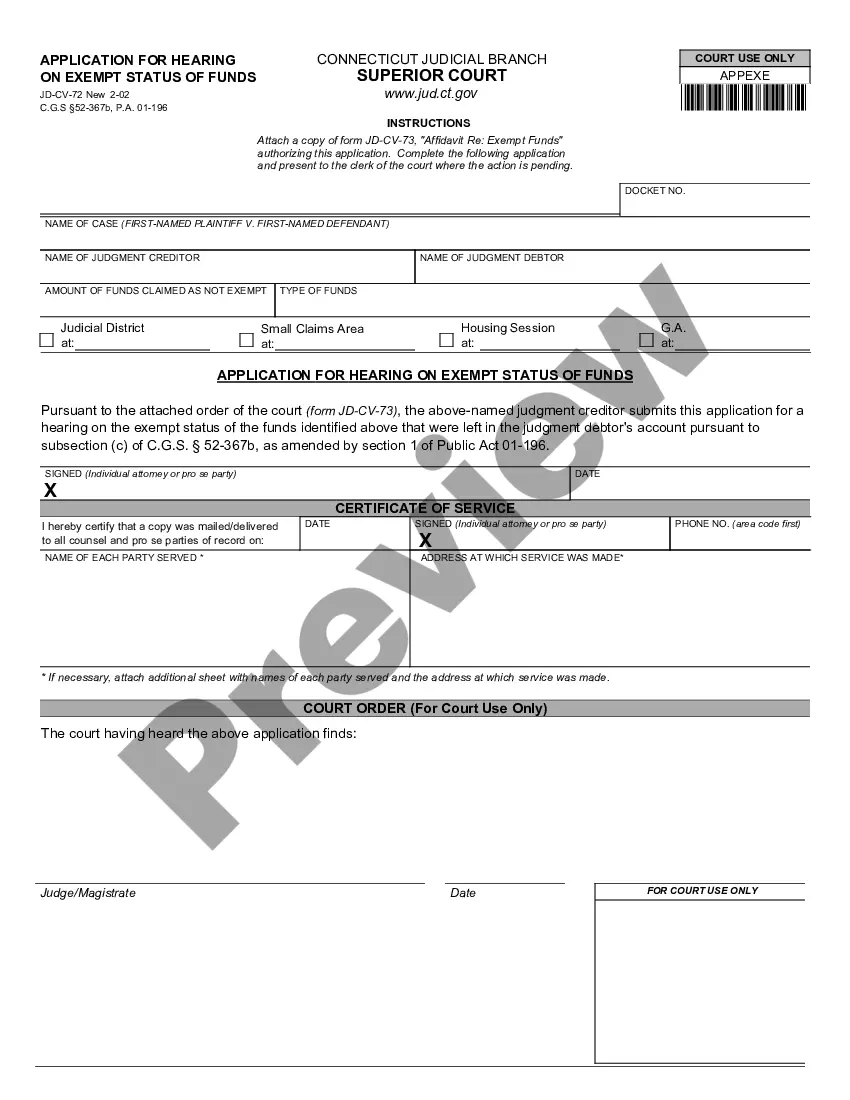

This form is an affidavit regarding exempt status of funds. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Affidavit Regarding Exempt Status of Funds

Description

How to fill out Connecticut Affidavit Regarding Exempt Status Of Funds?

The larger the quantity of documents you are required to generate - the more uneasy you become.

You can find a vast array of Connecticut Affidavit Regarding Exempt Status of Funds templates on the internet, but determining which ones to rely on can be a challenge.

Simplify the process of locating samples by using US Legal Forms.

Select Buy Now to initiate the registration process and choose a payment plan that suits your requirements. Fill in the necessary information to create your account and complete the payment using PayPal or a credit card. Pick a preferred document type and obtain your copy. Access all templates you acquire in the My documents section. Navigate there to prepare a new version of the Connecticut Affidavit Regarding Exempt Status of Funds. Even with professionally crafted templates, it remains important to consult with your local attorney to review the completed form to ensure your document is accurate. Achieve more for less with US Legal Forms!

- Obtain documents that are professionally prepared to meet state requirements.

- If you already have a US Legal Forms subscription, Log In to your account, and you will see the Download button on the Connecticut Affidavit Regarding Exempt Status of Funds page.

- If you are a new user of our site, follow these steps to complete the registration process.

- Verify that the Connecticut Affidavit Regarding Exempt Status of Funds is applicable in your state.

- Double-check your choice by reviewing the description or using the Preview option if available for the selected document.

Form popularity

FAQ

Yes, public and certain private educational institutions are generally considered tax-exempt in Connecticut. This status allows them to be exempt from various taxes, including sales tax and property tax, under specific conditions. Utilizing forms like the Connecticut Affidavit Regarding Exempt Status of Funds helps confirm this exemption status as required by state laws.

Connecticut has specific categories of exemptions from sales tax, including certain food items, prescription medications, and items sold to tax-exempt organizations. Understanding these exemptions is crucial for businesses and organizations to comply with state regulations. If you're seeking exemptions, consider using the Connecticut Affidavit Regarding Exempt Status of Funds to clarify your status.

Obtaining tax-exempt status in Connecticut involves fulfilling specific eligibility requirements and submitting the necessary forms. You'll typically need to file the Connecticut Affidavit Regarding Exempt Status of Funds along with supporting documentation that validates your claim. Ensure you stay informed about state rules to expedite the process.

To change your tax status to exempt, you must first identify your eligibility and then complete the required forms. In Connecticut, the Connecticut Affidavit Regarding Exempt Status of Funds serves as a key document in this process. Make sure to gather supporting documents and submit them as required by state regulations to successfully update your status.

Being exempt from state income tax often requires filing specific forms demonstrating eligibility, such as the Connecticut Affidavit Regarding Exempt Status of Funds. This process typically involves meeting certain income criteria or being part of specific groups like non-profits. Ensure you follow the necessary steps to maintain compliance and update your status as needed.

Tax-exempt status is determined by various factors, including the purpose of your funds or organization, income level, and adherence to state regulations. Organizations like charities must typically meet strict guidelines set by the IRS and state authorities. Utilizing the Connecticut Affidavit Regarding Exempt Status of Funds can support your claim to qualify for this status.

To qualify for tax exemption, you need to demonstrate specific criteria that relate to your financial situation or the nature of your organization. Generally, exemptions apply to non-profit organizations, certain income types, or individuals meeting income thresholds. Completing a Connecticut Affidavit Regarding Exempt Status of Funds is crucial to officially express your intention to claim this status.

In Connecticut, most affidavits need to be notarized to ensure they hold legal weight. This includes the Connecticut Affidavit Regarding Exempt Status of Funds, which typically requires notarization to be recognized. Notarization confirms the signature and the content of the affidavit, providing an added layer of authenticity. Always verify specific requirements before filing any documents.

Yes, you can file an affidavit without a lawyer, especially for straightforward cases. However, using a Connecticut Affidavit Regarding Exempt Status of Funds might require some familiarity with the legal filing process. While it's possible to do it alone, having professional assistance can ensure you complete everything correctly. Many users find platforms like uslegalforms to be a great help in preparing their documents.

Filling out a financial affidavit involves providing detailed information about your income, expenses, assets, and liabilities. You can streamline this process by using a template designed for a Connecticut Affidavit Regarding Exempt Status of Funds. Make sure to gather all necessary documentation beforehand and fill out the form accurately. If you encounter challenges, consulting a legal expert may be helpful.