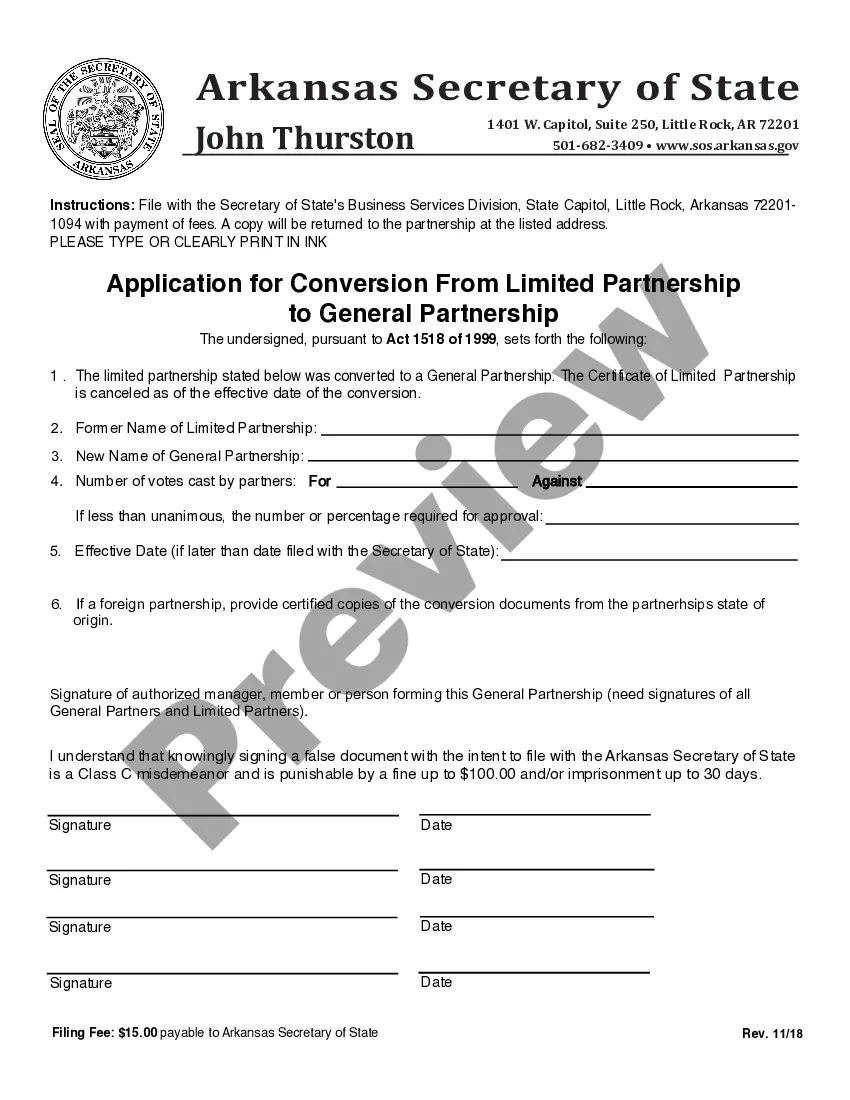

Colorado Amendment of common stock par value

Description

How to fill out Amendment Of Common Stock Par Value?

If you wish to total, obtain, or print legitimate papers layouts, use US Legal Forms, the biggest collection of legitimate forms, that can be found on the Internet. Use the site`s easy and convenient look for to get the documents you require. Numerous layouts for organization and individual uses are categorized by groups and says, or keywords and phrases. Use US Legal Forms to get the Colorado Amendment of common stock par value with a couple of mouse clicks.

Should you be presently a US Legal Forms client, log in to your profile and click the Acquire button to get the Colorado Amendment of common stock par value. Also you can accessibility forms you earlier acquired inside the My Forms tab of your profile.

If you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form to the right town/land.

- Step 2. Use the Preview solution to look through the form`s content material. Do not neglect to read through the description.

- Step 3. Should you be not satisfied together with the type, utilize the Lookup area on top of the display screen to find other versions from the legitimate type design.

- Step 4. After you have found the form you require, go through the Buy now button. Opt for the rates plan you prefer and add your qualifications to register for an profile.

- Step 5. Method the deal. You may use your bank card or PayPal profile to accomplish the deal.

- Step 6. Find the file format from the legitimate type and obtain it on your own gadget.

- Step 7. Full, change and print or indication the Colorado Amendment of common stock par value.

Each legitimate papers design you acquire is your own forever. You have acces to every single type you acquired within your acccount. Select the My Forms section and choose a type to print or obtain once again.

Compete and obtain, and print the Colorado Amendment of common stock par value with US Legal Forms. There are millions of specialist and status-certain forms you can utilize to your organization or individual demands.

Form popularity

FAQ

Common?stock is called common stock when all classes have same rights and privileges. stock. 5. Par value stock?assigned a value per share by the corporation in its charter.

Can Shares Be Issued Below Par Value? Shares can be issued below par value, though doing so would be unfavorable for the issuing company. The company would have a per-share liability to shareholders for the difference between the par value of the stock and the issuance price.

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split). A stock split is exactly what it sounds like: a division of shares.

Hence, limited period of existence and centralized management are not typical characteristics of a corporation.