Connecticut Open End Mortgage Deed And Security Agreement is a type of mortgage deed that grants a lender a security interest in a mortgagor's real property in order to secure the repayment of a loan. This type of deed is commonly used in Connecticut and involves the mortgagor granting a lien on the property, with the lender taking a security interest in the property. The property is held as security for the loan and, in the event of default, the lender can foreclose on the property. There are two types of Connecticut Open End Mortgage Deed And Security Agreement: Single Family Mortgage Deed and Multi-Family Mortgage Deed. The Single Family Mortgage Deed is used when the mortgagor has one single family home as collateral and the Multi-Family Mortgage Deed is used when the mortgagor has multiple units in one building or multiple buildings as collateral.

Connecticut Open End Mortgage Deed And Security Agreement

Description

Key Concepts & Definitions

Open End Mortgage Deed and Security Agreement: This type of mortgage allows the borrower to secure additional loan amounts under the same mortgage lien even after the initial loan has been disbursed, without needing to execute a new mortgage. It includes provisions that detail the rights and obligations concerning real property used as security.

Loan Documents: Refers to the collection of legal papers including the mortgage deed, security agreement, promissory note, and others required when taking out a loan.

Mortgage Security: Encompasses the legal frameworks and agreements that guarantee a lenders interest in the borrower's property until the mortgage is fully repaid.

Step-by-Step Guide on Handling Open End Mortgage Deeds

- Understanding the Agreement: Review the mortgage deed thoroughly to comprehend the terms, especially the ability to draw additional funds.

- Consulting Legal Counsel: Seek legal advice to understand the implications of an open end clause within your state and its impact on future property encumbrances.

- Acknowledge the Fixture Filing: Ensure any personal property used as collateral is marked with a fixture filing to prevent disputes in property claims.

- Regular Monitoring: Regularly review your mortgage conditions to manage borrowing effectively under the open-end terms.

Risk Analysis of Open End Mortgage Deed and Security Agreements

- Over-leveraging Risk: Borrowers might incur additional debt beyond their financial capability due to the ease of securing more funds.

- Property Risk: In case of default, the risk of losing the real property increases as more funds are borrowed against it.

- Interest Rate Fluctuation: The additional funds are usually subject to current market rates, which may be higher than the original loan's rates.

Best Practices in Managing an Open End Mortgage

- Limit Borrowing: Only withdraw additional funds when absolutely necessary and within financial limits.

- Regularly Review Terms: Stay aware of any changes in mortgage rates and terms.

- Comprehensive Insurance Policy: Ensure coverage is sufficient to meet the loan balance at any given time, adjusting as more funds are drawn.

Common Mistakes & How to Avoid Them

- Failing to Plan for Future Costs: Anticipate future needs and financial health to avoid overextending yourself.

- Neglecting Legal Advice: Always consult with a real estate attorney when changes are made to your mortgage deed.

- Ignoring Additional Costs: Understand the fees and additional costs involved in accessing more funds through an open end mortgage.

FAQ

Q: Can I use an open end mortgage for any property?

A: While typically used for real property, terms can vary by state and lender requirements.

Q: Are there limits to how much more I can borrow?

A: Yes, lenders usually set a maximum credit limit, which is detailed in the agreement.

Q: Does automatic upload apply to mortgage documents?

A: Some lenders allow automated uploading of documents for faster processing, but it depends on their system capabilities.

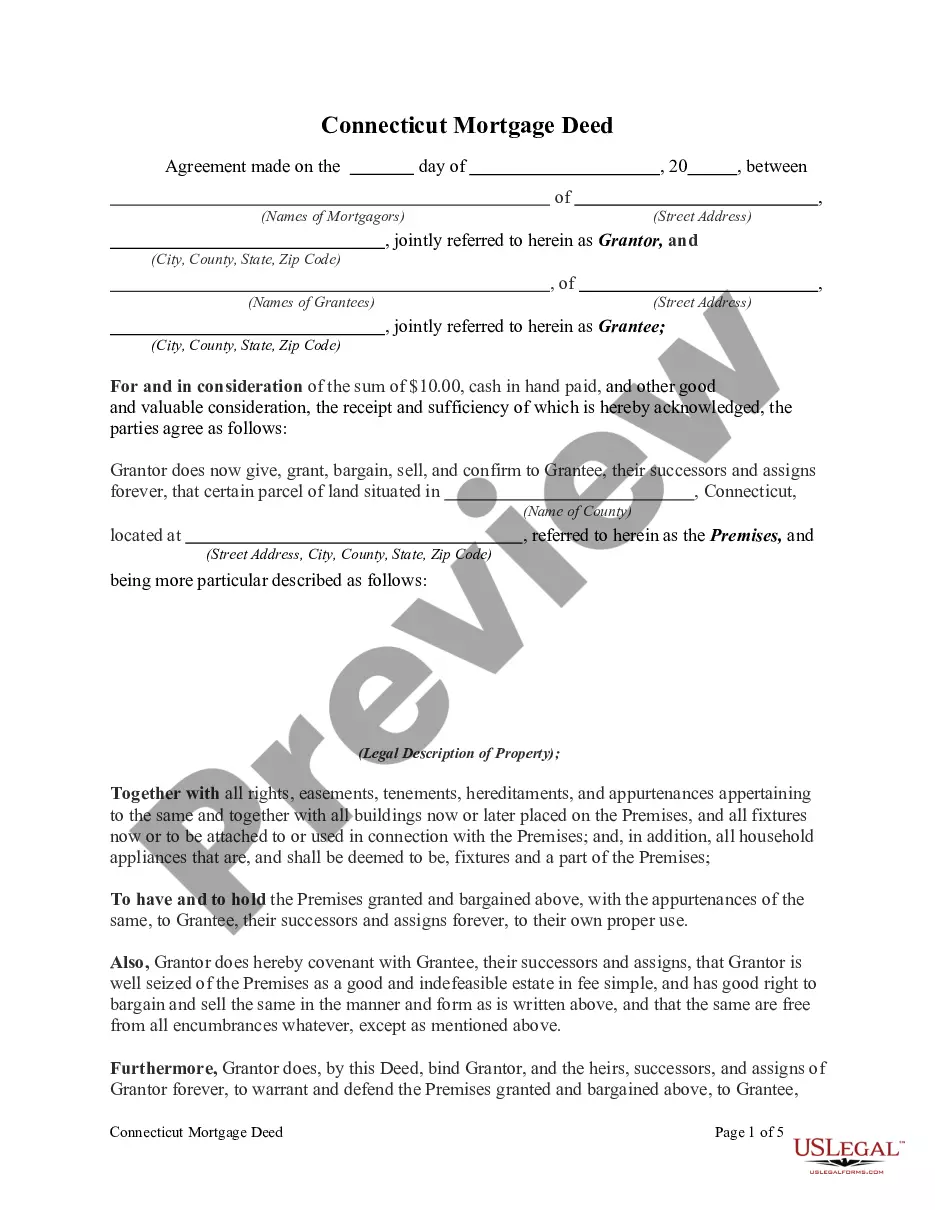

How to fill out Connecticut Open End Mortgage Deed And Security Agreement?

Handling legal documentation necessitates focus, accuracy, and utilizing correctly-prepared forms. US Legal Forms has been assisting individuals nationwide in achieving this for 25 years, so when you select your Connecticut Open End Mortgage Deed And Security Agreement template from our platform, you can be assured it complies with federal and state regulations.

Interacting with our service is straightforward and quick. To access the necessary document, all you will need is an account with an active subscription. Here’s a concise guide for you to acquire your Connecticut Open End Mortgage Deed And Security Agreement in just a few minutes.

All documents are designed for multiple uses, like the Connecticut Open End Mortgage Deed And Security Agreement presented on this page. If you require them in the future, you can complete them without further payment—just access the My documents tab in your profile and finalize your document whenever necessary. Try US Legal Forms and accomplish your business and personal documentation swiftly and in complete legal compliance!

- Make sure to carefully examine the form content and its alignment with general and legal standards by previewing it or reviewing its description.

- Search for an alternative official template if the previously accessed one doesn’t fit your circumstances or state laws (the tab for that is located in the upper page corner).

- Log in to your account and download the Connecticut Open End Mortgage Deed And Security Agreement in the format you require. If it’s your first visit to our site, click Buy now to continue.

- Create an account, choose your subscription plan, and pay using your credit card or PayPal account.

- Choose the format in which you wish to receive your document and click Download. Print the form or upload it to a professional PDF editor to prepare it electronically.

Form popularity

FAQ

A security agreement establishes a legal claim for a lender on a borrower's assets in the event of default. In the context of a Connecticut Open End Mortgage Deed And Security Agreement, it allows the lender to secure their investment by holding the right to certain property. This agreement clearly outlines how the collateral can be used and the obligations of the borrower, ensuring both parties understand their rights.

You can obtain a mortgage agreement through financial institutions, legal professionals, or online platforms. U.S. Legal Forms offers various templates and resources for creating a Connecticut Open End Mortgage Deed And Security Agreement, providing a simple solution to your paperwork needs. Ensuring you have the right agreement can streamline your mortgage process.

Getting an open-end mortgage can be a wise choice if you anticipate needing additional funds in the future. This type of mortgage offers flexibility and can be an effective financial tool to manage changing needs. However, it is essential to review the terms of a Connecticut Open End Mortgage Deed And Security Agreement carefully to ensure it aligns with your financial goals.

In a deed of trust, the security is held by a trustee on behalf of the lender. This arrangement ensures that the lender's interest in the property is protected, while allowing the borrower to retain control over their home. If you're considering a Connecticut Open End Mortgage Deed And Security Agreement, it's beneficial to understand how these relationships function.

In most cases, the lender holds the security deed when a borrower enters into a Connecticut Open End Mortgage Deed And Security Agreement. This deed protects the lender's interest in the property, ensuring they can reclaim the asset if the borrower defaults. It's important for borrowers to understand this relationship, as it affects their financial responsibilities.

Open-end loans, such as the Connecticut Open End Mortgage Deed And Security Agreement, can be advantageous in certain situations. They provide flexibility and accessibility, allowing you to borrow as needed with your home as collateral. However, they also require careful management to avoid excess debt. For many, these loans can be a powerful financial tool when used wisely, so it's essential to weigh the benefits and potential risks.

Borrowers frequently opt for Connecticut Open End Mortgage Deed And Security Agreement because they offer flexibility in borrowing. This type of mortgage allows homeowners to access additional funds as needed, all while using the same collateral. It can be particularly useful for those who may require funds for home improvements or unexpected expenses. This arrangement can simplify the borrowing process, making it an appealing choice for many.